Related Blogs

- Everything you need to know about SaaS financial model or SaaS business model from A to Z

- Leverage data visualization for your business plan

- The central importance of market research

- How to Create an Effective Executive Summary

- Financial model as part of the investment track

Many businesses are run by people who know nothing about financial planning and analysis. They are highly skilled professionals in other aspects of their business, such as marketing, technology, or sales, but know nothing about this area. The purpose of this article is to help you become familiar with some basic financial analysis concepts and how to use them to improve the health of your business.

What you need to know about financial analysis before you start

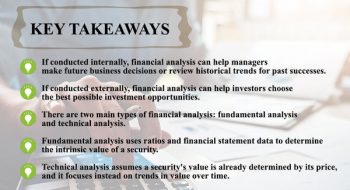

Financial analysis is a process review financial data to assess a company’s long-term or short-term performance and suitability. Financial analysis is important for effective decision making. Accordingly, investing time in financial planning and forecasting is the first thing every entrepreneur should do. At the very beginning, put your priorities back on the right. Even though you might be an expert in another area, put the financial analysis of your business first . The most common mistake entrepreneurs make is that they put so much effort into building a brand.

Download the Excel template! Learn even more ⟶

By focusing more on marketing and technology, they completely neglect business planning and financial modeling. Many consider financial planning the most complicated part of doing business. In fact, it is not. You just need more time and effort to gather the right data. For this reason, invest time and money in Financial planning and forecasting. It could save the life of your business in the future.

Performance Analytics User Types

Financial analysis affects decision making for many people, not just your company’s management. There are different types of users who use this information as the basis for their actions. There are many, and this only highlights the importance of financial analysis and planning.

The types of users who use financial analysis are:

- Shareholders

- Managers and employees

- Creditors

- Financial institutions

- Government institutions

Shareholders want to know more about the company’s profitability. They focus more on the success factor and return on investment. Managers and employees share similar interests with shareholders. They want to know more about the company’s profitability as well as progress and sustainability. Creditors are looking for ratios. They want to know how liquid your business is because they want to get paid on time.

Download the Excel template! Learn even more ⟶

Financial institutions, for lending purposes, are most interested in the company’s liquidity or ability to cover long-term liabilities. Government institutions have various uses, but they use the report if you participate in a public offering or to analyze your taxes. Analyzing financial performance affects many people and decisions that directly dictate the success of your business in the marketplace.

Download the Excel template! Learn even more ⟶

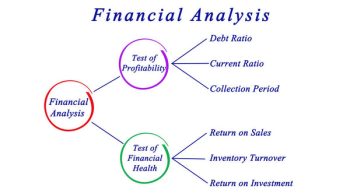

Performance analysis through the analysis of parameters and financial statements

Determining your performance refers to analyzing financial statements and calculating financial ratios. There are three types of statements: balance sheet, cash flow and income statement. This should be your starting point. To calculate financial ratios, data from these financial statements are used and narrative parts are developed. This group of tools and statements are realistic indicators of how your business is performing in the marketplace.

From there, with these calculations in mind, you can take some serious action and improve the overall health of your business. Analyzing financial data is important to know how the business operates and what the accepted practices are before drawing conclusions. This type of information and analysis of financial risks is crucial and extremely important data for the decision-making process of the company.

In conclusion, financial analysis is something that every business must undertake in order to maintain its place in the market and achieve long-term success. Every decision is based on the analysis of financial data. Also, instead of investing time and energy in marketing and sales, start with financial planning and analysis first. Investing in these activities will also leave space in the future for other activities.

So, if you don’t have the necessary expertise, you can always contact the financial analysis companies. you can always Contact us. We have the right team and the right tools, and we will deliver a quality product that you will use for many years to come.

Download the Excel template! Learn even more ⟶

[right_ad_blog]