- Home

- Sales and revenue

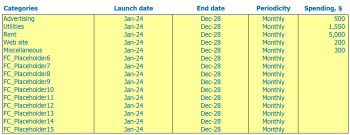

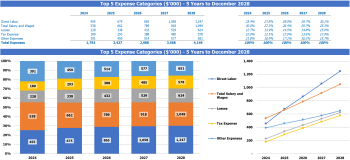

- Running costs

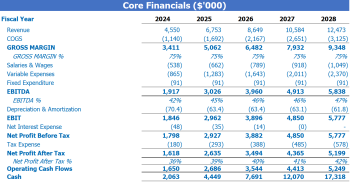

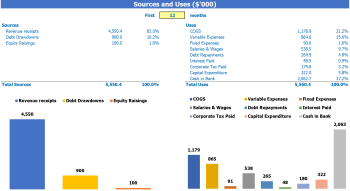

- Financial

Welcome to our blog post on how to build a financial model for an antique store. If you’re a budding entrepreneur or a seasoned business owner considering opening your own antique store, it’s important to have a solid financial plan in place. This includes understanding your Antique Store Business Plan , Startup Costs , Sales Forecast , Profit Margin , and Return Return .

One of the essential components of a solid financial plan is to create a financial model that can help you predict your store’s performance and profitability. Our guide will walk you through the steps of building an Antique Store Revenue Model , as well as performing a financial analysis , determining cash flow , performing a break-even analysis and projecting financial projections to ensure the long-term success of your store. Let’s dive into the details!

Antique Store Revenue and Sales Forecast

Revenues and sales forecasts are essential parts of an antique store’s financial model. For a new antique store, having a clear idea of revenue and sales forecasts is imperative to creating a viable business plan. Launch date, ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality are some factors that should be considered when forecasting revenue and sales. sales.

Launch date of antique stores

The launch date of your antique store is very important for the success of your business. This is the day you officially open your store to the public and start selling your products. This date determines when you will start generating income and when you will start covering your start-up costs.

The antiques financial model model provides an assumption for the start month of businesses. You need to choose the date when your antique business will start operating. It is important to plan business start-up activities and costs to ensure smooth operations.

Tips & Tricks:

- Choose a launch date that aligns with your sales forecast to ensure maximum profitability.

- Consider the seasonality of your business when choosing a launch date. Opening in the winter may not be ideal if your store primarily sells outdoor furniture.

- Set a realistic timeline for your start-up costs and cash flow to avoid unexpected financial hurdles.

- Communicate your launch date to your customers in advance to build anticipation and excitement for your opening day.

Having a well-planned launch date is crucial to the success of your antique store. By carefully choosing the date to start your business, you can ensure that you are financially strong and ready to provide a successful shopping experience for your customers.

Ramp-up time

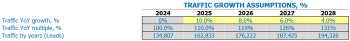

When starting a business, it is crucial to forecast sales in order to understand the ramp-up time needed to reach the sales plateau . This period is important to know for many reasons, such as identifying when your capital may be depleted or when you will start to become profitable.

What is the ramp-up period for your antique business? It varies based on location, size, and resources, but on average it can take 1-2 years to plateau. During this time, it’s important to have a financial analysis in place to manage start-up costs , cash flow , and return returns .

Tips & Tricks:

- Create a solid antique store business plan with sales forecasts , financial projections , and break-even analysis .

- Understand your profit margin and adjust pricing strategies accordingly.

- Increase revenue model by expanding inventory and offering additional services like restoration or appraisals.

All in all, predicting the time to ramp up to the sales plateau and understanding the necessary financial analysis will set your antique store up for long-term success.

Antique Shop Appointment Traffic Entrances

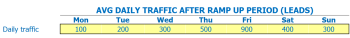

Assuming the sales plateau has been reached, average weekday visitor traffic is an important input to building a financial model for an antique store.

For example, on weekdays there might be higher traffic in antique stores near busy office buildings compared to others located in residential areas.

Additionally, factors such as holidays, road construction, or changes in the neighborhood can also affect walk-in traffic and should be considered when building the financial model.

Over time, an antique store can also expect growth in walk-in traffic as it builds its reputation, conducts marketing campaigns, and hosts events such as auctions, appraisals, or workshops.

Using historical data, as well as projected future growth based on new initiatives, the model can project walk-in weekday traffic for future years.

Tips & Tricks:

- Consider the impact of local events such as festivals, sports games or cultural celebrations on walk-in traffic.

- Use social media, email marketing or newsletters to keep customers informed about new arrivals, discounts or store events to increase footfall.

- Partner with complementary businesses such as antique furniture refinishing, art restoration, or framing services to attract more customers to the store, benefit from cross-promotion, and enhance the store’s reputation as a one-stop shop unique for lovers of the old ones.

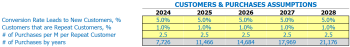

Antique store visits for sales conversion and sale entries

When starting an antique store, it is important to analyze the conversion rate of visitors to new customers and the percentage of repeat sales. A good guess for conversions is around 10% for new visitors, meaning that for every 100 people who visit the store, 10 will make a purchase. Repeat sales are just as important and should represent around 35% of total sales.

For example, if the store makes 100 sales per month, 35 of them should come from repeat customers. These repeat customers are also likely to spend more per month, typically around 0 compared to new customers who only spend an average of 0 per month.

Tips & Tricks

- Offer loyalty programs or discounts to encourage repeat sales

- Track your conversion rates and regularly repeat sales data to make data-driven decisions

- Focus on creating a welcoming and engaging shopping experience to increase conversions

These inputs are crucial to building a financial model for an antique store. Knowing how much revenue can be expected from new customers versus repeat customers helps create a sales forecast and determine store conversion rate and repeat sales goals. By understanding these important metrics, businesses can make smarter decisions about pricing strategies, marketing efforts, and overall operations.

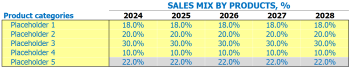

Mixed entries from antique store sales

In our antique store we sell a variety of antique items ranging from furniture and jewelry to collectibles and art. Each of these items belongs to a specific product category. Understanding how these categories contribute to our sales mix is crucial to optimizing our revenue model. For ease of understanding, we use sales mix assumptions based on product categories to forecast our sales and profits.

Let’s take an example of the product categories we use in our sales mix analysis. We have five categories: Furniture, Jewelry, Collectibles, Art, and Miscellaneous. Assuming that in the first year furniture will contribute 40%, jewelry will contribute 25%, collectibles will contribute 20%, art will contribute 10% and miscellaneous will contribute 5% to our revenue , we may use this information to project our sales forecast and profit margins for the first year. We can then adjust these percentages based on trends and change customer preferences over the next four years.

- Regularly update your sales mix assumptions based on product categories to identify gaps and opportunities in your revenue model.

- Use trends in your industry and customer behavior to adjust your sales mix assumptions for accurate sales forecasts and financial projections.

- Keep an eye on the profit margins of each product category to determine which are the most profitable for your business.

Tips & Tricks:

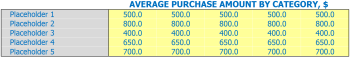

Average antique store sale take

Our antique store sells a variety of products, from furniture to artwork to jewelry, and we’ve organized each product into specific categories. This way we can make assumptions and calculations at the category level instead of the individual product level.

An important assumption we make is the average sale amount by product categories and years. For example, we assume that our furniture category sells on average 0 per item in the first year, increasing by 2% each year thereafter. Meanwhile, our jewelry category sells an average of 0 per item in the first year, increasing 3% each year thereafter.

Using this information, we can estimate our average ticket size. Let’s say that in the first year, 30% of our sales come from furniture, 50% from works of art and 20% from jewelry. Using the sales mix and the average sale amount of each product category, the model will calculate an average ticket size of 0.

Tips & Tricks:

- Regularly review and update your assumptions to ensure they are accurate.

- Consider adding new product categories over time to increase sales opportunities.

- Analyze your sales mix and adjust it if necessary to maximize profits.

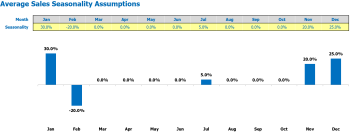

Seasonality of antique sales

When creating an Antique Store Sales Forecast , it is important to consider the assumption of sales seasonality. This is based on the understanding that sales can fluctuate depending on the time of year.

For example, the summer months may be busier due to an increase in tourists visiting the area, while the winter months may see a decrease in foot traffic. These seasonal factors can significantly affect your business and should be considered when creating your antique financial projections.

Tips & Tricks:

- Look for historical sales data to see how sales have varied throughout the year.

- Consider holidays and special events in your area that may increase or decrease foot traffic.

- Calculate the percentage deviation from monthly average sales per day to adjust your forecast accordingly.

By understanding your antique sales seasonality assumptions , you can create a more accurate antique store sales forecast and effectively manage your antique store cash flow . It is an essential component in determining your Antique Store Break-Even Analysis , Antique Store Profit Margin , Antique Store ROI, Antique Store Start-up Costs, and Antique Store Model. revenue from antique stores .

Antique Store Operating Expense Forecast

An operating expense forecast is an important part of an antique store financial model. These forecasts help to estimate and plan the various costs related to the management of the store on a monthly basis. Some of the key expenses included in these forecasts are the cost of goods sold by products %, salaries and wages of employees, rent, payment of leases or mortgages, utilities and other operating expenses.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | ,500 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | 0 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – ,000 |

Having a clear understanding of these operating expenses is crucial to an antique store business plan and can inform decisions on pricing, marketing, and overall financial strategies. By properly analyzing and forecasting these expenses, antique store owners can make well-informed decisions and improve business profit margin, cash flow, and return returns.

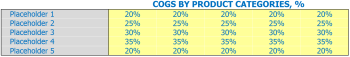

Cost of Antique Store Goods Sold

When it comes to the finances of an antique store, the cost of goods sold (COG) is a critical aspect that needs to be understood. COGS represents the direct costs associated with the goods the store sells, including the price of the item, transportation costs, and storage costs .

To calculate COGs, the store must have a good understanding of its inventory and the quantity of each item in that inventory. This means the store should have a proper inventory management plan in place that tracks the cost of each product and deducts it from overall revenue.

The COG percentage will vary depending on the type of vintage items sold. For example, if the store specializes in rare furniture, COGs may be higher due to transportation and storage costs. Antique stores that sell vintage accessories such as watches, jewelry, and decorative items tend to have a lower COG percentage of around 30% to 40% .

Tips & Tricks:

- Keep accurate inventory records to calculate COGS more efficiently.

- Increase profits by negotiating transportation and storage costs with suppliers.

- Regularly review and analyze COGs to identify ways to reduce expenses and increase profit margins.

Having a good understanding of COGS is essential for the financial analysis of an antique store, including revenue model, business plan, profit margin, cash flow, break-even analysis , sales forecasts, start-up costs, return on investment and financial projections.

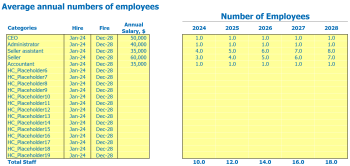

Salaries and wages of antique store employees

As a member of Antique Store Business Plan , it is important to estimate salaries and wages of employees. This allows you to project your Antique Store Financial Analysis , including Antique Store Revenue Model , Profit Margin , and Cash Flow . Annual financial projections and sales forecasts can also be determined with this information.

It is imperative to plan the number of staff members, their names/positions, and the annual salary for the Antique Shop Startup Costs . For example, you may decide to hire a store manager, housekeeper, and cleaning staff. The store manager can earn ,000 per year, while a floor clerk is expected to earn around ,000 per year. You may also require part-time staff or contracted professionals (such as accountants), so be sure to add these considerations to your plan.

Based on these assumptions, you can then determine the number of full-time equivalents (FTES) you will need each year. For example, if you determine that your business needs 1.5 ET for cleaning staff, this may mean that you will hire two part-time cleaning staff.

Tips and Tricks of Employee Salaries and Tricks of Employees in Antique Store:

- Research market wage rates for different roles/job positions in the Antique Shop business .

- Consider benefits such as health insurance or 401(k) plans. Be sure to also include these costs when planning salaries.

- Create a payroll system that keeps track of employee hours, taxes, and contributions to ensure accurate compensation.

Lease, lease or mortgage payment in store

One of the biggest expenses when starting an antique store is paying for the space you occupy. This can take form in rent, lease or mortgage payments. Rent payments are usually the most flexible option. A lease involves signing a contract for a fixed period, while a mortgage payment is required if you own the property in which you operate.

Tips & Tricks:

Here are some tips for processing these payments:

- Do your research before choosing a location to make sure you’re not paying too much rent or a mortgage payment.

- If possible, negotiate with the landlord to lower the rent or push the lease term that suits the antique store revenue model.

- Include all payments in your financial analysis of your antique store to ensure you include all expenses.

- Use your antique business plan as a way to describe the payments you will make.

Antique Store Utilities

When creating a business plan for an antique store, one of the sections you will need to consider is the financial analysis. This includes factors such as revenue, cash flow, profit margin, break-even analysis, sales forecast, start-up costs, return on investment, and financial projections. Another important area to consider is the utilities that will be needed to run your antique store.

The utility assumptions for your antique store will depend on a number of factors, such as the size of the space, the type of equipment you use, and the location of your store. For example, if you plan to operate a large store with multiple floors, you may need to purchase more equipment or hire more staff to keep everything running smoothly.

Utilities that may need to be factored into your financial analysis include electricity, water, heat, and internet. You’ll want to estimate these costs based on past utility bills, the types of equipment you use, and the square footage of your store. It is also important to consider seasonal fluctuations in utility bills. For example, heating bills may be higher during the winter months, while air conditioning costs may increase during the summer.

Tips & Tricks:

- Consider energy-efficient equipment to save on utility costs.

- Look for programs or incentives that may be available for businesses that use renewable energy sources.

- Consider outsourcing tasks like cleaning or landscaping to save on water usage.

Antique shop other running costs

When calculating the financial model for your antique store, you need to consider additional expenses outside of the traditional antique store start-up costs , such as promotion, advertising, insurance, rental, and others. additional equipment. These expenses are called “other operating costs”.

Advertising and marketing are vital for any business, including antique stores. Therefore, be sure to keep these expenses in mind while writing Antique Store Financial Projections . Additionally, depending on the size and location of your store, insurance costs will also vary. You may consider additional equipment expenses, such as purchasing paper bags with your brand logo.

The location of the property is essential when calculating expenses. The lease rate depends on the size, location of the antique store, and your geographic location. If your store is located in a sophisticated commercial area, the rental cost will be more than the standard rate.

Finally, don’t forget to add an amount in your start-up costs for equipment such as cash registers, credit card machines, security cameras, and software for accounting and inventory management.

Financial forecast

For an antique store to be profitable and sustainable, it is important to have a solid financial plan in place. The financial plan should include an Income Statement that describes the income, expenses and profits of the business. Plus, a Souleveillance Sources and Usage Report where the company’s funding will come from and how it will be used. Other important components of the financial plan include an Antique Store Business Plan , Antique Store Financial Analysis, Antique Store Cash Flow, Antique Store Break-Even Analysis , and Financial Projections of Antique Stores which includes the Antique Store Sales Forecast , Antique Store Startup Costs , and Antique Store ROI .

Profitability of antique stores

Once we’ve created revenue and expense projections for our antique store, we can move on to checking the profit and loss (P&L) statements. These statements provide a detailed overview of our store’s revenues, expenses and profits over a specific period of time. By analyzing the P&L statement including gross profit and EBITDA margin, we can determine the profitability of the store.

Other key financial statements to consider when evaluating antique store profitability include revenue models, cash flow analysis, break-even analysis, sales forecasts, startup, return on investment (ROI) and financial projections. These statements help us understand the store’s financial condition, which helps us decide whether to offer the opportunity to make necessary changes to increase profitability.

Tips & Tricks:

- Regular accounting is essential to determine when sales are falling and how expenses are changing over time.

- Accurately identifying your recurring and non-recurring expenses is critical to calculating your store’s break-even point to achieve profitability.

- Pay attention to customer preferences and adjust your inventory and prices accordingly. Also, provide quality customer service to increase customer loyalty and repeat purchases.

- Keep warehouse and equipment costs in line to keep overheads to a minimum.

With accurate projections of various financial statements and a good understanding of how to calculate antique store profitability, we can make effective decisions to ensure our store’s long-term success.

Sources and use of antique shops

The Sources and Uses of Funds in Excel’s Financial Model for Antique Store provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other.

Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks

- Be diligent in your projections for sources and uses of funds to avoid inaccurate financial planning.

- Consult with a financial analyst or accountant to help forecast and analyze your antique store’s revenue model and financial projections.

If you are planning to start an antique store or are looking forward to expanding an existing financial model, building a solid financial model is key to your success. Using antique store revenue model, business plan, financial analysis, profit margin, cash flow, break even point analysis, sales forecast, start up costs, ROI and financial projections, you can set achievable goals and measure your progress towards them.

Remember that building a financial model requires careful attention to detail and a good understanding of the market, competitors, and target customer. Keep track of your financial performance over time and compare it to your projections to make informed decisions that will help you achieve your long-term goals. By following these steps, you can build a strong, resilient antique store that generates lasting profits and delivers value to your customers.