- Home

- Sales and revenue

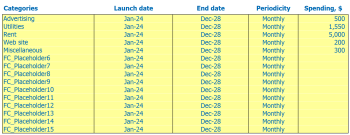

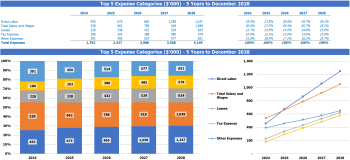

- Running costs

- Financial

Welcome to our comprehensive guide on how to build a financial model for a Glacier . As you embark on this exciting journey of starting your own ice cream business, it’s important to have a clear understanding of the financial planning and analysis required. From Ice Cream Shop Revenue Model to Cash Flow Projection , every element of your financial plan will play a crucial role in the success of your business. This post will provide you with an in-depth understanding of the Income Statement , Profitability Analysis , Sales Forecast and other important components of Ice Cream Shop Budgeting . Let’s start!

Ice Cream Shop Revenue & Sales Forecast

Revenue and sales forecasts are a crucial part of the financial model for any ice cream shop. The forecast gives an estimate of the sales that the ice cream shop will generate over the next few years. It is essential to prepare a sales forecast before the launch date to determine the break-even point, cash flow and break-even point of the business. Sales forecasts take into consideration sales ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality.

Ice Cream Shop Launch Date

Choosing a launch date is crucial when starting an ice cream shop. Not only does this impact your timeline for all tasks leading up to opening day, but it also affects your financial plan and projections.

Tips & Tricks:

Consider the following when choosing a launch date:

- The seasonality of ice cream sales in your area

- The availability of suppliers and staff

- Your main competitor operating schedules

- The time needed to prepare the shop and the equipment

Ice Cream Rise Time

Sales forecasting for any business is essential, while predicting a ramp-up time to reach the sales plateau. For an ice cream shop, forecasting the increase in sales is crucial to understanding and executing the financial plan accordingly.

Ramp-up time refers to the length of time it takes for a business to grow and reach the sales plateau. For an ice cream shop, it depends on various factors such as location, demand, competition, and seasonality. Generally, the ramp-up period is higher for new business ventures as they need to create a brand image, build foot traffic, and gain customer trust.

Calculating ramp-up time for an ice cream shop can be tricky. The easiest way is to analyze industry trends and benchmarks. According to industry experts, the ramp-up period for a typical ice cream shop ranges between three and twelve months, depending on location and seasonality.

Tips & Tricks:

- Analyze local competition and target customer segments to estimate ramp-up period.

- Focus more on marketing and advertising in the first few months to attract customers.

- Stay up to date with the latest ice cream shop revenue model and financial analysis to make informed decisions.

To optimize profitability and cash flow, it is crucial to predict the time to ramp up sales and plan accordingly. Accurate sales forecasting enables effective budgeting, convenient financial analysis, and timely decision making. The ramp-up period can vary depending on your business location and other factors, so estimating it correctly is crucial for successful financial planning.

Ice cream ice cream traffic entries

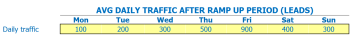

After the ramp-up period, the average daily walk-in traffic of visitors to our ice cream shop is as follows:

- Monday: 60

- Tuesday: 70

- Wednesday: 80

- Thursday: 90

- Friday: 110

- Saturday: 150

- Sunday: 130

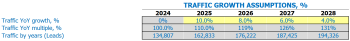

This data is crucial for our Financial Plan for Ice Cream Shop , as the number of customers has a direct impact on our revenue. We use it to develop our Sales Forecasting, Budgeting , Income Statement , and Profitability Analysis . Without this information, we cannot accurately project our cash flow projection and return on investment .

We also use this data to calculate the average-in average traffic growth factor. In our case, we typically see a 5% increase in daily traffic each year. Using this information, we can build a model that predicts future walk-in traffic for the next five years, allowing us to make data-driven decisions to optimize our Ice Cream Shop Revenue Model .

Tips & Tricks:

- Track daily traffic to make informed decisions regarding inventory planning and management

- Consider hosting events on slower days to increase targeted traffic and sales

- Adjust pricing strategy on high traffic days to maximize ROI

Ice Cream Shop Visits for Sales Conversion and Repeat Sales Entries

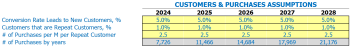

When it comes to building a financial model for an ice cream shop , it’s important to consider the visits to sales conversion rate and the number of repeat customers. On average, an ice cream shop will convert about 20% of visitors into new customers.

Additionally, it is important to note that repeat customers will make up a large portion of your income. The amount of purchases each customer will repeat per month will vary depending on factors such as location and marketing efforts, but even a conservative estimate of two visits per month can significantly increase revenue.

For example, if your ice cream shop has 1000 visitors per month, you can expect to have around 200 new customers each month. However, if you can retain just 10% of these new customers as repeat customers, they will represent 20% of your monthly revenue with just two visits per month averaging per visit.

Tips & Tricks:

- Offer loyalty rewards programs to incentivize repeat visits

- Create special limited-time flavors to keep customers coming back

- Engage with your customers on social media to excite them for your business

Overall, visits to sales conversion rate and number of repeat customers are important inputs to consider when building a financial model for an ice cream shop. By calculating these factors into your financial plan for the ice cream shop, you can ensure that you are making informed decisions about budgeting, sales projections, break-even analysis, cash flow and return on investment.

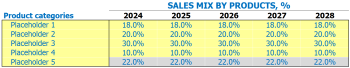

Ice Cream Shop Sales Mix Intarts

Your Ice Cream Shop store sells different ice cream shop products and each product belongs to a specific product category. Entering the sales mix assumption on the product category lever will be much easier to understand. Here is the mix of selling by product category assumptions in detail with examples.

- Enter up to 5 product category names to use in the sales mix.

- Enter the sales mix in percentage for each of the 5 years provided by product category.

Tips & Tricks

Let’s say your ice cream shop has five different product categories: cones, sundaes, shakes, pints, and cakes.

For the first year, you estimate that cones will be 30% of your sales, Sundaes will be 20% of your sales, shakes will be 10% of your sales, pints will be 25% of your sales, and your cakes will be 15% of your sales.

For the second year, you estimate that cones will be 35% of your sales, Sundaes will be 15% of your sales, shakes will be 15% of your sales, pints will be 20% of your sales, and your cakes will be 15% of your sales.

For the third year, you estimate that cones will be 25% of your sales, Sundaes will be 25% of your sales, shakes will be 15% of your sales, pints will be 20% of your sales, and your cakes will be 15% of your sales.

For the fourth year, you estimate that cones will be 25% of your sales, Sundaes will be 20% of your sales, shakes will be 20% of your sales, pints will be 20% of your sales, and your cakes will be 15% of your sales.

Finally, for the fifth year, you estimate that Cones will be 25% of your sales, Sundaes will be 20% of your sales, Shakes will be 20% of your sales, Pints will be 20% of your sales, and Cakes will be 15% of your sales.

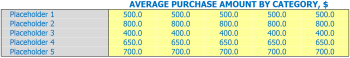

Ice Cream Shop Sales Entry Amount

In our ice cream shop, we sell a variety of products to our customers. These products are divided into different categories, such as regular slimes, premium scoops, cones, toppings, and drinks. It is much easier for us to estimate the average sale amount at the category level rather than for each individual product. For example, instead of estimating the average sale quantity for each flavor in the regular scoop, we estimate it for the entire regular scoop category, which includes all flavors.

We use this assumption of an average sale amount per product category per year to estimate the average ticket size, which is a critical metric for our revenue model. The average sale amount is the price at which we sell a single item from a specific product category, and we use it to calculate the sales mix, which is the proportion of sales from each product category.

Let’s say in our first year of operation, our estimated average sale amount for regular scoops is .50, for premium scoops is .00, for cones are .50, for toppings is .75 and for drinks is .00. Using these estimated average sales amounts and our expected sales mix, the model calculates the average ticket size, which is the average amount a customer is expected to spend per visit to our store.

Tips & Tricks

- Keep track of your sales data and adjust your assumptions accordingly to make more accurate financial projections.

- Be conservative with your estimated average sale amounts to avoid overestimating your earnings.

- Consider offering promotions or discounts to increase your sales volume and attract new customers.

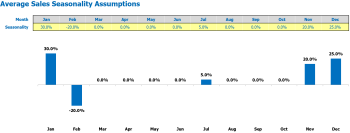

Ice cream sales seasonality

Understanding the seasonal nature of your ice cream shop sales is crucial for financial planning and budgeting purposes. Seasonal factors can vary over the calendar year, with the most obvious peaks in sales during the warmer months and a decrease during the cooler months.

Assuming an average sale per day of 0, we can expect a deviation of -25% during the winter months (November to February), -10% during the spring months (March to April) and a deviation positive by +40% during the summer months (May to August). Finally, we can expect a deviation of -5% during the autumn months (September to October).

Tips & Tricks:

- Use historical data to refine your seasonal factors over time.

- Consider offering flavors or seasonal promotions to boost sales during slower times.

- Adjust staffing and inventory levels based on expected sales volume.

By understanding the seasonality of your ice cream shop’s sales, you can create a more accurate financial plan, profit and loss statement, break-even analysis, cash flow projection, and sales forecast. Additionally, knowing your expected sales allows for better budgeting and financial analysis, improving your return on investment and overall profitability.

Ice Cream Operational Forecast

In any financial plan for an ice cream shop, operational expense forecasts are an essential part. It provides an estimate of a company’s monthly expenses and helps determine break-even analysis, cash flow projection, and profit and loss statement. These expenses include the cost of goods sold by the products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating expenses.

| Cost category | Amount (per month) |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,500 – ,000 |

| Public services | 0 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – ,000 |

By forecasting operational expenses, ice cream shop owners can budget their finances and make informed decisions about their business. Regular financial analysis is essential to ensure the ice cream shop is profitable and to realize its return on investment.

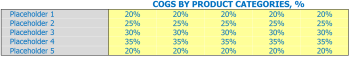

Cost of Ice Cream Cost of Goods Sold

The cost of goods sold (COG) for an ice cream shop is the total cost of the ingredients and supplies used to make the ice cream. It includes things like milk, cream, sugar, and flavorings. The COGS assumptions for an ice cream shop will depend on the types of products they sell and how they make them.

For example, if an ice cream shop makes all of its ice cream from scratch, their cogs will be higher than if they buy pre-made ice cream mix. Also, if they offer a lot of toppings or mixes, their cogs will be higher than if they just offer plain ice cream flavors.

Tips & Tricks:

- Carefully track your COGs so you can make adjustments to your fare or menu prices if your costs start to get too high.

- When doing your financial analysis and creating your budget, be sure to factor in the costs of utensils, bowls, and other items needed to serve the ice cream.

- Consider offering seasonal flavors or specials that use less expensive ingredients at certain times of the year.

In general, the cogs for an ice cream shop should account for around 20-30% of their total revenue. Within that 20-30%, different product categories may have different percentages. For example, plain vanilla ice cream cogs may be inferior to cogs for flavor that includes expensive blends like fresh fruit or nuts.

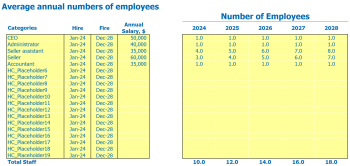

Salaries and wages of ice cream employees

The success of an ice cream shop relies heavily on the quality of the employees it hires. This section focuses on the salary and wages that must be paid to your employees.

It is essential to have a clear understanding of the number of employees you need and the tasks they will perform. Naming staff members/positions will allow you to easily communicate with them. For example, a cashier is responsible for operating cash records and ensuring exceptional customer service. You may need to hire a cashier or two, and they will mostly earn around ,000 to ,000 per year. However, salaries vary depending on your location and employee experience.

Additionally, you can consider hiring scoopers who will be responsible for serving ice cream, and their salaries will be between ,000 and ,000 for part-time scoopers. The full-time equivalent staff (FTE) is the total amount of monthly hours of part-time employees divided by the number of hours of work of a full-time employee. Suppose your ice cream shop requires 5 FTE employees and each staff member works 40 hours/week. In this case, the total number of hours required annually is 10,400 (5 * 40 * 52), and your personnel costs will accumulate between ,000 and ,000 per year.

Tips & Tricks

- Always do a market survey to determine competitive salary and wages that won’t put a dent in your income.

- Plan your staff schedule in advance to avoid understaffing, which can lead to customer dissatisfaction or over-staffing, which increases costs.

- Consider employee turnover by training employees and incentivizing good performance.

Ice cream payment, rental or mortgage payment

When creating a financial plan for an ice cream shop, it’s important to consider the cost of rent, lease, or mortgage payments. The assumptions made in this area can have a significant impact on the overall profitability of the business.

For example, if the ice cream shop decides to rent a storefront for ,500 per month, that will equal ,000 in annual rent costs. However, if the store is able to secure a lease with a lower monthly payment or decides to purchase a building with a mortgage, the occupancy cost could be significantly reduced.

Tips & Tricks:

- Compare rental prices in different areas before signing a lease

- Consider subletting or sharing space with another business

- Factor in any potential rent increases into long-term financial planning

Overall, assumptions made regarding rent or mortgage payments should be carefully considered as they play a major role in ice cream revenue model, profit and loss statement, threshold analysis profitability, sales forecasts and return on investment. A thorough financial analysis that includes budgeting, cash flow projections, and a detailed review of start-up costs can help determine the best strategy for the company’s real estate needs.

Ice Cream Utilities

When preparing a financial plan for Ice Cream Shop, it is important to consider utility costs. These costs may include electricity, water, gas and internet. The budgeting for the ice cream shop should include estimates of monthly utility costs based on industry averages and shop size.

Assumptions for utility costs may vary depending on location and size of shop. For example, a small store in a residential area may have lower electricity costs than a larger store located in a busy commercial area. Additionally, certain utilities may be included in the lease or lease agreement, which should be carefully considered when creating the financial plan for Ice Cream Shop.

Tips & Tricks:

- Look for ways to conserve energy, such as switching to LED bulbs or investing in energy-efficient equipment.

- Compare utility rates from different providers to find the best deals.

- Carefully track utility costs to identify trends and areas for improvement.

By accurately estimating and monitoring utility costs, ice cream shop owners can create an ice cream profit and loss statement , ice cream age analysis , and ice cream cash flow projection. ice cream . This allows them to make informed decisions about the Ice Cream Shop Revenue Model and Ice Cream Return on Investment .

Ice Cream Shop Other Operating Costs

Aside from the start-up costs for your ice cream shop, you also need to consider the other running costs involved in running your business. These expenses are necessary to keep your ice cream shop afloat, and they can greatly affect your long-term ice cream revenue model.

First, there are employee salaries and benefits, which are an important part of your Ice Cream Shop Financial Plan . You must pay your employees accordingly, provide them with benefits, and follow the labor laws in your area.

Rent and utilities are also major running costs for your ice cream shop. Rent, especially in high traffic areas or tourist sites, can be quite expensive. Meanwhile, utilities such as electricity, gas, and water are also needed to keep your ice cream shop running smoothly.

Other running costs May include expenses for marketing and advertising, ongoing maintenance and repairs to your equipment and facilities, and office and administrative costs such as accounting and legal fees. To make sure your ice cream shop remains profitable, it’s important to factor these Other Operating Costs into your Income Statement , Sales Forecast , Cash Flow Projection , and Profitability Analysis .

In summary, building a financial model for an ice cream shop does not just involve creating a budget and sales forecast. It also involves understanding the Other Operating Costs involved in running your business and allocating them in your financial analysis and planning.

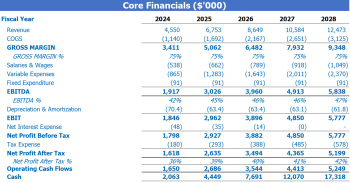

Ice Cream Shop Financial Forecast

As part of any successful ice cream financial model, a financial forecast is crucial to demonstrate expected revenues and expenses, as well as the overall viability of the business. This forecast should include a profit and loss statement, sources and uses of the report, break-even analysis, sales forecast, and cash flow projection. With these financial documents, the company can budget effectively, analyze the financial health of the company and calculate the return on investment. By analyzing ice cream startup costs and creating a solid financial plan, the business can set itself up for success.

The profitability of ice cream

Once we have created a financial plan for our ice cream shop, including projections for revenue and expenses, we can analyze the profit and loss (P&L) statement. This statement shows us the company’s profitability, including gross profit and EBITDA margin.

It is important to check the P&L regularly to ensure that our ice cream shop is operating profitably. By reviewing the statement, we can identify areas where we may need to adjust prices, reduce expenses, or increase sales.

Tips & Tricks:

- Review your P&L statement regularly to ensure your business remains profitable

- Focus on increasing sales and reducing expenses to improve profitability

- Consider offering seasonal flavors and promotions to increase sales during slow times

- Monitor your inventory levels to reduce waste and control costs

By using tools such as break-even analysis, cash flow projections, and sales forecasts, we can ensure that we are budgeting appropriately and making informed financial decisions for our ice cream shop. . Regular analysis of financial data is crucial to maintain profitability and ensure return on investment.

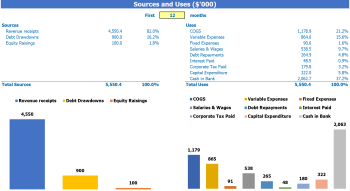

Ice Cream Sources and Use of the Chart

Sources and uses of funds in the financial model in Excel for Ice Cream Shop provides users with an organized summary of where capital is coming from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When establishing an ice cream revenue model, financial planning is crucial. Having a complete and accurate Income Statement can help assess whether the business is doing well or not. A break-even analysis should be done to find out the minimum amount of sales the business needs to generate to cover expenses, and thus remain solvent. A cash flow projection is considered a useful tool to understand the cash flow of the business for the future to come.

Tips and tricks

- Develop a realistic sales forecast .

- Understand your budgeting needs.

- Perform a complete financial analysis .

- Calculate the startup costs that correspond to launching the business.

- Calculate the return on investment of the ice cream shop.

In conclusion, having a robust financial plan is essential for ice cream shop success. Maintaining financial performance and healthy cash flow to keep the business sustainable is difficult, but it is necessary to stay on track with budgeting and financial planning.

Building a financial model for an ice cream shop is an essential step in ensuring the profitability and success of the business. With a well-planned financial plan that includes a revenue model, profit and loss statement, cash flow projection, break-even analysis, sales forecast, start-up costs, return on investment and budgeting, you can estimate the financial health of your ice cream shop. It is imperative to be diligent with your financial analysis, and the right tools and expertise will ensure success. With a solid financial model in place, you can make informed decisions, identify areas of potential growth, and improve the overall efficiency of your ice cream shop.