- Understanding Financial Models and Their Role in Business

- Understanding and Implementing Exit Strategies for Your Business

- Working Capital Management: Understanding Its Impact on Cash Flow

- How to Avoid Mistakes When Making a Business Evaluation

- The Benefits and Process of Comprehensive Business Planning

Preparing a pro forma income statement in addition to providing assumptions and supporting valuations should be a basic assignment for your business. The crucial part is that you need a pro forma income statement report to present the financial results. They are based on some financial planning features that your business will likely encounter in the near future.

Download the Excel template! Learn even more ⟶

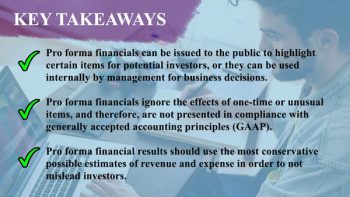

The Pro Forma report is proof that your business is generating revenue. This is crucial for any business. The thing is, it’s going to rank ballpark numbers for your organization. It includes income, loss and expenses. Also, while investors are deciding how much money they are going to invest, they have to follow certain rules. They must do this while making a pro forma income statement . And surely, you have to accept principles to make the most comparable statement.

Why the pro forma income statement is crucial for a company

In 2016 Nike reported 6% growth, but ended up with 12% growth. This gave them an estimate as well as a plan and direct funds between different departments. That’s why the Pro Forma report is a retailer’s best friend.

Importantly, expected financial statements also predict the loss of a startup. Make it very essential for them to get the report because so as to avoid any kind of major loss. It is also important to include instructions in a standard format in the columns.

It is easy to compare them between the operational and financial sectors of a startup. The main use:

- You can develop and change sales projections due to market changes.

- Required expenses for products and services can be developed based on income.

- Profit can be estimated, loss can be reduced and balance sheets can be compared.

Moreover, with the projected risk factors, you can analyze your loss, caused by an individual factor.

Download the Excel template! Learn even more ⟶

It will allow a company to rethink its model, therefore:

- It enables companies to gain a mutual understanding of important brands based on current data.

- Moreover, with such a financial report, you can develop a marketing strategy that will suit your business model.

Noteworthy :

It’s great if you Discuss simplified procedures . Use it to prepare and evaluate the pro forma income statement and pro forma balance sheet with experts first.

Let’s clarify

Moreover, with a pro forma statement, a startup or a company can decide the amount of money for marketing, research and development. It also helps investors review strategy, business plan, and profit operation. A well-adjusted income report provides investors with a better understanding of the financial consequences.

However, you may find some cases where companies may try to manage the report as a pro forma statement as well. They do this by giving an image that the vision is softer than the reality. But this is equal to the dupe of investors. The same person who allocates the capital will no longer worry about your other initiatives. On the other hand, the pro forma statement can predict the earnings on each plan and predict the capitalization.

You can use these statements to choose from the different plans offered. Based on these declarations, the company presents the budget. Pro forma statements are also useful for shareholders of the Company. It helps to assess the progress of the company and then decide to invest more or less according to their program.

DRY format

The Securities and Exchange Commission (SEC) requires a regular format for companies in creating and executing pro forma statements. You must use the following format. There are several tools available that can help make your job easier:

1. Introduction

Anything formed on which is formed should be displayed here such as the companies involved or the time frame.

2. body

Balance sheet and income statement Must be displayed in columnar form. Expenses and previous adjustments with reason must also be presented.

3. Conclusion

Explanatory notes for the adjustments made and the financial impact of the adjustments should be documented and presented in this area.

4. points to stress

Conclusion

As the above steps show, Pro Forma is quite basic and at the same time quintessential. Without a fundamental report, the financial market or entrepreneurs would not approve of the business model. With such a financial report, you can technically predict the future of your organization. For a startup, the pro forma income statement is crucial. True professionals should prepare it with the utmost precision.

Download the Excel template! Learn even more ⟶

[right_ad_blog]