- Understanding How to Read a Cash Flow Statement

- Financial Modeling – A Beginner’s Guide

- Everything You Need to Know About Cash Flow Statement Changes

- Understanding Cash Flow Statements and Their Benefits

- Blog Post Title:Understanding Cash Flow Statements: What You Need to Know

We have designed 450+ Financial Model Templates Designed in Excel or Google Sheet for different companies which are ready to use and you just need to type the inputs in the yellow cells and you will get the desired financial model. You can also check E-Commerce Financial Model Templates , Food and Beverage Financial Model Templates , Hospitality Financial Model Templates .

After reading this article, you should be Apple to learn:

- What are Indirect Cash Flows

- How to Prepare Indirect Cash Flows

- Method of preparing indirect cash flows

- Importance of indirect cash flows

- Indirect cash flow limits

- FREQUENTLY ASKED QUESTIONS

What is the cash flow statement?

A cash flow statement is a financial statement that highlights all cash inflows and flows and the cash equivalent of the business. It is an important part of financial statements and is used as a tool of investors and stakeholders to understand the clear picture of all transactions taking place and the overall health of the company.

There are two types of reporting methods used for cash flow statement which are given below:

- Direct method of reporting cash flow.

- Indirect method for reporting cash flows.

Both signaling cash flows are used by the company but the most popular method followed widely used in the industries is the indirect method which is explained below.

IMPORTANT NOTE: Check out our detailed article on the cash flow statement. You can also try Cash Flow Dashboard Designed in Excel and Google Spread Spread. Here you just need to enter the data in the yellow cells and see the closing balances with well-built graphs.

Download the Excel template ⟶

What is the Statement of Indirect Cash Flows

The indirect method for preparing the cash flow statement involves adjusting net income for changes in the balance sheet to calculate cash from operating activities. In other words, the indirect method uses the net income as the basis and then makes the necessary changes needed by adding and subtracting different variables to cover the net income to the cash amount of the transactions.

Method of preparing indirect cash flows

There are three important components for the preparation of cash flow statement which are given below:

- Cash flow from operating activities

are calculated by initially taking the company’s net income from the income statement, calculated on an accounting basis, and then adjusted to remove non-cash items. As the net income of the business income statement does not portray the accurate presentation of operating cash flow from operating activities, so it becomes necessary to make all the adjustment of the items that affect the net income even if no payments or receipts made against them. For example, if there is an increase in current assets (inventory) which will show that the decline in cash will not be reflected in net income reported in the income statement or otherwise if income is accrued (receivables ) and the money is not yet received, still this turnover is included in the net income in the income statement of the company. In either case, total current assets have increased and therefore a higher net income is reported than the actual net cash impact of related operating activities. - Cash flow from investing activities

is explained in our article on the cash flow statement. - Cash flow from financing activities

is explained in our article on the cash flow statement.

How to Prepare Indirect Cash Flows

In the indirect method, the elements of the accounting line are taken into consideration to calculate the inflow or outflow. It is the reconciliation of net income at the time of cash. The indirect method is followed by many companies and users of financial statements. The indirect method is used during financial modeling.

Here is an example of the operating segment of cash flow produced on an indirect approach:

|

ABC Restaurant |

|||

|

Cash flow statement (indirect) |

|||

|

For the year ending June 30, 20xx |

|||

|

Operation activities: |

|||

|

Net revenue |

,700,000 |

||

|

Deduct: |

|||

|

Depreciation |

,000 |

||

|

Gain from restaurant sale |

$(1,753,000) |

||

|

Inventory |

,000 |

||

|

Accounts payable |

,000 |

||

|

Stationery |

$(75,000) |

||

|

Wages |

$(780,000) |

||

|

Interests |

$(15,000) |

||

|

Tax expenditures |

$(65,000) |

$(2,616,000) |

|

|

Net cash from operating activities |

,084,000 |

||

For it is obvious that in the indirect method, the net income is used as the basis and then adjusted for all non-monetary expenses, gains and losses which are added or subtracted from the net income.

The table below may be useful for calculating cash flow using the indirect method:

|

accountant head |

Description |

Effect on cash flow |

Raison |

|

Current assets |

Increase in inventory |

Subtract it from net income in operating activities |

The increase in inventory is mainly due to the purchase against cash, which therefore represents the compensation. |

|

Decrease in inventory |

Add it to net income in operating activities |

The decrease in inventories is mainly due to sales against cash, which thus represents cash inflows. |

|

|

Current liabilities |

Increase in accumulated expenses |

Add it to net income in operating activities |

The increase in accumulated expenses indicates that someone else’s money is being used for business, thus represents rest. |

|

Decrease in inventory |

Subtract it from net income in operating activities. |

The decrease in accumulated expenses is mainly due to the payment to creditors and is therefore due to the run-off. |

|

|

Similarly, the increase/(decrease) in other current assets/payroll is treated as cash flow. |

|||

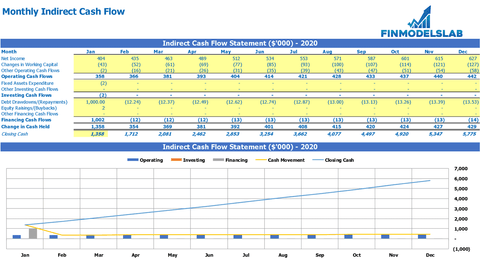

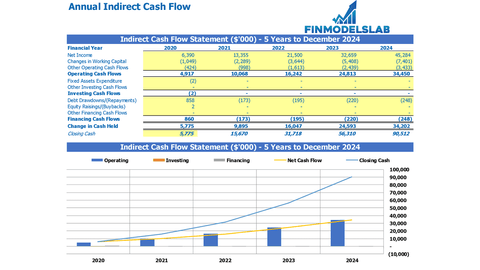

IMPORTANT NOTE: We have designed Free Excel and Google Monthly Indirect Method Cash Flow & Annual Indirect Method Cash Flow . Here you just need to enter data in the yellow cells and see closing balances, track cash, etc. as well as well-constructed graphics.

Download Indirect Method Annual Cash Flow in Excel and Also Download Monthly Indirect Method Cash Flow in Excel

Importance of indirect cash flows

A cash flow statement is an integral part of all financial statements. Here are the key factors that make the indirect cash flow statement method more important:

- Reconciliation of net income with actual cash flows play an important role in the indirect method . As noted above, net income does not represent the precise position as it is calculated on an accrued basis, therefore it is reconciled with actual cash flows from operating activities. This reporting method acts as a reconciliation itself and requires less effort to prepare the cash statement. It highlights the difference between business profitability and its cash holding position.

- Disclosure of Non-monetary Transactions Using the indirect method helps the user understand how this factor impacts net income but not cash flow sources. Depreciation is one of the non-cash expenses which is always added to the net income and causes an increase in the number of cash flows and does not become a source of cash flow.

- Indirect Method Simplified Reporting Format makes it more popular for business to use as it is easier to understand for the reporting user and is readily available.

- Linking financial statements For the preparation of cash flows, it must be established that the user of the statement helps to have a more clear and systematic view of the company’s financial statements. The current assets and the current liabilities of the business can be easily attributed to the operating activities of the business which are present in the income statement.

Indirect cash flow limits

Despite many advantages, there are some limitations of the indirect method. Here are some key limitations of cash flow statements:

- Accuracy is the main limitation of the indirect method as it is prepared on the basis of exercise and a lot of adjustment is needed to be made which causes a lack of transparency and will be a particular concern for the company in highly regulated industries. .

- The indirect method of cash flow reporting is not much favored by international standard fixing bodies, as it provides a clear picture of how cash flows through the business.

- This type of declaration also contains unnecessary details which may affect the user’s view of the statement and cause confusion.

- Another limitation of this method is that the treatment of certain expenses such as depreciation suggests that the expenses are the origin of the cash.

FREQUENTLY ASKED QUESTIONS

Q. Why is the indirect method preferred for the preparation of cash statements?

Q. Does the net income of the business income statement require an adjustment in the indirect reporting method?

Q. Is net cash flow from operating activities calculated using the same direct and indirect?

[right_ad_blog]