- Home

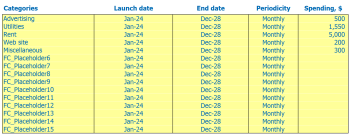

- Sales and revenue

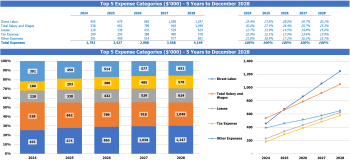

- Running costs

- Financial

Starting a gun store can be a difficult task, especially if you don’t have a financial plan in place. Building a financial model for your gun shop is vital as it helps you predict your gun shop revenue model , gun shop revenue projection , Gun Store Profit , Gun Dealer Financial Statement , Gun Retailer Financial Analysis , and Gun Supplier Financial Report . Your Gun Shop Cash Flow Projection and Gun Shop Financial Model will provide you with a clear overview of your finances and help you make informed financial decisions. In this blog post, we will discuss how to create a financial model for your gun shop.

Gun Store Revenue and Sales Forecast

Revenue and sales forecasts are an essential part of any business model, and gun stores are no exception. To predict store profitability and to identify potential problems, it is necessary to create a financial plan that includes gun store revenues, sales forecasts, and other essentials.

When creating a financial plan, several factors should be considered, such as launch date, ramp-up time, walk-in traffic and growth assumptions, customer and purchase and the seasonality of sales. A thorough analysis of these factors will provide insight into expected sales volume, pricing strategies and cost structures.

There are several methodologies and approaches to create a gun shop revenue projection, gun shop profit forecast, and gun retailer financial analysis. Some of the most popular tools include the Gun Cash Flow Projection, Gun Shop Financial Model, Gun Dealer Financial Planning, and Gun Supplier Financial Report and the gun dealer’s financial statements.

Gun Store Launch Date

When to launch your gun store is one of the most important decisions you will make as a business owner. This date sets the pace for everything that will follow in your firearms business, from marketing to inventory to revenue projections. It is important to take the time to research and analyze your Gun Store Cash Flow Projection, Gun Financial Model, and Gun Dealer Financial Planning to ensure success.

When you set your Gun Shop Revenue Projection, Gun Shop Financial Plan, or Gun Shop Profit Forecast , choose the start date based on the Financial Model Template from the gun store can be advantageous. This will provide you with an overview of activities, costs and projections related to starting your firearms business, even if you plan to launch your business in the middle of the year.

Tips & Tricks

- Research market demand for gun sales and establish a target market.

- Choose a location that is suitable for a gun store, with adequate parking and accessibility, and compliant with all zoning regulations.

- Make sure you have the necessary licenses, registrations, and permits needed to operate a gun store.

- Consider hiring an experienced financial analyst to help you with your Gun Retailer Financial Analysis and to provide a Gun Dealer Financial Statement .

Ramp-up time

When starting a new gun store, it’s important to remember that it takes time to build your customer base and establish yourself in the market. This period of time, known as the ramp-up time, is crucial for forecasting while projecting sales.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In your industry, this may take around 6-12 months. During this time, you will invest in advertising, marketing, and building your inventory. Your sales will gradually increase until you reach a point where they end.

Tips & Tricks:

- Focus on building relationships with your customers.

- Offer promotions and offers to attract new customers.

- Stocking the most popular firearms and accessories.

- Invest in online advertising to reach a wider audience.

Forecasting your gun store ramp-up time is essential to creating a successful gun store financial plan. By analyzing your gun store’s revenue projection and performing a thorough financial analysis of gun retailers, you can prepare for the ramp-up period and set realistic goals for your business.

Keep in mind that the ramp-up period may vary depending on factors such as location, competition, and local gun laws. By staying informed and adapting to changes in the market, you can navigate the ramp-up period and reach your full potential as a firearms dealer.

Gun Store Appointment Traffic Entrances

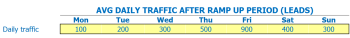

After the ramp-up period, Monday and Tuesday are typically the slowest weekdays at a gun store with daily walk-in traffic, an average of about 10-15 visitors. Wednesday and Thursday see a moderate increase in traffic, with around 25 to 30 visitors per day. Friday to Sunday have the highest traffic, with around 35 to 40 visitors per day.

It is important to take the day of the week into consideration when predicting walk-in traffic for a gun store. Without this assumption, a financial model may overestimate or underestimate the revenue potential for certain days of the week.

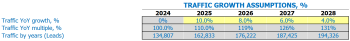

Over the next five years, the average dating traffic growth factor is expected to be around 2-3% per year. This estimate takes into account general population growth rates and the possibility of increased interest in gun ownership due to geopolitical events or changes in gun laws.

Tips & Tricks:

- Consider offering slower weekday promotions or events to increase foot traffic and sales.

- Implement marketing strategies to reach potential customers during peak days.

Based on average weekday walk-in traffic inputs and projected growth factors, a gun store financial model can accurately predict future revenue potential. This information can be used to make informed decisions about inventory, staffing and expansion plans.

Gun store visits for sales conversion and repeat sales entries

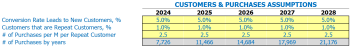

When it comes to running a successful gun store, conversion rates and repeat sales are crucial in determining the level of revenue and profit the store generates. The percentage of new customers generated from store visits is a critical metric. For example, if Out of 100 visitors, 50% of them make a purchase , it means that the store is transforming at 50%.

Another important metric for gun stores is repeat customers. Once a customer has made a purchase at the store, it is essential to track whether they return for future purchases. Suppose that out of 10 customers who make a purchase, 4 will return to the store the following month . If each repeat customer makes an average of 2 purchases per month, that would translate to a total of 8 purchases per month from repeat customers alone.

The repeat sales assumption is important when building a financial model for a gun store. Knowing the percentage of new customers who convert and the percentage of repeat customers who make purchases, gun shop owners can forecast their Gun Shop Revenue Projection, Revenue Model of the gun shop, gun shop financial plan, gun shop financial model and gun dealer financial plans .

Tips & Tricks:

- To improve conversion rates, consider offering various incentives, such as discounts or free items with purchase.

- To encourage repeat customers, consider having a loyalty program or offering promotions for frequent shoppers.

- Pay attention to customer feedback and make adjustments to store offerings accordingly.

Gun Store Sales Mix Entries

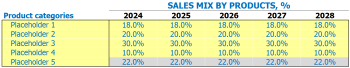

In our gun store we sell a variety of products such as guns, ammunition and accessories. Each product belongs to a specific product category, and entering the sales mix assumption on the product category lever will be much easier to understand.

Let’s say we have five product categories: handguns, rifles, shotguns, ammunition and accessories. To create our sales mix assumptions, we need to determine what percentage of sales will come from each category over the next five years. Here’s an example of what our sales mix might look like:

- Handguns: 30%

- Rifles: 25%

- Shotguns: 20%

- Ammo: 15%

- Accessories: 10%

Tips & Tricks:

- Consider market trends and customer preferences when creating sales mix hypotheses.

- Regularly review and adjust sales mix assumptions to reflect changes in market or customer demand.

- Use historical sales data to inform sales mix assumptions.

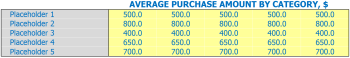

Average sale amount of entered firearms

We sell a variety of different products in our gun store, each belonging to a specific product category. To make it easier to make assumptions, we enter them at the product category level instead of the product level.

One of the most important assumptions we make is the average sale amount (ASA) by product category and year. This is the expected amount for which we will sell each item. For example, if we are selling rifles, we will make a different ASA assumption than if we are selling handguns.

Let’s say we make an ASA assumption of 00 for rifles and 0 for handguns in 2020. Using our sales mix, or the percentage of sales that each product category constitutes, we can calculate our average size of tickets expected (ATS). If rifles are 60% of our sales and handguns are 40%, our ATS would be 0. (60% of 00 + 40% of 0 = 0).

Tips & Tricks:

- Keep track of ASA assumptions by product category and year to make more accurate financial projections.

- Regularly review the sales mix and adjust ASA assumptions accordingly.

- Consider external factors such as market trends and competitor pricing when making ASA assumptions.

By using ASA assumptions and sales mix, we can make more accurate financial projections and analyze our gun store’s revenue model. An in-depth gun shop financial plan is essential for any gun retailer financial analysis, as it provides a clear path to success in the highly competitive gun shop industry.

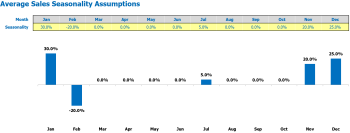

Seasonality of gun store sales

At our gun store, we understand that there are seasonal factors that impact gun sales. December is usually a high sales month for firearms due to the holiday season and Christmas gifts. In contrast, February is usually a slow selling month, after the holiday rush.

It is important to analyze these seasonal factors and have a plan in place to account for fluctuations in sales. When analyzing these seasonal factors, we use historical data to determine the average sales per day for each month of the year. Based on this average, we can then determine the percentage deviation from the average monthly sales per day.

Tips & Tricks:

- When forecasting sales, be sure to consider seasonal factors

- Use historical data to determine average sales per day for each month of the year

- Adjust sales projections based on percentage deviation from average monthly sales per day

By taking these seasonal factors into account, we are able to make more accurate projections for our gun shop revenue model. This allows us to make informed decisions about inventory planning, staffing, and other important aspects of our gun store financial plan.

Gun Store Operational Expense Forecast

Operational expense forecasts are an essential part of every gun store financial model. It includes the cost of goods sold by products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating costs.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | ,000 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – ,000 |

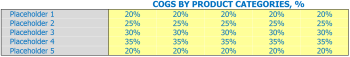

Cost of Goods Sold

Cost of Goods Sold (COGS) is the amount of money a gun store spends to purchase or produce the products they sell. This includes the cost of materials, labor and any other expenses directly related to the production or acquisition of products. As a gun store owner, it’s important to understand your COGs in order to set prices, plan inventory levels, and forecast revenue.

The COGS percentage varies by product category. For example, the COGS for handguns is typically around 60% of the retail price, while ammunition has a lower COGS percentage at around 40%. This means that for every 0 spent on wholesale handguns, the gun shop owner would have to sell them for around 0 to make a profit. For ammo, a wholesale cost of 0 would sell for 6.

Tips & Tricks:

- Regularly review your COGs for each product category.

- Consider negotiating with suppliers or finding new suppliers to reduce COGs.

- Keep an eye on price trends in the market to adjust your prices accordingly.

- Use software to analyze your COG and understand how it affects your business finances.

Understanding your gun store COGS is crucial in creating a gun store financial plan, making gun revenue projections, forecasting gun retailer financial analysis fire, creating gun store cash flow projection, developing gun financial model, gun dealer financial planning, financial gun supplier report and create a global gun store profit forecast. By tracking and analyzing COGs, a gun store owner can make informed financial decisions that contribute to the success and growth of their business.

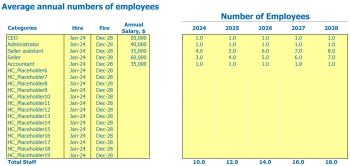

Salaries and wages of gun store employees

At our Gun store, we plan to hire a team of experienced professionals who understand the importance of providing high quality service to our customers. Our staffing plan includes a store manager, business associates, gunsmith and administrative support staff.

The Store Manager will be responsible for overseeing the daily operations of the store. The position will be filled in the first quarter of our first year of operation. The store manager will earn an annual salary of ,000.

Sales associates will be hired during the first month of operation. We aim to have 2-3 full-time equivalent employees per shift. They will earn an hourly wage of .50 plus sales commission.

The gun position will be filled in the second quarter of the first year. The gunsmith will earn an annual salary of ,000.

Administrative support staff roles will be filled in the second quarter of the first year. They will earn an hourly wage of .50.

Tips & Tricks

- Offer competitive salaries to attract and retain top talent

- Incentivize sales staff with a commission to drive sales

- Consider hiring part-time staff to offset labor costs

Gun Store Rental, Lease or Mortgage Payout

When creating a financial plan for your gun store, it is important to consider ongoing expenses related to your physical location. These expenses can fall into one of three categories: rent, lease payments or mortgage payments.

If you rent out your storefront, you make regular rent payments to your landlord. This type of arrangement is often beneficial for new businesses as it provides flexibility to move around if needed. For example, if your gun store revenue is lower than expected, you may be able to negotiate a lower rent bill or look for a new, more affordable location.

Lease payments are similar to rent payments, but generally cover a longer period, such as three to five years. They usually have stricter requirements for early termination and may require a security deposit. With a lease, you typically commit to staying in the space for a set amount of time.

If you own the property where your gun shop is located, you make mortgage payments instead of rent or lease payments. Owning your property can be beneficial because you have more control and equity in the asset. However, this requires a larger initial investment, and you will need to have solid gun shop income projections to ensure that you can make your mortgage payments each month.

Tips & Tricks

- When negotiating a lease or rent agreement, be sure to consider factors such as the length of the agreement, lease renewal options, and any hidden fees or charges such as utilities or the interview.

- Consider hiring a commercial real estate agent to help you locate a space within your budget while aligning with your business goals and needs.

- Carefully review your firearms retailer’s financial analysis to inform your decision regarding lease or mortgage payments. Calculating your gun store’s cash flow projection is critical.

Gun Store Utilities

When creating a financial plan for a gun store, it is important to consider the utility assumptions that will affect the profitability of the store. Utilities can vary widely depending on store location and types of services offered.

For example, a gun shop that provides gun training may have higher utility costs due to the additional lighting and HVAC needed for the range. A store that offers gunsmithing services may have higher utility costs due to the need for specialized equipment and tools.

Other important utility assumptions to consider when creating a financial plan for a gun store include water and sewer costs, electricity costs, and heating and cooling costs. . These costs will vary depending on store size, location and types of equipment used.

Tips & Tricks

- Consider the cost of utilities when choosing a location for your gun store and factor these costs into your financial projections.

- Look for ways to reduce your utility costs, such as replacing light bulbs with energy-efficient bulbs or investing in energy-efficient HVAC equipment.

- Consider partnering with other gun stores in your area to negotiate better rates with utility providers.

Gun Store other running costs

Besides the obvious costs like inventory, rent, and advertising costs, there are other costs you need to consider when building a financial model.

Utility Expenses: Expenses for utilities such as water, electricity and gas should be considered. This is a recurring expense that can add up over time.

Benefits: If you plan to hire employees, you need to consider the cost of providing benefits such as health insurance and retirement plans for them.

Credit Card Fees: Credit card companies usually charge merchants a fee for each transaction they make. This is a cost you need to consider when building your financial model.

License and Permits: You must obtain the necessary licenses and permits to operate a gun store. These fees may vary depending on your location and the type of gun shop you plan to open.

Repairs and Maintenance: Equipment and accessories may break down over time and require repair. You should factor the cost of repairs and maintenance into your financial model to ensure you are covered in the event of a breakdown.

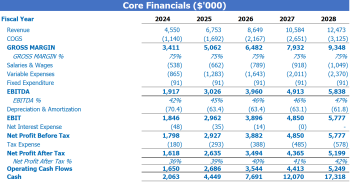

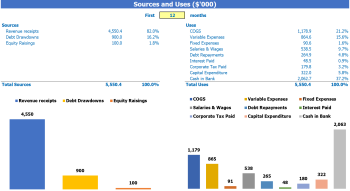

Gun Store Financial Forecast

Financial forecasting is a crucial part of any successful gun store. It involves predicting the future financial performance of the store by reviewing various financial documents including profit and loss statements, sources and uses of report and other financial statements. The gun store financial forecast provides insight into the future of your gun store, which is essential for making strategic decisions about your business. By analyzing these documents together, you can make an accurate gun shop revenue projection, gun cash flow projection, and gun dealer financial planning, assistance in gun dealer financial statement analysis or gun retailer financial analysis and gun store profit forecasts.

Profitability of gun shops

Once we’ve created projections for income and expenses, the next step is to check our profit and loss (P&L) statement. By doing so, we can identify our net profit and assess our profitability. This will help us visualize important financial ratios such as gross profit and EBITDA margin.

It is crucial to regularly analyze the P&L statement to evaluate the financial performance of our gun store. This will give us a clear picture of where our income is coming from and what expenses we need to reduce or optimize.

Tips & Tricks:

- Compare your expenses to revenue and benchmark with gun stores with similar revenue patterns.

- Review your sales data to identify top performing products and gauge the effectiveness of marketing strategies.

- Consider implementing a customer loyalty program to increase repeat business and improve profitability.

Through regular financial analysis and projection, we can create a solid financial plan that optimizes the revenue and profit potential of our gun store.

Sources and use of gun shops

The sources and uses of funds in the financial model in Excel for Gun Store provides users with an organized summary of where capital will come from sources and how that capital will be spent in the uses . It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When creating a sources and uses statement for a gun store, be sure to include all potential sources of funding, such as bank loans, government funding, and investment in capital investment. Likewise, all potential uses of capital, such as equipment purchases, personnel costs and marketing expenses, should be included.

Tips & Tricks:

- Use historical trends to project future sources and uses of funds

- Consider multiple scenarios in creating the statement to account for risk and uncertainty

- Be sure to update the statement regularly to reflect changes in the business environment

Creating a sources and uses statement can be a difficult but critical task for store owners and firearms operators. However, by following best practices and considering a range of scenarios, it is possible to develop an accurate and useful statement that can inform decision-making and help ensure long-term business success.

Building a financial model for a gun store is a critical task that requires careful consideration of all income and expenses associated with the business. By creating a strong gun store revenue model , you can better project and plan for the future. A gun store financial plan considers all sources of revenue, such as sales, rentals, and training costs, as well as all expenses, such as inventory, rent, and employee salaries . With a Gun Shop Revenue Projection , you can anticipate how much revenue you will generate over a specific time period. By creating a Gun Shops Profit Forecast , you can analyze how much net profit you can expect based on your projected expenses and income. The Gun Retailer Financial Analysis allows you to understand the key drivers of profitability and identify areas where you can improve efficiency. Finally, a gun store cash flow projection is important to ensure that you have enough cash on hand to cover expenses and invest in growing your business. With all of these financial reports together, you can create a complete Arms Shop Financial Model . Although creating a financial model can be daunting, understanding the financial health of your business and setting yourself up for success in the future is essential.