- Home

- Sales and revenue

- Running costs

- Financial

Are you planning to start an auto parts store or are you looking to improve the financial performance of your existing business? In either case, having a well-designed financial model is crucial to success. A financial model is a useful tool that helps predict future financial performance, set goals, and identify potential risks. It provides insight into your business operations and guides you in making important financial decisions. In this blog post, we will discuss how to create a financial model for an auto parts store, including revenue and profit models, financial analysis, planning, projection, forecasting, reporting, management, performance and metrics.

Auto parts store revenue and sales forecast

An accurate and realistic revenue and sales forecast is crucial for any auto parts store financial model. Such a forecast serves as the basis for financial planning, projections and, ultimately, financial management. When developing a revenue and sales forecast, an auto parts store should consider a variety of factors including, but not limited to, launch date, ramp-up time, walk-in traffic and growth, customer and purchase assumptions, and sales seasonality.

Auto parts store launch date

Choosing the right launch date is crucial to the success of your auto parts store business. It can determine initial customer response and help you plan your finances accordingly. The Auto Parts store financial model template provides a guess for the companies launch month.

It is essential to consider the seasonal demand for auto parts as it can impact your sales and revenue. For example, if you are starting your business during the summer months, you can expect higher demand for air conditioning parts and oil filters.

Tips & Tricks

- Research the market demand for auto parts during different seasons.

- Choose a launch date that aligns with high demand periods.

- Factor in preparation and planning costs for the launch date.

Besides seasonal demand, it is also important to consider other factors such as supplier availability and logistical support. You need to ensure that you have a steady supply of high quality auto parts to satisfy your customers.

In conclusion, your launch date can strongly influence your auto parts store’s profit model and financial performance. Be sure to research thoroughly and plan the right launch date that suits your business needs.

Auto Parts Store Ramp Time

Forecasting auto parts store sales is crucial for financial planning and management. It is important to note the ramp-up time to the sales plateau when forecasting sales. The time it takes for the auto parts store to reach sales plateau is critical in projecting financial projections.

The ramp-up period for an auto parts store varies depending on the financial analysis of the store. A thorough financial statement can provide important information about the store’s financial performance. Typically, the ramp-up period for an auto parts store ranges from 6 to 12 months.

Tips & Tricks:

- Perform in-depth market research to identify potential demand for auto parts in a particular geographic area.

- Provide excellent customer service to retain customers and encourage positive word of mouth marketing.

- Manage inventory levels to ensure availability of popular auto parts for customers.

In the auto parts industry, the sales ramp-up period can be affected by several factors such as competition, consumer behavior and economic conditions. However, with proper financial forecasting and planning, an auto parts store can project financial metrics that can help them achieve their financial goals and maximize their profit model.

Auto parts store walk-in traffic entries

After the ramp-up period, the auto parts store receives an average daily appointment traffic of 150 visitors on Monday, which gradually decreases by 10% per day, reaching a low of 105 on Sunday. This information is crucial to building a financially viable model for the auto parts store.

In order to forecast the future daily traffic, it is important to know the average daily traffic growth rate in the years in the future. The average growth factor for the next five years is 1.05, which will represent a steady increase in daily appointments over time.

Using these inputs, the auto parts store can build a financial model, projecting future weekday walk-in traffic for five years. This information will help financial planning, Auto Parts store financial projections, forecasting and management strategies.

Tips & Tricks:

- Consider the effect of weather conditions on walk-in traffic.

- Offer special promotions to increase walk-in traffic, such as discounts on select items.

- Develop a customer loyalty program to retain current customers and attract new ones.

Auto parts stock visits to sales conversion and repeat sales entries

One of the most important factors in the auto parts store revenue model is the conversion rate of visitors to new customers. This is the percentage of people who visit your store and actually make a purchase. This may vary depending on the types of products you sell, your store location, and other factors. For example, if you have a store in a high traffic area, you might have a higher conversion rate than a store in a more distant location.

Another important factor to consider is the percentage of repeat customers. Repeat customers are people who have purchased from your store before and have returned to make another purchase. Knowing the percentage of repeat customers helps you plan your marketing strategies and customer loyalty programs that can increase the auto parts parts profit model . In this case, determining the number of purchases each repeat customer will make per month is key to predicting future sales.

Tips & Tricks:

- Collect customer data to know your regular customers

- Offer rewards and discounts to repeat customers

- Use email marketing campaigns to remind customers of promotions and new products

These assumptions are essential in terms of financial modeling for an Auto parts store financial analysis , to ensure that it is done right. By knowing the percentage of repeat customers, you can make Auto Parts Store Financial Planning , Auto Parts Store Financial Projections , and Auto Parts Store Financial Forecasts more accurate. These measures are part of the Financial Statements of Auto Parts Parts . Additionally, you can measure the success of marketing initiatives and customer loyalty programs to see how they influence the Auto Parts Store Financial Management and Auto Parts Store Financial Performance .

Auto Parts Store Sales Mix Entries

Your auto parts store sells different auto parts store products and each product belongs to a specific product category. Entering the sales mix assumption on the product category lever will be much easier to understand. For example, if you have 3 product categories, each with 5 products, you can estimate the percentage of sales for each product category, which will make your revenue model more accurate and accurate.

Enter up to 5 product category names to use in the sales mix. You can choose to categorize products based on their usage codes or types. For example, product categories may include categories such as: engine parts, brake parts, suspension parts, body parts, and electrical parts.

Enter the sales mix in percentage for each of the 5 years provided by product category. In order to create a sales mix, you will need to anticipate the percentage of sales that each product category will generate for each year. For example, let’s say you expect engine parts to generate 40% of your sales in the first year, then 35% in the second year, 30% in the third year, 25% in the fourth year, and 20% in the second year. fifth year.

Tips & Tricks

- Create a product mix by tracking your sales: You can make your financial analysis more accurate by keeping track of your sales based on product categories.

- Monitor quarterly changes: Keep track of trends by analyzing the percentage of sales generated by each category over each quarter.

- Periodically review sales mix assumptions: You may need to adjust your sales mix assumptions if you notice significant changes in your customers’ buying preferences.

Auto Parts Store Sale Amount Entries Amount

Our auto parts store offers a variety of products from different categories such as oil filters, air filters, brake pads, etc. Rather than entering assumptions at the individual product level, we find it easier to estimate the average sale amount at the product category level. This allows for more efficient financial analysis and planning.

For example, we estimate that the average sale amount for oil filters is , while the average sale amount for brake pads is . This is based on historical sales data and projections for the coming years. By inputting this information into our revenue model, we can estimate the average ticket size, which is the average amount spent per transaction.

The calculation of the average ticket size is based on the mix of sales and the average sale amount of each product category. For example, if oil filters represent 30% of our sales mix and have an average sale amount of , while brake pads represent 20% of our sales mix and have an average sale amount of $, the average ticket size would be estimated to be based on the formula:

Average ticket size = (30% x ) + (20% x ) =

Tips & Tricks

- Regularly update your sales data to ensure your average sales amount is accurate

- Consider adjusting your sales mix based on seasonal trends or changes in customer behavior

- Use the average ticket size metric to identify opportunities to increase revenue, such as suggesting complementary products to customers at checkout

Seasonality of auto parts store sales

Understanding the sales seasonality of an auto parts store is crucial to creating a financial analysis , financial planning , and financial forecasting model. By looking at sales data over a calendar year, you can identify patterns and make more informed decisions about inventory levels, pricing strategies, and marketing campaigns.

Generally, auto parts stores tend to experience higher sales volumes during the spring and summer months and slower sales during the fall and winter months. However, these trends may vary based on factors such as geographic location, customer demographics, and store product offerings.

For example, a store located in an area with severe winters may see a spike in sales of cold weather products like windshield stripping and antifreeze during the colder months. Alternatively, a store with a strong online presence may see steady sales throughout the year.

Tips & Tricks:

- Identify products with high and low seasonality to adjust inventory levels accordingly

- Create targeted marketing campaigns for high seasonality

- Regularly monitor sales data to identify changes in seasonal trends

By incorporating seasonal factors into your financials and financial performance metrics, you can create a revenue model and profit model for your auto parts store. This will allow you to make more informed decisions and achieve greater long-term success.

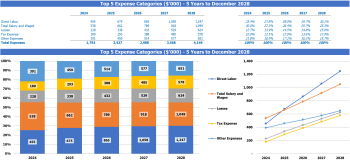

Automotive Parts Store Operational Forecast

Operational expense forecasts are an essential part of the auto parts store’s financial model. It helps in predicting future cash flows and determines key financial metrics such as profit and loss, cash balance and receivables, etc. utilities and other operating costs.

| Operating Expenses | Amount |

|---|---|

| Cost of goods sold by products % | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | ,000 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – ,000 |

Correct forecasting of operational expenses is crucial for an auto parts store to maintain a healthy financial model. Financial forecasting and money management planning are equally important to successfully running an auto parts store.

Auto Parts Store Cost of Goods Sold

Auto parts stores need to track their costs and expenses to ensure long-term profitability. The cost of goods sold (COGS) is a crucial element in determining the profitability of an auto parts store’s financial statements .

COGS refers to expenses incurred directly in the production or purchase of products sold. It includes the cost of materials, labor and overhead required to produce or purchase the inventory. For an auto parts store, cost of goods sold includes different categories such as oil filters, brake pads, and tires.

The percentage of COGS varies by product category in a revenue model auto parts store. For example, the COGS percentage for oil filters can range from 30% to 50%, while the percentage for tires can be around 80% to 90%. The variations depend on the nature of the products and the volume of sales for each category. Thus, understanding the percentage of COGS is essential to determine the profitability of each product category.

Tips & Tricks

- Track COGS regularly to identify cost reduction opportunities.

- Compare the COGS percentage for each product category to identify the best-selling and most profitable products.

- Implement cost reduction measures such as reducing material cost or optimizing labor expenses to improve overall profitability.

Auto Parts Store Employee Salaries and Wages

When analyzing the financial performance of an auto parts store, wages and salaries of employees are an essential aspect of the financial statements . As part of our financial planning process, we have created certain assumptions regarding staff members and their salaries.

First, we suggest naming your management positions as General Manager, Assistant Manager, and Sales Manager. The general manager is to receive an annual salary of ,000, while the assistant manager and sales manager are expected to earn ,000 and ,000 per year, respectively. It is suggested that these positions be filled directly at the start of the business plan.

Second, we recommend that two full-time retail customer service representatives be hired annually. They should each earn ,000 a year. These positions should be filled at least six months after starting the business, as customer demand will increase.

Tips and tricks:

- Consider hiring part-time workers if the store is experiencing low demand. This will save money while providing flexibility.

- Review employee performance regularly to ensure the quality of customer service remains high.

- Perform a financial analysis of payroll costs each year to ensure the business remains profitable.

Auto Parts Store Lease, Lease or Mortgage Country

The revenue model of auto parts stores depends on the amount of sales generated, and it is important to consider the cost of rent, lease or mortgage payments. For example, an auto parts store may pay ,000 in rent per month for their storefront location.

When creating a financial plan for an auto parts store, it is essential to include projections for rent, leases or mortgage payments. By knowing these costs in advance, store owners can better plan their financial future.

The profit model of auto parts stores can be affected by the cost of rent, lease, or mortgage payments, and keeping them as low as possible is critical to maximizing profits.

Tips & Tricks:

- Consider negotiating a lower rate than your rent, lease or mortgage payments

- Choose a location that is affordable and has high traffic

- Factor in a potential rental increase over time when creating your financial forecast

Auto Parts Store Utilities

The financial analysis of the auto parts store involves several critical factors. One of them is utility expenses. Utilities expenses include electricity, water, gas and other costs associated with operating the store.

Utility expenses will vary depending on the location, size and type of auto parts store. For example, a large store with multiple floors will have higher utility expenses than a smaller store with one floor. Also, an auto parts store located in an area with high electricity costs will have higher utility expenses than a store located in an area with lower costs.

Tips & Tricks:

- Invest in energy efficient technology to reduce utility costs

- Use natural light whenever possible to reduce electricity consumption

- Consider negotiating rates with utility providers

By including utility expenses in financial planning, an auto parts store can develop projections for future expenses and establish a financial management plan that ensures adequate revenue and profit margins. Financial metrics related to utility spending can also be used to review financial performance and identify areas for improvement.

Auto parts store other running costs

When building a financial model for an auto parts store , it is important to consider all operating expenses that will affect the revenue model and profit model . While the financial statements will include categories like rent, utilities, and inventory expenses, there are also “other” costs to consider.

Other costs of running an auto parts store might include things like marketing expenses, insurance premiums and miscellaneous supplies like cleaning supplies and office supplies. For example, if the store wants to run a promotion to attract new customers, it will cost money. If the store wants to insure its inventory against theft or damage, that will also be an expense.

It is important to list all of these other costs and estimate how much they will be each month or each quarter. This will help create a more accurate financial plan with more accurate financial projections and financial performance metrics for financial forecasting .

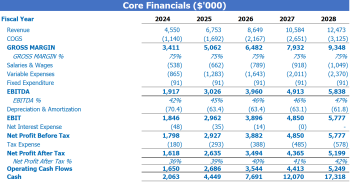

Auto parts store financial forecast

Financial forecasting is a crucial part of the auto parts store’s financial model. This forecast provides a comprehensive view of a store’s financial performance by estimating future revenues, expenses, and profits. The profit and loss report, sources and uses of the report and other financial statements are used to generate forecasts for the coming months and years. Auto Parts store financial forecasts provide vital information for the store’s financial planning and decision-making processes, enabling managers to make informed decisions based on accurate projections of future financial results.

Profitability of auto parts

Once we’ve created revenue and expense projections for your auto parts store, it’s important to review your profit and loss (P&L) statement. This statement will demonstrate your store’s profitability, including metrics such as gross profit and EBITDA margin.

After reviewing your P&L statement, it’s now time to analyze your auto parts store’s financial metrics. This analysis may include examining key aspects such as sales growth, inventory turnover rate and profit margins. With this information, you can make strategic financial planning and management decisions to improve your store’s financial performance.

Tips & Tricks

- Update your financial projections regularly to ensure profitability stays on track.

- Consider diversifying your product offerings to increase revenue streams.

- Set achievable financial goals and benchmarks for your auto parts store to measure success.

In summary, understanding your auto parts store’s revenue and expense patterns alongside financial analysis and reporting will allow you to create good financial projections and stay profitable. Use financial forecasting and planning for financial stimulation and stay ahead in the increasingly competitive auto parts industry.

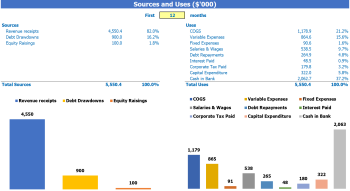

Auto Parts Parts Sources and Usage

The Sources and Uses of Funds in Financial Model in Excel for Auto Parts Store provides users with an organized summary of where capital will come from sources and how that capital will be spent in uses.

Auto parts store financial analysis

When performing financial analysis for an auto parts store, emphasis should include understanding the revenue and profit model, analyzing financial statements, financial projections, forecasting, and managing financial performance.

Tips & Tricks:

- Regularly review financial metrics to identify areas for improvement

- Implement effective financial planning strategies to optimize performance

- Ensure the revenue model is diversified to minimize risk and maximize profit

Financial management of the auto parts store

Effective financial management is essential to the long-term success of an auto parts store. Maintaining accurate financial records, regularly monitoring financial performance, and implementing effective financial planning strategies will help ensure the store remains financially stable and profitable over time.

Building a financial model for your auto parts store will help you analyze your financial performance and forecast your future finances . It will allow you to make informed decisions regarding the financial direction of your business. This model includes different financial metrics such as revenue model , profit model , financial planning , and projections. Remember that a well-structured and comprehensive financial model will come in handy to achieve your business goals.