- Finding the Right Investment Banking Firm

- Why Do You Actually Need a Pro Forma Income Statement?

- The Benefits and Potential Pitfalls of Financial Modeling

- How to Create a Successful Business Plan

- Creating a Financial Model: An Overview

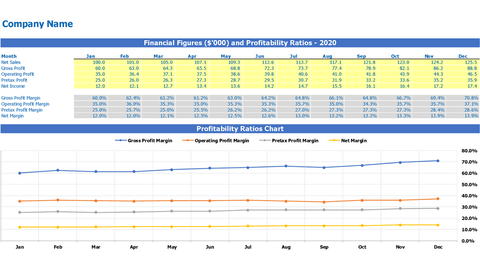

FinModels Lab has created a fancy but informative dashboard to visualize the strengths and weaknesses of your business by simply passing Financial Dashboard . A well-constructed template is designed for users without advanced Excel skills. Just enter the numbers in the appropriate cells and run the dashboard smoothly.

After reading this article, you should be Apple to learn:

- What is the profitability ratio

- Commonly used profitability ratios

- How profitability ratios are used

- Importance of profitability ratios

- Profitability Ratio Limitations

- FREQUENTLY ASKED QUESTIONS

What is the profitability ratio

Profitability ratio is the ratio that tells business owners and business managers about the efficiency of the business that uses its financial and human resources to generate profit from the sales of goods/services. The basic objective of a business activity is to increase wealth and the profitability ratio is used to assess the value that a business activity has generated over a specific period.

Commonly used profitability ratios

The commonly used profitability ratios along with its formulas are explained below:

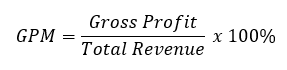

- Gross Profit Margin (GPM)

shows the percentage of total revenue a company saves after incurring the cost of goods sold. It shows how the business is placed in the niche. If the GPM abandons previous periods, it indicates that the company needs to control its cost of goods sold either by changing business processes or finding suppliers to buy cheap raw materials, or the price of the product needs to be evaluated.The simple formula to calculate the GPM is as below:

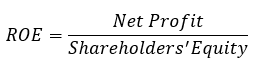

- Return on Equity (ROE)

shows the profitability of a company with respect to equity. Simply put, ROE is the value generated by a dollar of investment made by shareholders. The investor will invest in the business if the ROE is more than the rate of inflation and the risk-free return on government bonds.ROE is calculated as:

- Return on Assets (ROA)

shows the profitability of a company with respect to assets. Simply put, ROA is the value generated by a dollar of assets owned by a company at any given time. The lower ROA compared to competitors or previous periods indicates that the business requires more investment in plant, machinery and equipment.ROA is calculated as:

IMPORTANT NOTE: We have designed free Profitability Ratios Excel Template Calculator where you just need to create a copy of the sheet and put your numbers in the yellow cells and see the profitability ratios over a period as well as graphical trends . You can also try Financial Dashboard .

Download Profitability Ratios Excel Template Calculator in Excel

How profitability ratios are used

Profitability ratio is calculated and used to value a business by:

- Evaluate trend analysis and compare with profitability ratios from prior periods. If the profitability ratio is higher than previous periods, the better the business is and there are chances of strong expansion.

- Comparison of profitability ratios with competitors and industry leaders. The better the ratio of competitors, the more shareholders wish to be likely to invest, or a private company may obtain a lucrative offer from a buyer to acquire business. While comparing the ratio with competitors, business managers should ensure that competitors and businesses follow the same accounting policies or make appropriate accounting adjustments before comparing.

- Comparison of ratios with targets set by a company for a specific period. The lower the profitability ratio is from set goals, business leaders need to assess what went wrong and where they need to improve.

Importance of profitability ratios

Profitability ratios inform stakeholders about a company’s operational efficiency and performance. Different stakeholders use the profitability ratio for their own purpose which is explained below:

- Business Leaders Compare profitability ratios with previous periods and targets set to assess a company’s operational efficiency and therefore take corrective action, if necessary. These corrective actions may include revising the pricing strategy, removing unprofitable products, reducing costs, or increasing the customer base.

- Shareholders Compare profitability ratios with other companies to see if the amount invested is used efficiently and creates wealth for shareholders. The lower profitability ratio sends a signal to shareholders to explore other business opportunities, unless other ratios related to financial condition are better.

- Banks/creditors Also uses profitability ratios when granting a loan to a business or extending credit facility. The higher the profitability ratios, the more confidence banks/creditors have that their loans will be repaid.

In a way, the profitability ratio is also related to the assumption of the preparation of the preparation of the preparation of financial statements. This is because a business with consistently impressive profitability ratios means better management of funds and will have resources to continue operations for the foreseeable future.

Profitability Ratio Limitations

Although the profitability tool is useful for evaluating business performance, however, it has certain limitations and cannot be used in isolation to make a business decision.

Few basic limitations are explained below:

- The profitability ratio is better for small companies, because giant companies with multi-divided businesses may not find the competitors to compare the results.

- Seasonal businesses affect profitability ratios and comparing monthly profitability ratios may not yield meaningful insights into the operational efficiency of businesses.

- Inflation may affect profitability and the judgment to be applied in comparing results with prior periods (particularly due to depreciation and inventory). Some companies use FIFO methods and other weighted averages for inventory valuations. Similarly, some companies use the straight line and others may use the reduction of the balance depreciation method. This change in accounting policies affects profitability calculations, making it difficult to compare ratios with competitors.

It is pertinent to mention that profitability is no doubt a good financial benchmark to compare financial operations, however, an actor cannot base his decision solely on these calculations, but a more complete analysis is required by evaluating the liquidity ratios / solvency / valuation.

FREQUENTLY ASKED QUESTIONS

Q. Is the profitability ratio an accounting concept?

A. No. Profitability ratio is the concept of financial management and business managers, shareholders bankers, creditors and competitors calculate them to derive significance information.

Q. How does a business leader interpret if the gross profit margin is high, but the net profit margin is low compared to previous periods or competitors?

A. This situation implies that a company’s value adding or manufacturing process is efficient, however, operating expenses must be assessed and controlled.

Q. Can the best profitability ratios be explicitly quantified?

A. No

[right_ad_blog]