Related Blogs

- Balance Sheet – Definition and Examples (Assets = Liabilities + Equity)

- How to Create a Cash Flow Budget

- Increased cash flow through strategic sales

- Streamline bottom-up budgeting with technology

- Understand the role of financial modeling in corporate finance

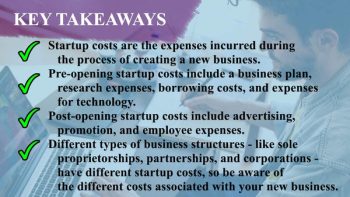

Inventing the future and creating a real business is a long and often very expensive road for startups. If you want to think and act like a startup entrepreneur and do very well at first, you have to practice and perfect the art of being frugal. Startup costs need careful counting, reasonable cost calculations, monthly budget planning, consolidation and reporting, especially in the first phase.

Hundreds of new startup organizations underestimate business expenses, neglect the planning process, and start projects. They have a wishful thinking that a product will explode and become profitable. For example, one of the most common mistakes new entrepreneurs make when it comes to a marketing budget is assuming the ad is a start-up cost and not an investment. Or startups often wait too long to invest in HR – it’s better to start investing as soon as possible.

Download the Excel template! Learn even more ⟶

Additionally, new businesses should consider additional features that help businesses budget expenses, or, for example, help reduce costs for accommodation expenses when traveling. Exploring the potential demand for a new business and getting it started can be an expensive proposition. For a new business, things get expensive quickly.

Early stages and planning

Startup expenses are those spent on sales or administrative costs involved before the product is run. Some expenses are important, and that’s more than office equipment and rental. More broadly, expenditure is defined as a budgetary term. And most often it refers to an organization spending money used for a particular purpose and over a certain period of time.

Let’s take a look at the different sources of funding for startups:

- Investment –When an investment business or someone else gives money to another business, the person or business has the right to acquire and own a business. It also means taking calculated risks: the business might get back less money than they invested or make their own profits later.

- Fund raising – If your startup is at a fundraising stage, that means you could be looking for seed funds to fund the main project idea. Time to impress and suggest investors start or continue funding the product.

- Equity financing –A general term, it means the process of raising business capital by receiving cash in exchange for issuing stock in your company.

- Debt financing – When you borrow money by selling bonds, bills, or notes to individuals and/or institutional investors, that is debt financing. Borrowed money must be repaid whether or not your product earns income. The most common are venture capital debt, debitable credit loans, asset loans (equipment and other areas), and Small Business Administration (SBA) loans.

- Bank credit – If your credit history is excellent, you may be able to obtain a loan to finance your business. But you should be prepared to pay interest on the loan (sometimes very high). So, visit a bank and discuss some of your options.

- Friends and family –A friend or family member may be able to give you an interest-free loan and put the first money into a business.

SO

Undercalculated costs may rise to wrongly assume the net profit (income less expenses). This is a situation that does not bode well for any startup. Well, you should also remember that spending a limited amount of money can be a Reason why the startup fails .

To start a successful business, you should consider using a startup financial model To consider all aspects of a business plan and your initial funding. The quality of your work should be that of absolute involvement with a huge start-up effort. And the Creating a business plan will help you To establish primary trade balances and calculate start-up costs.

Download the Excel template! Learn even more ⟶

Concrete list of all expected startup costs to get started

Do you know what your fixed and variable expenses might be? You should. Here is a great list of startup costs common to all startups:

- Brief and market studies – Analysis of daily expenses and costs should be organized before starting a project. Entrepreneurs have to decide whether to run the business on their own or hire market research companies. The latter ensure a deep dive and look at all aspects of the business including facilities, people and processes.

- Registration fees, taxes and insurance – Most organizations must have a license, special equipment and qualifying locations. For example, a business may require health/food safety inspections or special permits for work, etc.

- Equipment and technology expenses – You must decide whether to buy or rent primary equipment and supplies. Don’t forget to include the cost of a website and software development for your product.

- Market research, advertisements and discounts – Pure truth, the startup does not walk around. So you have to be careful and do some market research. Of course, there’s more than advertising and ad placement you could do. But remember, making discounts and giving away free company t-shirts will help you promote the product and earn more revenue.

- Employee expenses – Consider that your company will spend a large sum on health care, wages, compensation and benefits when hiring employees. Remember that you need to plan for higher salaries to attract quality employees!

Summary

You never know when your car might need a repair, the same for the business process. Having extra cash stowed away for unexpected expenses is always worth paying attention to. More businesses fail for lack of money than for lack of profit when faced with unexpected problems.

Above all, seek information and advice from others who have walked the same path. The thing is, you can never tell where the best business recommendation will come from. do not hesitate to contact us and see how to make a first-notch business plan Sets your business up for success.

[right_ad_blog]