- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our guide on how to build a financial model for a hat and cap store. If you own a puzzle shop, a whistle shop, a beanie and snap shop, a fedora and beret shop, a trucker hat shop, a baseball cap shop, or even specialize in hats and top bowlers, this guide will be invaluable. A financial plan is crucial for any business, especially in the retail industry. In this guide, we will discuss the key elements needed for a complete financial model, including financial analysis, projections, and forecasts. By the end of this guide, you will have the knowledge and tools to create a successful financial plan for your framing store.

Hat and cap sales enthusiasts and forecasts

Welcome to the revenue and sales forecast section of our HAT and CAP Shop financial model. This section is crucial in predicting our potential revenue and outlining our sales growth plan. Our launch date is set for next month, and our ramp-up time should be relatively quick given the high demand for fashionable headwear. We anticipate a steady stream of walk-in traffic and growth assumptions based on our prime location and targeted advertising campaigns. Our assumptions of customers and purchases are based on research and past sales data at similar retail stores. We will also consider the sales seasonality of headwear trends.

Hat and Cap Workshop Launch Date

Choosing the right launch date for your hat and cap business is crucial to a successful launch. The launch date sets the tone for your business and can have a significant impact on your financial plan, analysis, projection and forecast.

Consider factors such as seasonality, holidays, and local events that can impact your target market’s desire to purchase hats and caps. Launching your business at the right time can help generate more interest and sales. Alternatively, launching at the wrong time can lead to missed opportunities and financial losses.

Tips & Tricks:

- Research your target market and their buying habits to determine the best time of year to launch your business.

- Create a launch event or promotion to generate buzz and attract customers.

- Consider launching Soft your business to test the market and make adjustments before launching on a larger scale.

Once you’ve chosen your launch date, be sure to build a solid financial plan, analysis, projection and forecast around it. Use the cap and ceiling financial model template to help you prepare and plan activities and costs related to launching your business.

Remember, the key to a successful launch is proper planning and execution. Take the time to carefully consider your launch date and prepare accordingly for a great start to your hat and cap store business.

Hat and Cap Rise Time

Sales forecasting can be a daunting task for HAT and CAP stores, but it is essential. As a business owner, you need to be aware of your ramp-up time to the sales plateau to make informed decisions about your financial plan, projection, and forecast.

Your ramp-up time is the time it takes for your business to reach its maximum sales potential. It is time for your business to move from initial sales to a plateau of maximum sales. Every industry has a different ramp-up period, and Hat and Cap stores are no exception. In general, the ramp-up time in this industry can reach xxx months.

Tips & Tricks:

- Start with a realistic and accurate financial projection to track your business growth and performance.

- Invest in marketing campaigns to drive traffic to your store and increase your sales.

- Focus on customer retention by providing an excellent in-store experience and offering unique and fashionable hat collections.

Knowing your ramp-up time is key to developing an actionable financial plan for your hat and cap store. It can help you estimate your income and expenses, determine your break-even point and profitability, and make informed marketing and inventory decisions. Therefore, it is crucial to track your sales and adjust your financial projection and forecast regularly to reflect the actual performance of your business.

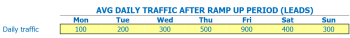

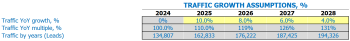

CHAPOS AND CAP SHOP INTERACTIONS BY CADIAFE

After the sales plateau, it is important to know what is the daily intro traffic by walk-in visitors per week. For example, on Mondays, the shop can receive an average of 50 customers, while on Saturdays, they can receive an average of 150 customers. This assumption is needed to build a financial model because it helps predict future sales and labor costs.

The average traffic growth factor in traffic is also an essential factor to consider when creating a financial model. For example, if the store has a growth factor of 10%, it can predict an average customer of 55 by Monday in the first year and 74 customers on Monday by the fifth year. This information is crucial in determining which products to market and when to hire help.

Tips & Tricks:

- Remember that holidays and special events can increase the average number of walk-in traffic.

- Remember to consider changes in the economic climate when forecasting walk-in traffic growth.

- Look at historical data from nearby stores to better understand daily traffic patterns in your area.

Overall, having accurate date traffic inputs into the financial model is vital to the success of the hat and cap workshop. With this information, the store can generate realistic sales forecasts, effectively manage inventory, and make informed hiring decisions.

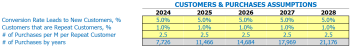

Visits to the hat and cap workshop for sales conversion and sales entries

When analyzing the financial projection of a hat and cap store, it is important to consider the conversion rate of visitors to new customers and the rate of returning customers. Based on previous data, the conversion rate for visitors to new customers is around 10%. This means that out of 100 store visitors, 10 will make a purchase.

The rate of repeat customers is essential to consider when forecasting sales. On average, about 20% of customers are repeat buyers. These customers tend to visit the store once a month and make a purchase of two hats. Therefore, it is safe to assume that each repeat customer will have two purchases per month.

Tips & Tricks:

- Offer loyalty programs to encourage repeat business

- Update inventory regularly to keep customers interested in new styles

- Consider offering a discount for purchases made during the customer’s birthday month

The number of repeat customers and their buying habits are both important assumptions to make when building a financial model for a hat and cap store. These assumptions help project revenue, cash flow, and ultimately the success of the business.

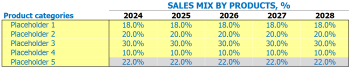

Hat and cap store sales mix entries

At Hat and Cap Shop, we sell a variety of headwear products, each belonging to a specific product category. In order to better understand our sales mix, we enter the sales mix assumptions on the product category lever. This helps us forecast our sales and plan our inventory accordingly.

The combination of sales by product category assumptions is as follows. We entered up to 5 product category names:

- baseball caps

- Fedoras and berets

- trucker hats

- Snapbacks and dad hats

- Beanies and Snapbacks

We then entered the percentage sales mix for each of the 5 years provided by the product category.

Tips & Tricks:

- Regularly update your sales mix assumptions based on actual sales data.

- Use historical sales data to identify patterns and trends in your sales mix.

- Consider the seasonality of your products when forecasting your sales mix.

- Regularly analyze your sales mix to ensure that you are optimizing your profitability.

Hat and Cap Shop Average Entry Sale Amount

Before launching a Hat and Cap Shop financial plan or any other financial projection for that matter, it is important to have a solid understanding of your expected financial information. You should carefully review and analyze the market, as well as your competitors, while considering trends that could impact your future operations.

Your Hat and Cap store probably sells many different products that can be sorted into categories such as beanies, snapbacks, fedoras, berets, trucker hats, baseball caps, top hats, bowlers and hats. dad’s. Rather than the product level entry hypothesis, it is easier to focus on each category as a hypothesis. For example, if you assume that the average sale amount for a trucker hat should be around , this will be applied to each individual trucker hat sale.

Each hat with a different category has different average sale amounts, and it will be assumed that these values will stay relatively the same for each year. This is called the average sale amount by product categories and by years. The average ticket size estimate uses the average sale amount. Using the sales mix and the average sales amount of each product category, the model will calculate the average ticket size. Therefore, you need to be accurate during the prediction process as it will directly affect the average ticket size calculation.

Tips & Tricks

- Try to suppress your category assumptions for your cap and shop financial forecasts to increase accuracy.

- Use internal and external market data such as industry reports, social media data, and trade association data.

Seasonality of hat and cap store sales

Understanding sales seasonality is crucial for any business, including headwear boutiques. Seasonality refers to sales patterns that recur at regular intervals throughout the year. It is important to analyze and incorporate these patterns into your financial plan to avoid sudden drops in income and to capitalize on high demand seasons.

The ideal seasonal factors should be based on the company’s historical sales data. For example, a beanie and snapback store may have higher sales during the winter months, while a baseball cap store may experience increased sales during the summer. These trends should be reflected in the seasonal factors of the financial projection.

Tips & Tricks

- Focus on the most important factors affecting your seasons when projecting future sales.

- Make sure your projection reflects realistic seasonal fluctuations, not just a uniform increase or decrease in sales throughout the year.

- Periodically revisit your seasonal factors and projections to adjust them based on actual sales and new market trends.

Incorporating seasonal factors into your financial plan will help you create a more accurate picture of your business’s earning potential. Whether you are a business of a few people with peak demand in the fall or a Fedora and Beret store with higher sales in the summer, understanding sales seasonality is a key part of financial forecasting.

When analyzing the seasonality of sales, it is important to consider the percentage deviation from the average sales per day. By comparing average sales per day with actual sales each month, you can create a better projection of future revenue.

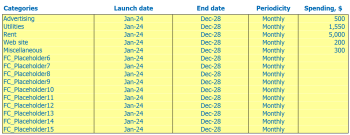

Cap and Cap Operational Expenditure Forecasts

Operational expense forecasts are an important part of the financial model for any business, including HAT and CAP stores. This includes various expenses that are essential to run the business effectively, such as cost of goods sold by products %, wages and salaries of employees, rent, lease payment or mortgage services, utilities and various other operating costs.

| Expenses | Amount (per month) Ranges in USD |

|---|---|

| Cost of Goods Sold by Products% | 1000 – 5000 |

| Salaries and wages of employees | 3000 – 8000 |

| Rent, lease or mortgage payment | 1500 – 5000 |

| Public services | 500 – 1500 |

| Other running costs | 1000 – 3000 |

| TOTAL | 7000 – 20000 |

By forecasting operational expenses, hat and cap shop owners can better understand their monthly financial commitments and make prudent decisions.

Cap and corking Cost of goods sold

Cost of Goods Sold (COGS) is a critical consideration for businesses that sell physical products like our hat and cap store. COGs are the direct costs incurred to create or purchase the products we sell. It includes the materials, labor and other direct costs used to produce each product.

To accurately calculate our COGs, we made several assumptions:

- Materials: For example, the materials needed to make a fedora might be different from those needed to make a baseball cap.

- Labor: Depending on the complexity of the design, some hats may require more hours of labor than others.

- Other Direct Costs: We also need to consider other costs such as shipping expenses, packaging material, and label design that are required to put finished products on our shelves.

The COGS percentage plays a crucial role in determining our gross profit margin. To calculate the COG percentage for each product category, we need to divide the cost of goods for the category by the revenue for that category.

For example, if the total cost of hats sold is ,000 and the revenue generated from those sales is ,000, the COGS percentage would be 50%.

Tips & Tricks:

- Regularly reviewing and evaluating the cost of goods sold to ensure that it is in line with our projected finances.

- Streamline production processes to improve labor efficiency and reduce direct costs.

- Partner with reliable vendors to get the best deals on high quality materials.

Salaries and wages of hat and cap employees

In our hat and cap store, we carefully reviewed the financial plan and created projections for employee wages and salaries. The assumptions we have made are based on industry averages and our specific business needs.

We have categorized our staff into four positions: Manager, Sales Associate, Social Media Coordinator, and Warehouse Associate. The manager will be hired in the first month of operation, while the other positions will be filled in the second month. The Manager will earn ,000 per year, while the Sales Associate will earn ,000, the Social Media Coordinator ,000 and the Warehouse Associate ,000 for a 12 month period.

A full-time equivalent (FTE) staff member works a 40-hour week for 52 weeks per year. We anticipate needing two ETP Managers, six ETP Business Associates, two ETP Social Media Coordinators, and two ETPE Associates each year.

Tips & Tricks:

- Consider industry averages when setting salaries and wages.

- Decide on staff positions and when they will be hired.

- Calculate the annual salary for each position.

- Estimate the number of full-time equivalent staff needed.

Lease, lease or mortgage payment of cap and ceiling

When creating a financial plan, it’s important to consider the cost of renting, renting, or owning a property for your hat and cap store. Rent and lease payments are generally based on the size and location of the property, while a mortgage payment will depend on the cost of the property and loan terms.

For example, if you decide to rent a small storefront in a retail location, your monthly payment may be higher than renting a larger space in a less popular area. Likewise, if you choose to buy a property to own, your monthly mortgage payment will depend on the price of the property and the terms of your loan.

Tips & Tricks:

- Research the local real estate market to determine average rent, lease, and mortgage costs for commercial properties in your desired area.

- Consider negotiating rental terms, such as a longer lease or reduced rent, to reduce your costs.

- Tive based on additional expenses, such as utilities and property maintenance, when calculating your total occupancy costs.

Whether you decide to lease, lease or own your cap and cap location, it is important to carefully consider the financial implications and factor these costs into creating your financial plan, financial analysis, financial projection, your financial forecast or your financial model .

Cap and Ceiling Workshop Utilities

Utilities are the essential services needed to keep any hat and cap workshop running. These include electricity, water, gas, internet and telephone services. It’s important to consider these expenses when creating a financial plan for your business.

Assuming a hat and ceiling workshop requires electricity to power lighting, heating and cooling systems and cash registers. The cost of electricity varies by state, but the average monthly cost is around 0. Water and sewer services are also a necessity for the boutique restrooms, and the average monthly cost is around . Gas utilities can also be used for heating, and the average monthly cost is around 0.

Internet and telephone services are necessary for communication and processing of online orders. The average internet cost is around per month, while phone services can range from to per month.

Tips & Tricks:

- Shop for the best deals on utilities to save money.

- Consider switching to energy-efficient lighting to reduce electricity costs.

- Invest in a high-speed Internet connection to improve productivity.

Cap and ceiling Shop Other running costs

When creating a financial model for your hat and cap store, it is essential to consider the other running costs besides the initial investments and the cost of goods sold. These costs involve fixed and variable expenses like rent, utilities, salaries, insurance, marketing, repairs and maintenance.

For example, your store’s rent is a fixed cost that you must pay regardless of your sales. Likewise, wages and salaries of your employee are variable expenses that depend on the performance of your business. You should also allocate funds for insurance, which insures your store and inventory from damage, theft, and liability claims.

Marketing is another crucial parameter to consider for the success of your hat store. You need to invest in advertising, social media promotions, and other marketing tactics to attract customers and build your brand. Additionally, regular maintenance of your property, equipment and inventory is essential to ensure customer satisfaction and avoid costly repairs.

Therefore, you need to create a comprehensive financial model that includes all of the factors affecting the profitability and sustainability of your hat and cap store. By incorporating these operating costs into your financial forecast, you can accurately predict your expected income, expenses, and profits, allowing you to make informed decisions and manage your finances effectively.

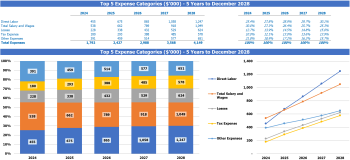

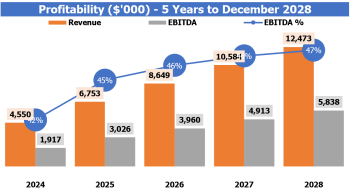

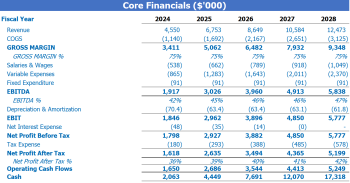

Cap and cap financial forecasts

In order to run a successful hat and cap store, it is essential to develop a financial plan that includes a comprehensive forecast. A financial projection typically includes a profit and loss statement, which details your business income and expenses, and a Sources and Use report, which outlines how you will finance your operations. These reports are essential for attracting investors or obtaining loans. Whether you’re starting a whistle business, a trucker hat shop, or a baseball cap store, developing a strong financial model is key to achieving long-term success.

Cap and cap cap

Once we’ve built our income and expense projections for our financial caps and caps plan, the next step is to check the profit and loss (P&L) statement. This statement will show us the profitability of our business.

The P&L will provide excellent insight into the financial health of our business. Starting with revenue and moving to net profit, we can visualize the profitability of our business. Some key aspects of profitability to look at include gross profit or EBITDA margin.

Tips & Tricks:

- Update your P&L regularly to monitor business performance.

- Compare your P&L with industry benchmarks to see where you stand.

- Identify areas where you can reduce expenses to increase profitability.

Ultimately, understanding and evaluating profitability is crucial to any hat and cap financial analysis, whether you run a pill shop, whistle business or beanies and snapbacks, fedoras and hats. berets, trucker hats, baseball caps, top and bowler hats, snapbacks or dad hats.

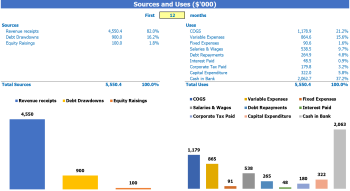

Sources and use of the hat and uses: graphic:

The sources and uses of funds in the financial model in Excel for Hat and Cap Shop provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses.

It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks:

- Regularly update your sources and use a graph to accurately represent the company’s financial situation.

- Use realistic projections for future income and expenses to ensure the graph is reliable.

- Seek advice from financial professionals to help create and interpret the chart.

In conclusion , building a financial model for a hat and cap store is crucial to its success. By using the various financial tools available, such as a HAT Store Financial Plan or a Trucker Hat Shop Financial Analysis, you can forecast sales, expenses, and profits with greater accuracy. It’s also important to regularly review and update your financial projections to ensure you’re on track to meet your business goals. Remember to consider all aspects of your business when creating a financial forecast, from inventory costs to marketing expenses. With a solid financial plan in place, you can make informed decisions that will help your puzzle shop thrive.