- How to create an Engaging Pitch Deck

- All You Need to Know about SaaS Financial Model or SaaS Business Model from A to Z

- How to Build Ideal Startup Financial Model

- Investing in Startups: How to Analyze Any Opportunity

- Writing an Effective Executive Summary

FinModels Lab has created a fancy yet informative dashboard to visualize the strengths and weaknesses of your business by simply switching to Annual Financial Performance Dashboard & Financial Dashboard . A well-constructed template is designed for users without advanced Excel skills. Just enter the numbers in the appropriate cells and run the dashboard smoothly.

After reading this article, you should be Apple to learn:

- What is financial liquidity

- Commonly used liquidity ratios

- Importance of liquidity ratios

- Benefits of Liquidity Ratios

- Disadvantages of liquidity ratios

- FREQUENTLY ASKED QUESTIONS

What is financial liquidity?

The financial liquidity of finance and accounting shows the ease of converting assets into cash. Bonds and stocks are sort of assets that can be converted into cash very timely and easily. However, important assets such as property, factories and equipment are difficult to convert into cash. In other words, items included in non-current assets on the balance sheet are not liquid, while current assets on the balance sheet are mostly liquid.

In financial and accounting analysis, a company’s liquidity is a measure of how easily it can fully meet short-term financial obligations.

Commonly used liquidity ratios:

Commonly used liquidity ratios along with its formulas are explained below:

- Current Ratio

Measures a company’s ability to repay its current liabilities with its total current assets such as cash, accounts receivable and inventory. The ratio is higher than the liquidity position will be high.The simple formula to calculate the current ratio is as under:

Current Ratio = Current Assets ÷ Current Liabilities

- Quick report

Defines a company’s ability to meet its short-term obligations through its most liquid assets (near cash and fast assets). Current assets that can be included in quick assets are those that can be quickly converted into cash at close to their book value. Alternatively, the quick ratio is also called the acid-test ratio.The formula to calculate the quick ratio is given below:

Quick Ratio = (Current Assets – Inventories) ÷ Liabilities to Current

In calculating quick ratio inventories, inventories are deducted from total current assets because they are less liquid than all other current assets. The higher the quick ratio, the better the financial situation and the health of the company.

- Cash Ratio or Cash Asset Ratio

A company’s cash and cash equivalent assets to its total liabilities. The cash ratio indicates the readily available funds that can easily repay liabilities.The simple formula for calculating cash ratios is given below:

Cash Ratio = Cash and Cash Equivalents ÷ Current Liabilities

The cash ratio is not a much financially used ratio like the current ratio and the quick ratio, its usefulness is limited. Some companies accept cash ratio of at least 0.2.

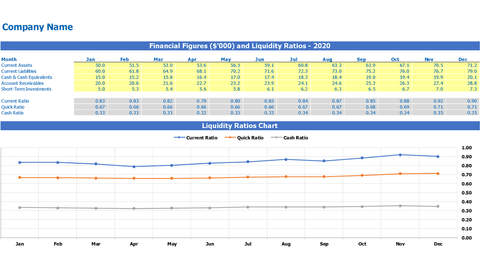

IMPORTANT NOTE: Check out our free designed Liquidity Ratios Excel Template Calculator In Excel and Google Spread Spread Sheet which calculates ratios without having Excel skills. You just need to insert quantities in the yellow cells and see the monthly ratios.

Current assets and current liabilities used in the liquidity ratios are taken from the balance sheet. To understand current assets and current liabilities, you can read our article on balance sheet. Also check out our free specially designed Monthly Balance Sheet and Annual Balance Sheet This helps you prepare the balance sheet by simply entering the numbers in the yellow highlighted cells.

Download Excel Liquidity Models Calculator in Excel

Importance of liquidity ratios:

There are different aspects that are analyzed by liquidity ratios.

Some of them are highlighted below:

- The ability to manage short-term obligations measure shows how much cash equivalent funds are available with a company to cover short-term obligations and to what extent. A ratio of 1 is better than a ratio of less than 1, but it is not ideal in every scenario and will vary from company to company. Most of the time, creditors and investors are interested in seeing a high ratio, such as 2 or 3. This is because the liquidity ratio is high implies that the company is in condition to pay its short-term obligations. . The company having a ratio lower than 1 or negative will face the problem of liquidation.

- Determining creditworthiness is an important factor from a creditor’s perspective, as creditors analyze the Company’s liquidity ratios when deciding whether to extend credit terms to a business. They ensure that the company they are lending to has the financial strength to repay in a timely manner. Any hint of instability may result in disqualification from credit or obtaining a loan.

- The measure of investment value is the measure used by investors to ensure that the company is financially sound and secure enough for them to invest. Working capital issues will also be limited to the rest of the business. The higher the better concept about liquidation ratios is true but to a certain extent as investors may raise the question at some point if the ratios are too high, for example, 7 or 8. an abnormally high ratio indicates that a company has liquid assets.

With liquidity ratios, there is a balance between a company being able to pay its bills in the short term and poor capital allocation. Capital allocation should be managed in such a way that the value of the company for the shareholder increases.

Benefits of Liquidity Ratios:

Liquidity ratios are the most important tools for determining the resilience of the business using income statement and balance sheet items and cash flow statements in the calculations.

Some of the most important benefits are listed below:

- Standardized method of comparison: The use of liquidation ratios is a standardized method to compare companies and industries in their respective proportions. Company ratios can be used as a measure to judge the performance of the company, regardless of its size, sales volumes and market shares. This method of comparison can go beyond the numbers to analyze the quality of the business in profit, business financing, and growth through sales rather than debt.

- Industry Analysis and Benchmarking: Helps indicate different trends in particular industries and creates a baseline against which the performance of all industry payers can be measured. There are many small businesses that use the industry benchmark to illustrate their organizational strategy and benchmark their own performance against the industry.

- Planning and performance: It is directly related to liquidity ratios as they are used for creating business plans and preparing presentation for investors and lenders. Small businesses can strategize by using industry trends to set time-bound performance goals in terms of different ratios to satisfy investor needs and insight into the potential of the new business.

Cons of Raios Liquidity:

Liquidity ratios are very important to analyze the performance of the company against the industry, but there are also some disadvantages which are necessary to consider and are given below:

- The ratios only provide the data showing the financial impact of the business, but there are other important non-financial issues that should also be taken into consideration. For example, the quality of assets and how those assets contribute to shareholder value.

- The company uses inventory figures to calculate liquidity ratios. However, this may lead to miscalculation due to overestimation. Higher inventory can also interpret that sales are low, which is why the inventory level is high, so the inventory calculation may not provide the true and accurate liquidity position of the business. Additionally, in the event that all other factors in the liquidity ratio are the same and inventories are increasing, it may indicate that the inventory is not being properly managed resulting in excess maintenance cost, provisions slow inventory, etc. This implies that the liquidity ratio shows a better financial situation, however, the performance of the company may not be good.

- There are also certain chances that the calculation of the liquidity ratio is the result of creative accounting because it uses the information shown in balance sheet of financial statements. To confirm the financial position of the company, one must go beyond the data available on the balance sheet to perform the ratio analysis.

FREQUENTLY ASKED QUESTIONS:

Q. How are liquidity ratios used by business leaders?

A. Business leaders calculate liquidity ratios and compare it to prior periods, budget figures, industry standards and competitors to assess liquidity position. It is also important to mention that the normally current ratio of 1 is considered good, however, it differs significantly from industry to industry and from year to year, for example, within the fiscal year 2010, the current average manufacturing and retail trade ratios were 2.72 and 1.32 respectively.

Q. What is the difference between the solvency report and the liquidity report?

A. Both ratios refer to the financial condition and health of a company, however, the solvency ratio measures the ability of a company to repay its long-term liabilities while the liquidity ratio is a measure of the ability of a company to settle its liabilities in the short term.

Q. Does the higher liquidity ratio only indicate business weakness?

Yes indeed. Activities with excessively high liquidity ratios could sideline assets to expand operations, improve equipment, etc.

[right_ad_blog]