- 5 Tips to Improve Your Cash Flow

- Understanding Cash Flow from Investing Activities

- Creating a Cash Flow Statement: A Step-by-Step Guide

- An Introduction to Financial Models

- 7 Smart Ideas for Preparing a Financial Plan in Just 10 Minutes

Almost every business gets a loan for different reasons, so the loan amortization schedule is part of every financial model. So, we have designed 450+ Financial Model Templates Designed in Excel or Google Sheet for different companies which are ready to use and you just need to type the inputs in the yellow cells and you will get the desired financial model. You can also check E-Commerce Financial Model Templates , Food and Beverage Financial Model Templates , Hospitality Financial Model Templates .

After reading this article, you should be able to learn:

- What is loan amortization?

- What is the loan amortization schedule and how is it prepared?

- How is loan amortization used in financing decisions?

- What is the cost of debt?

- How Loan Amortization Helps Businesses.

- FREQUENTLY ASKED QUESTIONS

What is loan amortization?

Loan amortization is the repayment of the loan over a period of time. In loan amortization, the repayment would be the sum of interest interest on the loan and the principal amount. The borrower makes repayments according to a pre-aggression schedule on the Loan Held. The repayment is first applied to interest interest for the period and the remaining repayment balance is applied to the principal amount. Loan terms are the term of payment of installments which are bifurcated into principal amount and interest on the loan. The term of the loan depends on the nature of the agreements agreed between the borrower and the lender or specified in the debt instrument.

The amortized loan usually includes car financing, domestic financing, debt instruments issued by an organization, loan obtained for capital expansion, etc.

Loan amortization schedule

An amortization schedule is a schedule of periodic payments includes principal amount and interest. Each payment is generally equal to the total for each period.

The principal amount: This is the amount that was originally intended to represent the size of the loan. Interest calculations are based on the principal amount of the loan outstanding at the end of each year. The installment paid in accordance with the loan terms covers the accrued interest on the loan and the remaining balance is charged at the principal amount. Due to the decrease in the principal amount during the period, the interest expense decreases and more of the repayment is adjusted against the principal balance. At the end of the loan period, the principal repayment will cause the outstanding balance to be zero.

The amortization schedule is used to broadcast loan repayments over its term. Both the lenders and the borrower use the amortization schedule to calculate their interest income/expenses and record the remaining receivables/liabilities. The schedule is presented in tabular form and explained using the following illustration.

To illustrate, let’s say a company obtains a loan facility of ,000 at 10% interest for a period of five years starting in year 01. The loan will be repaid in annual installments of ,638.

|

Year |

Rent payment |

Interest amount |

Major |

Balance in suspense |

|

0 |

– |

– |

– |

10,000 |

|

01 |

2,638 |

1,000 |

1,638 |

8,362 |

|

02 |

2,638 |

836 |

1,802 |

6,560 |

|

03 |

2,638 |

656 |

1,982 |

4,578 |

|

04 |

2,638 |

458 |

2,180 |

2,398 |

|

05 |

2,638 |

240 |

2,398 |

0 |

As shown by the illustration above, each year the 10% interest rate is applied to the outstanding balance. During this five-year period, the interest interest increased from ,000 to 0 while on the other part, the principal part of the amount of the amount increased from ,638 to ,398. By paying the director, the outstanding balance becomes zero at the end of the fifth year.

Loan Capital Accounting:

The accounting for the loan depends on the purpose of the loan, however, if we need to see simple accounting entries, the loan initially would be counted as a liability, then the subsequent payment is recorded as:

- Partially reduce the principal balance of the loan and

- Partially save interest.

In the case of the example above, when the company takes the loan and receives the money, the entry on its books of account would be as follows:

|

Description |

Debit |

Credit |

|

Cash / bank |

,000 |

|

|

Loan payable |

,000 |

The loan payment in the first year should be recorded as follows:

|

Description |

Debit |

Credit |

|

Loan payable |

,638 |

|

|

Interests |

,000 |

|

|

Cash / bank |

,638 |

The ,638 reduces the loan principal on the balance sheet, ,000 will be expenses on the profit and loss account, and the cash/bank credit will reduce the cash balance.

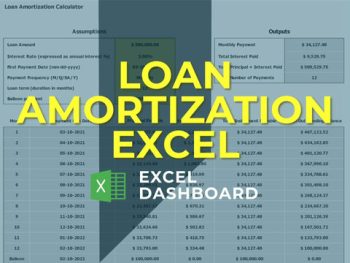

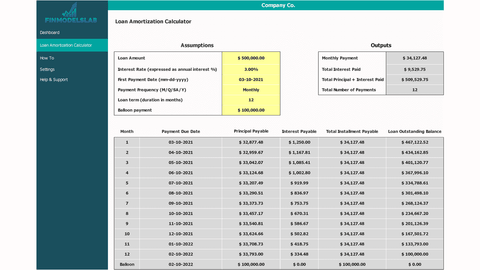

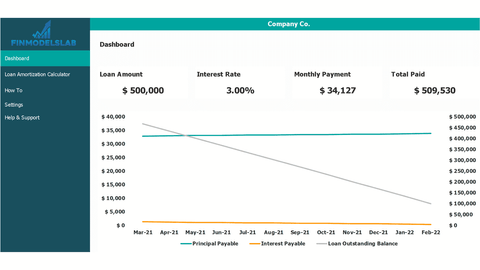

IMPORTANT POINT: We have designed a free Excel/Google Loan Amortization Excel sheet where you just need to put your assumptions in the yellow cells. Templates help to perform monthly, quarterly, semi-annual and annual amortization schedule as well as balloon payments. Just fill in the yellow highlighted cells and get the results you want.

Download Loan Amortization Excel in Excel

How Loan Amortization Uses in Financing Decisions

Through the use of the amortization schedule, the borrower can determine the extent of interest that will be incurred on obtaining an amortized loan. In an amortized loan, the repayment is spread over the loan period and the management can easily forecast their cash flow due to the equal installments at a pre-attacked time.

Interest is the cost of debt that has been loaned to the borrower. He also bundled many other lending instruments, such as convertible debt and bonds.

To calculate interest on a loan, follow these steps:

- Get the principal amount that is outstanding on the loan during the loan period.

- Apply the annual interest rate to the loan agreement documents.

- Determine the number of times over which interest is calculated.

- Use the interest expense formula below to calculate interest.

Cost of debt/loan for a business

Cost of debt refers to the interest a business has to pay on loans obtained from lenders. Capital business includes debt and equity and it has to pay the return to capital providers. Both the lender and the equity provider need returns on their investments. Equity investors receive a return in the form of dividends while debt providers earn interest on their loan. The cost of debt is part of the company’s Total Cost of Capital when determining the weighted average cost of capital.

The cost of debt depends on various factors, including the capital structure of the company, the term of the debt obtained, collateral against the debt. The risk associated with the loan is high, the cost of debt is high.

The only difference between debt and equity financing is that interest payments are tax deductible, unlike dividend payments. This means that for a business, the cost of debt would be less than the interest rate offered by the lender, because the rate will be reduced by the tax rate of the business.

The following formula should be used to calculate the actual cost of debt for the emprans

The cost of debt is also calculated using the yield to maturity or YTM of a company’s debt. In the event that a public company that issued straight bonds making periodic interest payments and the principal is repaid at maturity. In this method, any return on the bond is estimated on the assumption that it will hold until expiration.

How loan amortization helps the business?

Loan amortization is beneficial for businesses which gives them a clear picture of their liability and repayment structure. It also helps businesses manage their interest by paying extra payments. Amortized loan support organization to finance their operations as well as their expansions. Reimbursement and interest are covered by the activities thanks to the income generated by these investments or operations.

FREQUENTLY ASKED QUESTIONS

Q. Is loan amortization required by the applicable accounting framework or GAAP?

A. Loan amortization is an accounting method used for calculating interest interest and determining loan liability.

Q. What are the key factors in the amortization schedule?

A. For loan amortization calculation, loan principal amount, interest rate and loan period are the three key factors used for loan calculation.

Q. How can the amortization schedule be changed or revised?

A. The incasional loan is rescheduled, either by postponing the payment of the tenure of the loan, the amortization schedule must be revised.

[right_ad_blog]