Related Blogs

- How to get an unsecured business loan

- How to qualify for an SBA loan

- Understand the different types of safety structures

- How to find the right start-up loan for your business

- Understand cash flow and strategies to improve financial performance

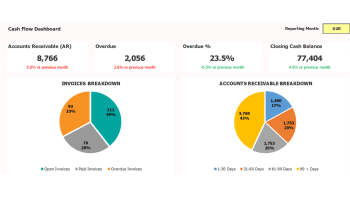

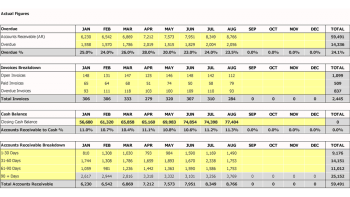

FinModels Lab has created a fancy Accounts Receivable Dashboard in Excel to visualize the structure and progress of Accounts Receivable . A well-constructed template is designed for users without advanced Excel skills. Just enter the numbers in the appropriate cells and run the dashboard smoothly.

After reading this article, you should be Apple to learn:

- What are Creative Accounts

- Accounts Payable Entries Journal

- Bad debts concept

- Accounts payable cycle

- Importance of Accounts Receivable

- Accounts Receivable Management

- Accounts Receivable and Cash Job

- Impact of accounts receivable on working capital

- FREQUENTLY ASKED QUESTIONS

What are Creative Accounts

The amount owed from clients/customers against sales made or services provided on credit. It is like giving a business loan to clients/customers and appears on the balance sheet under current assets. The Company following the basis of execution of accounting accounting accounts.

Companies conduct credit sales to catch sales or to respond to the granting of credit by competitors. In some cash-intensive businesses, the more days of credit allowed to customers, the more customers/customers are willing to use a facility and the greater the market share will be and vice versa.

Download Accounts Receivable Calculator in Excel

Accounts Payable Entries Journal

Accounts receivable have the nature of debit and the increase in accounts receivable is recorded as an increase in assets and vice versa. In this case, examples will clarify the concept of accounts receivable.

Suppose you are the business owner of a fast food restaurant. An office located in your vicinity makes an agreement with you that you provide lunch to their staff. Every working day, the restaurant provides 30 lunch boxes at /lunch box, and the office pays you by 5 th of the next month. This creates accounting accounts in your books of accounts.

Now, every day after the delivery is completed, this sale will result in receivables which are recorded as follows:

|

account heads |

Debit |

Credit |

|

Accounts Receivable |

0 |

|

|

Sales |

0 |

At the end of the month, the accounts receivable balance will be ,900/- (considering 22 working days: 0 x 22 = 9,900). Now on the 5th Next month, you have invoiced your accounts receivable balance and transferred office on the same day.

The reversal entry to adjust accounts receivable is:

|

account heads |

Debit |

Credit |

|

Bank / cash |

,900 |

|

|

Accounts Receivable |

,900 |

Bad debts concept

Not all accounting accounts are good and sometimes clients/clients will not pay in full or in part. Indeed Bad debts can be due to many different reasons, and few are summarized for a clear concept:

- The client/customer faces financial difficulties and both parties reach a compromise.

- The client/customer is declared bankrupt.

- Simply, the client/customer runs away with your money.

The accounting treatment of recording bad debts depends on the probability of recoverability. If a company is certain that the amount due to a certain party is not collectible, it is recorded directly as an expense in the income statement.

The accounting entry will be as follows:

|

account heads |

Debit |

Credit |

|

Bad debts |

xxx |

|

|

Accounts Receivable |

xxx |

In case there are doubts about the collectability of a certain amount from a customer/customer, bad debts expense is not directly recorded, however, disposition is recorded against bad debts.

The accounting entry will be as follows:

|

account heads |

Debit |

Credit |

|

Provision for doubtful debts |

xxx |

|

|

Accounts Receivable |

xxx |

Once it is confirmed that the accounts payable that were doubtful in the first place are no longer collectible, the following accounting entry will be made to record the expenses:

|

account heads |

Debit |

Credit |

|

Bad debts |

xxx |

|

|

Provision for doubtful debts |

xxx |

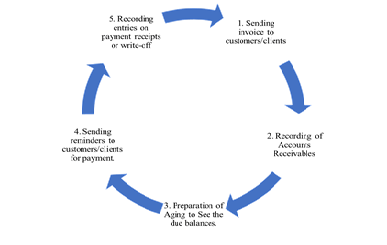

Accounts payable cycle

Download Accounts Receivable Calculator in Excel

Importance of Accounts Receivable

The financial situation of a company cannot be determined by evaluating a parameter; However, accounts receivable is one of the parameters as any client/customer entering into a business agreement with the company will look at a company’s credit policy.

One of the important things to know is whether lower account receivables are better for business or higher. The answer is more than receivables are accounts.

Days of Accounts Receivable are great benchmarks while assessing a company’s financial condition. It shows how long money has been owed to clients/clients. In other words, it waits for a company’s time to collect the money from customers/clients. Receivables days are different for different companies.

To understand the importance of receivables days, we need to understand different scenarios:

- The increase in days of accounts receivable from the normal credit facility indicates that the company is not collecting cash in a timely manner and vice versa.

- The increase in days of receivables compared to the previous period indicates that the business needs more money to finance the business and yet the return on investment will drop, which is never liked by business owners. company and vice versa.

- In the event that the days of receivables are higher than those of competitors, it indicates that the company is in a weak bargaining position and the product is not as welcoming as those of competitors and vice versa.

Banks also see the recoverability cycle of a business when deciding on loan/overdraft facility. Also, companies with higher days of receivables normally have more receivables. According to a Forbes article, the highest days of receivables are 125 days and 111 days for “business and enterprise management” and “oil and gas extraction” companies respectively.

Accounts Receivable Management

Accounts receivable management is important to make better use of resources. They say no lunch is free in this world. Likewise, waiting for customer/customer payments for a longer period has its cost. Customers/customers strive to get as long credit days as possible because they get the chance to use someone else’s free money, while businesses strive to get back some credit. money as soon as possible to use resources and manage funds.

We need to understand this from two different angles:

- Suppose the business model of one of your clients is to fund their business through interest bearing bank loans. When your business extends a credit facility, it signifies that the customer has secured an interest-free loan in the form of inventory which is their main purpose, thus their bottom line and return on investment will improve. Therefore, customers/clients like longer credit days.

- Now suppose you have your own money to fund your business, however, you have arrangements with the bank that any access cash will be placed in a savings account to generate interest income. Now your company will make efforts to collect accounts receivable as soon as possible to earn interest.

Entrepreneurs do not pressure customers/customers to pay before the business relationship is maintained by credit terms. However, managers need to make calculations to check whether the allowed discount on early customer/customer receipts brings more value to the business or vice versa.

Business leaders should keep an eye on the following for better resource management:

- Track and interpret changes in accounts receivable over time

- Review the total amount of accounts receivable.

- Debited and overdue balances comparison accounts.

- Cash/Bank Funds vs Accounts Receivable.

- Number of open, paid or overdue invoices.

IMPORTANT NOTE: Try our Free Accounts Receivable Calculator Designed in Excel or Google template to track and interpret changes in Accounts Receivable over time. You may also like Accounts Receivable Dashboard To see a dashboard of all important information related to accounts receivable without knowing anti-excel skills. Just make a copy of the highlighted cells in foil and yellow to see the magical results.

Download Excel Accounts Receivable Dashboard Template in Excel

Accounts Receivable and Cash Job

Since Accounts Receivable is basically the interest free loan given to customers/customers which indicates that the business money is being used by someone else, hence it has a negative impact on the cash flow . In the cash flow statement, the increase in accounts receivable is negative in cash flow from operating activities and vice versa.

Impact of accounts receivable on working capital

Working capital is the difference between current assets and current liabilities. It indicates the overall liquidity and health of businesses. Positive working capital means that a company’s current assets are more than current liabilities and therefore it has the potential to grow and invest. Accounts receivable are part of current assets and therefore have a direct correlation to working capital.

To understand this concept, let’s see an example.

|

Description |

Scenario-i |

Scenario-II |

|

Current assets – Accounts Receivable – Species |

,000 0 |

,000 0 |

|

Current liabilities |

$(2,500) |

$(2,500) |

|

Working capital |

,000 |

,000 |

|

* All numbers except accounts receivable are constant to see impact. |

||

The table above shows how the increase in accounts receivable has had a positive impact on working capital. Thus, more funds are needed to finance the business.

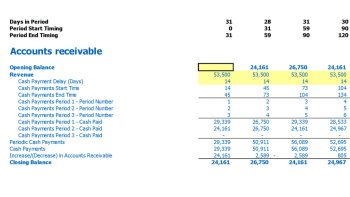

IMPORTANT NOTE: Our working capital (AR) calculator is specially designed in Excel and Google Sheet to show you closing balances of your accounts receivable based on credit terms. You just need to update the yellow highlighted two number manual and it will generate automatic reports.

Download Accounts Receivable Calculator in Excel

FREQUENTLY ASKED QUESTIONS

Q. What is the difference between Accounts Payable and Accounts Receivable?

A. Accounts payable, shown as current liabilities on the balance sheet, are money owed by the business and must be paid in the future to settle the liability. Although accounts receivable, shown in current assets on the balance sheet, is the money owed to businesses by customers/customers and they have to pay to settle their account.

Q. How many days of accounts receivable are considered good?

A. There is no universal answer to this question in absolute terms. However, if the days of accounts receivable are less than the credit term or the previous period or those of competitors, it is good management of accounts receivable.

Q. Are income and accounts receivable the same thing in accounting?

A. No. Income is the amount earned by businesses due to business transactions, whether received or deferred. If the amount owed by the customer / customer is deferred, it becomes accounts receivable. Revenue appears in the income statement, while accounts receivable is a balance sheet item.

[right_ad_blog]