- Home

- Sales and revenue

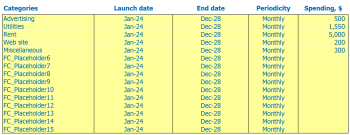

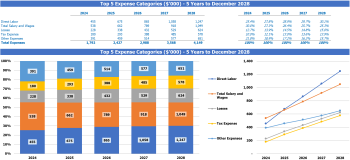

- Running costs

- Financial

Welcome to our comprehensive guide on how to build a financial model for a musical instrument store. A musical instrument store revenue model is critical to the long-term success of the business. A solid financial plan can help you manage expenses, forecast income, and ultimately maximize profits. In this blog post, we will provide you with a step-by-step guide on the key elements that should be included in a Musical Instrument Store Profit Model . We’ll also explore the importance of conducting a Music Store Financial Analysis and provide you with the tools you need to create a Musical Instrument Store Cash Flow Projection , Music Store Financial Forecast , and Plan. musical instrument store budget . We will also examine the essential role of carrying out a financial feasibility analysis in determining the long-term sustainability of the business. Finally, we’ll dive deep into the Music Store Income Statement and Breat-Instrument Store Analysis . Let’s start.

Musical Instrument Store Revenue and Sales Forecasts

A vital component of any financial plan for a musical instrument store is revenue and sales forecasts. These forecasts typically include projected sales figures, the timeline for sales ramp-up, and assumptions regarding customer growth and behavior. Key factors to consider when developing these forecasts include launch date, walk-in traffic, growth assumptions, customer buying patterns, and sales seasonality.

Once developed, music store financial forecasts can be used to inform a range of financial decisions, from budget planning to cash flow projections. Ultimately, the goal of this financial analysis is to establish a clear path to profitability and determine the financial feasibility of a music store. This analysis typically includes an income statement, cash flow projection, break-even analysis, and other financial metrics that provide insight into the viability of the musical instrument store’s profit model.

In summary, a well-designed financial plan for a musical instrument store is critical to success. By creating and regularly updating revenue and sales forecasts, store owners can make informed decisions about budgeting, inventory management, and marketing strategies. With careful planning and analysis, a music store can create a profitable business model and establish a strong presence in the local music community.

Musical Instrument Store Launch Date

Your business launch date is a vital factor to consider as it triggers a chain of activities and events that will affect your financial plan and ultimately your success. The revenue model of the musical instrument store depends on various factors such as the timing of product launches, marketing campaigns, and seasonal fluctuations in demand.

It’s important to select a launch date that aligns with your music store’s financial projections and allows you to maximize revenue potential. A well-timed launch can attract new customers, generate buzz and increase sales. On the other hand, a poorly timed launch can lead to missed opportunities, financial losses, and a weaker musical instrument store profit model.

Tips & Tricks:

- Research the market and identify peak buying seasons for musical instruments in your area.

- Consider your competitors’ launch dates and adjust yours accordingly.

- Plan your marketing strategy well in advance to build hype and anticipation.

- Make sure your inventory is fully stocked before launch to avoid missing out on potential sales.

The musical instrument store cash flow projection is another important tool that will help you determine the financial feasibility of a music store launch. This projection will show you the expected cash inflows and outflows for your business, allowing you to make informed decisions about your budget plan and spending.

Once you’ve selected your launch date, it’s important to track your music store and music store profit and loss analysis. These financial metrics will help you track your progress, assess your profitability, and make any necessary adjustments to your strategy.

Musical Instrument Store Ramp Time

The ramp-up time to sales plateau is an essential factor to consider when forecasting sales for a musical instrument store. It explains the period when a store needs to access full-fledged operations and reach the break-even point. A new store might take a longer ramp-up time, while an existing store looking to expand operations might have a shorter ramp-up time.

What is the ramp-up period for your business? This is a crucial question that every business owner must answer while creating a financial plan for their musical instrument store. The answer to this question is critical as it will determine the viability of your business and how much you need to invest in your business. In the music store industry, it can take around 6-12 months to reach sales plateau.

Tips & Tricks

- Create a detailed financial plan for your musical instrument store before starting the business

- Research the industry to determine the ramp-up time for similar companies

- Prepare a comprehensive break-even analysis to determine your store’s profitability

- Regularly track your store’s income and expenses to adjust your financial plan accordingly

Forecasting your musical instrument store ramp-up time can help you create a realistic financial plan and manage your finances successfully. By considering the sales ramp-up period, you can make informed decisions on financing, resource management, and marketing strategies to create a profitable and sustainable business.

Musical Instrument Store Walk-in Traffic Entrances

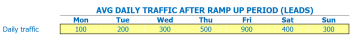

After the ramp-up period, our store receives an average of 90 walk-in visitors per day. On weekdays, we receive the highest traffic on Wednesdays, with an average of 105 visitors. Mondays and Fridays are our slowest days, with an average of 75 visitors.

Having accurate walk-in traffic data is crucial to building a financial model for a musical instrument store. This information helps us to accurately estimate income and expenses. Without knowing the number of visitors, we cannot calculate the conversion rate and sales per customer. Additionally, walk-in traffic is necessary for a break-even analysis.

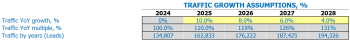

The average growth rate of walk-in traffic is 2% per year. Using this assumption, we predict that we will have an average of 92 visitors per day after one year and 109 visitors per day after five years.

Tip: Be sure to track walk-in traffic regularly to ensure data accuracy. This information is essential for making informed decisions about personnel and marketing strategies.

Musical instrument store visits for sales conversion and sales inputs

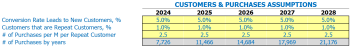

When creating a financial plan for a musical instrument store, it is important to consider the conversion rate of store visits to sales, as well as the percentage of repeat customers and the average monthly purchases per repeat customer.

Assuming that for the 10 visits, 2 customers make a purchase, the store’s sales conversion rate is 20%. This means that for every 100 visits, the store will make 20 sales. Also, assuming a repeat customer rate of 30%, the store will have 6 repeat customers out of 20 sales. If each repeat customer buys an average of 2 items per month, the store can expect 12 additional purchases per month from repeat customers.

Tips & Tricks

- Encourage repeat sales by offering loyalty discounts or reward programs.

- Train staff to provide excellent customer service to increase customer retention.

- Consider offering financing options or rental programs to attract new customers and increase revenue.

This information is important when building a financial model for the musical instrument store as it impacts revenue projections and cash flow projections. By accurately estimating conversion rate, repeat customer rate, and average monthly purchases, the store can create a more accurate budget plan, income statement, and cash flow projection. Additionally, understanding these key inputs can help the store identify areas for improvement and develop strategies to increase sales and customer retention.

Mix of musical instrument store sales

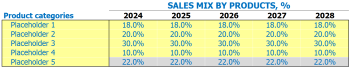

In our musical instrument store, we sell various products including guitars, drums, keyboards and accessories like strings, sticks and stands. Each product belongs to a specific product category, and entering sales mix assumptions at the product category level is much easier to understand.

For example, we can assume that the category of sales by products is:

- Guitars – 40%

- Drums – 20%

- Keyboards – 25%

- Accessories – 10%

- Others – 5%

This assumption will help us forecast our sales mix for the next five years for each product category, which will be helpful in creating a financial plan for our musical instrument store. By knowing the percentage of each product category in our sales mix, we can estimate the revenue and profit generated by each category.

Tips & Tricks:

- Regularly review and update your sales mix assumptions to ensure they are accurate and reflect current market trends.

- Consider the impact of seasonality on your sales mix, for example, guitars may sell better during the holiday season and fall off during the summer.

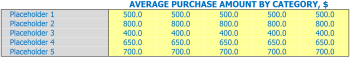

Musical instrument store Average ticket sales amount

Our musical instrument store sells a variety of products including guitars, drums, keyboards and accessories. To simplify our financial plan, we have organized our products into categories, such as string instruments and percussion instruments. This allows us to enter assumptions at the category level, rather than for each individual product.

An important assumption is the average sales amount per product category per year. For example, we can estimate that the average sales amount for an electric guitar in the first year of operation is 0. This information is then used in estimating the average ticket size.

The average sale amount for each product category varies. For example, the average sale amount for stringed instruments is 0, while the average sale amount for percussion instruments is 0. Using the sale mix and the average sale amount for each product category, the model can calculate the average ticket size.

Tips & Tricks:

- Regularly update your average sales assumptions based on current market trends.

- Focus on increasing average ticket size by cross selling props or upselling.

- Consider offering bundle offers to encourage customers to purchase multiple products.

By using category-level assumptions for the average sale amount, we can more accurately estimate our store’s revenue and profitability. This, in turn, allows us to create a solid budget plan, cash flow projection, and financial feasibility analysis for our music store.

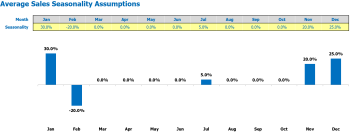

Musical instrument store sales seasonality

Understanding the seasonality of a musical instrument store’s sales is crucial to creating a successful financial plan. Seasonality refers to consistent sales patterns that occur throughout the year. By analyzing seasonal factors, we can project future revenues and plan for peak and slow periods accordingly.

For example, during the holiday season, sales tend to increase due to gifts and the demand for musical instruments for holiday events. In contrast, January and February tend to be quieter months where people may have spent their vacation money and have less disposable income.

Tips & Tricks:

- Pay attention to events and holidays that are relevant to musicians and adjust marketing efforts accordingly

- Create promotions or sales during slow times to encourage purchases

- Adjust inventory levels to match expected sales during peak and slow periods

When analyzing seasonal factors, it is important to look at the percentage deviation from the average monthly sales per day. This can help determine the magnitude of the seasonal effect and allow more accurate projections. By incorporating this analysis into a financial forecast for a music store, a well-informed budget plan can be created.

Ultimately, understanding the financial feasibility of a music store through a thorough music store financial analysis, including a musical instrument break-even analysis and cash flow projection, can lead to a successful profit model and revenue model for a musical instrument store.

Musical Instrument Store Operating Expense Forecast

Operating expense forecasts are an important part of the financial plan for a musical instrument store . It includes estimates of the cost of goods sold by products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating costs.

| Type of cost | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | ,000 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – ,000 |

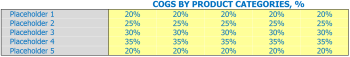

Musical Instrument Store Cost of Goods Sold

When analyzing the financial feasibility of a music store, it is crucial to understand the cost of goods sold (COGS) assumptions. This represents the direct costs of products sold by the store, including the cost of materials, labor, and production overhead.

Assuming the musical instrument store offers four different product categories – guitars, drums, keyboards and accessories – the COGS percentage could be estimated as follows:

- Guitars: 55%

- Drums: 65%

- Keyboards: 50%

- Accessories: 30%

Tips & Tricks:

- Regularly review your COGS assumptions to ensure they are accurate and up-to-date. This can help you identify any opportunities for cost savings or price adjustments.

By understanding COGS assumptions, a music store can estimate its profitability and determine a pricing strategy that maximizes revenue. Additionally, the COGS estimate can be used in combination with other financial performance metrics, such as cash flow projections, income statements, and break-even analysis.

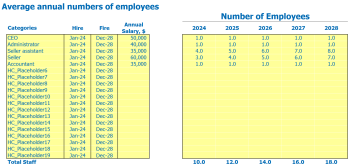

Musical Instrument Store Salaries and Wages of Employees

In terms of our financial plan for a musical instrument store, we need to consider employee wages and salaries. This includes not only our business associates, but also administrative and support staff.

With respect to the names of our staff members/positions, we may have sales associates, inventory managers, marketing coordinators and customer service representatives. We plan to hire our business associates and customer service representatives within the first month of operations. Inventory Managers will be hired in the first six months, while Marketing Coordinators will be added to the team later, after the first year.

For the 12 month period, we expect our business associates to earn an average of ,000 per year, while customer service representatives will earn around ,000. Inventory Managers will earn ,000 and our Marketing Coordinators will earn ,000 per year.

In terms of full-time equivalent staff, we plan to have five sales associates, two customer service representatives, an inventory manager and a marketing coordinator in our first year of operation.

Tips & Tricks:

- Offering competitive salaries can attract top talent to your music store.

- Consider hiring part-time staff, especially during busier seasons or for specific projects, to save costs.

- Review and adjust salaries annually to account for inflation and any changes in the industry.

Musical instruments store rent, rental or mortgage payment

When creating a financial plan for a music store, one of the biggest expenses to consider is the cost of your storefront. There are different options to choose from, such as renting, renting or buying a space through a mortgage payment.

Rent: Renting a storefront is a common option for new businesses in the music industry. When renting, you pay a monthly fee to your landlord to use their building. Rent payment will vary depending on the size and location of the space. For example, a 1,500 square foot space in a premium location can cost around ,000 per month.

Leasing: Leasing is another option where you sign a contract for a longer period, usually 3-5 years, at a fixed rate. Unlike renting, you are responsible for maintaining and repairing the space. A 3,000 square foot space can range from ,000 to ,000 per year.

Paying off the mortgage: Buying a storefront means you take out a loan, make monthly payments to the bank, and gradually build equity. A 3,500 square foot space can have mortgage payments of around ,000 to ,000 per month, depending on the length of the loan and the interest rate.

Tips & Tricks:

- Consider your business plan and financial goals when deciding which option is best for your storefront.

- Research comparable spaces in your area to estimate your monthly rent, lease or mortgage payment.

- Include these expenses in your financial analysis to determine if your overall model is possible.

Musical Instrument Store Utilities

In order to accurately project the financial feasibility of a music store, it is important to consider the various expenses associated with the store’s utilities. These expenses can have a huge impact on the store’s overall budget plan and profit model. Here are some common assumptions for a musical instrument store’s utilities:

- Consider negotiating with utility providers for lower rates.

- Energy efficient lighting and appliances can significantly reduce utility costs.

- Regular maintenance of HVAC systems can prevent costly repairs.

Tips & Tricks:

Electricity is a major cost for any retail store, but especially for a store that relies on lighting and sound equipment to showcase their products. Expenses for water and gas can also be significant, depending on the size of the store and the frequency of using the toilets and cleaning instruments.

Another important consideration is the heating, ventilation, and air conditioning (HVAC) system, which can greatly affect the cash flow projection of musical instruments. HVAC is essential for maintaining a comfortable environment for customers and employees, but can also be a major expense, especially in extreme weather.

Finally, it is important to consider any maintenance or repair costs for the store’s utilities. For example, an unexpected HVAC repair can have a huge impact on the music store’s financial forecast. By planning for routine maintenance and setting aside a budget for repairs, the store can mitigate the risk of unexpected expenses.

Musical instrument store other running costs

When building a financial model for a musical instrument store, it is important to consider all of the expenses involved in running the business. In addition to the obvious costs such as inventory and marketing, there are a number of other expenses that should be included in your budget plan.

These can include things like rent or mortgage payments on your store, utilities such as electricity and water, insurance premiums, and salaries or wages of your employees. It’s also important to consider any taxes or fees that may be associated with running a small business in your area.

For example, if you plan to open a new music store in a downtown area, you may need to budget for parking fees for customers or permits for displays or outdoor events. Or, if you plan to offer music lessons in addition to selling instruments, you’ll need to factor in the cost of hiring instructors and maintaining classrooms.

By taking the time to carefully consider all of these other operating costs in your music store financial forecast, you will be better prepared to create a financial plan for your musical instrument store that is realistic and achievable over the long term.

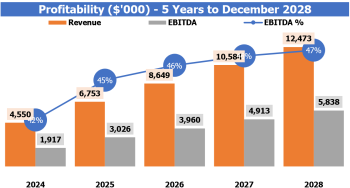

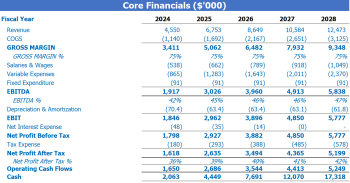

Musical Instrument Store Financial Forecast

As any business owner knows, financial forecasting is critical to business success. This is especially important for musical instrument stores, as revenue and profit models can be complex. By creating a solid financial plan for your music store, you can better understand your cash flow projection, budget plan, and overall financial feasibility. In addition to a profit and loss statement and sources and usage report, a music financial analysis should also include a break-even analysis and income statement. A strong financial forecast is a key part of a successful musical instrument store.

Profitable musical instruments store

Once we have created projected income and expenses for a musical instrument store, the next step is to verify the P&L statement. This report helps visualize store profitability by looking at metrics such as gross profit or EBITDA margin.

A good financial plan for a music store should include a detailed financial analysis. The analysis includes a cash flow projection, budget plan and financial feasibility assessment. The valuation should also contain a break-even analysis that will help you determine how long it will take your business to become profitable.

Tips & Tricks:

- Identify products that offer high margins and promote their sales

- Implement a loyalty program

- Reduce expenses by negotiating with suppliers

Overall, a music store’s financial forecast should be an essential part of any business plan. By analyzing data and making sound financial decisions, a musical instrument store can achieve long-term profitability.

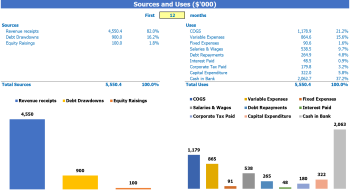

Sources and uses of musical instrument stores and use

The sources and uses of funds in the financial model in Excel for Musical Instrument Store provides users with an organized summary of where capital will come from Sources and how that capital will be spent in the Uses . It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

While planning Financial Plan for Musical Instrument Store , the Financial Analysis of Music Store should include Musical Instrument Store Budget Plan, Musical Instrument Store Cash Flow Projection, Forecast music store financials, and a musical instrument store profit model . These elements will allow the business to analyze and understand the financial feasibility of a music store . The Music Store Income Statement is also an important part of the analysis as well as the Breat-Instrument Store Analysis .

Tips & Tricks:

- Be sure to use accurate data when creating the sources and use statement.

- Use financial professionals to help create the financial analysis.

- Revisit and update the financial model regularly to ensure accuracy.

- Consider multiple scenarios and outcomes when analyzing finances.

In conclusion , building a financial model for a musical instrument store is crucial to the success of the business. With a solid financial plan and careful analysis, store owners can project their Musical Instrument Store Revenue Model , Profit Model , Cash Flow Projection , Budget Plan , Revenue Statement , and Profitability Analysis . Although it may seem daunting at first, creating a music store financial forecast is ultimately necessary to understand the financial feasibility of a music store . Using these tools will help store owners make informed decisions and increase the likelihood of long-term success.