- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our guide on how to build a financial model for a stationery store. For any new or established stationery store owner, having a financial model in place is crucial to making informed business decisions. In this blog post, we’ll cover the basics of creating a financial plan for your stationery store, including important concepts like financial projections, financial statements, and financial feasibility. By the end of this guide, you will have a clearer understanding of your stationery store’s financial performance and will be better equipped to manage your finances. Let’s dive!

Stationery Store Revenue and Sales Forecast

As a crucial part of a stationery store’s financial model, revenue and sales forecasting involves projecting future sales based on several assumptions. These assumptions are based on factors such as launch date, sales ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality. Forecasts provide an estimate of the company’s financial performance over the specified period and help create a more comprehensive financial plan.

Stationery store launch date

The launch date of your business can have a significant impact on its success.It’s important to carefully consider the timing of your launch to maximize profitability and minimize risk. The stationery store financial plan can help you determine the best launch date for your specific business.

When deciding on a launch date, consider factors such as competition in your area, time of year, and upcoming events that could impact your business. For example, launching a stationary store just before the start of a new school year could be advantageous. This would allow you to capitalize on the increased demand for school supplies.

Alternatively, it may be more beneficial to launch your business during a slower season when competition is less intense. It can help you establish your brand and attract new customers who are looking for unique stationery.

Tips & Tricks:

- Research the contest in your area before selecting a launch date

- Consider launching during peak season to increase demand for your products

- If launching during a slow season, offer promotions to attract new customers

In addition to timing your launch, you should also consider your stationery store’s financial projections, analysis, statements, and performance. These can help you achieve your financial goals and stay competitive in the market. By carefully planning and executing your launch, you can set your stationery business for long-term success.

Stationery Store Ramp Up Time

When forecasting sales for a stationery business plan, it is crucial to consider the ramp-up time on the sales plateau. This is the period it will take for the company to reach a point where sales stabilize and grow at a consistent rate.

What is the ramp-up period for your business? This will depend on various factors such as location, target market, marketing strategy and competition. In your industry, it can take 6-18 months to reach sales plateau.

Tips & Tricks

- Conduct market research to understand your target audience and competition before you open the store.

- Create a strong brand identity to stand out in a competitive market.

- Invest in effective marketing strategies to attract and retain customers.

- Offer promotions and bump offers to attract more customers during the ramp-up period.

- Track your financial performance closely and make adjustments as needed to meet your financial goals.

To ensure the financial feasibility of your stationery store, it is essential to have a realistic financial plan that considers ramp-up time and financial projections. Evaluating the stationery store’s financial analysis, statement, model model, and financial forecast will enable you to make informed financial management decisions that will facilitate the store’s financial performance.

Stationery Store Walk-In Traffic Entrance

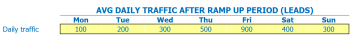

After the ramp-up period, we observed that the influx of traffic to the stationery store increased significantly. On Monday we have about 225 clients; Tuesdays we have the maximum traffic influx (about 300 / day); Wednesdays, Thursdays and Fridays have the same average daily influx (250/day); Saturdays have slightly lower traffic (around 200/day), Sundays are public holidays, so the store remains closed.

Keeping track of daily traffic input is important as it determines staffing requirements and revenue forecast. It also helps us coordinate marketing activities and promotional campaigns.

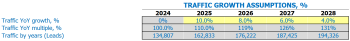

Walk-in traffic analysis revealed that there was an average growth factor of 8% per year over the past five years. Given this factor, the model will predict future weekday intro traffic inflows for the next five years.

Tips & Tricks:

- Maximize your weekday staff during Tuesdays as it has the highest influx

- Present weekly offers or discounts on Wednesdays, Thursdays and Fridays to improve customer retention and increase sales

- Identify the reasons for the reversal of low appointment traffic on Saturday and plan promotional campaigns to attract more customers

All in all, monitoring walk-in traffic and predicting future entrances is crucial for any retail business, especially a stationary store. It helps with financial planning, marketing strategies and personnel requirements. By using the stationary store financial model model, financial performance projection based on walk-in traffic analysis becomes easier and more accurate.

Stationery store visits in sales conversion and sales inputs

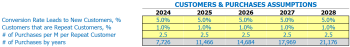

When opening a stationery store, one of the important assumptions of building a financial model is the percentage of conversion of store visitors into new customers. This number can vary significantly depending on factors such as location, marketing efforts, and overall shopping experience. For example, if your store is located in a high traffic area and has a warm, welcoming atmosphere with friendly, knowledgeable staff, your conversion rate may be higher than a store located in a less visible area with unfriendly staff. .

In addition to the percentage of new customers from visitors, another important assumption to consider is the percentage of repeat customers. A repeat customer is someone who has made a purchase from your store and is coming back to make additional purchases. Repeat customers are important because they help generate revenue and provide stability for your business.

Let’s say your store has a 30% conversion rate. This means that out of 100 visitors to your store, 30 of them will make a purchase. And let’s say your store has a repeat customer rate of 20%. This means that of the 30 customers who made a purchase, 6 will return to make another purchase in the future.

It is important to consider the average purchase amount for each repeat customer. For example, if you expect every repeat customer to make a purchase per month, your store can expect to earn 0 in revenue per month from repeat customers.

Tips & Tricks

- Offer loyalty programs or discounts to encourage repeat business

- Ensure your staff are knowledgeable and friendly to provide a positive shopping experience

- Track your conversion and repeat customer rates to adjust your marketing and sales strategies

Pointry Store Sales Mix Starters

Your stationery store sells a variety of products, each belonging to a specific product category . To make it easier to understand the sales mix hypothesis, it is best to grasp the product category lever. Here are some examples of product categories that can be used in the sales mix:

- writing instruments

- Paper products

- Office supplies

- art supplies

- Gifts and cards

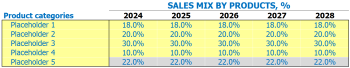

Enter the sales mix assumption for each year of the 5-year forecast by product category . This will help with financial management and give you a better understanding of your financial performance . For example:

In the first year, writing instruments will represent 30% of sales, paper products will represent 25% of sales, office supplies will represent 20% of sales, art supplies will represent 15% of sales and gifts and the cards will increase sales by 10%.

Use this financial model template to enter your sales mix assumption for each product category in the same way. This will make sales forecasting and financial analysis a much easier process.

Tips & Tricks:

- Consider your customer base and which products are most popular with them when determining your sales mix.

- Use sales data from previous years to help inform your sales mix assumptions.

- Remember to adjust your sales mix assumptions as needed based on changes in the market or other economic factors.

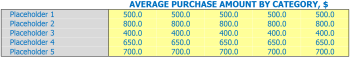

Stationery store Average admission amount

Our stationery store offers a variety of products in different categories, including writing instruments, paper products, office supplies, and arts and crafts. Instead of estimating the average sale amount (ASA) of each individual product, we found it much easier to enter assumptions at the product category level. This means that we estimate the ASA for each category and by years.

For example, in the category of writing instruments, we estimate an ASA of .50 for the first year of operation, .75 for the second year and .00 for the third year. In the paper products category, we estimate an ASA of .50 for the first year, .00 for the second year and .50 for the third year.

These assumptions are then used in the calculation of the average ticket size (ATS) for each transaction. To calculate ATS, we take the sales mix and multiply it by the ASA for each product category. For example, if sales of the writing instruments category is 30% of total sales and the estimated ASA for writing instruments is .50, the writing instruments contribution to the ATS is 30% x .50 = .05.

Tips & Tricks:

- Grouping your products into categories can help simplify financial forecasting.

- Estimating ASA by category and year may be more practical than estimating it for individual products.

- To calculate ATS, multiply the sales mix by the ASA for each product category.

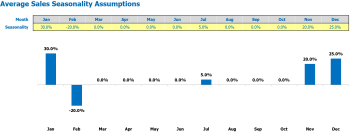

Seasonality of stationery store sales

When preparing financial projections for a stationery store financial plan, it is important to consider the seasonality of sales. This refers to the model in which sales fluctuate throughout the year due to factors such as holidays, school hours, and weather conditions.

To accurately project sales seasonality, it is crucial to collect data on historical sales patterns for the company and the industry as a whole. From there, you can identify seasonal trends and make assumptions based on factors such as:

- Holidays: Sales tend to be higher during holiday seasons such as Christmas and Valentine’s Day.

- School hours: The back-to-school season is a major sales driver for stationery stores.

- Weather: Stationery sales can be affected by weather conditions such as snowstorms, which could lead to increased online sales but decreased in-store traffic.

Once you have identified these factors, you can enter the percentage deviation from the monthly average sales per day. This will allow you to create a sales seasonality hypothesis that takes into account the unique factors affecting your business.

Overall, considering the seasonality of sales is key to creating a realistic financial model that accurately predicts the financial performance of the stationery store.

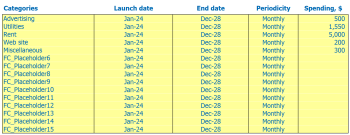

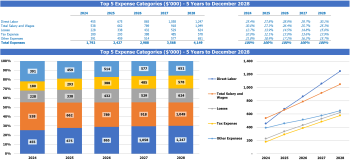

Stationery Store Operational Expense Fees

Operational expense forecasts are an essential part of the stationery store’s financial model. It includes various costs associated with running the store, including cost of goods sold by products %, employee salaries and wages, rent, lease payment or mortgages, utilities and other utility costs. functioning.

| Costs | Amount (per month) Ranges in USD |

|---|---|

| Cost of goods sold by products % | 1,500 – 2,500 |

| Salaries and wages of employees | 2,000 – 3,500 |

| Rent, lease or mortgage payment | 3,000 – 4,500 |

| Public services | 500 – 750 |

| Other running costs | 1,000 – 1,500 |

| Total | 8,000 – 12,750 |

By accurately forecasting these operating expenses, stationery store financial management can make better decisions and improve financial performance. A detailed financial analysis of operational expenses helps to predict the financial feasibility of the stationery store, financial projections and financial statements.

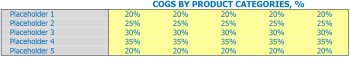

Stationery Store Cost of Goods Sold

Cost of goods sold (cogs) is an essential aspect of the stationery store’s financial plan . COGS includes the direct costs associated with producing or purchasing the products that the store sells. These costs are made up of materials, labor and other direct expenses.

The percentage of COGS varies depending on the product category. Stationery products such as paper, pens, and envelopes have a lower COGS percentage of about 30% to 40%. While other products such as technology and office furniture may have a higher COGS percentage of around 60% to 70%.

Tips & Tricks:

- Consider negotiating with suppliers to get better prices for materials.

- Focus on selling products with higher profit margins to increase overall profitability.

- Regularly review COGs with financial projections and adjust pricing and product offerings accordingly.

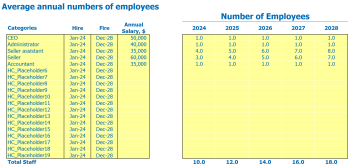

Stationery Store Employee Salaries and Wages

When creating a financial plan for a stationery store, it is important to consider the cost of employee wages and salaries. This includes determining how many staff members you need, what positions they will fill, when they will be hired, and how much they will earn each year. For example, you may need a manager, sales associates, and an accountant. You can name your staff members/positions as per your preference.

Assuming you hire a manager at the start of your Business Plan Financial Stationery Plan, that manager can earn around ,000 to ,000 per year. Salespeople can earn ,000 to ,000 per year, while an accountant might earn ,000 to ,000 in annual salary. You may need two business associates and an accountant position.

In total, you might need 3 full-time equivalent staff (including the manager) for the whole year. However, the amount of staff you need may vary depending on your store size, seasons, and estimated customer traffic.

Tips & Tricks

- Consider offering bonuses or commission plans to your business associates as an incentive to increase sales

- Look to offer benefits, like health insurance, to attract and retain employees

- Regularly review your employee’s salaries and wages to ensure they are competitive within the industry and with your competitors

PAREAGE LOCTER THE LOCE, LEASE OR MORTYAGE:

One of the biggest expenses for a stationery store is the rent, lease, or mortgage payment for the physical location. This expense can make up a large portion of the overall business budget and therefore requires careful consideration when creating a financial plan.

Rent: If the stationery store rents its location, the amount of rent should be carefully negotiated. It is essential to ensure that the monthly rent payment is something the business can afford. For example, if a stationery store rents space for ,000 per month, the business should ensure that its financial projections can support these expenses, and ideally the rent payment should not exceed 10% of projected revenue. of the company.

Leasing: If the stationery store signs a lease, it is essential to understand the terms and conditions of the lease before committing. The lease should be carefully reviewed to understand all costs associated with occupying the space, including utilities, taxes, and maintenance. Suppose a stationery store signs a lease for five years with an annual payment of ,000. In this case, he should make a financial plan that can sustain these expenses for the long term and ensure a positive cash flow.

Mortgage payment: If a stationery store buys a property, it will likely have a mortgage payment. A lender will assess the stationery store’s financial statements and credit history. If the mortgage payment exceeds 25% of the monthly projected cash flow, the store could struggle to make payments. In other words, a stationery store can only afford to buy a property if they have a sustainable source of income to cover operational expenses and mortgage payments.

Tips & Tricks:

- Always negotiate the best rent or tenancy agreement possible.

- Carefully review the rental conditions.

- Make sure that no lease or rent amount is too high to be supported by company finances.

- Explore all the mortgage payment options that fit the stationery store’s financial goals and plan.

stationery utilities

The stationery store’s financial plan should also include utility costs. These costs will depend on store size and location. It is important to remember that utility costs can fluctuate depending on the season. For example, the cost of heating and cooling will increase during the summer and winter months.

To accurately project utility costs, the store owner should research and collect price data for electricity, water, gas, internet, telephone, and alarm systems in the region. They should also consider the efficiency of the building, the lighting system and the use of renewable energy sources.

Tips & Tricks

- Look for energy-efficient fixtures and fittings.

- Turn off appliances and lights when not in use.

- Install a smart thermostat.

- Negotiate utility prices with suppliers.

By considering these factors, the store owner can create an accurate financial analysis, forecast, and feasibility study. This will help with the store’s financial management and improve its long-term financial performance.

Stationery Store Other running costs:

In addition to core expenses like rent, staff, inventory, and equipment, there are other running costs you need to consider when building a financial model for your stationery store. These costs can vary depending on the size of your store and where it is located. Here are some examples of these costs:

Marketing and advertising costs: To attract customers to your store, you need to allocate a budget for marketing and advertising expenses. These expenses include creating and designing flyers, posters, brochures and online advertisements, and paying for social media and search engine advertisements.

Insurance expenses: To protect your business against unforeseen circumstances such as theft, fire or natural disaster, you must have insurance. Insurance costs can vary depending on the coverage you need and the insurance provider you choose.

Legal and accounting services: As a business owner, you need to ensure that your stationery store is legally compliant and financially stable. Hiring outside legal and accounting services can help. The cost may vary depending on the complexity of your store structure and operations.

Utility Costs: These are the regular expenses you have to pay for your store’s utilities such as electricity, water, and gas. Utility costs may vary depending on the rate of consumption and the rates set by the respective utility companies.

Office Supplies: Running a stationery store means you need to have office supplies and business supplies for day-to-day operations. These include paper, printer ink/toner, pens, pencils, stamps, etc. These costs can add up, especially if you need to frequently replenish your supply.

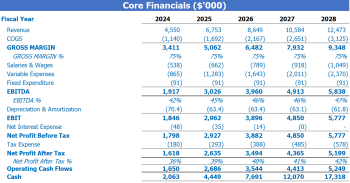

Stationery store financial forecast

In order to successfully run a stationery business, it is crucial to have a solid financial plan in place. This includes creating accurate financial projections and forecasts to guide decision making. An essential part of a stationery store financial model is the profit and loss statement, which details the income and expenses of the business. Another important document is the Sources and Use report, which outlines where the company will get its funding and how that funding will be allocated. By regularly reviewing these financial statements and forecasts, stationery store owners can better manage their financial performance and make informed decisions about their business strategy.

Stationery Store profitability

Once we have completed our financial projections for income and expenses, we can move on to the profit and loss (P&L) statement. This will allow us to assess the “profitability” of our stationery store, including metrics such as gross profit or EBITDA margin.

To create a thorough financial analysis, it is essential to break down our sources of revenue and identify our cost of goods sold. This will give us a clear view of our gross profit, which measures our profitability after taking into account the cost of producing our products. From this we can subtract our operating expenses to determine our operating profit or EBITDA margin.

Tips & Tricks

- Continuously monitor your financial performance to identify areas for improvement

- Consider implementing cost reduction measures to increase profitability

- Regularly review your pricing strategy to ensure it aligns with your profit goals

In summary, analyzing the financial performance of our stationery store is crucial to ensuring its success. By creating a comprehensive financial plan, including projections, analysis and statements, we can make informed decisions that contribute to our long-term profitability and success.

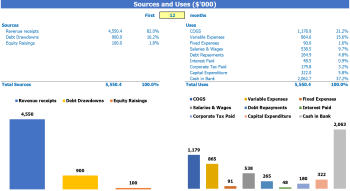

Stationery Sources Chart Sources and Usage

Sources and uses of funds in the financial model in Excel for Stationery Store provides users with an organized summary of where capital is coming from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Here, as part of the source column, funds received for the purchase of assets, capital investment or working capital are considered. The section where uses of funds are covered is the expenses section. These are all costs related to operations, project development, working capital and other related expenses.

Tips & Tricks:

- The sources and uses chart can be an effective tool to show investors or lenders how their investment will be used and returned.

- When creating a sources and uses statement, be sure to consider all potential sources of capital and expenses, including unexpected ones that may arise.

- Use the sources and regularly use a statement to ensure that you are on track to achieve your financial goals and objectives.

Overall, the sources and uses chart is an essential part of a stationery store’s financial plan, and it can help ensure that the business has the necessary funds to meet its goals and objectives. By creating accurate sources and uses, the stationery store can better manage its finances and ensure financial growth and stability.

The strategy for the success of a stationery store is a must . Building a financial model is a great way to support the overall business plan. By incorporating financial projections, analysis, forecasting, and performance measurement, you can identify opportunities for growth and mitigate potential losses. Creating a financial plan can be challenging, but with persistence, attention to detail, and using a financial model template that is right for your business, stationery store financial feasibility can be achieved. Remember that financial management is an ongoing process and you should review and adjust your financial model consistently to reflect the changing needs of your stationery store.