- Everything You Need to Know About Balanced Funds – Start Investing Today!

- Gain a Deeper Understanding of Your Financial Statements with Vertical Analysis

- Improve Your Business Performance with a Low Cash Conversion Cycle (CCC)

- Setting Up Your Own SMSF: Take Control of Your Retirement and Wealth

- How to Calculate and Understand a Balloon Payment – Take Action Today!

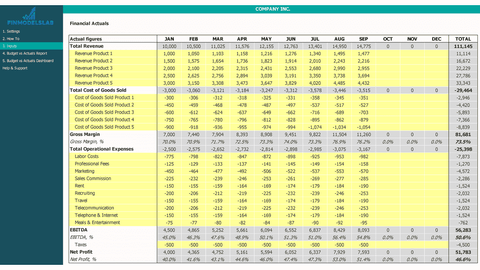

FinModelsLab has created free fancy and informative Excel templates for Monthly Income Statement, Annual Income Statement , Monthly Balance Sheet and Annual Balance Sheet . You don’t need to be expert in using templates, just enter the numbers in the appropriate cells and run the reports smoothly.

After reading this article, you should be Apple to learn:

- What is budget vs actual

- Budget vs actual report

- Interpretation of budget vs actual

- Budget vs actual limits

- FREQUENTLY ASKED QUESTIONS

What is budget vs actual

To understand the Budget vs Actual ratio, it is best to first understand the basics of Budget and Actuals. Budget is the estimate of income and expenses for a specific period normally a year and helps to identify the income and expense pattern of a business. Budgets can also be thought of as a plan used to keep track of all business activities and set key performance indicators. The actual is essentially the historical financial results of a company during a specific period. Accountants record business transactions on a daily basis and these transactions are basically part of the financial statements which are called real in financial management.

IMPORTANT NOTE: Check out our in-depth article on Financial Statements and also use our free Monthly Financial Statements & Annual Financial Statements Templates designed in Excel where you just need to put your numbers in the yellow cells and see the results with well constructed graphs .

|

Download Monthly Financial Statements in Excel |

Download annual financial statements in Excel |

The budget vs actual, commonly referred to as the variance ratio, is a financial management tool used to compare target amounts with final financial results for a specific period to understand where a business stands with respect to its planned financial performance. It is basically a percentage difference between planned and final results and calculated by taking the difference between the budgeted and actual figures and dividing the result by budget.

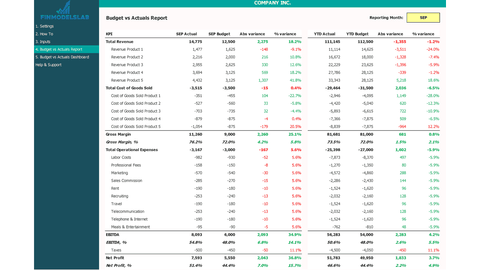

Budget vs actual report

The company normally prepares budget and actual comparisons to see trends. These reports are prepared in terms of account to see results and can also be prepared based on divisions, products, locations, etc.

The different comparison techniques are explained below:

- A classic technique is to compare the financial results from the beginning of the year (YTD) with the budget and see the difference. Suppose a business manager wants to prepare the budget versus actual report for October and the end of the business year is June, the four month actuals will be compared to the four month budget to see if the business is on track or that corrective action needs to be taken.

- A more robust technique is to compare the financial results for a specific period with the budget figures for a specific period. This is a more useful technique for businesses with seasonal effects. Suppose a restaurant located in Holiday Spot had forecasted its peak days in October, then it is best to view the monthly comparison to take corrective action in case peak season targets are missed.

Some companies also compare the monthly results and YTD of the current year with the results of the same month of the previous year and the YTD (i.e. if a company manager prepares a report for October 2021 having the end of June, it will compare October 2021 with October, 2020 and four months of 2021 with four months of 2020). Evaluating variances using this technique helps highlight potential shifts in seasonality and timing shifts that can help correct future forecasts. It also tells a story about business growth. However, this technique may not be useful especially in the unstable economy where interest rate, inflation rate, exchange rates, etc. fluctuate considerably.

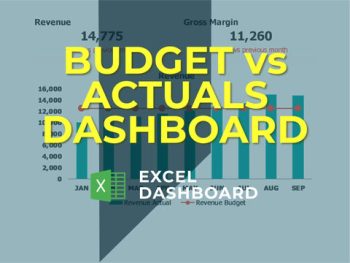

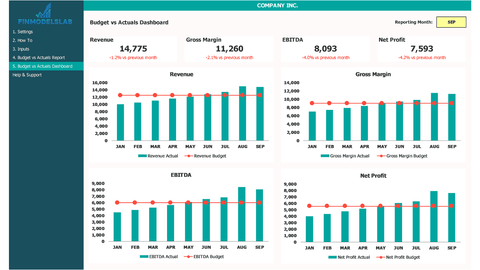

IMPORTANT NOTE: Check our also use our free Budget vs Actual Dashboard Designed in Excel where you just need to put your numbers in the yellow cells and see monthly results and YTD variance reports along with nicely constructed charts.

Download Budget vs Actual Dashboard in Excel

Interpretation of budget vs actual

Budget vs Actual is basically a variance ratio and is split into two categories based on the results:

- Favorable variance indicates that actuals are better than budget targets. The results are better if the actual income is higher than the budgeted income or the actual expenses are lower than the budgeted figures.

- Negative variance indicates that the actuals are worse than the budget results. The results are worse in case the actual income is less than the budgeted income or the actual expenses are higher than the budgeted figures.

Business leaders need to see if revenue or expense variances are negative and decide on corrective actions. However, before taking corrective action, business leaders need to understand if the assumptions used during the budget process were correct and rational.

Some of the corrective actions are explained here to get an idea of using the variance ratio:

- In the event of unfavorable revenue variances, the business manager should assess pricing strategy, sales volume, and whether a product/business line should be discontinued based on market demand (discontinuation in a specific location or in his outfit). Based on the analysis done, an entrepreneur has to decide whether to improve the price or increase the sales volume by lowering the prices and entering a new market. Business leaders also need to assess whether increasing marketing costs can generate more revenue.

- In the event of unfavorable revenue variances in the cost of goods sold, business managers must assess whether suppliers are providing quality products to avoid wastage or whether there is a need to change suppliers to obtain cheaper raw materials. or that the business is labor intensive and it is necessary to invest in modern machinery to reduce costs. It might also indicate that a company needs to focus on internal controls to avoid pilot and leaks.

- If operating expenses are unfavorable, the business manager should assess whether the machines have been too old requiring more repair and maintenance or whether the cost of administration is higher, or whether travel expenses have increased and so on.

Business leaders should ensure that financial statements are prepared to the correct standards and that there is no misclassification of income or expenses before taking action. Suppose cost of goods sold shows favorable variances as labor cost is wrongly classified in operating cost showing negative variances, business managers will focus to reduce operating cost instead of cost of goods sold as well as efforts are diverted to the wrong area.

IMPORTANT NOTE: Check out the in-depth Financial Statements article and also see free Monthly Financial Statements & Annual Financial Statements Templates where you just need to put your numbers in the yellow cells and see the results along with well constructed charts.

|

Download Monthly Financial Statements in Excel |

Download annual financial statements in Excel |

Budget vs actual limits

Although the Budget vs Actual ratio is a very simple technique to assess where the business went wrong and in fact business managers are beginning to assess the performance of the business from these calculations, however, the following things are worth mentioning here:

- Budget assumptions can be incorrect and optimistic goals can create unnecessary debate among stakeholders. Budget figures should be supported by appropriate assumptions free from bias and an appropriate approval process should be in place. This concept is called budget slack where management intentionally understates income and overstates expenses to show a favorable budget against actual results and get bonuses, promotions, etc.

- Budget vs Actuals report will help management in case proper bookkeeping is followed, all income/expenses are recorded in bookkeeping data, financial and non-financial data are available, and books of accounts are closed in a timely manner to view results for decision making. Also, management should mention the reasons for each negative variance while presenting themselves to shareholders and other decision makers.

- If budgets are not prepared in detail covering each account, product, product, location, business division, etc. Benchmarks may not be available to compare results and analyzing company-level numbers may not provide meaningful insights.

- In the case of one-time transactions of a non-recurring nature, if not identified, cannot give a complete picture of the business results and these must be taken into account before reporting Budget vs Actual.

FREQUENTLY ASKED QUESTIONS

Q. How often are the budget vs. actuals prepared by companies?

Q. Do budget vs actual results require non-financial information?

Q. Is the negative variance of an expense justified by favorable revenues?

[right_ad_blog]