- The Benefits of Professional Business Plan Help

- Finding the Right Business Plan Writer to Fit Your Vision

- Dos and Don’ts in Making a Genuine Financial Forecast

- How to Create an Effective Business Budget

- How to Do Primary Calculations Before Starting a Project

The primary purpose of a Financial Model is to virtually recreate the real business; It shows, emulates and projects the performance of any business. To recreate it virtually, financial experts use the variables to define financial measures. Once these variables are created, it becomes easy for a financial analyst to enter different financial parameters and get the impact of those in the forms of numbers and charts.

These variables, which are called the assumption in financial parlance, are accustomed to predicting the impact of various changes created from company policies or by market ups and downs. These assumptions may include growth rate, operating margins, product prices, commodity price changes, refinancing or recapitalization.

There are several financial models available in the market; Before using or creating a Financial Model, you need to know your business purpose or purpose. For simplicity, the company would have a reason why and what they want to measure regarding business performance. Once the business decides on the objectives of the financial model, it is easy to design the functionality of the financial model to produce the required results.

Types of financial models

Financial modeling enables key personnel to make better decisions. These models are used for various types of decision making. Therefore, one model cannot be used for all types of decision making. As a result, several different types of models must be created. Each of these models requires different inputs and provides different outputs. A good financial modeler should be aware of the basics of these different types of models. There are different types of models created for different types of decisions.

Some of the important ones have been listed below:

- Discounted Cash Flow Model (DCF)

- Merger model (M&A)

- Model initial public offering (IPO)

- Three-statement model

- Consolidation model

- Budget model

- Forecast model

- Leveraged buyout (LBO) model

- Options pricing model

It should be noted that financial modeling is not a method where an exact process is followed to obtain exact results. Instead, financial modeling is a framework or set of guidelines that provides the means to derive the many financial results reflecting the performance of any business.

In this article, we will discuss the financial forecasting model and why a business needs a financial forecasting model regarding its performance.

What is the Financial Forecasting Model?

Financial forecasting is a vital function in business planning, budgeting and operational management. Business managers, investors, and creditors look at these forecasts to assess expected income and expenses so they can estimate a company’s cash flow throughout the accounting period. A financial forecasting model examines trends in external and internal historical data and projects those trends to provide decision makers with information about how the company’s financial performance is likely to be in the future.

Financial forecasts are an essential tool for key business stakeholders to make decisions about hiring, spending, and financing. It is also used for budgeting by CFOs to properly utilize company resources for profitability. A well-designed financial forecasting model gives you the information about what resources are needed, when they are needed, and how you will pay for those resources.

Most companies use financial forecasts for the coming month, quarter or year. Often, financial forecasts also cover longer periods, such as three or five years. Due to unforeseen factors, if the sales trend is in a different direction, companies use revised forecasts during the base period.

Objectives of a financial forecasting model

Undoubtedly, when a company forecasts a financial forecasting model, it has a goal that must be achieved by the proposed model. There are mandatory objectives of a well-designed financial forecasting model.

These goals are listed below:

- Profitability planning

- Liquidity planning

- Credit planning

- Business valuation

- Valuation of financial instruments

Let’s dive deep to explain each of the objectives in detail.

- Profitability planning

- Liquidity planning

- Credit planning

- Business valuation

- Valuation of financial instruments

These types of financial models are extremely complex, and it is quite difficult for individuals to design and create such complex models. On the other hand, these financial models have become necessary because financial instruments have become more and more complex nowadays. Since to create such a complex financial model, it has to consider various variables, and it cannot be done using a simple tablet or ordinary programming software.

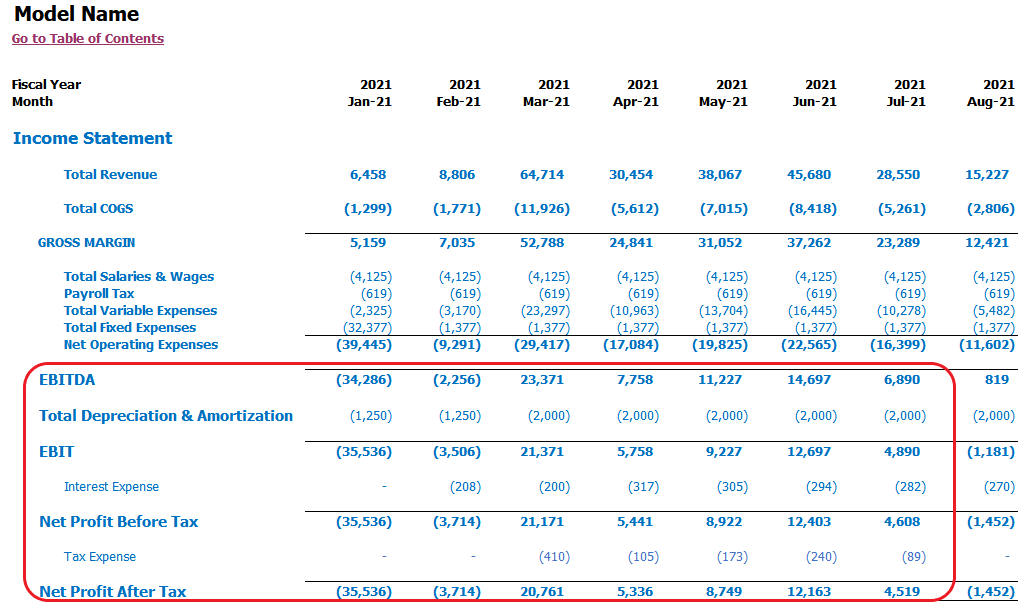

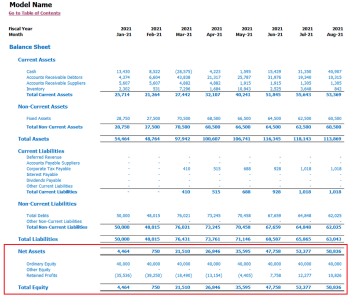

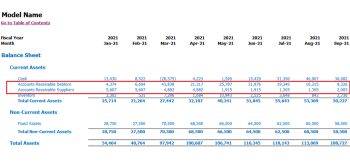

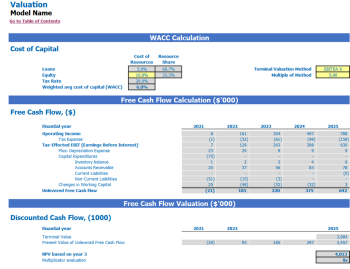

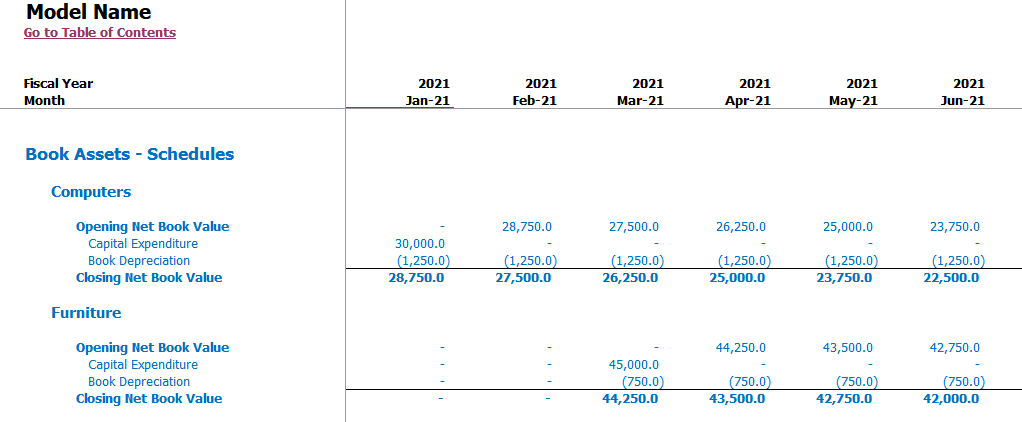

FinModelslab has made your complex financial forecasting model easy to use. Financial forecasting models designed by FinModelslab automatically execute all complex operations; You don’t need to remember an Excel formula or do the math. Below is one of the financial forecasting models from FinModelslab .

Excel Business Valuation Expert Financial Template

Download the Excel template ⟶

The five-year business valuation expert is a format for startups and entrepreneurs to impress investors and get funded. Key financial charts, summaries, metrics, and funding forecasts are built-in. Created with the business mind of business valuation experts. Business valuation, expert startups costs spreadsheet, used to evaluate startup ideas, plan startup pre-launch expenses and get funded by banks, angels, grants and funding capital risk.

With this financial plan, you will be able to calculate business valuator start-up costs, forecast income and expenses, plan margins and sales, salaries and cost of sales. Business valuation, expert revenue models will be beneficial for service-based startup financial modeling. They allow users to forecast expenses and income and show you how to succeed.

This expert business valuation financial plan is designed specifically for the needs of the service-based business. Inside, you’ll find a full forecast of all sales, fixed expenses, and cash flow. You’ll see that this model can benefit service-based businesses, helping them deal with the most common pain points.

Our business valuation expert startup budget will help with the following. First, you will be able to make a detailed Excel Pro Forma for a business valuation expert startup and get a forecast for every aspect of your business. As a result, you will know how to launch a business valuation expert startup.

Plus, this business valuation expert startup cost template has the best financial tools to achieve your business goals and manage your business growth.

[right_ad_blog]