- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our guide on how to build a financial model for a jewelry store! Running a jewelry business can be hugely rewarding, but it’s no secret that it comes with a significant amount of financial planning and organization. In this guide, we’ll cover the essential steps to creating a reliable financial model for your jewelry store. We’ll explore everything from financial projections and analysis to creating a full financial statement and forecast. By the end of this guide, you’ll have the tools you need to manage your jewelry store finances with confidence.

Jewelery revenue and sales forecast

Revenue and sales forecasts are an essential part of the jewelry store financial model. By creating a projection for store sales, a business can better understand its financial future. In the Financial Jewelery Business Plan, revenue projections describe the amount of money a store expects to earn from sales of its products.

When projecting revenue and sales, many factors need to be considered. These factors include launch date, sales ramp-up time, walk-in traffic, growth assumptions, customer and purchase assumptions, and sales seasonality. Using these assumptions, a jewelry store financial model is created to help the business make better-informed management decisions.

Financial projections, analysis, statements, plan, forecast, management, performance and strategy of jewelry stores are all based on revenue and sales forecasts. Therefore, it is crucial to use accurate assumptions to ensure that the forecast is a reliable tool to help the business make decisions regarding growth and investment.

Jewelery launch date

The launch date of your jewelry store is a crucial aspect of your business. It sets the tone for your brand, establishes your presence in the market and determines the success of your business.

Choosing the right launch date can be a game-changer for your business. You need to consider various factors such as seasonality, competitor activity, and consumer demand. For example, launching your jewelry store during peak wedding season can be beneficial because that’s a time when people are more likely to buy jewelry.

In terms of financial planning, the jewelry store financial model model provides an assumption for the start month of the business. However, it’s up to you to choose the specific launch date that suits your needs and goals.

Tips & Tricks

- Research your competitors and assess their launch dates.

- Consider the seasonality of your industry and choose a launch date accordingly.

- Consider major events and holidays that may affect consumer demand.

- Prepare and plan activities and costs related to your launch date to ensure a successful launch.

Ultimately, your launch date can make or break your business. Take the time to carefully consider your options, plan and strategize, and execute your launch with confidence.

Jewelry store ramp-up time

In any jewelry business plan, understanding ramp-up time to sales plateau is essential to accurately project sales. Ramp-up time is the period it takes to reach peak sales performance or the sales plateau. This is an important metric for any business owner as it will allow them to predict when they will become profitable.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In the jewelry industry, the ramp-up time can be 3-6 months. It takes time to build a customer base, create brand awareness and build trust with customers.

Tips & Tricks

- Use your ramp-up period to focus on building customer relationships and creating a memorable experience.

- Invest in marketing strategies to create brand awareness within your target audience.

- Stay on top of industry trends and changes to stay relevant and meet customer needs.

As a jewelry store owner, understanding ramp-up time and integration into your financial projections will give you a better understanding of what to expect in terms of sales performance. This knowledge will enable you to make informed decisions on your jewelry store’s financial analysis, financial statements, financial model model, financial plan, financial forecasts, financial management, financial performance and financial strategy. Accurate predictions will help you stay on top of your finances and make informed decisions that will help your business succeed.

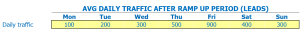

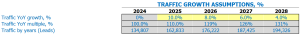

Walk-in traffic schedules

After the ramp-up period, the store’s average daily traffic is 50 visitors on Monday 45 visitors on Tuesday 60 visitors on Wednesday 75 visitors on Thursday 90 visitors on Friday and 100 visitors on Saturday. Sunday traffic is relatively lower than other days, with only 40 visitors per day on average.

The above data is essential while building a financial model for a jewelry store because the revenue of the store largely depends on the number of visitors who come to the store. Finances on the jewelry store business plan are heavily influenced by walk-in traffic and therefore daily traffic data for the week is a vital indicator for predicting the sales potential of the store.

To improve the financial performance of the store, the financial management of the jewelry store focuses on increasing walk-in traffic year by year. The store management team has established a growth factor of 10% for each day of the week for the next five years. This growth factor is a valuable input for the financial forecasts of the jewelry store, increasing the accuracy of the projections.

Tips & Tricks

- Conduct market research to better understand the business realities of the region.

- Focus on appropriate signage and display to grab customers’ attention.

- Partner with related businesses to develop inter-promotional offers.

By incorporating daily walk-in traffic and the growth factor by year, the jewelry store’s financial model model will accurately project the store’s walk-in weekday traffic for the next five years. Armed with this information, store management can create a detailed jewelry store financial plan focused on increasing store traffic and driving sales.

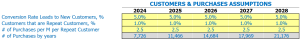

Visits to jewelry stores for sales conversion and sales entries

When running a jewelry store, it is crucial to understand the conversion rate of visitors to new customers, as well as the percentage of returning customers. A good estimate for conversion is around 20%, which means that out of 100 visitors, around 20 will make a purchase.

For repeat customers, this number can vary significantly depending on the quality of your products, customer service, and marketing efforts. Ideally, you want to aim for at least a 20% repeat customer rate. Assuming you have 100 new customers per month, that means you will have 20 repeat customers.

Each repeat customer will have a different purchase frequency, but a good estimate is around two purchases per month. Therefore, with 20 regular customers, you can expect around 40 additional purchases per month.

Tips & Tricks:

- Offer incentives to regular customers, such as discounts or exclusive promotions.

- Focus on creating a positive customer experience to encourage word of mouth referrals.

- Regularly analyze the effectiveness of your marketing efforts to ensure you are reaching your target audience.

These assumptions are important when building a financial model for a jewelry store. By understanding your conversion and repeat sales rates, you can accurately project your sales revenue and incorporate it into your financial statements. This allows you to better plan the financial future of your jewelry store and make informed decisions about your business strategy.

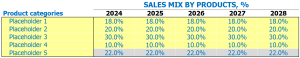

Jewelery sales mix entries

In our jewelry store we offer a range of products including necklaces, bracelets, earrings and rings. Each product belongs to a specific product category, which makes it easier for us to track our sales mix assumptions.

Our sales mix by product category assumptions consider the percentage of sales for each product category. For example, let’s say the necklace category represents 30% of our total sales. Over the next five years, we can assume that this figure decreases by 5% each year. On the other hand, if earrings represent 20% of our total sales, we could assume that this figure increases by 2% each year.

Overall, entering sales mix assumptions at the product category level is much easier to understand than entering specific product sales figures. For example, rather than tracking the sales of a particular necklace or ring in isolation, the sales mix hypothesis allows us to see all of the necklaces or rings and compile their sales into a single category.

Tips & Tricks

- Consider current jewelry market trends when making your sales mix assumptions

- Look at your past sales data and see how product categories have performed over time

- Keep in mind the seasonality of certain products, such as holiday-themed jewelry around Christmas and Valentine’s Day

By entering our sales mix assumptions by product category, we can create a much more accurate financial forecast for our jewelry business plan finances. This data will help us develop a robust jewelry store financial model that will guide our jewelry store financial management and support our jewelry store financial strategy.

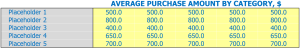

Jewelry Average sale amount of inputs

Our jewelry store offers a wide range of products including engagement rings, wedding bands, necklaces, bracelets and earrings. Each product belongs to a specific product category based on its type, material, design and price range. Instead of entering assumptions at the product level, we calculate the average sale amount by product categories and by years.

For example, our category of engagement rings includes solitaire rings, halo rings, three stone rings, vintage rings, and more. We estimate the average sale amount for each product category based on historical data and market analysis. We assume that sales of engagement rings will increase by 5% every year due to our marketing and advertising efforts.

The average sale amount for our engagement ring category is ,000 for the first year and ,200 for the second year. Using the sales mix and average sale amount of each product category, our financial model will calculate the average ticket size. Average ticket size is the average amount a customer spends in our store, and it’s a key performance indicator for any retail business.

Tips & Tricks:

- Group your products into specific categories to facilitate the estimation and analysis of your financial data.

- Use historical data and market analysis to make realistic assumptions about your average sales amount and sales growth.

- Keep a close eye on your ticket size to track your financial performance and identify areas for improvement.

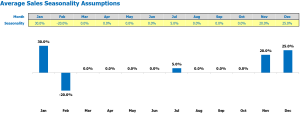

Seasonality of jewelry sales

In the jewelry industry, sales seasonality is an important factor that business owners should use to analyze their financial performance. Seasonality refers to the cyclical changes that occur in sales volume in different parts of the year.

For example, during Valentine’s Day, Mother’s Day, and Christmas, jewelry store financial projections indicate high sales due to more gift giving. However, during other seasons, such as fall and winter, it is common for sales to dip.

Tips & Tricks

- Investing in marketing during low selling seasons can help boost sales.

- Stocking up on seasonal items ahead of time can help manage inventory and optimize sales for different times of the year.

- Tracking and analyzing the business Financial statements of the jewelry store Can provide information regarding the effectiveness of the business’s seasonal strategy.

Business owners can use a jewelry store financial model to plan and predict needed changes based on historical sales data. For example, analysis of monthly sales records and financial management records can indicate the percentage deviation from average sales per day. A financial plan that takes into account the predictable seasonality of the jewelry market would help ensure effective holiday sales and profitability.

Additionally, a business owner can develop a Jewelery Business Plan Financial Section that focuses on managing seasonality. This may include creating marketing plans, managing the supply chain, and managing expenses during low seasons, among others.

Understanding and monitoring jewelry sales is an integral part of building and maintaining a healthy and profitable jewelry business.

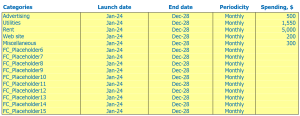

Jewelery operating expense forecast

As part of a comprehensive jewelry financial model , operating expenses provide a crucial role in determining the expected financial performance of a business. These forecasts include various expenses that the business will incur during its day-to-day business operations.

Major operating expense categories include:

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | 500 – 10,000 |

| Salaries and wages of employees | 2,000 – 8,000 |

| Rent, lease or mortgage payment | 1,000 – 5,000 |

| Public services | 500 – 2,000 |

| Other running costs | 500 – 2,500 |

| Total | 4,500 – 28,500 |

Depending on the size and scope of the business, these expenses can vary significantly. However, having a clear understanding of the expected costs associated with running a jewelry store is essential to making informed business decisions.

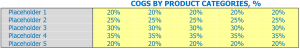

Jewelry Cost of Goods Sold

Cost of Goods Sold (COG) is a crucial aspect of any retail business, including jewelry stores. It refers to the cost of materials and labor used to produce jewelry products. COGS assumes that jewelry stores include the cost of raw materials such as gold, silver, diamonds, etc., as well as all labor costs involved in the manufacturing process such as design, casting, setting, polishing and shipping.

Typically, the percentage of cogs for jewelry products is around 40-60% of the selling price. This percentage may vary depending on the type of product category, supplier agreements and overhead. For example, for gold jewelry, the COG percentage may be higher than for silver jewelry because the cost of raw materials like gold is more expensive. Likewise, the COGS percentage for bespoke jewelry would be higher due to the additional labor costs involved in creating a unique piece of jewelry.

Tips & Tricks

- Regularly review supplier agreements and negotiate where possible to obtain better prices on raw materials.

- Invest in technology and equipment to streamline the manufacturing process and reduce labor costs.

- Keep overhead costs low by optimizing inventory management and reducing waste.

By carefully managing your cost of goods sold, you can ensure that you price your jewelry products efficiently while maintaining healthy profit margins. By using financial tools and projections, such as a financial model template or financial statements, you can track and adjust your COGS assumptions to meet your business needs.

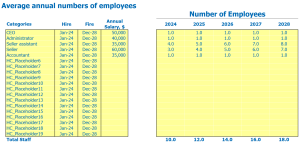

Salaries and wages of jewelry store employees

When developing jewelry store financial projections , it is critical to consider jewelry financial management , specifically wages and salaries of employees . To make accurate projections, a business owner should consider:

- Staff members / positions

- The hiring timeline

- Annual salary per person / category

- Full-time equivalent staff needs each year

For example, a jewelry store may have the following positions:

- Owner / manager

- Sales Associate

- An accountant

It is crucial to determine when each person will be hired. If the store opens in January, the owner/manager could start in November or December in preparation for the store launch. The accountant can be hired before opening to establish financial systems.

The average Jewelery Financial Analysis For salaries and employee wages is ,000 per year. However, rates may vary by location and experience. A sales associate can earn to per hour, depending on their skill set, while an accountant can charge to per hour.

For a staff of four, including the owner, the average annual cost would be 0,000. This figure does not include payroll taxes and other costs associated with employing people.

Tips & Tricks

- Consider part-time positions to reduce costs.

- Factor in training and benefits.

- Look for hiring interns or apprentices to learn while gaining experience.

Jewelery rental, lease or mortgage payment

One of the biggest expenses for any jewelry store is rental, lease, or mortgage payments. The amount varies depending on location, size, and other factors. In the Jewelry Store Financial Plan , it is important to make specific assumptions about these payments.

Rent: If you rent a space, you will pay the rent monthly or quarterly. The amount of rent depends on your location, size of space, and other factors. For example, if you are in a prime location in a mall, your rent will be higher than if you are on a side street. You can negotiate the rent, so make sure you get a good deal.

Rental: If you are renting a space for a longer period, you will pay a lease payment. The lease payment is paid in advance and is usually less than the rent. This is a good option if you want to stay in the same place for a longer period, but can negotiate the terms of your lease.

Mortgage payment: If you own the property, you make mortgage payments. The amount of your mortgage payment depends on the size of your loan, the interest rate and other factors. It’s a good option if you want to invest in your own property, but it does require a significant initial investment.

Tips & Tricks:

- Research the average rent, lease or mortgage payments in your location before making assumptions

- Negotiate the terms of your lease or mortgage payment to save money

- Include rent, lease or mortgage payments in your jewelry store financial statements to keep track of your expenses

Jewelry store utilities

One of the important aspects of a jewelry business plan is the utility assumptions. These assumptions refer to the estimated costs of utilities such as electricity, water and gas for the jewelry business. It is important to make reasonable assumptions based on the size and location of the store, as well as the equipment and appliances that will be used.

The jewelry store financial projections should include estimated utility costs, which will affect the overall jewelry store financial analysis. A jewelry store financial statement should also include a breakdown of utility expenses, with comparisons to projected costs.

Tips & Tricks

- Consider the energy efficiency of appliances and equipment when creating utility assumptions.

- Research utility rates in the area to make accurate projections.

- Tive based on seasonal changes in utility costs, such as higher electricity bills during the summer months.

A jewelry store financial model template can be used to help make accurate projections for utility expenses. Proper jewelry store financial management will include monitoring and controlling utility costs to improve the financial performance of the jewelry store. A jewelry store financial strategy should also be in place to ensure the long-term sustainability of the business.

Jewelery Other operating costs

When building a financial model for a jewelry store, it’s important to consider all operating costs , not just the obvious ones like inventory and rent. Other running costs can include things like:

- Marketing expenses (advertising, promotions, events)

- Employee training and development

- Insurance and security

- Equipment maintenance and replacement

- Utilities (electricity, internet, water)

While some of these may be smaller expenses, they can add up over time and impact the overall financial performance of the store. For example, investing in employee training can lead to higher customer satisfaction and repeat business, while neglecting equipment maintenance can lead to costly breakdowns and repairs.

Therefore, it is important to factor all other operating costs into a jewelry store’s financial model to ensure accurate financial projections and a sustainable financial plan .

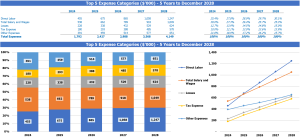

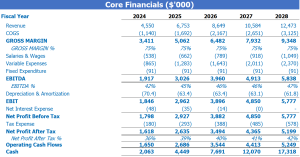

Jewelery Financial Forecast

In order to ensure the success of a jewelry store, financial projections and analysis are crucial. A financial model template can help create a financial plan, including a financial performance forecast. One of the most important aspects of these forecasts is the profit and loss statement, which helps in tracking income and expenses. Additionally, a Sources and Use report can provide insight into the company’s funding and finance, enabling optimal financial management and strategy.

Profitability Jewelry

Once we’ve created our income and expense projections for our finances on the jewelry business plan, it’s time to check our profit and loss statement, often called a P&L. The P&L statement shows profitability from revenue to net profit. This will help us visualize the profitability of our jewelry store, such as gross profit or EBITDA margin.

It is essential to analyze our jewelry store’s financial projections and financial statements to understand the company’s financial performance. It will help us assess the direction of the business, make informed decisions, and take action to improve business performance. Through financial analysis, we can diagnose the financial situation and identify areas that need to be addressed to achieve our goals.

Tips and tricks:

- Regularly review financial statements to ensure the business is on track with its financial goals.

- Track key performance indicators (KPIs) such as stock turnover rate and customer acquisition cost

Using our jewelry store financial plan, we can create a financial model to help us forecast the financial performance of the business. By planning our finances in advance, we can build a roadmap for future business growth. Using a jewelry store financial model template or seeking help from a financial expert can help you make more accurate financial projections.

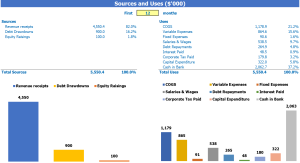

Jewelry sources and use of the chart

Sources and uses of funds in Excel’s financial model for jewelry provide users with an organized summary of where capital comes from sources and how that capital will be spent in uses.

It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks:

- Be sure to double check all your numbers before finalizing the sources and uses statement.

- Consider potential future scenarios and how they will impact your sources and uses of funds.

- Collaborate with financial experts who can view and provide feedback on your sources and use statement.

Building a financial model for your jewelry store is an essential and ongoing process for the success of your business. Your financial plan should be a compass for the direction of your business, allowing you to make informed decisions and adjustments when necessary. Good financial management will help you predict the growth of your business which will inform your strategies and operations. With the right tools and financial model preparation, you will be able to take control of your financial performance and create a roadmap for your success.