- Home

- Sales and revenue

- Running costs

- Financial

Are you planning to start a used tire store? One of the key steps in starting any successful business is creating a detailed financial model. This template should include financial projections , revenue models , a marketing plan , and SWOT analysis to ensure your tire store is profitable and sustainable. Moreover, it is crucial to assess the profit margins and industry trends to make informed decisions. In this blog post, we’ll walk you through the process of creating a business plan , competitive analysis , start-up costs , and pricing strategy for your used tire store.

Used Tire Shop Revenue and Sales Forecast

In any used tire shop business plan, financial projections play a crucial role in determining its success. A solid revenue model that includes sales forecasts is needed to make informed decisions about pricing, inventory, and marketing. When creating a projection, important factors such as start-up costs, pricing strategy, profit margins, competitive analysis, SWOT analysis for used tire stores and industry trends industry must be taken into account. Once you’ve determined your launch date, sales uplift, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality, you can then start building revenue. and sales forecasts that will set the foundation for your use of The Tire Shop success.

Launch date of the second-hand tire shop

When to start a used tire shop is a critical and strategic decision that can determine the success or failure of your business. It’s the date when your business is officially open to the public, and it’s also when you start selling your products and services to your target customers. Therefore, it is crucial to select the appropriate launch date that aligns with your financial projections, industry trends, marketing plan, and pricing strategy.

In addition, the used tire shop income model model assumes a specific month for launching businesses. Therefore, it is essential to consider start-up costs, profit margins, and competitive analysis when deciding the launch date. For example, you can launch your business during the peak season when demand is high, or you can choose to launch your business during the off-season when start-up costs are lower.

Tips & Tricks:

- Perform a SWOT analysis for your used tire store to identify your strength, weakness, opportunities and threats that may affect your launch date.

- Research industry trends to determine the best time to launch your business and anticipate demand for your products.

- Create a comprehensive marketing plan to promote your business launch and attract potential customers.

- Develop a pricing strategy that aligns with your financial projections and profitability goals.

- Plan and budget for start-up costs, including rent, inventory, equipment, and marketing expenses, to avoid financial setbacks after the launch date.

Overall, the launch date of your used tire shop can have a significant impact on the success of your business, and it is essential to consider various factors before deciding on a specific date. As a result, taking your time to carefully plan and prepare for your launch date can help you achieve long-term success and profitability.

Used tire shop ramp up time

When forecasting sales projections, it is important to consider the ramp-up time to the sales plateau. This period refers to the time it takes for a business to reach its full revenue potential. Ramp-up time is critical to financial projections because it can help determine start-up costs and expected revenue.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In the used tire store industry, it can take 6-12 months to reach sales plateau. During this ramp-up period, businesses can expect to see incremental increases in revenue as they establish their customer base and grow their brand.

Tips & Tricks

- Develop a solid business plan that includes a detailed SWOT analysis and a marketing plan.

- Research industry trends and competitive analysis to determine your pricing strategy and profit margins.

- Consider start-up costs such as equipment, inventory, and marketing costs.

By forecasting the time to ramp up to the sales plateau, companies can strategically plan for growth and budget accordingly. Keep in mind that every business is unique and may experience variations in their ramp-up time. However, with a solid business plan, competitive pricing strategy, and focused marketing efforts, used tire stores can reach their full potential and succeed in this industry.

Used Tire Shop Used Traffic Entrances

After the ramp-up period, the average daily in-traffic of second-hand tire store industry visitors is generally highest on weekends. Saturday traffic is typically 30% higher than Monday traffic, while Sunday traffic is over 20% higher. A significant percentage of the remaining traffic is generated on weekdays.

Average daily traffic for an established used tire shop on weekdays can range from 100 to 300 visitors, with weekends having 400 to 700 visitors depending on location and other factors. This walk-in traffic plays an important role in building a financial model for the used tire shop industry, as it determines and affects revenue projections for the business.

Assuming 3% annual growth for walk-in traffic, the projected average daily visitors for five years are:

- Monday: 125

- Tuesday: 130

- Wednesday: 136

- Thursday: 141

- Friday: 146

- Saturday: 556

- Sunday: 667

Tips & Tricks

- Use digital marketing to reach potential local customers on platforms such as Google Maps, Facebook and other social media sites

- Participate in community events and sponsor activities to increase brand awareness and drive traffic

- Partner with complementary businesses such as auto repair shops, retail stores, and car washes to offer mutually beneficial incentives and promotions

Understanding the projected walk-in traffic for used tire stores, based on their weekday outage, is key to building a solid financial plan. With this data analysis in mind, business owners can set realistic financial goals and implement an appropriate pricing strategy. Analyzing the numbers required for a financial plan can also help increase profitable sales margins, and it can be concluded that a solid strategy and plan can generate more revenue on the most popular weekdays, to make this even more profitable growth process.

Opportunity shop visits for sales conversion and sales inputs

Let’s say a used tire store has 100 visitors in a month. Based on the store’s marketing efforts and competitive pricing strategy, 20% of these visitors convert to new customers, which means the store acquired 20 new customers this month. This is a critical input to the store’s revenue model as it helps determine the store’s sales and revenue projections.

According to industry trends, around 60% of the store’s sales come from their regular customers. This means that out of the 20 new customers, the store can expect around 12 of them to eventually become repeat customers. If each repeat customer has an average of ten purchases per month, the store can expect 120 purchases from repeat customers in that month.

This assumption is crucial because it helps build the store’s financial model by projecting sales and revenue realistically. Without the repeated conversion and sales inputs, the store will not be able to know its expected cash flow and cannot make informed decisions on how to grow their business.

Tips & Tricks:

- Offer the loyalty program to encourage repeat purchases from customers.

- Provide excellent customer service to ensure customer satisfaction and loyalty.

- Keep track of visitor and customer conversion rates to gauge the effectiveness of marketing efforts and pricing strategy.

Used tire shop sales mix entries

In our used tire store, we sell a variety of products that are classified into five distinct categories: passenger tires, truck tires, off-road and agricultural tires, performance tires and all-season tires. In order to estimate our financial projections for the next five years, we need to create a sales mix assumption at the product category level.

Entering the sales mix hypothesis at the product category level will make it much easier for you to understand how we can allocate our resources and create an effective marketing plan for our used tire shop. Here is the mix of sales by product category Assumptions we made:

- Passenger tires – 40%

- Truck tires – 20%

- Off-road and agricultural tires – 10%

- High performance tires – 20%

- Tires all seasons – 10%

Tips & Tricks

- Be sure to regularly update your sales mix assumptions based on industry trends and changes to your business plan.

- Perform a SWOT analysis for your used tire store to identify areas where you can improve your sales mix and increase your profit margins.

- Use a competitive analysis to see how your pricing strategy compares to other used tire stores in your area.

- Be sure to factor in your start-up costs when creating your financial projections.

Used tire shop average sale amount entries

When estimating financial projections for used tire stores , it is important to consider the Average Sales Amount of each product category . Our store sells several different used tire products, each belonging to a specific category. To simplify the process, we enter assumptions at the product category level instead of the individual product level.

For example, we have a category for passenger car tires and assume an average sales amount of per tire for the first year, for the second year, and for the third year. Another category is truck tires with an assumed average sales amount of for the first year, for the second year, and for the third year.

All product categories in our Used Used Revenue Model have their own average sales amounts per year. Using these inputs and the mix of sales, our model calculates the Average Ticket Size for each transaction.

Tips & Tricks:

- Include every product category in your used tire store marketing plan to maximize profit margins.

- Conduct a SWOT Analysis for used tire stores to identify areas of opportunity and potential threats.

- Consider Used Tire Shop Industry Trends When Developing Your Used Tire Shop Pricing Strategy .

- Conduct a Competitive Analysis for used tire stores to identify your store’s unique selling points.

- Estimate your used tire shop start-up costs carefully to ensure financial stability.

Seasonality of used tire store sales

When it comes to running a used tire store, understanding sales seasonality is critical to success. Different seasons will bring different levels of demand for your services, and failure to account could leave you with excess inventory, lost profits, or both.

For example, during the winter months, customers may be more likely to come to your store for snow tires or other types of specialty tires. You may also see an increase in business following storms or other severe weather events. During the summer months, however, demand can drop significantly as fewer people think about their tyres.

By using historical data, you can develop a sales seasonality hypothesis that accounts for these fluctuations. For example, you can assume that December sales will be 10% higher than the annual average, while July sales may be 20% lower.

Tips & Tricks:

- Examine industry trends to identify potential fluctuations in demand

- Consider regional variations in climate and weather patterns

- Factor in holidays and other seasonal events that may impact sales

- Regularly monitor sales trends and adjust your projections as needed

By incorporating your sales seasonality assumption into your financial projections and revenue model, you can accurately forecast your expected income and expenses throughout the year. This will allow you to create a more effective marketing plan, choose the right pricing strategy, and make other business decisions with confidence.

Used Tire Used Operational Forecast

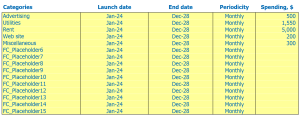

Operational expense forecasts are a vital component of the financial model for used tire stores. It provides an estimate of the monthly expenses that the business needs to run efficiently. These expenses include the cost of goods sold by the products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating expenses.

| Operating Expenses | Amount (per month) (in USD) |

|---|---|

| Cost of goods sold by products % | 0 – 00 |

| Salaries and wages of employees | 00 – 00 |

| Rent, lease or mortgage payment | 0 – 00 |

| Public services | 0 – 0 |

| Other running costs | 0 – 00 |

| Total | 00 – 00 |

The table above provides an estimated range of monthly expenses that used tire shops might incur. Keeping in mind that operational expenses vary with business size, location and other factors.

Cost of Used Tire Shop Goods Sold

Cost of Goods Sold (COGS) is a critical component in calculating profit margins for used tire stores. COGS is the cost of the product a business sells, including labor and materials. For a used tire shop, COGs include the cost of purchasing tires, transportation costs, and any associated labor costs.

Calculating COGS is critical when determining the revenue model for a used tire store. Typically, the COGS percentage range for tire shops is 40-60%, with labor costs around 10-15%.

Suppose a used tire store has four main product categories: passenger tires, light truck tires, heavy truck tires, and specialty tires.

- Passenger tires: COGS percentage: 40%

- Light truck tires: COG percentage: 45%

- Heavy truck tires: COGS percentage: 50%

- Specialty tires: COGS percentage: 60%

Tips & Tricks:

Using these COGS assumptions, a used tire shop can create accurate financial projections for their business plan. Additionally, the COGS percentage can help the tire shop create a pricing strategy and determine the level of profitability they want.

By performing a SWOT analysis and competitive analysis, a used tire store can identify industry trends and develop a marketing plan that maximizes their profit margins while remaining competitive.

Salaries and wages for second-hand employees

In our financial projections for used tire stores, we have created assumptions about employee wages and salaries. For our used tire store, we have identified four different positions that need to be filled: Manager, Sales Associate, Mechanic and Assistant.

The manager will be hired from day one and will be involved in day to day operations, marketing plan for used tire stores, revenue model and SWOT analysis for used tire stores. The manager will earn ,000 per year. The sales associate and mechanical positions will be filled at the end of the first quarter. The sales associate will earn ,000 per year, while the mechanic has a higher salary of ,000 per year. The assistant position will be filled at the end of the second quarter, earning ,000 per year.

As for full-time equivalent staff, we believe that one manager, two sales associates, two mechanics and one assistant are sufficient. However, depending on store occupancy, more FTEs may be required, particularly during peak season.

Tips & Tricks:

- Consider offering benefits to your staff, such as a 401(k) plan or health insurance, to attract and retain employees.

- Regularly review employee salaries and wages to ensure they are competitive and fair.

- Offer bonuses or incentives to reward employees for their hard work and performance.

Second-hand workshop rent, rental or mortgage

When starting a used tire shop, one of the biggest expenses will be the cost of physical space. There are three main options for acquiring a location: renting, leasing, or buying with a mortgage.

Rent: If you choose to rent a space, you will pay a monthly fee to a landlord. This can be a good option if you don’t have a lot of initial capital and don’t want to commit to a long-term lease or mortgage. However, be sure to consider potential rent increases over time when creating financial projections for used tire stores .

Lease: A lease is similar to leasing, but usually a longer-term commitment (eg, three to five years). A lease can often give you more stability and control over the space, as well as potential cost savings compared to long-term renting. Be sure to include lease payments in your Used Car Revenue Model .

Mortgage: If you have the capital or are able to secure financing, purchasing space with a mortgage can be a good option for long-term stability and control of your location. However, it will be a larger initial investment and you will be responsible for maintenance and repairs. Include mortgage payments in your financial projections for used tire stores .

Tips & Tricks:

- Research the local real estate market and factor in any trends when making a decision

- Consider negotiating with landlords or sellers to get a better deal on the space

- Be realistic about the amount of space you need and choose a location that meets your business needs and goals.

Used Tire Shop Utilities

When creating a financial projection for used tire shops , it is important to consider the required expenses for used tire shop utilities . These utilities include electricity, water, gas and internet.

The Second-Hand Revenue Model should incorporate the cost of utilities into overall operating expenses. One way to reduce these costs is to implement energy-efficient solutions such as LED lighting, low-flow water fixtures, and smart thermostats.

The pricing strategy for used tire stores could also factor in utility costs. For example, if a store owner decides to charge slightly higher prices for their tires, they could use the extra revenue to cover utility costs.

Tips & Tricks:

- Look for energy efficient solutions to reduce utility costs.

- Incorporate utility costs into overall operating expenses when creating a financial projection.

- Consider adjusting pricing strategies to cover utility costs.

All in all, by considering Used Tire Shop Industry Trends and implementing smart utility solutions, store owners can ensure that they have a sustainable Used Tire Shop business plan. with healthy profit margins for used tire stores while performing a Competitive Analysis for used tire stores and SWOT Analysis for used tire stores To create a successful Marketing plan for used tire stores opportunity .

Used tire shop Other running costs

Besides start-up costs and profit margins, running a used tire shop also involves other expenses, which must be accounted for when building a financial model. These costs include rent, utilities, repairs, maintenance, insurance and employee salaries.

To keep the store running, the owner must pay rent, utilities, and other bills, which could vary depending on the location, size, and type of building. Similarly, repair and maintenance costs could result from equipment breakdowns, installations or upgrades.

To protect the store and its assets, the owner might need to pay premiums for insurance against theft, fire, accident or other types of liabilities. Finally, if the store hires employees, their salaries and benefits should be factored into the financial model.

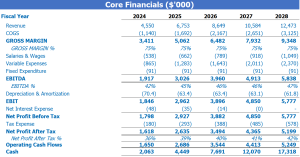

Used Tire Shop Financial Forecast

Financial projections for used tire stores are a crucial part of creating a successful business plan. As part of this projection, it is important to include a profit and loss statement as well as a Sources and Use report. A profit and loss statement breaks down revenue, cost of goods sold and expenses to determine your net income, while a Sources and Use report shows where your funds came from and where they will be allocated.

Used Tire Shop Profitability

Once you have created financial projections for your used tire store, including revenue models, marketing plans, SWOT analysis, industry trends, profit margins, business, competitive analysis, startup costs and pricing strategies, you can check the Profit and Loss (P&L) Statement.

By analyzing the P&L statement, you can see the overall profitability of your used tire store. This includes gross profit and EBITDA margin analysis. You need to make sure that your used tire store generates enough gross profit to cover your expenses and create a net profit at the end of the day.

Tips & Tricks:

- Avoid underestimating your tires as this can lead to low profit margins.

- Keep a close eye on your inventory to avoid overstocking, which will reduce profitability.

- Don’t ignore additional revenue streams such as the sale and installation of new tires or the provision of tire-related services, which can have a significant impact on profit margins.

Regularly tracking your profitability, updating your financial projections regularly, and creating a budget is key to planning and monitoring your spending. Remember that a successful used tire shop is not only about generating profits, but also about creating a sustainable business model that withstands any market change.

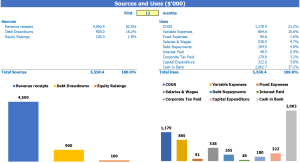

Sources and use of used tire stores

The sources and uses of funds in the financial model in Excel for Used Tire Shop provides users with an organized summary of where capital is coming from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Having a solid understanding of your used tire shop sources and chart uses is essential to forecasting and managing revenue streams. There are many factors in determining how much money you will need to keep your business afloat, and where the money will come from will dictate how you allocate the funds. Regularly reviewing and adjusting your sources and using a statement is important for your business to run smoothly.

Tips & Tricks

- Create a detailed usage section, including a breakdown of expenses such as rent, equipment, and payroll.

- Be realistic with your income projections in the Sources section.

- Review and update your sources and use a statement regularly.

Understanding your sources and using the graph is just one aspect of creating a successful tire opportunity business plan. Performing a SWOT analysis, developing a marketing plan, and analyzing industry trends can all help create a profitable revenue model. It’s also important to consider start-up costs, profit margins, and pricing strategies when developing your business plan.

Financial modeling is an essential tool for planning and managing a used tire store. With a well-structured business plan , including financial projections , a revenue model and a marketing strategy , you can gain a thorough understanding of the profit margins and start-up costs involved in the industry. A SWOT analysis and competitive analysis can help you identify potential challenges and opportunities, while tracking industry trends can help you stay ahead of the game. A carefully considered pricing strategy can make all the difference in building of a profitable and sustainable business.