- Home

- Sales and revenue

- Running costs

- Financial

Opening a butcher shop is an exciting endeavor for meat lovers and business owners. However, building a successful butcher shop requires more than passion and knowledge of meat. A solid financial plan is crucial to ensuring your butcher shop runs smoothly and profitably. In this article, we will discuss the key elements of building a financial model for a butcher shop, including the necessary financial statements, cash flow analysis, break-even analysis, and financial projections. By the end of this article, you will have a complete understanding of how to build a solid financial plan for your meat business and be equipped with the tools to take your butchery to the next level.

Butcher Shop Fervend & Sales Forecast

As a crucial part of any financial plan for a butcher shop, revenue and sales forecasts are essential. Forecast revenue models are developed by estimating the revenue and potential revenue streams that will be generated once operations begin, and the butcher shop becomes fully functional.

The financial feasibility of a butcher shop is largely determined by its ability to generate enough revenue to cover its expenses and show a profit. This involves careful consideration of the butcher’s cash flow analysis, butcher’s profit and loss statement, and a break-even analysis.

The meat shop financial forecast should make allowances for launch date, sales ramp-up time, walk-in traffic, growth assumptions, customer and purchase assumptions, and seasonality of sales. sales. All of these factors should be considered at the planning stage of the butchery, so that the planned figures reflect a realistic picture of the financial situation of the business during the first years of operation.

Butcher shop launch date

The start date of your butchery business is very important for your financial plan. It determines the start of your business’s cash flow, and everything from opening day prep fees to the first time you’ll see revenue will depend on that date.

The Butcher Shop financial model template provides a guess for the start month of businesses. However, you have the flexibility to choose your own launch date. If you plan to launch your business in the middle of the year while the financial model begins in January, it may be useful to prepare and plan launch activities and costs accordingly.

Tips & Tricks

- Consider factors such as seasonal variations in demand for different meats when setting your launch date.

- Plan marketing and advertising spend leading up to launch and post-launch to maximize visibility and sales.

- Make sure you have all the necessary permits and licenses before you open your doors to avoid any legal issues.

Remember that the launch date of your butcher shop can impact your revenue model, cash flow analysis, profit and loss statements, and financial projections. Take the time to carefully consider and plan this important step in the success of your business.

Butcher Shop Ramp Up Time

When planning sales for a new meat shop, it is crucial to consider the ramp-up time on the sales plateau. This reflects how long it will take for the business to reach its full potential in terms of revenue and profitability.

The sales ramp-up period varies depending on factors such as location, competition, marketing strategy, and customer base. In the meat industry, it can take 6 to 18 months to reach sales plateau.

Tips & Tricks:

- Offer discounts or promotions to attract new customers during the ramp-up period

- Focus on building relationships with local restaurants and food services to generate consistent business

- Invest in digital marketing and establish a strong online presence to attract a wider customer base

By accurately forecasting the financial projections of the meat market and considering the ramp-up period, butcher owners can come up with a good financial plan for their business. This should include a butcher shop revenue model, cash flow analysis, profit and loss statement, income statement, break-even analysis, and financial feasibility analysis. With a solid financial foundation, a butcher shop can thrive and become a fixture in the local community.

Butcher Shop Traffic Entrances

Average daily traffic is an important factor when building a financial model for a butcher shop. To do this, we must collect certain data and assume certain growth factors to make projections for the future.

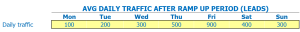

After the ramp-up period, we assume that the average daily weekday appointment traffic will be around 120 visitors, with slower traffic on Mondays due to weekend closures. Over the weekend, Saturdays are expected to bring around 150 visitors and Sundays around 130.

Using these inputs, we can estimate the shop’s projected monthly revenue through sales volume of beef, pork, lamb, and poultry products, and their respective margins. We can also project the shop’s overall daily expenses based on their cash flow analysis, profit and loss statement, and breakdown.

Tips & Tricks:

- To increase walk-in traffic, try hosting events like food tastings or grill demos

- Consider partnering with local restaurants or catering services to sell them your products

Assuming a growth factor of 2% per year for daily traffic, we can project what traffic will look like in 5 years. By doing so, we can estimate the butcher’s future income statement and other financial forecast projections.

Butcher visits for sales conversion and sales inputs

When starting a butcher shop, it is crucial to understand the percentage of visitors that will turn into new customers. According to previous studies, a conversion rate of 10 to 15% is expected for corkers. This means that out of 100 visitors, 10-15 will turn into new customers.

Another important input is the percentage of repeat customers. Regular customers are expected to contribute heavily to meat stores revenue, so tracking their numbers is a must. A repeat customer percentage of 20-30% is considered healthy, meaning out of 100 customers, 20-30 will return for another purchase.

The purchase amount of a repeat customer is also an important assumption. For example, if a repeat customer spends 0 per month and the percentage of repeat customers is 20%, that equates to ,000 in monthly revenue from repeat customers alone.

Tips & Tricks

- Offer loyalty programs to encourage repeat customers.

- Remind customers of promotions and sales via email or SMS.

- Train staff to prioritize customer service and product knowledge to keep customers coming back.

Tracking visits in sales conversion and repeat sales inputs is crucial for a meat market financial forecast. These assumptions help create a financial feasibility model, profit and loss statement, cash flow analysis, and break-even analysis. Knowing these inputs, Butcher Shops will be able to create a financial plan with the potential for success.

Butcher shop butcher sales mix starters

In our butcher shop, we offer different products that belong to specific product categories such as beef, pork, chicken, lamb and seafood. One of the crucial inputs in our financial plan for a butcher shop is the sales category of sales by product, which gives us an idea of how much revenue we can generate from each category.

By entering into the sales mix hypothesis on the product category lever, it is much easier for us to understand how each category contributes to our revenue. For example, if we assume that beef sales will bring in 40% of our revenue for the year and our total revenue goal is 0,000, we can estimate that beef sales will bring in ,000 in revenue for the year. ‘year.

Here are some specific examples of our sales mix by product category assumptions:

- Beef – 40%

- Pork – 25%

- Chicken – 15%

- Lamb – 10%

- Seafood – 10%

Tips & Tricks:

- Track and regularly update your sales mix by product category to ensure you’re meeting your revenue goals.

- Consider offering promotions or discounts on categories that aren’t performing as well to increase sales and improve your overall revenue mix.

- Consider market trends and adjust your sales mix accordingly to stay competitive in the industry.

By constantly monitoring our sales mix, analyzing our sales data and adjusting our strategy accordingly, we can ensure the continued financial feasibility of our butcher shop.

Butcher Shop Input Sale Amount Amount

In our butcher shop we sell a variety of products including beef, pork, chicken and lamb. Each product belongs to a specific category, which makes it easier to enter assumptions at the category level rather than at the product level. This allows us to estimate the average sale amount by product categories and by years, which is used in estimating the average ticket size.

For example, our beef category includes products such as Ribeye, Sirloin and Ground Beef. We collect data on the average sale amount for each product category over a period of time, such as a year. By analyzing the data, we are able to estimate the average sale amount for each category.

Using the sales mix and average sale amount of each product category, our butcher shop financial plan calculates the average ticket size. This is important to understand our butchery revenue model and meat market financial projections. For example, a higher average ticket size means our customers spend more and we have greater earning potential.

Tips & Tricks

- It is important to regularly analyze and update your average sales assumptions to ensure the accuracy of the projected finances.

- Consider adjusting pricing strategies for each product category to maximize profit.

- Try selling customers by offering bundles or incentives to increase the average ticket size.

Seasonality of meat shop sales

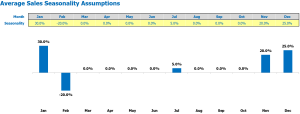

Understanding Seasonality of meat shop sales is crucial to any financial planning for a meat market. At its core, this concept means that a meat shop’s sales are not constant throughout the year – they are affected by various seasonal factors.

Butcher Shop Cash Flow Analysis and Meat Market Financial Projections can help entrepreneurs predict and account for these variations in sales over time. A common way to visualize the seasonality of a butcher shop is to plot monthly sales trends over a calendar year.

For example, suppose a hypothetical butcher shop typically sells an average of 100 units per day during non-seasonal months of the year (such as January and September). However, during the first summer season (June to August), their sales increase by 50%. In contrast, during the sluggish winter months (December to February), their sales drop by 30%.

Tips & Tricks

- Use historical sales data to identify seasonal trends

- Adjust your inventory and staffing levels to match changes in sales volume

- Create targeted marketing campaigns to drive sales during slow seasons

To better capture Seasonality of meat shop sales In the meat shop financial forecast, it is recommended to enter the percentage deviation from monthly average sales per day. This can help create a more accurate financial plan for a butcher shop, including a butcher shop revenue model , butcher shop profit and loss statement , and butcher shop break-even analysis .

Forecast of operational expenses for the butchery workshop

In order to have a successful butcher shop or meat market, financial planning is crucial. This includes creating a solid financial plan and conducting a cash flow analysis to ensure the business is viable. An important aspect of the financial model for a butcher shop is forecasting operational expenses. This includes estimating the cost of goods sold, employee wages and salaries, rent or mortgage payment, utilities, and other operating costs.

| Operational expenses | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | 0 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,500 – ,000 |

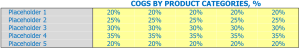

Cost of Butcher Goods Sold

Cost of Goods Sold (COGS) is a crucial factor for any butcher shop, and it is the cost associated with producing the items sold. The percentage of COGS varies from company to company and industry to industry. For meat shops, it is important to have a good understanding of COGs to effectively run your business.

As an example, take a beef tenderloin that costs at a butcher shop. When the store sells this meat to the customer for , the is the “cost” of the goods sold. The remaining is the “gross profit” for that item. It is important to calculate the cost of all items to determine COGs.

Butchers deal with various product categories such as beef, pork, poultry, etc. For example, beef can have a COG of 35%, pork can have 30%, poultry can have 25%, and lamb can have 20%.

Tips & Tricks:

- Keep your COGs under control by regularly reviewing your profit and loss statements.

- Explore new revenue models to increase your profit margins

- Create financial projections and plan by assigning COGS

- Always monitor inventory to control costs

By considering the cost of goods sold assumptions, butcher shops can make solid financial plans and budgets. Accurate financial planning is essential for a reliable financial feasibility study and profitable meat financial forecasts.

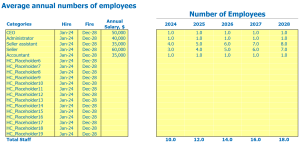

Salaries and wages of butchery employees

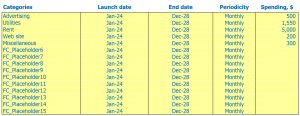

When creating the financial plan for a butcher shop, it is crucial to consider employee wages and salaries. This includes determining the number of employees needed, their titles, when they will be hired, and how much they should earn each year.

Assuming a standard butchery revenue model, you may need a store manager, head butcher, sales associate, and store cleaner. The Store Manager and Head Butcher will likely be hired first and earn the most. For example, a store manager might earn ,000 a year, while a head butcher might earn ,000. A sales associate might earn ,000 per year and a store cleaner might earn ,000 per year.

It is important to consider how many full-time equivalent staff you need each year. For example, if the Store Manager is expected to operate full-time, that would be a 1.0 FTE. If the head butcher is only needed for part of the year, you could budget an FTE of 0.5 for this position. The total cost of salaries and wages for all staff would then be calculated based on the FTE.

Tips & Tricks:

- Consider offering benefits such as health insurance or paid time off to attract and retain high-quality employees.

- When projecting wages and salaries, be sure to consider annual inflation rates.

- Consider hiring a bookkeeper or accountant to help manage payroll and ensure accurate record keeping.

By carefully considering employee salaries and wages, you can effectively plan the financial feasibility of a butcher shop or meat market. This includes projecting cash flow, creating financial projections, analyzing profit and loss statements, and performing a break-even analysis.

Slow Butcher Shop, Rent or Mortgage Payment

When creating a financial plan for a butcher shop, it is crucial to consider the cost of rent, lease, or mortgage payments for the property. The assumption made for these payments can significantly affect the financial feasibility of the business.

For example, if the butcher chooses to rent a property, the amount of rent will vary depending on the location, size, and condition of the property. A premium property in a prime location will have a higher rent than a smaller property in a less desirable location.

On the other hand, if the butcher shop decides to buy a property, the mortgage payment will be determined by the purchase price of the property and the terms of the loan. This option may require a larger initial investment, but may result in long-term cost savings if the value of the property increases and the butcher shop is able to create equity.

Tips & Tricks:

- Research rental rates and real estate prices in the area to determine the most profitable option.

- Consider negotiating lease terms or seeking loans with favorable interest rates to keep costs down.

- Include rent, lease, or mortgage payments in the butcher’s cash flow analysis to ensure the business can afford these expenses.

Overall, the cost of rent, lease, or mortgage payments will be an important factor in the butcher shop’s revenue model and the financial planning of a meat market. As such, it is important to carefully consider the options and make well-informed decisions to ensure the financial feasibility and success of the butcher shop.

butchery utilities

When creating a financial plan for a butcher shop, it is essential to consider the various utilities needed to operate the business.

Utilities assumptions Include electricity, water, gas, telephone, internet and waste management. These costs can vary depending on the location and size of the store, as well as the time of year and usage requirements. For example, during the summer months, electricity costs may increase due to the need for air conditioning, while during the winter, heating costs may increase.

Tips & Tricks:

- Research the average utility costs for your area to get an accurate estimate.

- Consider energy-efficient alternatives such as LED lighting or low-flow faucets to save on long-term costs.

- Try to negotiate with utility providers for lower rates or bundled services.

By carefully analyzing the utility’s assumptions, you can develop a complete financial projection of the Meat market and create a solid financial feasibility plan. With the butcher shop revenue model, cash flow analysis, profit and loss statement, and income statement, you can make sure your meat market financial planning is on point. track, including butcher shop break-even analysis and financial forecasting.

Butcher Shop other running costs

When building a financial model for a butcher shop , it is important to consider all of the costs associated with running the business. In addition to the cost of meat and labor, there are other running costs that can have a significant impact on the financial feasibility of a butcher shop .

These other operating costs may include expenses such as rent or mortgage payments, utilities, insurance, and equipment maintenance costs. For example, the cost of refrigeration equipment can be a major expense for a meat market. Other expenses may include marketing and advertising costs, office supplies, and accounting or legal fees.

It is important to accurately project and account for these other operating costs in order to create a complete financial plan for a butcher shop . One method of doing this is to conduct a Butcher Shop Cash Flow Analysis , which can provide insights into the financial projections of the meat market and help identify areas for optimization and improvement.

The Butchery Profit and Loss Statement and Income Statement can also provide a clear picture of the overall financial health of the business. By conducting a Butcher Shop Break-Even Analysis and using financial planning tools for a meat market, owners can not only identify potential problems, but also create a plan for future growth and success.

Butcher financial forecasts

Financial forecasts are a crucial part of any business plan, including a butcher’s revenue model. It provides a projection of expected income and expenses, as well as estimating cash flow analysis. The forecasts include a Profit and Loss Statement, which illustrates the expected net profit/loss of the business, and a Sources and Use Report, which outlines the initial and ongoing costs associated with opening and running a business. ‘a butcher shop. Understanding the financial feasibility of a butcher shop, as well as performing a break-even analysis, and financial planning for a meat market are important steps in creating a solid financial plan for your business.

Profitability of butchers

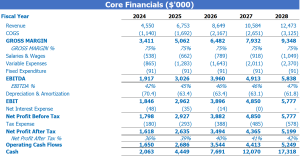

Once we’ve created revenue and expense projections for a butcher shop, it’s important to check the profit and loss (P&L) statement from revenue to net profit. This allows us to visualize “profitability” including gross profit or EBITDA (Butchery Profit and Loss Statement) margin.

It is important to compare the P&L report with previous periods to follow the growth of the company (Meat Market Financial Projections) . To go further, it is useful to break down the numbers by various factors such as category, day, time, etc. to determine where costs can be reduced or where profits can be increased (Butcher Shop Cash Flow Analysis) .

Tips & Tricks:

- Use cloud-based accounting software

- Track inventory religiously

- Offer daily specials or promotions during slower days or times

- Organize meat cuts and products by popularity to ensure stock levels remain sufficient and reduce waste

One of the most important things to keep in mind when evaluating the profitability of a butcher shop is to understand your finances as best you can. Using a financial plan, performing a break-even analysis and creating a financial forecast all contribute to the financial feasibility of a butcher shop.(Financial feasibility of a butcher shop). Armed with this knowledge, making informed business decisions becomes much easier.

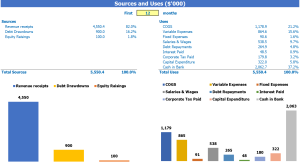

Butcher sources and uses the chart

The Sources and Uses of Funds in Excel’s Financial Model for Butcher Shop provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When creating a financial plan for butcher shop cash flow analysis, including meat market financial projections, butcher shop profit and loss statement, store financial feasibility butcher shop, butcher shop break-even analysis, meat shop financial forecast and butcher shop income statement, It is important to have a full understanding of the butcher shop revenue model. butcher’s shop. Describing the sources of capital and the uses of that capital results in a really useful financial model for a business.

Tips and tricks

- When creating a financial model in Excel for Butcher Shop, be sure to incorporate the sources and uses of capital statements to ensure a balanced budget.

- It is essential to understand the revenue model of a butcher shop before analyzing its financial feasibility.

- Make sure that when forecasting, accurate expenses are considered for the meat shop.

Financial planning for a meat market can be a daunting experience. Creating a solid financial model is your best bet when it comes to butchery profitability.

The financial planning of a butcher shop is crucial to its success. By building a comprehensive financial model that includes revenue projections, cash flow analysis, profit and loss statements, and break-even analysis, you can determine the financial feasibility of a meat market and make informed business decisions. Good financial planning also allows you to create a roadmap to profitability and growth, helping you stay on track with your financial goals. Remember, a solid financial plan is the foundation of a successful butchery, and it requires careful attention and attention to detail.