- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our guide on how to build a financial model for a tire store. As a tire shop owner, you must have a solid financial plan in place to ensure the success and profitability of your business. This includes understanding the various financial statements and projections necessary for analysis and forecasting. In this guide, we’ll cover the steps to create a complete financial plan for your tire shop, including a revenue model, profit analysis, cash flow projection, break-even analysis, income statement , balance sheet, financial forecasts, planning and analysis . Let’s dive!

Tire Shop Revenue and Sales Forecast

As a crucial part of tire trail financial planning, revenue and sales forecasts provide an overview of expected sales results over a defined period. Revenue and sales forecasts consider launch date, sales ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality. It projects future sales performance of the tire store, providing valuable information for tire financial analysis.

Tire Shop Launch Date

Choosing when to launch your tire store is a critical decision that can impact the future success of your business. It is important to consider several factors when selecting a launch date, such as seasonal tire demand, local events that may impact traffic, and stock availability.

Tip: Conduct market research to determine the best launch date for your tire store, considering factors such as local competition and market demand for your products and services.

Tips & Tricks:

- Consider launching during peak tire buying seasons to maximize revenue potential

- Plan your launch date around local events that can attract potential customers

- Ensure adequate inventory is available at launch to meet customer demand

Once you have selected your launch date, it is important to develop a detailed financial plan that includes a tire shop revenue model, financial forecast, profit analysis, cash flow projection, break-even analysis, an income statement and a balance sheet. This will help you assess the financial viability of your business and make informed decisions about pricing, inventory management, and other financial aspects of running a successful tire shop.

Tip: Use a tire financial model template to simplify the process of creating a comprehensive financial plan and forecast for your business.

Ramp-up time

When forecasting sales for your tire store, it is important to consider sales plateau turnaround time. This period is the time it takes for your business to reach its full potential in terms of generating income. Understanding this timeframe is crucial while doing any tire shop financial planning .

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In the tire shop industry, it can vary. However, on average, it can take around 6-12 months for a new player to reach their full sales potential.

Tips & Tricks

- Revise and renew the tire shop revenue model for better understanding.

- Analyze the tire shop income statement and balance sheet while creating a financial forecast.

- Take the help of the Tire Shop Financial Analysis Report to make a realistic cash flow projection.

- Calculate the Tire Shop Profit Analysis to see how much profit is made.

- Use the Tire Shop Break-Even Analysis to determine the point where expenses and revenue match.

Keeping ramp-up time in mind will allow you to strategically plan your businesses finances and allow you to realistically understand your sales potential. Prepare diligently and keep an accurate tire shop financial forecast to stay ahead of the game.

Tire Shop Tire Traffic Entrances

After the ramp-up period, the daily walk-in traffic for the tire store was recorded for each weekday. From this, it can be concluded that the store has the highest traffic on weekends, where the average traffic ranges from 50 to 70 visitors per day. However, on weekdays, the number of visitors varies from 30 to 50 on average.

Knowing the average weekday walk-in traffic is crucial for estimating potential tire shop revenue. A high number of customers will likely correlate with high sales, leading to high revenue. Building a financial model for a tire shop requires knowing and accurately estimating these numbers.

The average traffic growth factor in the years is calculated based on the observations of the last years. For example, in the first year, traffic is expected to increase by 5%, and in the second year, it is estimated to increase by 7%. This growth factor is then used to predict future walk-in traffic for five years.

Tips & Tricks

- Regularly monitor walk-in traffic and adjust the growth factor accordingly

- Consider external factors such as location, seasonality and competition

- Make sure the data is accurate and reflects the reality of the store

By knowing the average weekday appointment traffic and their growth factor, a financial forecast can be developed using tools such as break-even analysis, cash flow projection, result and balance sheet. This data can provide insight into the tire shop’s financial performance, potential profitability, and areas for improvement.

Tire shop visits for sales conversion and sales inputs

Every tire shop owner wants to know how many visitors they turn into new customers and how often those customers return for repeat purchases. Let’s say a tire store gets 100 visitors in a month, and 50 of them become new customers. The conversion rate is 50%, which means that half of the visitors turned into customers.

Repeat customers are those who return to the store for more purchases. If the tire store has 100 customers in a month and 30 of them make another purchase, the repeat sales percentage is 30%. So, in a month, the shop had 50 new customers and 30 repeat purchases, which represents a total of 80 sales.

Tips & Tricks:

- Offer discounts for regular customers

- Create a loyalty program to encourage more repeat purchases

- Market the benefits of returning to the tire service store, such as free tire rotation after a certain number of purchases

Knowing the conversion rate and the percentage of repeat sales are essential for a tire shop’s financial plan. By calculating the average purchase amount per customer, you can forecast monthly revenue, cash flow, income statement, and balance sheet. This information is crucial for the tire shop’s revenue model and financial analysis, which includes a break-even analysis, cash flow projection, income statement, and balance sheet.

Ultimately, tire shop financial planning and analysis relies heavily on the assumption of how well the shop can convert visitors into new customers, as well as how often those customers will make repeat purchases. By staying on top of this critical data, any tire shop owner can create a solid financial forecast and guide their business to success.

TIRE SALE MIX INPETATIONS

In our tire shop we sell different products, each belonging to a specific product category such as tires, rims and accessories. To make it easier to understand our sales mix assumptions, we enter them on the product category lever.

For example, we assume that our tire products account for 70% of total sales, rims account for 20%, and accessories account for the remaining 10%. This sales mix assumption gives us a clear picture of which products contribute the most to our revenue.

Over the next five years, we expect the category of sales by sales by product to remain the same. We expect tires to continue to generate 70% of our total sales, rims will contribute 20% and accessories will make up the remaining 10%. By doing this, we can plan our tire shop financial forecasts and make financial planning decisions based on accurate data.

Tips & Tricks

- Pay attention to your sales mix assumptions and adjust them accordingly to maximize your tire shop revenue model .

- Regularly review your financial statements, including the Tire Shop Income Statement and Tire Shop Balance Sheet, to assess your performance.

- Perform a Tire Shop Profit Analysis to identify areas where you can reduce costs and increase revenue.

Takes Shop Amount Entry Amount

In our tire store we sell a variety of products, each belonging to a specific product category. It is easier to enter assumptions at the product category level than at the product level.

For example, we offer tires, rims and accessories. Tires fall under the “tire” category, while rims fall under the “wheel” category. Accessories can be further broken down into “lighting” and “audio” categories.

To estimate the average ticket size, we use the average sale amount by product categories and by years. For example, we assume that the “tire” category will have an average sales amount of 0 in the first year, 5 in the second year, and 0 in the third year. Similarly, the “wheel” category will have an average sales amount of 0 in year one, 5 in year two, and 0 in year three.

Using the sales mix and the average sale amount of each product category, the model will calculate the average ticket size. For example, if a customer buys two tires at 0 each and a rim at 0, the average ticket size will be 0 ((0 x 2) + 0).

Tips & Tricks

- Regularly update your assumptions to reflect changes in the market.

- Track your actual average ticket size to compare your projections.

- Consider bundling products to increase sales and increase your average ticket size.

Seasonality of tire store sales

Seasonality is a critical component to the tire shop’s revenue model. Understanding monthly sales patterns is crucial when creating a financial plan for tire shops.

For example, during the winter season, customers will need snow tires resulting in increased sales. Spring will see a decrease in sales as there is no need for winter tires. Also, except for some areas, summer months see relatively low sales compared to winter and fall.

Tips & Tricks

- Use previous year’s sales data to predict seasonal patterns

- Use promotions and discounts during off-peak seasons to reduce seasonality effects

- Maintain optimal inventory levels during peak seasons to maximize sales

Using monthly sales data, a tire shop can perform tire sales seasonality analysis and create a financial forecast that aligns with seasonal trends. Such analysis should lead to the development of a tire shop income statement, tire shop balance sheet, and tire shop cash flow projection that can inform planning. tire shop’s finance.

Tire Shop Operating Expense Forecast

As part of the financial model for a tire store, it is crucial to create an operating expense forecast to ensure that the business can operate sustainably.

Major operating expenses for a tire shop include:

| Costs | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,500 – ,000 |

| Public services | 0 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – ,000 |

Cost of Goods Sold

COGS is a critical part of the tire shop revenue model . It represents the cost of goods sold by a company to produce its products or services. These costs include the cost of materials, direct labor, and overhead, such as rent and utilities. The calculation of COGS excludes indirect costs, such as marketing, research and development expenses.

Assuming you own a tire shop, let’s see how COGs work in practice. For example, you buy ten sets of tires, and the invoice on each is 0, and you pay for shipping. Therefore, the cost per set of tires is 0. Plus, you have to pay your workers to assemble them, bringing the labor cost to 0 per set. Finally, rent, utilities, and other overhead is per set. Therefore, the total COG per set of tires is 0.

Tips & Tricks:

- Keep your cogs as low as possible, while maintaining quality.

- Track your COGs regularly and adjust your prices accordingly.

- Use financial planning tools, like a Tire Shop Profit Analysis, Cash Flow Projection, Break-even Analysis , and Financial Forecast to optimize your cogs and revenue.

- Prepare financial statements, such as an Income Statement, Balance Sheet, and other reports to provide insight into your Tire Shop Financial Analysis and Planning .

In general, the average COG percentage for the tire industry is around 60-75% of total revenue. However, the percentage may vary depending on the product categories. For example, many tire stores report that the profit margin on specialty tires is lower than regular tires, so the COGS percentage may be higher. Therefore, it is crucial to analyze the profitability of each product category and optimize your cost structure accordingly.

Salaries and wages of tire shop employees

When planning your tire shop’s financial forecast, it’s important to consider your employee’s salaries and salary assumptions. This includes the names and positions of your staff members, when they will be hired, how much they are expected to earn for the year, and how many full-time equivalent staff you need annually.

For example, you may have two business associates, a manager and a mechanic. You plan to hire the sales people and manager when you start your tire shop, while the mechanic will be hired three months later. The manager will earn ,000 per year, each sales associate will earn ,000 per year, and the mechanic will earn ,000 per year. In total, you need 3 full-time equivalent staff on an annual basis.

Tips & Tricks:

- Consider any additional benefits or bonuses you can offer your employees, such as health insurance or performance-based incentives.

- Regularly review your employee’s salaries to ensure they are competitive with the market and adjust accordingly as your tire shop grows.

- Ensure that each member of staff is trained and qualified for their position, which can lead to better customer satisfaction and ultimately increased revenue for your tire store.

By carefully considering your employees’ wage and salary assumptions, you can better plan your tire shop’s financial forecast and ensure the success of your business.

Tire shop rent, lease or mortgage payment

When it comes to opening a tire store, one of the biggest financial considerations is the cost of rent, lease, or mortgage payments for the location. This expense varies greatly depending on location, store size, and other factors.

Rent: If you plan to rent the space for your tire store, you will consider a monthly rent payment. This option is good for those who want a low-risk, low-commitment lease. For example, a tire shop located in a small town in Texas will have lower rental costs than one located in New York.

Renting: On the other hand, renting the location means that you have agreed to rent and maintain the property for a specific period from the owner. This means that you may have negotiated terms such as no rent increase for the duration of the lease or the option to renew at a pre-determined price. For example, leasing a location for a tire store for five years in New York has different costs than the same contract in a small town in Texas.

Mortgage: Finally, if you decide to purchase the location, you will need to take out a commercial mortgage. This option is good if you plan to stay at the location for several years and want to build equity there. However, if your tire shop isn’t generating enough revenue to cover mortgage payments, it can become a burden. You could in this scenario consider renting or leasing the place. For example, a mortgage payment plan for a tire store in Houston may vary from a mortgage plan in Chicago.

Tips & Tricks

- Look for prices in different places to find the best option for your tire shop.

- Determine your revenue model, financial plan, profit analysis, cash flow projection, break-even analysis, income statement, balance sheet, financial forecast and financial planning

- Create an emergency fund in case you have a sudden drop in income and cannot cover rent, lease or mortgage payments.

- Work with a professional accountant or financial analyst to determine the best option for the long-term financial health of your tire store.

Tire Shop Utilities

Tire shop financial planning Requires detailed analysis of tire shop revenue model, financial plan, profit analysis, cash flow projection, break-even analysis , income statement, balance sheet and financial forecasts. A crucial aspect of this planning is determining the cost of utilities to operate the business and including it in the financial projections.

The cost of utilities is a fixed expense that is essential for the daily operation of the tire shop. These include electricity, water, heating and cooling. Here are some of the assumptions made for utility expenditures.

- Electricity: Assuming there are ten ceilings in the shop with LED bulbs. Electricity consumption could be estimated by a dealer’s financial analysis at 7 kWh per day (ten hours), which resulted in an electricity consumption of 0.7 kW/d (0.07 kW/light * 10 lights ).

- Water: The tire shop can use up to 50 gallons of water per day, depending on the number of employees in the shop and the size of the establishment.

- Heating and Cooling: The tire shop may require heating during the winter months and cooling during the summer months. The cost of heating and cooling depends on the regional climate and the size of the shop.

Tips & Tricks

- Consider installing energy efficient LED bulbs to save on electricity costs.

- Check for plumbing leaks or drips to reduce water costs.

- Install insulation to save on heating and cooling costs.

Tire shop Other running costs

While preparing the financial plan for a tire shop , the other running costs should be considered. These costs are those expenses that are not directly related to the sale of tires but still need to be managed. Two important categories of these costs are general and administrative cost, also known as G&A, and marketing and advertising costs.

G&A fees include expenses such as rent, utility bills, telephone bills, office supplies and other administrative expenses. These costs are fixed each month and should be accounted for in the cash flow projection which would be essential in Tire Shop Profit Analysis and Tire Shop Break-Even Analysis .

Marketing and advertising expenses include expenses that help promote a tire store. Examples of this category are social media advertisements, putting up billboards or posters, creating brochures or flyers for customers. Costs associated with this category should be included in the Tire Shop Income Statement authorize Tire Shop Financial Analysis .

Tire shop financial forecast is incomplete without the inclusion of tire shop balance sheet . The balance sheet is an instantaneous representation of the financial situation of a tire shop at a given moment. It shows how much the business owns (its assets), how much it owes (its liabilities), and what is left for the owner (its equity).

Therefore, in Tire Shop Financial Planning , it is recommended to consider all expenses including other running costs to accurately project the financial performance of the business.

Tire Shop Financial Forecast

In order to run a successful tire shop, it is important to have a comprehensive financial plan in place. The financial plan should include an Income statement to analyze store income and expenses, a Sources and usage report to track the inflow and outflow of money, a Profitability analysis to determine volume sales needed to cover costs, an income statement and balance sheet to monitor the store’s financial health, and a cash flow projection to project future income and expenses. By including these documents in the financial forecast, tire shop owners can have a clear understanding of their business’ financial condition and make informed decisions about their operations.

Tire Shop Profitability

Once we have created income and expense projections for a tire shop, it is essential to analyze the profit and loss statement. This will help us understand the profitability of the tire shop, including gross profit and EBITDA margin.

It is imperative to analyze financial statements like balance sheet, income statement and cash flow projection for a tire shop. This will help in financial planning of the tire shop and to better understand the financial situation of the tire shop.

Tips & Tricks

- Check the revenue model in detail to make sure it can generate enough profit.

- Always analyze industry benchmarks for any financial analysis of tire shops.

- Prepare for all possible eventualities and prepare contingency plans.

After analyzing all financial statements in detail, a Tire Shop Profit Analysis helps identify key areas where tire shop owners can improve their revenue and profitability.

A Tire Shop Financial Forecast is a great tool for projecting and identifying how the business is doing and profitability will perform over the next several years.

Finally, after analyzing all the financials, preparing a Tire Shop Financial Plan can help identify a Tire Shop Break-Even Point Analysis , which is the minimum gross profit needed to cover all costs associated with running the business.

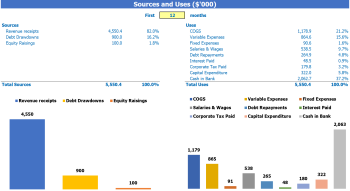

Tire Sources and Use of the Chart

Sources and uses of funds in the financial model in Excel for Tire Shop provides users with an organized summary of where capital is coming from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks:

- Make sure all sources and uses of capital are accounted for in the statement.

- Include a detailed description of each source and use of capital.

- Regularly review and update sources and use the statement as the company’s financial condition changes.

In conclusion, building a financial model for a tire shop is an essential step in ensuring that your business will be successful in the long term. With complete tire shop revenue model , tire shop financial plan , tire shop profit analysis , cash flow projection , tire shop break even point analysis , report tire shop performance report , and tire shop balance sheet , you’ll have the tools you need to make informed financial decisions and plan for the future of your business. Keep in mind that a Tire Shop Financial Forecast is an ongoing process that requires you to update your finances regularly to stay informed and react quickly to any changes in your business. By investing in Tire Shop Financial Planning and regularly conducting Tire Shop Financial Analysis , you will be able to make informed decisions, reduce risk, and prepare your business for long-term success.