- Home

- Sales and revenue

- Running costs

- Financial

Welcome to the guide on how to build a financial model for a flower shop. Establishing a flower shop revenue model and a flower shop profit model is essential for the success of your business as it allows you to monitor your flower shop financial performance effectively. Creating a financial plan can also help you identify areas where you can cut costs and increase revenue. In this article, we will guide you on how to create a successful Flower Shop Financial Analysis including Financial Projections, Forecasts, Financial Statements , as well as how to manage your flower shop financial metrics .

Flower leaves and sales forecasts

Revenue and sales forecasts are an integral part of the financial model for a flower shop. It involves predicting expected revenue and sales for a specific period of time which is usually done during the financial planning stage. Financial forecasts are also the basis of various financial analyzes such as financial projections, financial statements and performance measures. Key considerations when creating a revenue model include launch date, ramp-up time, drop-in traffic, growth assumptions, customer and purchase assumptions, and seasonality. Sales.

Flower shop launch date

The launch date of your flower business can make or break your financial performance. It’s crucial to plan and set a launch date that aligns with your flower shop’s revenue and financial goals. A carefully chosen launch date can help you minimize costs, increase revenue and improve overall financial performance.

Tips & Tricks:

- Choose a launch date that coincides with seasonal flower demand

- Set a financial forecast for your first year and choose a launch date that helps achieve those financial goals

- Plan marketing activities before the launch date to create buzz about your new flower business

- Allocate enough budget for launch-related costs and remember to include contingencies in your financial planning

The flower shop financial model template can help you plan and set a launch date that suits your business goals. It will provide you with valuable insights into your flower shop’s profit model, financial analysis, and performance metrics. By following it, you can make informed decisions about financial planning, forecasting, projections, reporting, and managing your flower shop.

Remember that the launch date of your flower shop is the start of your financial journey. A well-planned and executed launch will set you up for success and help you achieve your financial goals.

Ramp-up time

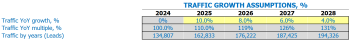

Sales forecasting is a crucial part of any flower shop’s financial planning. When creating financial projections, it is important to consider the ramp-up time to the sales plateau. This period represents the time required for a company to reach its expected level of sales.

Analyze your flower shop’s revenue and sales data to determine this metric. Based on the flower shop revenue model, calculate the number of months it takes your business to achieve maximum sales . The flower shop profit model largely depends on your sales ramp-up period.

For a flower shop, the average ramp-up period can be around 6 months. However, this number differs significantly depending on the flower shop’s location, target market, and competition. Perform a financial analysis of the flower shop to determine how long it takes your business to reach its sales plateau.

Tips & Tricks

- Use flower shop financial metrics to track your progress and to help you determine when you hit your sales plateau.

- Consider adjusting your marketing strategy if your ramp-up period is taking longer than expected.

Good financial management of your flower shop requires strong financial planning, forecasting and analysis. Understanding your sales ramp-up period will dramatically improve your flower shop’s financial performance and enable accurate financial projections.

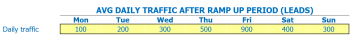

Flower Shop Date Traffic Intities

After the ramp-up period, walk-in flower shop traffic averages 23 customers per weekday, 34 customers on Saturdays, and 43 customers on Sundays. These numbers are consistent over the last year and a half, so they will be used as inputs for the financial model.

In terms of financial planning, it is important to know the average number of appointments on the day of the week to decide the hours of operation and the scheduling of employees. It also helps determine how much inventory is needed and when to restock. Financial statements and the profit model may be adjusted based on the expected amount of traffic, which may affect revenues and expenses.

The average-in traffic growth factor is estimated at 3% per year. This should be taken into consideration when making financial projections and forecasts.

Tips & Tricks

- Observe customer behavior by keeping a tally of which areas of the shop are most visited.

- Use social media to attract more customers and promote special offers or events.

- Consider offering delivery services to reach customers who are unable to visit in person.

Using these inputs, the flower financial model calculates future walk-in traffic for the next five years, broken down into weekdays. This information can be used for financial analysis and management to identify trends and make informed decisions that increase financial performance and metrics.

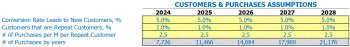

Flower shop visits for sales conversion and sales inputs

The financial performance of a flower shop greatly depends on its revenue which derives from its Revenue Model, Profit Model, Financial Analysis, Financial Planning and Forecasting, Projections, Statements, Management, Performance and Metrics . The store’s ability to convert walk-in visitors into new customers and retain existing customers is one of the most important financial metrics for measuring business performance.

Knowing the % conversion of visitors to new customers and the % of repeat customers helps the shop understand the effectiveness of its marketing and sales strategies. For example, if during the first month the flower shop received 100 visitors and only 20% of them bought something, the conversion rate is 20%. With such knowledge, the store can modify its marketing plan or layout to increase its conversion rate.

In addition, customer retention is essential to ensure steady sales growth. A 20% increase in the number of returning customers per month translates to an improvement of more than 240% in revenue in one year, considering a growth rate of 2.5% per month. Also, the assumption regarding the amount each repeat customer will pay per month is a vital input in building a financial model for the flower shop. If a repeat customer buys worth of flowers every month, their revenue contribution for the year will be 0, which is a crucial assumption to connect to a financial plan.

Tips and tricks

- Offer loyalty programs to encourage repeat sales

- Use social media and email marketing techniques to engage customers and increase brand awareness

- Create a memorable storefront to attract new customers and improve your conversion rate

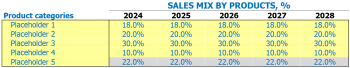

Flower shop sales mix starters

As a flower shop owner, it’s important to understand the sales mix of your products. Each product belongs to a specific product category, such as “roses” or “arrangements”. By entering sales mix assumptions on the product category leverage, you can easily understand the sales mix.

For example, if you sell roses, lilies, and sunflowers, the product categories would be “roses,” “lilies,” and “sunflowers.” You can then enter the percentage sales mix for each category for each year of your forecast up to 5 years.

Here are examples of 5 product categories that could be used in a flower sales mix:

- Roses

- Lilies

- orchids

- eyelets

- Provisions

By entering the sales mix in percentages for each product category, you can forecast your flower shop revenue model, profit model, financial analysis, financial planning, financial forecast, financial projections, financial statements, financial management, financial performance and financial metrics. This will give you valuable insights and help you make informed trading decisions in the future.

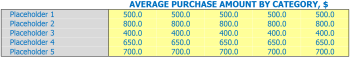

Flower Shop Sales Entry Amount

Your flower shop offers a wide variety of products, each belonging to a specific product category. To make your flower shop’s financial model more manageable, it’s more efficient to enter assumptions at the product category level rather than at each product level. For example, if you offer roses in different colors and sizes, rather than entering the details for each one, you can group them as flowers and set the average sale quantity of flowers per category per year.

Assuming you offer flowers, potted plants, and vases, you can set the average sales amount per year for each category. If in 2019 the sales amount for flowers was , potted plants were , and vases were , you can set these as your inputs for 2020 and beyond. In this way, we define an assumption on the amount of each product category.

Tips & Tricks:

- Group your products by categories and estimate an average sale amount at the category level.

- Update these assumptions for each year to reflect changing market trends and customer preferences.

- Use these inputs to estimate your average ticket size, which is the average amount a customer buys from your store.

After getting the average sale amount for each product category and updating them for each year, we can use the sale mix and the average sale amount to calculate the average ticket size. Sales mix is the percentage of total sales that each product category contributes to monthly or annual revenue.

For example, if the flower sales mix was 60%, potted plants were 30%, and vases were 10%, we can use that in the calculation. Assuming each customer purchased 1 flower, 1 potted plant, and 2 vases, we multiply the average sales amount of each product category by the sales mix and add them together. In this case, we get as the average ticket size.

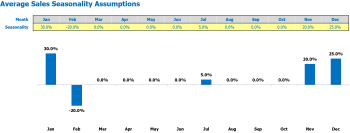

Seasonality of flower shop sales

Understanding the seasonality of sales is crucial for the financial analysis of any flower shop. Seasonality refers to the fluctuation of sales depending on the time of year or certain holidays. For example, Valentine’s Day is often the most profitable day for a flower shop, while the summer months see a drop in sales. By reviewing these patterns, flower shops can better predict their financial performance.

To accurately predict the seasonality of sales, a flower shop must collect data on its historical performance. By calculating the average daily sales for each month, a store can identify the most profitable times of the year. Assuming the highest earning month generates $X in daily sales, the store can use that as a benchmark against which to compare other months. For example, if the month of May in the flower shop generates daily sales of x * (0.7), then the seasonality is 30% lower than the peak month.

Tips & Tricks:

- Aim to forecast seasonality for at least a year in advance, in order to plan promotions and staff.

- Be prepared to adjust your financial projections if external factors, such as a pandemic, impact buying patterns.

- Monitor metrics such as order size, number of customers, and average order value to supplement your forecast.

Overall, understanding the seasonality of your flower shop’s sales is vital to creating a successful financial plan. Accurately forecasting sales based on seasonal trends can help ensure that the shop remains profitable and financially stable throughout the year.

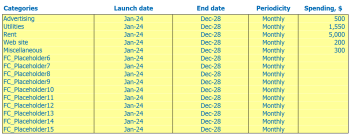

Flower Shop Operating Expense Forecast

In a flower financial model, operational expense forecasts play a crucial role. It helps the business estimate and manage costs associated with day-to-day operations. Operating expense forecasts include cost of goods sold by products %, employee wages and salaries, rent, lease payments or mortgages, utilities, and other operating expenses.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | 0 – ,000 |

| Salaries and wages of employees | ,500 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | 0 – ,500 |

| Other running costs | 0 – ,000 |

| Total | ,000 – ,500 |

With accurate flower shop operational expenses and other financial analytics, businesses can strategize and optimize financial management, ensuring financial performance and growth.

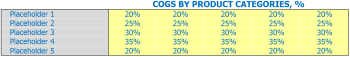

Cost of Goods Sold

Cost of Goods Sold (COGS) is an important factor to consider when analyzing the financial performance of a flower shop. COGS refers to the cost incurred in creating or purchasing the products sold. As a general rule, COGs for a flower shop should not exceed 50% of sales.

When calculating COGs, flower shops consider the cost of materials used to make the arrangements, as well as any labor costs associated with assembling the arrangements. Ultimately, the inner workings of a flower shop will depend on the types of products they sell. For example, a flower shop that specializes in wedding arrangements will have a different COGS assumption than one that focuses on funeral arrangements.

Tips & Tricks:

- Regularly analyze your cogs to make sure they don’t exceed 50% of sales.

- Separate your product categories and enter a percentage of COGs for each category.

- Keep track of labor costs associated with assembly layouts.

In summary, understanding a flower shop’s COGS assumptions is crucial for financial analysis, planning, forecasting, and management. By separating product categories and regularly analyzing COGs, flower shops can ensure they are operating efficiently and profitably.

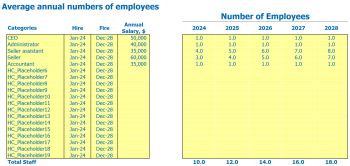

Salaries and wages of flower shop employees

When it comes to financial planning for your flower shop, it’s essential to include salaries and staff salaries in your projections. Naming your staff members/positions may depend on your preference; However, common flower staff positions include florists, delivery drivers, and customer service representatives.

Assumptions Can be made about when to hire full-time equivalent staff and how much they should earn for a 12 month period. For example, a full-time florist might be hired at the start of the year earning ,000 per year, while a delivery driver might be hired during high-volume times and earn an hour.

It’s crucial to consider your flower shop’s financial statements when determining salaries and staff wages in your revenue model . The cost of employees has a significant impact on your profit model and financial forecasting is essential to ensure that you have adequate funds for salaries and wages each year.

Tips & Tricks:

- Consider part-time or seasonal staff to reduce salary expenses during your slower times.

- Regularly review your financial performance Measures to ensure wages and salaries align with your budget.

- Offer incentives such as bonuses or commissions to increase employee productivity and job satisfaction.

Flower shop rent, lease, or mortgage payment

When it comes to the financial management of a flower shop, rent, lease or mortgage payments are one of the most important expenses that should be included in the financial planning of the business. The flower shop’s financial statements should include financial projections and financial analysis that covers rent, lease or mortgage payment assumptions.

The financial metrics A flower shop’s lease, lease, or mortgage payment assumptions can be compared to other competitors in the market. For example, if your flower shop revenue model is similar to other flower shops in your area, but your rent, lease, or mortgage payments are significantly higher, it could have a significant impact on your business. financial performance and your profit margins.

To be effective at financial forecasting and projecting future costs and revenues, you need to have a clear understanding of the flower shop’s short-term, long-term, and long-term goals. For example, if the flower shop’s goal is to expand or relocate within the next five years, it would influence future rent, lease, or mortgage payments that should be included in the financial statements .

Tips & Tricks:

- Research the average rent, rental, or mortgage payments of other similar flower shops in your area to determine the competitive landscape.

- Always include your rent, lease, or mortgage payments in your financial projections and financial planning .

- Understand how your rent, lease, or mortgage payments fit into your flower shop’s short- and long-term goals.

flower utilities

One of the essential factors of a flower shop financial analysis is the category of utilities. These include expenses related to electricity costs, water bills, gas or fuel expenses, internet and telephone bills, and other expenses necessary for the day-to-day operations of the store. These costs are generally categorized as variable costs because they vary based on usage and business activity.

Flower shop revenue model and flower shop profit model are both closely related to financial management, including financial forecasting, planning, and analysis. Monitoring and adjusting utility costs is one of the crucial steps in financial planning , especially when it comes to budgeting and financial projections.

For example, suppose a financial analysis of the flower shop showed that utility costs have increased over the past several months without a significant increase in revenue. In this case, the business owner might need to consider whether there are ways to reduce these expenses. One way would be to switch to energy-saving light bulbs or appliances, use energy-efficient HVAC units or systems, or lower internet services or phone plans to less expensive options.

Tips & Tricks:

- Regularly monitor and track utility spending to avoid costly surprises and detect unusual or unnecessary usage.

- Consider investing in appliances, lighting, or HVAC or HVAC systems that can significantly reduce your utility expenses in the long run.

- Compare and evaluate phone and internet plans or providers to identify potential savings options.

- Train employees and staff to conserve energy and utilities and encourage them to participate at minimum expense.

Flower shop Other running costs

When building a financial model for a florist , it is important to consider all of the expenses necessary to accurately predict revenue and profit . In addition to the usual costs such as rent, utilities, and labor, there are other running costs that should also be considered.

The first of these other costs is inventory. A flower shop must keep fresh and beautiful flowers in stock, which means constantly buying and replacing inventory. This can be a relatively high expense, especially if the store has a large selection of flowers.

Another cost that should be considered is marketing. Running ads, creating promotional materials, and attending events can all be expensive, but they’re necessary to attract new customers and retain existing ones.

Finally, there are equipment and supply costs. A flower shop needs a variety of tools and supplies to create beautiful arrangements, such as floral foam, vases, and specialty scissors. All of these items must be factored into the financial projections to ensure the store is profitable.

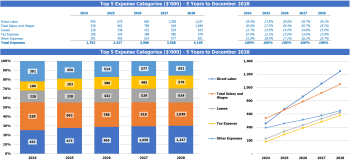

Flower Shop Financial Forecast

In order to have a successful flower shop, it is important for business owners to have an understanding of their finances. This includes having a financial forecast that outlines the expected revenue and profitability of the business. The financial forecast should include a profit and loss statement, as well as a sources and usage report. By creating this financial analysis, a flower shop can make informed decisions about their financial planning and management. Additionally, by tracking their financial performance with metrics such as financial projections and financial statements, flower shop owners can ensure they are on the path to success.

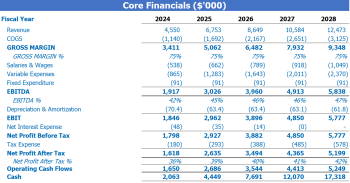

Profitability of the flower workshop

Once we’ve created income and expense projections for our flower shop, the next step is to check the profit and loss (P&L) statement. This statement shows revenue, cost of goods sold, gross profit, operating expenses, taxes, and net income or loss from flower shop operations. Understanding this statement will help us visualize the “profitability” of the business.

By analyzing the P&L statement, we can calculate important financial metrics such as gross profit, which is the difference between total revenue and cost of goods sold. We can also calculate EBITDA margin, which is a measure of profitability that looks at earnings before interest, taxes, depreciation and amortization as a percentage of revenue. These metrics can help us assess the financial performance of the flower shop and identify areas for improvement.

Tips & Tricks:

- Regularly review the P&L statement to ensure the flower shop is on track to meet its financial goals.

- Compare financial metrics such as gross profit and EBITDA margin to industry benchmarks to see how the flower shop performs against competitors.

- Use insights gained from financial analysis to adjust flower shop revenue and expense projections, financial planning, and forecasting to improve profitability.

By implementing these flower shop financial management strategies and regularly monitoring financial performance, we can ensure that the flower shop is operating profitably and meeting its financial goals over time.

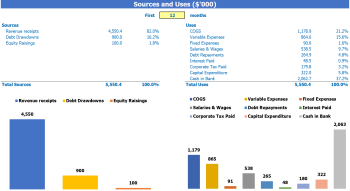

Flower Sources and Use of the Chart

The Sources and Uses of Funds in Excel’s Financial Model for Flower Shop provides users with an organized summary of where capital will come from sources and how that capital will be spent in uses.

It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks

- Regularly update your flower shop’s financial statements.

- Perform a financial analysis of your flower shop to identify trends and areas that need improvement.

- Use financial forecasts and projections to plan for the future.

- Understand your flower shop’s financial metrics to make informed decisions.

- Develop a flower shop financial management plan to ensure sustainable growth.

Flower shop financial analysis is crucial for the growth and success of any business. Building a financial model for your flower shop can help you understand your current financial performance , identify areas for improvement, and make good decisions going forward. By using financial planning tools like financial forecasting , financial projections , and financial metrics , you can better manage your flower shop financials and monitor revenue and profit trends. By focusing on financial management , you can make strategic decisions based on reliable financial data and increase your chances of long-term success.