- Home

- Sales and revenue

- Running costs

- Financial

Discount stores are a popular retail option for consumers looking for affordable products. However, owning and operating a discount store can be difficult without a solid financial plan. Building a financial model can help discount store owners analyze their revenue, expenses, and overall profitability. In this blog post, we’ll discuss how to create a financial model specifically for a discount store, including financial analysis, planning, projections, forecasts, metrics, performance, and strategy. By following these steps, you can ensure that your discount store is running successfully and continues to meet the needs of your customers.

Discount Store Revenue and Sales Forecast

A crucial part of the discount store financial model is revenue and sales forecasts. It predicts the future revenue the store will generate, based on the discount store’s business model and financial strategy. Forecasts include various factors such as launch date, ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, sales seasonality.

By analyzing these discount store financial metrics, it is possible to make financial projections of the discount store and evaluate the financial performance of the discount store. The discount store’s profitability model depends on how well sales forecasts align with actual sales. Therefore, having an accurate and knowledgeable sales forecast is essential as part of discount store financial planning and discount store financial forecasting, especially in the early years of store operation. .

Discount store launch date

Choosing the launch date for your discount store is very important. It sets the tone for your business and can impact your financial performance. The Discount store financial model template provides a guess for the month of business launch, but ultimately the decision is yours.

A tip for choosing a launch date is to consider the seasonality of your business. For example, if you plan to sell seasonal items, launching just before that season can lead to increased revenue. Another tip is to give yourself plenty of time to prepare and plan for launch-related activities and costs, such as marketing and hiring staff.

Tips & Tricks:

- Consider the seasonality of your business when choosing a launch date.

- Give yourself enough time to prepare and plan launch activities and costs.

Additionally, the launch date can impact your financial planning and forecasting. By choosing a launch date, you can create a timeline for your financial projections and strategies. This calendar can help you track progress and make necessary adjustments to improve your discount store’s financial performance.

Overall, your discount store’s launch date is a crucial milestone that requires careful attention. Taking the time to plan and strategize can lead to a successful launch and long-term financial success.

Ramp-up time

Whenever a new discount store opens, the initial sales period is critical. The sales ramp-up time is an important metric to predict while predicting sales. If a company underestimates the ramp-up period, it may have heavier expenses early in the period and may even run the risk of running out of money. The longer the ramp-up time, the more money the business needs to stay afloat. It is imperative to have an accurate forecast of the ramp-up period.

What is the ramp-up period for your discount store business? This is how long your business will need to reach the sales plateau. In the discount store business model, it can take around six to twelve months for the business to reach its sales plateau. Factors such as brand awareness, location, competition, and economic conditions can all impact the ramp-up period.

Tips & Tricks:

- Conduct market research to understand local consumer behavior and preferences.

- Choose a location with high visibility and accessibility.

- Offer discounts or promotions to attract customers during the ramp-up period.

- Have enough financial reserves to cover expenses until sales increase.

The financial analysis of the discount store should consider the ramp-up period while providing financial planning, financial projections and financial forecasts. A discount store profitability model should assess the financial performance of the business while considering ramp-up time to determine the right financial strategy.

Predicting ramp-up time accurately is crucial to ensure business sustainability, profitability and success.

Go traffic entries on the discount store

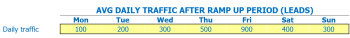

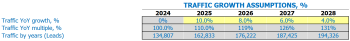

When building a financial model for a discount store, it is essential to consider the average walk-in visitor traffic. This traffic flow can vary greatly from week to week and changes over time, especially after the ramp-up period when sales.

For example, Monday and Tuesday tend to have lower walk-in traffic compared to Wednesday and Thursday. Fridays and Saturdays have the highest walk-in traffic due to the weekend rush. On the other hand, Sundays generally have lower walk-in traffic as it is a day to relax before the start of another week.

Assuming a discount store has an average daily traffic of 500 people on Monday during the ramp-up period, we can use this to forecast future walk-in weekday visitor traffic for five years. Assume the year-over-year average daily traffic growth factor is 3%.

So the model will calculate future walk-in traffic for the future on weekdays for five years based on the inputs we entered into the model. This information will inform the discount store’s business model, revenue model, financial projections and financial analysis, which ultimately impacts the store’s profitability model, financial metrics, financial performance and financial strategy. .

Tips & Tricks

- Consider public holidays and their impact on walk-in traffic.

- Consider local events, school holidays and seasonal variations.

- Implement strategies to increase walk-in traffic, such as marketing campaigns and promotions.

Discount store visits for sales conversion and sales inputs

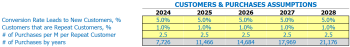

As we analyze the discount store business model, we need to consider the conversion rate of store visits into new sales. It is important to project the percentage of visitors who will become new customers, as well as the percentage of repeat customers. Additionally, it is essential to understand how much repeat customers are likely to spend per month.

The average conversion rate from visitors to new customers at discount stores is 20%. This means that out of ten visitors, two will become new customers.

Repeat customers often make up a significant percentage of a discount store’s total sales – typically between 30-40%. This speaks to the importance of developing a strong customer loyalty program in discount stores.

Based on our financial analysis, we have determined that repeat customers will shop on average approximately twice per month from the discount store. As we build our financial model for a discount store, it is imperative to have accurate assumptions regarding sales conversion rate visits and repeat customer percentages, as this determines the store’s estimated profitability.

Tips & Tricks:

- Order the store’s customer loyalty program through incentives such as free products, discounts and exclusive sales for repeat customers.

- Explore promotions that drive traffic to the store’s website, such as free shipping, low-cost offers, and coupons that can be redeemed in-store to convert leads into new customers.

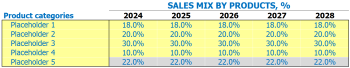

Discount store sales mix starters

In our discount store, we sell a variety of different products, each belonging to a specific product category. To better understand our sales mix, we entered sales mix assumptions at the product category level. This made forecasting our revenue model much easier and more accurate.

Let’s say our five product categories are apparel, electronics, home products, toys, and health and beauty. We have made assumptions about the percentage of sales that will come from each category for the next five years. For example:

- Clothing – 35%

- Electronics – 20%

- Home goods – 15%

- Toys – 25%

- Health and beauty – 5%

This allows us to forecast our revenue and create a profitability model for our discount store. By tracking the category of our sales mix by product, we can make adjustments to our product offering and financial strategy as needed.

Tips & Tricks:

- Regularly update your sales mix assumptions to stay current with market trends and customer preferences.

- Use historical data to inform your sales mix assumptions.

- Consider the impact of external factors, such as the economy or competition, on your sales mix.

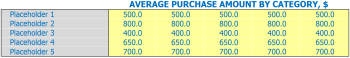

Average arrangement of the reduction Amount of entries

Your discount store offers a wide variety of products, from clothing to household items to beauty products, each belonging to a specific category. To simplify the estimation process, assumptions about the average sale amount for each category are entered at the category level, rather than by individual products.

For example, in the clothing category, assumptions are made about the average sales quantity of shirts, pants, dresses, etc., for each year. Similarly, in the household category, assumptions are made about the average sale quantity of items such as cleaning supplies, storage solutions, and tools.

These assumptions about average sale amounts are then used in estimating the average ticket size. The model calculates the average ticket size using the mix of sales and the average sales amount of each category.

So what could be the average sale amount for each product category? Well, it will depend on various factors including the type of product, the level of competition, and the target market. For example, a clothing store might expect the average sale amount for shirts to be higher than for socks, while a household store might expect the average sale amount for tools is higher than for cleaning supplies.

Tips & Tricks:

- Be sure to regularly review and update your assumptions about average sales amounts, based on changes in the market or consumer market.

- Consider experimenting with different pricing strategies, promotions, or product assortments to optimize your store’s average sale amount and overall profitability.

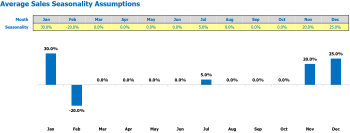

Seasonality of discount store sales

As a discount store, understanding sales seasonality is crucial for financial planning, projections and forecasts. Seasonality refers to variations in sales volume or revenue during the calendar year.

For example, many discount stores experience a spike in sales during the holiday season. Meanwhile, sales may dip in January and February as consumers recover from holiday spending. Seasonal factors can also impact sales depending on weather conditions, promotions and other events throughout the year.

Tips & Tricks:

- Monitor online and in-store traffic patterns to determine when customers are most likely to make purchases

Discount store owners and managers should analyze financial metrics , like average daily sales, monthly revenue, and customer traffic to identify patterns and make assumptions about seasonal factors. With these insights, they can develop a profitability model that takes into account expected fluctuations in sales volume throughout the year and create a financial strategy to optimize their revenue model.

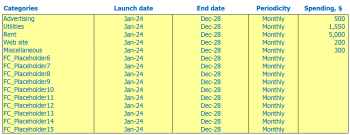

Discount Store Operational Forecast

As part of the Discount store’s financial model, a forecast of operational expenses is crucial to achieving financial stability and growth. These forecasts include the cost of goods sold by products %, wages and salaries of employees, rent, payment of leases or mortgages, utilities and other operating costs.

| Costs | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | 5,000 – 10,000 |

| Salaries and wages of employees | 15,000 – 20,000 |

| Rent, lease or mortgage payment | 8,000 – 12,000 |

| Public services | 2,000 – 4,000 |

| Other running costs | 3,000 – 5,000 |

| Total | 33,000 – 51,000 |

By accurately forecasting operational expenses, discount stores can easily assess and adjust their Discount Store Financial Planning, Financial Projections, Financial Metrics and Financial Performance To achieve maximum Discount Store Revenue Model, Discount Store Business Model discount, discount store financial analysis, discount store profitability model and discount store financial strategy .

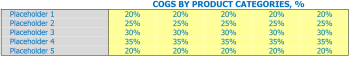

Discount Store Cost of Goods Sold

The discount store’s cost of goods sold (COGS) is the direct cost associated with producing or purchasing the goods sold by the store. This includes the cost of materials used in the creation of the product, as well as the cost of labor involved in production or purchase. COGS is one of the biggest expenses of any discount store, and projecting and measuring it is critical to maintaining profitability and financial stability.

Assumptions regarding COGs will vary depending on the product categories carried by a discount store. For example, a store that primarily sells food will have a very different COGS percentage than a store that sells clothing. As a general rule, COGs should not exceed 60% of the item’s sale price. Here are some examples of COGs for common discount store product categories:

- Food: 30 to 40%

- Clothing: 40-50%

- Household items: 20-30%

- Electronics: 50-60%

Tips & Tricks

- Regularly track and update your COG percentages for each product category

- Compare your COGS percentages to industry averages to ensure you’re not overspending on product costs

- Explore ways to cut the cogs through buying in bulk or negotiating better prices with suppliers

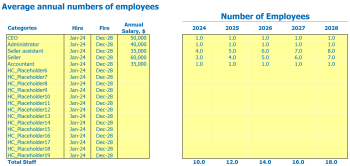

Salaries and wages of discount store employees

When it comes to financial planning for a discount store, a crucial aspect is to consider the cost of employee wages and salaries. It is essential to identify the staff members/positions needed and the cost involved in hiring and training.

The first step is to decide on the names of the staff members/positions. Let’s take an example; Discount store X requires a store manager, business associates, cashiers, and action clerks. Once you have a list of staff/positions, you need to determine when you will hire them.

Next, you need to decide how much money each person/category should earn for the 12 month period, including salaries and benefits. For example, a store manager might earn an annual salary of ,000, while salespeople might get paid hourly and receive benefits such as health insurance or a retirement package.

Finally, once you have discovered the staff members/positions needed and their costs, you need to calculate the number of full-time equivalent staff members you need each year. For example, if you need approximately 3000 hours of work per year and each employee works 2000 hours per year, you would need 1.5 full-time equivalent employees to cover the workload.

Tips & Tricks:

- Consider part-time employees to cover the workload during peak seasons to avoid hiring more full-time employees than necessary.

- Conduct industry salary surveys to stay competitive when it comes to paying employees.

- Incentivize employees with bonuses to improve productivity and retention rates.

Discounted in-store rent, lease or mortgage payment

One of the most important aspects of a discount store’s financial analysis is its rent, lease, or mortgage payment assumptions. This determines a large part of the company’s operational expenses and has a direct impact on its profitability, financial planning and forecasting.

A discount store’s rent or lease costs are usually calculated based on the size of the store, its location, and current market rent rates. Additionally, a discount store’s mortgage payment can vary depending on the down payment made when purchasing and the interest rates at the time of purchase.

For example, if a discount store is positioned in a high-traffic area, its rent or rental costs will be higher than that of a discount store located in a less trafficked area. Similarly, if a discount store has purchased or rented a large storefront, the rent, lease, or mortgage payments will be higher compared to a smaller store.

Tips & Tricks:

- Look for the best storefront locations that have high foot traffic and reasonable rents, leases or mortgage payments.

- Negotiate with the landlord for lower rent or lease payments or other financial benefits.

- Explore the option of subletting some of the space to another business.

The discount store’s financial analysis should consider its rent or lease and mortgage payment assumptions to build a realistic financial projection and assess its profitability, financial metrics, financial performance and financial strategy when making financial planning decision.

Considering all the factors that contribute to rent or mortgage payment assumptions, a discount store can create its discount store revenue model, discount store business model, and discount store profitability model, leading to adequate cash flow which helps the discount store to thrive.

Discount Store Utilities

The discount store revenue model must take into account various utility assumptions to ensure financial stability and profitability. These assumptions are key components of store financial planning and forecasting.

Utilities Assumptions Refer to the cost of electricity, water, and other utilities that the store needs to operate. For example, the cost of electricity is a major expense for any retail store, especially a discount store that relies heavily on energy-intensive lighting and air conditioning systems.

In addition to this, the cost of water can also be a substantial expense, especially in areas where water is scarce, or its cost is high. Therefore, the financial analysis of the discount store must take into account these additional expenses.

Here are some tips and tricks:

- Consider investing in energy-efficient lighting systems that use less electricity.

- Water-saving strategies such as low-flow faucets and toilets will also help reduce store water bills.

- Invest in renewable energy sources, such as solar panels, to help offset electricity consumption costs.

In conclusion, utility assumptions are a vital component of the discount store business model. Financial metrics and performance analysis should take these expenses carefully to ensure a profitable future.

Discount store Other operating costs

When creating a financial model for a discount store, it is important to consider all operating expenses that will affect the profitability of the business. While many of the costs, such as rent, utilities, and employee salaries, are relatively straightforward, there are also a number of “other” costs that can add up quickly.

These could include things like marketing and advertising expenses, as well as administrative costs like legal fees and accounting services. There may also be expenses related to inventory management, such as shipping and storage costs, as well as costs associated with maintaining equipment and facilities.

Other costs may also include unexpected expenses, such as losses due to theft or damage to goods. While these can be difficult to predict, it’s important to factor these risks into your discount store financial forecasting and financial planning to ensure that your business can withstand any unexpected setbacks.

By considering all of these Discount Store financial metrics and financial performance factors, you can build a complete Discount Store business model that considers all the costs and factors that will impact the Discount Store revenue model and Overall Discount Store Financial Strategy .

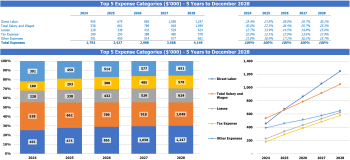

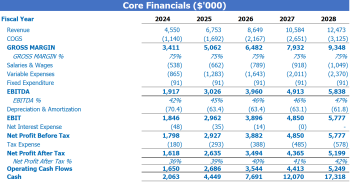

Discount Store Financial Forecast

In order to maintain a successful and profitable discount store, financial planning is essential. A fundamental aspect of discount store financial analysis is financial forecasting. This process involves projecting future financial performance using factors such as historical data, industry trends, and market changes to forecast income, expenses, and profitability. Financial forecasting includes the preparation of comprehensive profit and loss statements, source and usage reports, and financial measures such as profitability, liquidity, and cash flow. By implementing a reliable finance forecasting model, discount store business models can make informed decisions regarding expansion, inventory management, and financing, among others.

Discount store resitability

Once we’ve built Income and Expense Projections , it’s important to check the Profit and Loss (P&L) Statement of Income at a net profit. This helps us visualize the profitability of our discount store, such as gross profit or EBITDA margin.

By analyzing our Discount Store financial metrics , we can determine a profitable business model and financial strategy . A detailed financial analysis can help us understand our financial performance and create successful Financial Planning and Forecasting .

Tips & Tricks:

- Focus on increasing revenue and reducing expenses to improve profitability.

- Be sure to include all expenses, including inventory, labor costs, and rent.

- Update your financial projections regularly to ensure an accurate forecast.

Finally, it is essential to Regularly review our discount store financial projections to assess our financial performance and profitability model . With consistent monitoring and adjustments to our financial strategy , we can build a profitable and successful discount store.

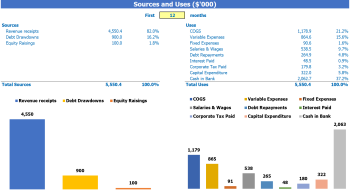

Discount Store Sources and Chart Usage

The Sources and Use of Funds statement is an essential part of the Discount Store Financial Analysis . It provides a summary of where capital comes from, how it is spent, and balances the two. This statement is particularly crucial when granting a recapitalization, restructuring or mergers and acquisitions (M&A) procedure.

When developing a financial model in Excel for a discount store, proper planning for sources and usage records should be in place. This should include an analysis of the company’s discount store revenue model , identifying potential sources of funds and how they will be used.

Tips & Tricks

- Carefully analyze the discount store business model to identify potential sources of funds.

- Make sure that the total amounts of sources and uses are equal.

- Update the statement regularly to reflect changes in the company’s financial performance.

In conclusion, a well-prepared sources and uses statement is necessary for the success of the discount store financial strategy , serving as a guide for proper financial planning, forecasting and projections.

Building a financial model for a discount store is an essential step in ensuring business success and sustainability. Using the right tools and techniques, discount store owners can create an accurate and detailed financial plan that explains all relevant factors affecting their store’s profitability. From revenue models to financial metrics, from forecasts to performance analysis, several critical elements must be considered when building a financial model for a discount store. With these factors in mind, discount store owners can create a solid and effective financial strategy that will guide the success of their business for years to come.