- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our comprehensive guide on how to build a financial model for a dollar store. A dollar store is a retail business that specializes in selling inexpensive items, usually priced at or less. It requires a well thought out financial plan to ensure success and profitability. In this guide, we’ll cover everything you need to know about building a solid financial model for your dollar store. From dollar store business plan to dollar store start up costs, profit margins, marketing strategy, inventory management, pricing strategy, cash flow analysis cash flow analysis, break-even analysis and ROI calculation, we have you covered.

Store revenue and sales forecast in dollars

In a dollar store business plan, a revenue and sales forecast is an essential component. This financial model helps identify start-up costs and profit margins, pricing and marketing strategies, break-even and ROI calculations, and cash flow analysis. Revenue and Sales Forecast estimates future sales and revenue based on launch date, sales ramp-up time, walk-in traffic and growth assumptions, customer assumptions and purchases and the seasonality of sales.

Revenue and sales forecasts also provide insight into inventory and cash flow management by forecasting revenue streams in a monthly, quarterly, and yearly format. It helps in making informed decisions on pricing and marketing strategies to attract and retain customers, increase sales and revenue, and maximize profits. Additionally, revenue and sales forecasts help in identifying the break-even point and ROI analysis, which determines the point at which the business becomes profitable and the return on investment.

Therefore, a revenue and sales forecast is vital to an in-store business plan, as it provides a roadmap for the financial success of the business and helps mitigate the risks associated with start-up costs, inventory management, pricing and marketing strategies . It is an integral part of the financial model that ensures the longevity and sustainability of the company.

Dollar store launch date

Choosing the right launch date for your Dollar Store business is crucial to its success. Your launch date will determine when you acquire your first customers, when you start generating revenue, and ultimately, when you start making a profit.

Tip: Consider launching your business during a busy shopping season, like back to school or the holiday season, to maximize foot traffic and sales.

In addition to considering the time of year, you will also need to ensure that you have all the necessary preparations ahead of your launch date. This includes:

- Finalize Your Dollar Store Business Plan

- Calculate your startup costs and secure funding

- Implement a marketing strategy to attract customers

- Manage your inventory and pricing strategy

- Perform cash flow and break even

- Calculating your return on investment to ensure profitability

Tip: Give yourself plenty of time to complete these tasks and test your systems before opening day. Harm can lead to avoidable mistakes and setbacks.

Once you’ve chosen your launch date and prepared accordingly, it’s time to focus on growth and expansion. Reviewing and continuously optimizing your revenue streams and profit margins will help you stay competitive and sustainable over the long term.

Tip: Regularly analyze your data, listen to customer feedback, and adapt your strategies accordingly to keep your dollar store business profitable and successful.

Ramp-up time

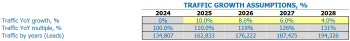

When starting a dollar store business, forecasting your sales accurately is crucial. An important factor to consider is the ramp-up time of the sales plateau. This is the period when your business gradually increases its sales revenue until it reaches a stable level. Forecasting your ramp-up time can help you manage your cash flow, inventory, and pricing strategy.

The ramp-up period for your dollar store business depends on various factors such as location, competition, and marketing strategy. On average, it can take 3-6 months for a dollar store to reach its sales plateau. However, in some industries it can take up to a year to reach this level. For example, if your store is located in a low traffic area, it may take longer to attract customers.

Tips & Tricks

- Research the dollar store industry in your specific location and consider hiring a consultant to help you predict your ramp-up time.

- Set realistic sales goals for your first year and adjust your inventory management and pricing strategy accordingly.

- Invest in a solid marketing strategy to attract customers and improve your store’s visibility in your community.

By forecasting your ramp-up time accurately, you can plan your finances more effectively. This includes understanding your start-up costs, revenue sources, profit margins, cash flow analysis, break-even analysis, and ROI calculations. With a solid business plan and realistic sales forecasts, you can enjoy a successful dollar store business.

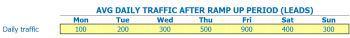

Dollar store dating traffic entries

Assuming the ramp-up period has passed, the daily walk-in traffic at a dollar store can vary from day to day. For example, weekdays may see a higher volume of customers than weekends. On average, Mondays and Tuesdays may have fewer customers than Thursdays and Fridays.

Therefore, analyzing and understanding the average weekday walk-in visitor traffic after the ramp-up period is critical to building a financial model for a dollar store. This input helps determine the revenue streams, profit margins, and break-even analysis required for the formulation of the Dollar Store’s business plan.

Also, the future growth factor and the expected increase in walk-in traffic in the coming years play an important role in estimating the expected revenue of a dollar store. For example, if the growth factor is positive, it will represent an increase in the number of visitors per day, which will lead to more sales.

Tips & Tricks:

- Conduct customer survey to understand step patterns

- Advertise on social media and community boards to attract potential customers

- Track survival data using software solutions or manual logs

Overall, analyzing and understanding the average weekday walk-in visitor traffic and its growth factor over the years is crucial in formulating and estimating a dollar store’s finances. These inputs will help achieve a clear picture of future walk-in traffic for the next few weekdays and help with ROI calculations, inventory management, pricing strategy and cash flow analysis, which are all vital components of a dollar store business plan.

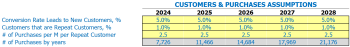

Dollar store visits in sales conversion and sales inputs

When starting a dollar store business, one of the most important considerations is determining the number of visitors that can be converted into customers. The conversion rate from visitors to new customers is generally low. A good conversion rate for a dollar store business is between 15% and 20%. This means that out of 100 people who enter the store, 15 to 20 of them make purchases.

In addition to this, a successful blockbuster store will also have a high percentage of repeat customers. Regular customers are those who visit the store more than once. The average percentage of repeat customers for a dollar store business is around 30%. This means that of the 15-20 customers who have made purchases, 30% of them are likely to return at least once more.

The other important factor to consider when creating a financial model for a dollar store business is determining the amount of purchases each repeat customer will have per month. On average, a repeat customer will buy between and worth of merchandise per month. Therefore, it is important to ensure that they have a range of products that cover all needs and that they visit regularly to keep the business afloat.

These assumptions are important to consider because they provide insight into the sources of revenue and potential profits for the business. By considering the conversion rate, percentage of repeat customers, and how much they will buy, an in-store business owner can create a financial model that predicts the revenue that can be generated. It ultimately helps in fixing dollar store start up costs, dollar store inventory management, dollar store pricing strategy, dollar store cash flow analysis, analysis the break-even point and the calculation of the return on investment of the dollar store.

Tips & Tricks

- Make your store accessible by choosing a location that is close to public transportation or has ample parking.

- Price appropriately to ensure your prices are competitive with other dollar stores in the area.

- Offer a variety of products to meet different needs, preferences and budgets.

- Focus on good customer service by going the extra mile to satisfy customers and always being polite and welcoming to new visitors and repeat customers.

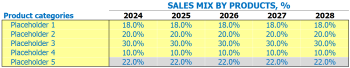

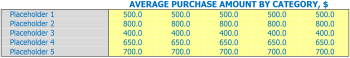

Dollar Store Sales Mix Intarts

When running a dollar store, it is important to understand the different product categories that your store has to offer. Each product can belong to a specific category which can affect the overall product line and ultimately drive sales. By entering sales mix assumptions on the product category leverage, it will be much easier to understand and predict.

For example, if your store sells school supplies, you can create a product category called “back to school” and enter the sales mix percentage for each year of your forecast. You can then create additional categories such as ‘Household Essentials’, ‘Party Supplies’, ‘Toys’ and ‘Health and Beauty’.

By carefully segmenting products by category, you can begin to develop hypotheses about what percentage of sales each product category will generate. This will help you develop a marketing strategy and ensure that you are properly stocking your store with the right inventory.

Tips & Tricks

- Regularly update your sales mix based on changing demand and customer buying behavior.

- Use Dollar Store Inventory Management Software to identify gaps in your product mix and optimize purchasing decisions.

- Experiment with Dollar Store Pricing Strategy to boost sales and improve your profit margins.

Once you have established your sales mix assumptions, you can use them to build a Dollar Store Cash Flow Analysis and determine your Dollar Store Break-Even Analysis . By understanding the Dollar Store Startup Costs and Projected Dollar Store Revenue Strots , you can calculate ROI DOSTOR and ensure your business meets your financial goals.

Dollar Store Amount the amount of the sale of inputs

Your dollar store offers a variety of products ranging from household items to seasonal decorations. Each product falls into a specific product category such as kitchen utensils, fixings, toys, etc. To estimate the average ticket size, it is easier to enter assumptions at the product category level rather than on individual products. This way, the brainstorming process will be easier and faster.

One of the important assumptions to make is the average sales amount for each product category per year. For example, if you expect to sell more cookware during the holiday season due to increased family reception, you may have a higher average sale amount for cookware in November and December.

Another example would be that in the stationary category, open-air pens might have a lower average sale amount, while pens with fancy or extra features might have a higher average sale amount.

Using the sales mix and the average sale amount of each product category, the model will calculate the average ticket size. Average ticket size will provide crucial insights into the consumer behavior of store shoppers, allowing you to make better pricing and marketing decisions.

Tips & Tricks:

- Keep track of historical data to make more informed predictions.

- Take note of other factors that could potentially impact the average sale amount.

- Make sure your pricing strategy aligns with the average sale amounts you estimate.

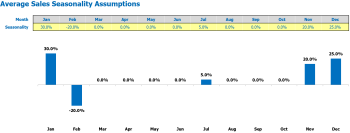

Seasonality of Dollar Store store sales

Understanding Seasonality of Dollar Store store sales is crucial to any successful business plan. The key is to analyze seasonal sales patterns and adjust the business model accordingly.

For example, dollar store sales are generally higher during the holiday season (approximately 40% deviation from the average daily monthly sales) and back school season (approximately 20% deviation %). On the other hand, the summer season may have a drop in sales (about 15% deviation). These seasonal factors can differ based on location and demographics, making it important to conduct market research and analyze data.

Tips & Tricks:

- Create a dollar store marketing strategy that targets seasonal sales trends.

- Adjust Dollar Store Inventory Management to match seasonal sales trends.

- Develop a Dollar Store Pricing Strategy This takes into account seasonal and market factors.

By conducting a Dollar Store Cash Flow Analysis and Dollar Store Break-even Analysis , business owners can determine the best way to allocate resources and optimize sales throughout the the year.

Overall, understanding and considering seasonal factors is crucial to managing dollar store startup costs and ensuring healthy dollar store profit margins as well as maximizing dollar store revenue streams . Calculate Dollar store ROI calculation to determine growth and profitability.

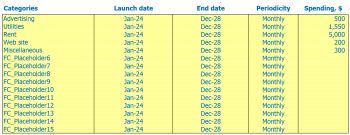

Forecast store operating expenses in dollars

Operational expense forecasts are a crucial part of the overall financial model for a dollar store. These forecasts include the estimated costs of running the store, including the cost of goods sold by the product, employee wages and salaries, rent, lease or mortgage payments, utilities, and other operating expenses.

| Operating Expenses | Amount (per month) |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | 0 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,500 – ,000 |

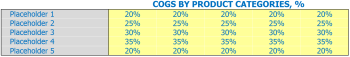

Cost of Goods Sold

Dollar store inventory management is crucial when analyzing dollar store startup costs . The cost of goods sold (COGS) includes all direct expenses associated with the sale of products or services, such as the price of the item, shipping costs, and packaging materials.

COGS varies by product category and typically ranges from 20% to 40% of the retail price. For example, if a product sells for , the COGs for that item should not exceed . This cost should be accounted for in the Dollar Store Profit Margins , as it directly impacts the Dollar Store Cash Flow Analysis . It can also help when performing a Dollar Store Break-Even Analysis and Dollar Store ROI Calculation .

Tips & Tricks:

- Track COGs by product category to identify areas of cost optimization.

- Regularly review and adjust pricing to ensure margins remain profitable.

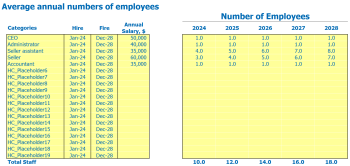

Salaries and wages of store employees in dollars

As part of the Dollar Store business plan, you need to estimate salaries and wages for employees to operate the store. An average dollar store might employ 5-10 people, depending on store size and product requirements. Here are some assumptions to consider for employee wages and salaries.

- Consider hiring part-time employees, especially for non-peak hours to reduce costs.

Tips & Tricks

You may want to have a store manager, assistant manager, and crew members as staff members/positions for your dollar store. The following shows the expected annual salaries for these positions:

- Store Manager: ,000 – ,000

- Assistant Director: ,000 – ,000

- Crew member: ,000 – ,000

For example, if you set the salary of a store manager at ,000 per year, you would have to pay ,333.33 each month for salary.

To determine the full-time equivalent (FTE) number, you will need to multiply the number of employees in each category by the portion of their time spent with the business. For example, if you have a full-time stores manager and two part-time crew members, the FTE count will be calculated as follows:

- Store Manager: one FTE

- Crew member: one FTE (0.5 x 2)

Accordingly, the total number of FTEs will be two.

Dollar store rent, lease, or mortgage payment

When you start a dollar store business, you will need to consider rent, lease, or mortgage payment costs for the store location.

Assuming you’ve decided to rent a 2,500 square foot space in a mall, you could start with a base rent of .85 per square foot per month. This translates to a monthly rent of ,125.

Alternatively, you can own the space in which you operate your dollar store, in which case you will need to make monthly mortgage payments . Suppose the purchase price of a 2,500 square foot space is 0,000, and you borrow 0,000 on a 20-year fixed rate mortgage with an interest rate of 4%. Your monthly principal and interest payment will be approximately ,020.

Tips & Tricks

- Consider the location of your store and the local real estate market when negotiating rent, lease, or mortgage agreement.

- Tive based on the cost of utilities, taxes and insurance which add up to your overall occupancy costs.

- Set aside a reserve fund for unexpected expenses such as maintenance and repairs.

Dollar store utilities

When creating a dollar store business plan, it is essential to consider various factors such as start-up costs, revenue streams, profit margins, marketing strategy, inventory management, pricing strategy, cash flow analysis, break-even analysis and ROI calculation. Moreover, it is also essential to consider the utilities that your store needs.

Utility assumptions may vary depending on store location and size. For example, if you rent space in a mall, utilities may be included in the rent. However, if you are renting a self-contained building, you will need to consider water, electricity, heating, cooling and internet as additional expenses.

Tips & Tricks:

- Compare the prices of different utility providers to find the most affordable option.

- Invest in energy-efficient light bulbs and appliances to reduce electricity costs.

- Consider using natural light during the day to reduce electricity costs.

Dollar Store other running costs

When building a financial model for a dollar store, it is important to consider all expenses that will impact the dollar store’s profit margins . In addition to predictable expenses like Dollar Store Startup Costs , Dollar Store Inventory Management , and Dollar Store Marketing Strategy , there are also other running costs that should be considered.

These other running costs can include things like utilities, rent, insurance, and employee salaries. You may also need to factor in unexpected expenses like equipment repairs or legal fees if something goes wrong. For example, if your store experiences a flood, you may need to invest in repairs to keep the store running smoothly.

It is important to carefully research and estimate all of these expenses for accurate Dollar Store Cash Flow Analysis and Dollar Store Break-Even Point Analysis . By understanding all the nuances of the Dollar Store Business Plan and Dollar Store Revenue Strots , you can create a strong Dollar Store Pricing Strategy and Dollar Store ROI Calculation That takes into account the both foreseeable and unexpected expenses.

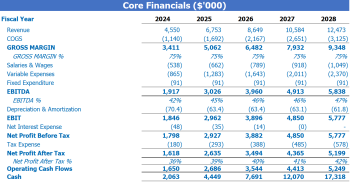

Dollar Store Financial Forecast

When starting a dollar store, it is crucial to have a comprehensive financial model that will project future profits and expenses. The financial model typically includes a profit and loss statement that shows income and expenses, as well as a Sources and Use report. To create a successful dollar store, it is essential to have an excellent pricing strategy, effective inventory management and a smart marketing strategy, but above all, a solid financial plan which includes a cash flow analysis, a breakeven analysis and an ROI calculation.

Dollar store profitability

Once we’ve created our Dollar Store Business Plan, it’s important to plan our start-up costs and revenue streams. By doing so, we can calculate our profit margins and determine a pricing strategy for our products.

After analyzing our inventory management and creating a marketing strategy to attract customers, we can perform a cash flow analysis to determine our break-even point. This is where we can use a break-even analysis to calculate the sales volume we need to cover our fixed and variable costs.

Tips & Tricks

- Consider increasing sales volume through promotions or discounts to increase revenue

- Regularly review inventory turnover to identify slow moving products and adjust order to optimize cash flow

- Perform an ROI calculation on various aspects of the business, such as the effectiveness of marketing campaigns or the return on investment in new products

Once we have created our revenue and expense projections, we can check the profit and loss (P&L) statement from revenue to net profit. This will help us visualize our profitability, such as gross profit or EBITDA margin, and identify areas where we can increase our results.

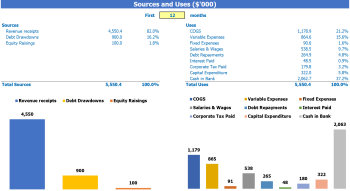

Sources of the dollar store and use of the chart:

The Sources and Uses of Funds in Excel’s Financial Model for Dollar Store provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks:

- Always check sources and use a statement to ensure total quantities are equal

- Be sure to consider all possible sources and uses of funds, including unexpected expenses

- Regularly update sources and use a statement to reflect changes in the company’s financial condition

When creating a business plan for a dollar store, it is essential to consider start-up costs, sources of revenue, profit margins, marketing strategy, inventory management, pricing strategy , cash flow analysis, break-even analysis and ROI calculation. By creating a thorough and well-researched business plan, dollar store owners can increase their chances of success and profitability.

Building a financial model is an essential step when starting a dollar store business. As mentioned earlier, it requires detailed planning and analysis, starting with a solid business plan, sources of revenue, start-up costs, and profit margins. Additionally, inventory, pricing, marketing strategy, and cash flow analysis must be considered to ensure the profitability of the business. A breakeven point and return on investment calculations help determine the viability of the dollar store business. By following these steps, you can create a realistic and successful financial model that guides the growth of your dollar store business.