52 Simple Ways to Manage Your Money – 13. No Free Lunch Today

A Weekly Journal & Workbook to Help You Take Real Control of Your Money

What it is …

Reaching out beyond yourself and your earning capacity for money, often, but not necessarily, with an agreement to pay back the money over time with a predetermined interest charged for the use of the money.

How it helps…

Allows you to purchase something today that you might otherwise not be able to afford.

How it hurts …

Increases the cost o f the item purchased. 01 Promotes system of paying off yesterday instead of creating and saving for tomorrow.

If borrowed from personal sources, can damage existing relationships.

Interest paid is generally not tax deductible.

Debt may get out of hand.

Key items to look for…

Low rate of interest.

Any pre-payment penalty.

Ways to pay off the loan early.

A plan to pay off the loan.

Time …

Varies.

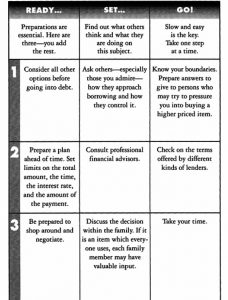

Keys to action …

Review goals and objectives.

Evaluate necessity o f borrowing.

Explore other options of obtaining funds.

Create plan to pay off loan before you borrow.

Investigate the terms of the loan, including interest rate and time period.

Complete the paperwork.

SET IT UP

Determine the need.

STEP ON IT

Consider the repayment plan.

STEP ON IT +

Evaluate the risk.

Notice…

Your reaction to obtaining credit.

Your reasons for needing credit.

But what if …

This need to borrow occurs regularly?

See chapter on overspending (Chapter 14) and get emotional and financial support.

Thought primers…

To me, borrowing means…

The good thing about borrowing is…

On the other hand…

When I overspend my income, I…

If no one lends me money...

If I had to rely on my own resources…