- Discovering the Benefits and Challenges of Business Valuation

- Understanding the Differences Between Asset-Based and Earnings-Based Valuation

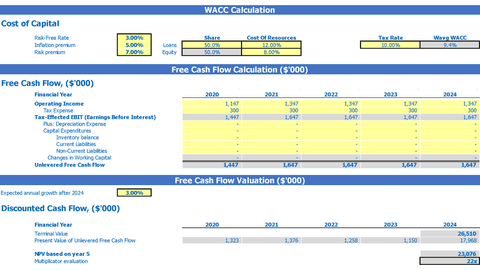

- Discounted Cash Flow DCF Formula

- Tips for Investing in High-Growth Startups

- Analyzing Cash Flow with Financial Models

We have designed 450+ Financial Model Templates Designed in Excel or Google Sheet for different companies which are ready to use and you just need to type the inputs in the yellow cells and you will get the desired financial model. You can also check Agriculture Financial Model Templates, Hospitality Financial Model Templates, Market Financial Model Templates and many more.

After reading this article, you should be Apple to learn:

- What is Weighted Average Cost of Capital (WACC)

- How WACC is calculated

- How we use WACC

- Limitation of WACC

- FREQUENTLY ASKED QUESTIONS

What is Weighted Average Cost of Capital (WACC)

The weighted average cost of capital is the cost of capital of the organization covering all sources of capital. The company’s sources of capital include ordinary share capital, preferred share, company-issued bonds and other long-term debt. Companies generate funds through equity or debt financing, and fund providers expect a return on investment. This return expected from the Capital Provider business is the cost of capital. Generally, the Company’s capital structure comprises the mix of shareholders’ equity and debt obtained from financial institutions or by issuing debt instruments to investors. Each source of capital has its own cost to the company, ie, dividend for shareholders and interest on debt instruments. Simply, WACC represents the expected cost that the company will pay to its investors.

Business managers and analysts create financial models for the evaluation of investments or projects. Net cash flows are discounted using an appropriate discount rate to know present values and assess the net present value of a project/investment. WACC is widely used in financial models to calculate the present value of net cash flows.

There are two types of usage of WACC i.e. nominal WACC which includes the inflation factor while other real WACC excludes the inflation factor. Nominal cash flows are discounted using the nominal WACC while actual free cash flows (excluding inflation) are discounted by a true WACC. Typically nominal WACC is used.

How WACC is calculated

For the calculation of WACC, we need to know the cost of capital and the cost of debt. WACC is calculated using the following formula:

Wacc = (Equity / total capital x cost of equity) + (debt / total capital x cost of debt) x (1-tax rate)

Download the Excel template ⟶

The interest incurred by the Company on the cost of debt is an eligible expense for tax purposes, therefore the cost of debt is multiplied by the factor (tax rate) which is referred to as the tax shield.

Example: Company ABC has a capital structure consisting of seventy percent (70%) equity and thirty percent (30%) debt; The company’s cost of equity is 10% and the after-tax cost of debt is 12%. The applicable corporate tax rate is 25%. WACC will be calculated as follows:

WACC = average cost of equity + average cost of debt x (rate at 1 tax)

|

Average Cost of Equity = % Age of Equity x Cost of Equity = 70% x 10% = |

7.0% |

|

Average cost of debt = % Age of debt x Cost of debt (tax rate at 1) = 30% x 12x (1-25%) = |

2.7% |

|

Waccage |

9.7% |

While calculating the WACC, we need to know our cost of capital which shareholders are expected as a return on investment in the business and the cost of our debt.

Cost of equity

This is the minimum return on equity of the company that should be earned by investing in the company. Investments should generate a return that exceeds the cost of capital. The cost of equity is relatively complex than the cost of debt because the expected return on debt instruments is clearly defined. To calculate the cost of equity, two models are used.

Dividend capitalization model

When the company pays a dividend to its shareholder, we use the following formula to calculate the cost of equity. This model assumed that the company must pay dividends to its shareholders

Cost of equity = (dividend per share / current market value of share) x dividend growth rate

Asset Pricing Model (CAPM)

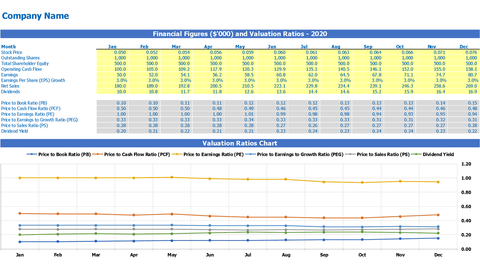

IMPORTANT POINT: We have designed a free Excel/Google sheet DCF calculator template where you just need to put your assumptions in the yellow cells and get the weighted average cost of capital. As an investor, creditor, debtor or banker, you may also be interested in Valuation Ratios, so we have designed a free Valuation Ratios Excel Template Calculator .

Download the Excel template ⟶

Download Excel Assessment Report Template ⟶

Uses of WAAC

WACC is very important financial tools used by investors, financial analyst and business managers. Some of the important uses are explained as follows:

- Every sound investor rings carries out necessary checks before undertaking an investment decision. A considered project is considered for investment if the expected return on capital investment is higher than the cost of capital calculated using WACC.

- Project Appraisal/Assessment: Considering the underlying assumption of WACC i.e. same risk and similar capital structure, however, if the considered project has the same risk and structure of capital, the WAAC of the company can be used for the valuation. If there is a difference in the level of risk, such as if a company in the steel industry evaluates the cement industry project, it will modify its WACC in accordance with the associated risk of the cement.

- Calculation of the NPV: The NPV is a very important financial tool used to assess the profitability of the project under consideration. Business owners, financial investors, etc. make financing models for the evaluation of the project. WACC is used as discount rate while calculating net present value for project appraisal.

- Business Valuation : Every investment decision, merger and acquisition required detailed financial analysis and due diligence by the potential investor for rational decision making. WACC is used by the investor for the valuation of the target company/company to determine its true value and bid price.

- Target return: For the business manager, WACC is a benchmark indicator that clearly indicates the minimum return the company must earn to meet the expectation of its shareholders and lenders. Every business must earn a return that exceeds its WACC.

WACC limits

Despite the fact that WACC is a very important tool, but it has some limitations explained below:

- The WACC includes the cost of equity and the cost of debt, the calculation of the cost of equity is more complex due to the involvement of multiple assumption. In the case of private companies, the calculation of WACC becomes difficult due to the lack of readily available information.

- The dividend and the CAMP model used to calculate the cost of equity have some inherent limitations due to the involvement of various estimates.

- The underlying assumption of WACC is that capital structure and WACC will remain constant, however, keeping the debt equity ratio constant is very difficult and variation in capital structure will change WACC.

- The additional injection of debt into the capital structure leads to a lower WACC, but an increase in debt beyond the optimal capital structure could lead to various challenges for the company due to higher leverage .

FREQUENTLY ASKED QUESTIONS

Q. What are the situations where WACC may not be used?

Q. Can WACC go negative?

Q. Whether a high WACC is good or bad?

[right_ad_blog]