- Home

- Sales and revenue

- Running costs

- Financial

Opening a clothing store requires more than just a passion for fashion; It also requires financial planning and analysis to ensure the viability of the business. To achieve this goal, you must have a solid financial model in place that can project future income, expenses and profits. This involves creating a financial forecast , with a profit and loss statement, cash flow analysis, break-even analysis, sales forecast, and budget plan. Overall, having a well-defined financial plan is essential to ensuring that your clothing store is profitable, sustainable, and successful in today’s highly competitive retail landscape.

Clothing store revenue and sales forecast

Revenue and sales forecasts are a crucial aspect of any clothing store’s financial model. This includes sales estimates throughout the year, projected sales growth based on various assumptions, and expected revenues generated. Launch date, ramp-up time, appointment traffic and growth assumptions, customer and purchase assumptions, and sales seasonality are factors that should be considered when forecasting revenue and sales for a clothing store.

To ensure financial stability, a clothing store’s financial model should also include profit and loss reporting, cash flow analysis, break-even analysis, and budget planning. Financial planning and analysis, along with effective financial management, play a vital role in the success of a clothing store business.

Creating and regularly reviewing clothing store financial projections is a key step in establishing a solid foundation for financial success. By accurately forecasting revenue and sales, a clothing store can make informed business decisions that can help grow the business, meet demand, and achieve financial stability.

Clothing store launch date

Choosing the right time to launch your clothing store can be a critical factor in ensuring success in the highly competitive fashion industry. Your launch date plays an important role in shaping the future of your store and determining its financial projections and revenue models.

Financial planning is essential in determining the viability of your clothing business. Your Income Statement , Cash Flow Analysis , Profitability Analysis , and Sales Forecast All depend on your launch date. Therefore, it is essential to choose a strategic day that suits the business you want to run.

Tips & Tricks:

- Think of the launch during a season when people generally buy more clothes.

- Choose a launch date after setting up your store and have products ready to sell.

- Make sure you have enough money to cover expenses until your business starts generating revenue.

- Launch at a time when people are looking for something new in the market.

Your budget plan should reflect the costs associated with launching your store, including marketing, inventory, staff, and other expenses. Whatever date you choose to launch should be well planned and well funded.

In short, Clothing store financial analysis and financial direction will highly depend on your launch date. It is crucial to take care of this important decision in order to set your business on the path to success.

Clothing store ramp up time

When it comes to financial projections for a clothing store, one of the key things to consider is the ramp-up time. Ramp-up time is the period during which sales gradually increase as the store gains visibility and establishes its customer base. This period is crucial to predict, as it affects both the store’s revenue model and its cash flow analysis.

What is the ramp-up period for your business? It ultimately depends on the industry and the details of your operation. For a clothing store, the ramp-up period can be six months to two years. During this time, it is important to consider expenses such as inventory and marketing, as they can have a significant impact on your profit and loss statement.

Tips & Tricks:

- Research your industry to better understand what to expect in terms of ramp-up times.

- Be realistic in your projections and consider worst-case scenarios.

- Focus on building your brand and establishing a loyal customer base during the ramp-up period.

By incorporating increased weather into your clothing store sales forecasting, budget planning, and financial management, you can better prepare for the challenges and opportunities that lie ahead. Don’t overlook the importance of this crucial period, as it can make or break the success of your store.

Walk-In Traffic Intarts Apparel Internship

After the ramp-up period, we can assume that the daily walk-in traffic for the clothing store varies by weekday. As a rule, on weekdays we see the greatest number of visitors. On average, Mondays see 150 visitors, Tuesdays see 180 visitors, Wednesdays see 170 visitors, Thursdays see 190 visitors and Fridays see 200 visitors.

This assumption is essential to build a financial model for the clothing store. The model requires revenue and profit projections, profit and loss statements, cash flow analysis, age analysis, sales forecast, budget planning, financial planning, l ‘financial analysis and financial management be based on the average traffic walk-in traffic traffic from the appointment traffic from the store.

Tips & Tricks

- Be sure to base your financial models on realistic traffic inputs.

- Consider all the factors that can affect store traffic, such as holidays, location, and marketing campaigns.

- Stay up to date with the latest industry trends to help predict future visitation patterns.

Assuming a growth factor of 3% per year, we can project the average appointment traffic for the clothing store for the next five years. Based on these inputs, we can predict that Mondays will see 164 visitors, Tuesdays will see 197 visitors, Wednesdays will see 186 visitors, Thursdays will see 209 visitors, and Fridays will see 219 visitors.

Clothing store visits for sales conversion and repeat sales entries

When analyzing the financial projections of a clothing store, an important factor to consider is the conversion rate from store visits to new customers. On average, the conversion rate is around 10% to 20%. This means that out of 10 people who walk into the store, at least one will make a purchase.

Another important metric to consider is the percentage of repeat customers. This varies greatly depending on the store and its customer service. A store with excellent customer service can expect a high percentage of repeat customers. The industry standard for repeat customers ranges from 40% to 60%.

To calculate the expected revenue from repeat customers, it is important to estimate the average purchase amount per customer each month. This can be done by reviewing past selling data and analyzing buying patterns. On average, a repeat customer will make 2-4 purchases per month, depending on the store’s product offerings and the customer’s needs.

Tips & Tricks

- Provide excellent customer service to increase the percentage of repeat customers

- Encourage repeat customers through loyalty programs or promotions

- Track sales data and analyze buying patterns to estimate the average purchase amount per customer

It’s important to keep these assumptions in mind when building a financial model for a clothing store. Revenue model, profit and loss reporting, cash flow analysis, budget planning, and financial analysis are all heavily influenced by store conversion rate and repeat customer metrics.

Clothing store sales mix checks

Our clothing store sells various products such as t-shirts, jeans, dresses, shoes and bags. Each product belongs to a specific product category. To make our financial projections easier to understand, we have entered the sales mix assumption based on product category.

For example, we assumed that 30% of our sales would come from T-shirts, 20% from jeans, 15% from dresses, 25% from shoes, and 10% from bags. We then forecast the sales mix percentage for each product category for the next five years.

Tips & Tricks:

- Regularly update your sales mix assumptions to reflect changes in customer demand.

- Include new product categories in your sales mix assumptions to diversify your revenue streams.

- Use historical sales data to validate your sales mix assumptions.

Clothing store average sales average entrances

In our clothing store, we sell a wide variety of products, including shirts, pants, dresses and accessories. To facilitate financial projections, we have grouped our products into categories. This way, we can enter assumptions at the product category level rather than at the individual product level.

One assumption we make is the average sale amount per product category per year. For example, we estimate that our shirt category will have an average sale amount of in year one, rising to in year two. This information is then used to estimate the average ticket size.

With the sale mix and average sale amount of each product category, the model will calculate the average ticket size. For example, if the first year’s sales mix is 40% shirts, 30% pants, 20% dresses, and 10% accessories, and the average sales amount for each category is mentioned above, the average ticket size would be in the first year.

Tips & Tricks:

- Be sure to update your assumptions regularly to reflect changes in your business and industry.

- Consider adding more product categories as your business grows to improve the accuracy of your projections.

- Use historical data to inform your assumptions and adjust them accordingly.

Clothing store sales seasonality

As a clothing store owner, it is important to understand sales seasonality assumptions. Seasonality factors determine the deviation from average monthly sales per day, which can be entered as a percentage. This will help you predict your store’s sales during different seasons of the year.

For example, during the summer months, sales of swimwear and summer clothing may increase, while sales of winter coats and boots may decrease. Therefore, there will be a higher deviation from the average monthly sales per day during the summer months compared to the winter months.

Tips & Tricks:

- Use historical data to determine seasonal patterns in sales.

- Adjust inventory levels to align with seasonal demand.

- Create promotions and discounts to boost sales during slower seasons.

By understanding sales seasonality assumptions, you can create accurate financial projections for your clothing store. It will help you a clothing store revenue model, clothing store profit and loss statement, clothing store cash flow analysis, clothing store break even analysis, Clothing Store Sales Forecasting, Clothing Store Budget Planning, Clothing Store Financial Planning, Clothing Store Financial Analysis, and Clothing Store Financial Management.

Clothing store operating expense forecast

The operational expense forecast is part of the clothing store’s financial model that gives an estimate of the costs associated with running the business. Important aspects of operational expenses include cost of goods sold by products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating expenses.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | 5,000 – 10,000 |

| Salaries and wages of employees | 3,000 – 6,000 |

| Rent, lease or mortgage payment | 8,000 – 12,000 |

| Public services | 500 – 1,000 |

| Other running costs | 2,000 – 3,000 |

| Total | 18,500 – 32,000 |

Clothing Store Cost of Goods Sold

Cost of Goods Sold (COGS) is a crucial aspect of financial planning for a clothing store. COGS refers to the direct costs of products sold by the store, including the cost of materials, labor, and manufacturing or production expenses. It is essential to understand the assumptions made in the calculation of COGs.

For example, if a clothing store produces T-shirts for each and sells them for each, the cogs for the T-shirts would be . Assuming that each product sold generates a profit margin of 50%, the revenue generated by each t-shirt sold would be (50% of ), and the store would have a gross profit of per t-shirt.

The percentage of COGS varies from one product category to another. Generally, it varies between 30% and 70% of the selling price of the product. For example, the cogs for a pair of jeans that cost to produce and sell for would be , which is 38% of the selling price.

Tips & Tricks:

- Regularly review your COGS assumptions to ensure they are accurate and up-to-date.

- Set a target gross margin for your clothing store and use COGS to determine the selling price of your products.

- Consider market demand and competition when pricing your products.

Clothing store wages and salaries of employees

When creating financial projections for a clothing store , it is important to consider the cost of employee wages and salaries.

Assumptions for employee wages and salaries should include the number of staff needed, their positions, when they will be hired, and how much they will earn each year. For example, a clothing store may need three full-time equivalent staff members for the year, with one person for each of the following positions:

- Sales Associate: Hired at the beginning of the year and earning ,000 per year.

- Store Manager: Hired at the beginning of the year and earning ,000 a year.

- Visual Merchandiser: Hired halfway through the year and earning ,000 a year.

It is important to fully consider the necessary staff and their salaries to accurately determine clothing store revenue model , Income Statement , Cash Flow Analysis , and Profitability Analysis .

Additional Clothing Store Financial Planning and Management Tips & Tricks For employee wages and salaries, including reviewing part-time staff, offering bonuses or commission incentives and staying up-to-date on laws and minimum wage regulations.

Tips & Tricks:

- Offer bonuses or commission incentives to encourage sales and employee retention.

- Consider hiring part-time staff to save on salary costs.

- Stay up to date on minimum wage laws and regulations to properly budget wages and salaries.

Clothing store rental, lease or mortgage payment

When creating financial projections for a clothing store, it’s important to consider rent, lease, or mortgage payments. These expenses will be an important part of the clothing store revenue model and will impact the clothing store profit and loss reporting and the clothing store cash flow analysis.

The assumptions for rent, lease or mortgage payments will depend on the location of the store and the terms of the agreement with the landlord or mortgage company. For example, if the store is located in a prime shopping district, the rent may be higher than if the store is located in a less desirable area.

Tips & Tricks:

- Research comparable rental rates for similar stores in the area

- Negotiate favorable rental or mortgage terms to reduce monthly payments

- Consider sharing retail space with complementary businesses to reduce costs

Clothing Store Utilities

Clothing Store Financial Planning Requires Accurate Financial Projections for Clothing Store . The clothing store revenue model is the backbone of any business plan, along with the Clothing Store Profit and Loss Statement , Clothing Store Cash Flow Analysis, and Clothing Store Break-Even Analysis. clothing stores Provide critical data to make informed financial decisions. An important consideration is the Clothing Store Sales Forecast , which helps determine expenses and revenue projections.

When developing a budget for a clothing store, it is important to consider utility costs. One assumption is that utility bills will remain consistent from month to month; However, this is not always the case. For example, during the winter months, heating costs are generally higher than in the summer. Another assumption is that the cost of electricity will increase each year as energy costs continue to rise. Additionally, it is important to ensure that you are accurately billed for your utility usage and to negotiate rates with your utility providers where possible.

Tips & Tricks:

- Consider investing in energy efficient lighting and appliances to reduce the cost of utilities.

- Adjust thermostat temperatures to conserve energy and reduce heating and cooling costs.

- Compare rates from different utility providers to find the best deal.

Clothing store other running costs

When creating a financial model for a clothing store, it is essential to consider not only direct costs, such as cost of goods sold or marketing expenses, but also indirect costs, also known as other» operating costs. These costs may not be directly visible, but they can have a substantial impact on the financial performance of your clothing store.

Other running costs may involve expenses such as office rent, utility bills, and insurance costs. Additionally, expenses such as legal services or technology support services may also arise, which you may not have considered, but need to be included in financial planning. For example, if you plan to expand your business online or want to integrate a better inventory management system, you need to consider the costs associated with it.

Therefore, consider all the possible costs that your clothing store might incur in the future while creating a financial model. Accounting for these expenses will give you a more complete view of your clothing store’s performance and help you make better decisions.

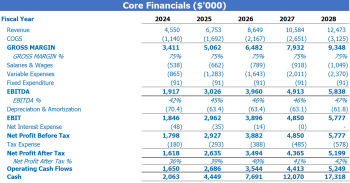

Clothing store financial forecast

As part of the financial model for a clothing store, a financial forecast can provide valuable insight into potential revenue and expenses. This can be achieved through various financial documents, such as profit and loss statement, report sources and uses, and cash flow analysis. Additionally, a sales forecast and break-even analysis can help with budget planning and financial management. A comprehensive financial analysis can help ensure the success and sustainability of a clothing store.

Compatibility of clothing stores

Once we have created financial projections for our clothing store, it is important to check the profit and loss (P&L) statement. This statement outlines income and expenses from the top line down to net profit. This will give us a clear picture of our store’s profitability, including metrics such as gross profit and EBITDA margin.

The clothing store revenue model can be built using sales forecasting, budget planning, financial planning, and financial analysis. It is also important to understand break-even analysis because it will help us understand when our store will start making a profit.

Tips and tricks

- Regularly review your store’s profit and loss statement to ensure profitability.

- Use break-even analysis to understand how long it will take for your store to start making a profit.

The Clothing Store Financial management is critical to ensuring the financial health and longevity of the business. By identifying potential problems early on and making necessary adjustments to budget and sales strategy, your store can become a profitable and successful business.

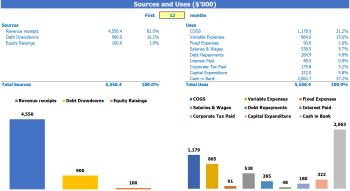

Clothing Store Sources and Use of the Chart

Sources and uses of funds in Excel’s financial model for clothing store provides users with an organized summary of where capital will come from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

- If the sources and uses of capital are not balanced, it may indicate a funding gap or an error in the financial model.

Building a financial model for a clothing store is a crucial task to ensure the long-term success of the business. By incorporating financial projections, revenue models, profit and loss statements, cash flow analysis, breakdown analysis, sales forecasting, budget planning, financial planning, financial analysis and management financial, a clothing store owner can gain a complete understanding of the financial health of their business. Developing a strong financial model requires careful planning, attention to detail, and a deep understanding of key financial metrics that drive profitability. With the right tools and techniques, any clothing store owner can build a solid financial model that provides insight into the current state of their business, as well as a roadmap for future growth and success.