- Understanding Financial Modeling for Business Planning

- How to Create a Comprehensive Business Plan

- An Introduction to Financial Modeling

- Setting and Achieving Clear Business Goals

- Understanding the Essentials of a Successful Business Plan

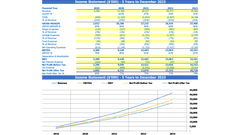

FinModels Lab has created a fancy but informative dashboard to visualize the strengths and weaknesses of your business by simply passing Annual Financial Performance Dashboard. A well-built template is designed for users without advanced Excel skills. Just enter the numbers in the appropriate cells and run the dashboard smoothly.

After reading this article, you should be Apple to learn:

- What are financial statements

- Components of Financial Statements

- Method of preparation of financial statements

- Financial statement users

- FREQUENTLY ASKED QUESTIONS

What are financial statements

The Dictionary.com explains statement as a sentence that tells the reader a fact or idea about a single topic. Financial statements are summary reports that convey a company’s business activities and financial performance. Financial statements are a collection of summary level reports on the company’s financial results, financial position and cash flow. It provides financial information at specific period to be used by many stakeholders such as business manager, employees, board of directors, investors, shareholders, customers, suppliers, bankers and other parties related stakeholders.

Components of Financial Statements

There are three basic statements and two explanatory statements. All the basic statements are closely related to each other while the explanatory statements give the users of the financial statements more idea of the company’s position and performance.

The set of financial statements contains five statements and five elements.

Here are the five statements:

- Statement of Financial Position or Balance Sheet,

- Statement of financial performance, or income statement,

- Declaration of change in equity,

- Cash Flow Statement, and

- Notes to the financial statements

These financial statements contain five major elements of financial reporting of the business, and these five elements of financial statements are:

- Assets,

- Liabilities,

- Stocks,

- income, and

- Expenses

Financial statements are constructed by five key elements. For example, Bilan is built by three elements which are assets, liabilities and actions and releve de revenue is built by two elements which are income and expenses.

To better understand the financial statements, these are briefly explained below:

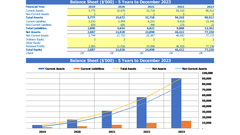

Statement of Financial Position or Balance Sheet Informs users of a company’s financial position as of a specific date. The balance sheet gives information about the balances of assets, liabilities and equity of a company and these balances are carried for the next year. In layman’s terms, the balance sheet is what a company owns and owes.

A company’s balance sheet tells stakeholders the health of companies on a specific date. Business owners or other stakeholders study the balance sheet to assess the position of liquidity, business performance, and corporate liabilities.

Download the annual balance sheet in Excel

IMPORTANT NOTE: See our detailed article on the balance sheet. You can also try the specially designed Free Monthly Balance Sheet and Annual Balance Sheet that helps you prepare the balance sheet by simply entering the numbers in the yellow highlighted cells.

Statement of financial performance or income statement is basically a statement that tells the story of the income and expenses of the organization. The income statement tells the story of a company’s operations and shows how profitable a company has been over a certain period. The income statement can be prepared for any period, including monthly, quarterly, half-yearly or annually. Technically, the income statement is a consistent and logical presentation of a business’s income and expenses and a simple formula for calculating the income statement is to subtract all expenses from income.

Download the annual income statement in Excel

IMPORTANT NOTE: See our detailed article on the income statement. You can also try our free Monthly Income Statement & Annual Income Statement Template where you just need to put your numbers in the yellow cells and see the horizontal/vertical analysis and the nice graphs.

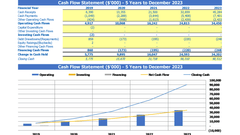

Statement of cash flows shows the net moment and the cash equivalent moment during the period. These moments are divided into three segments, namely operating, investing and financing activities. The cash flow statement allows investors to understand how a business operates, its source of money, and where the money is spent. It also provides resistance to the company’s liquid cash. The cash flow statement is the most important of all statements while evaluating a project and making the financial model and business plan. The cash flow statement is prepared by two approaches: (i) direct approach. (ii) Indirect approach.

Download Excel Annual Cash Flow Template in Excel

IMPORTANT NOTE: See our detailed article on cash flow statement. You can also try our 13 exciting free Cash Flow Templates Showing monthly/annual cash flow using direct/indirect methods and discounted cash flow projections.

Statement of changes in equity reconciles the opening and closing balance of equity. This statement forms part of the annual financial statements. The statement starts with the opening balance, then the increase/decrease of its components such as profits, dividends and investments, it shows the period ending balance. This statement is useful for a company to see the timing of net changes in the company’s total equity.

Notes to financial statements are the explanatory notes that are appended with the published financial statements of a company. These notes explain the assumptions used to prepare, the basis of preparation, the figures in the financial statements, the accounting policies adopted by the company. Notes help different types of users, such as businesses and investors, to understand all the figures added in the financial statements.

Method of preparation of financial statements

With reference to the basis of preparation, financial statements are divided into two major types.

- Accumulation Base records the transaction when it occurs. Revenue is recorded when earned without considering whether it is received from customers/clients or received is deferred. Normally, financial statements are prepared under accounting basis and these types of financial statements are accepted by accounting standard bodies.

- Cash basis Consider that transactions are recorded once expenses or income are paid or received. In other words, the transaction is recorded only if a commercial transaction is paid. The cash basis of accounting does not give a picture of a trade item as accounts payable or receivable is not recorded.

IMPORTANT NOTE: We have designed free Monthly Financial Statements & Annual Financial Statements where you just need to put your numbers in the yellow cells and see the horizontal/vertical analysis and the nice graphs.

Financial statement users

There are many users of financial statements prepared by a business. Here is the list of the most common users with their area of keen interest in financial statements:

- Business Leaders To make financial and investment decisions, management must understand the liquidity, earnings ratio and cash position of the business from its financial statements.

- Shareholders are concerned about the performance and position of the company, and they demand that the financial statements include this.

- Competitors require to assess the competitor’s financial strength to make strategic decisions to stay in race and this information can be obtained from the competitor’s financial statements.

- Government The authorities require the financial statements to make an assessment that the company has paid all taxes and duties imposed by the government on these activities.

- Financial analyst using analysis tools such as liquidity ratios, current ratios, gear ratios, etc. decides to recommend commercial titles to their clients. The investor anticipates the possibility of a rise or fall in trading securities.

- Lenders Need to assess the financial strength of the business before lending money to that business. Through financial statements, lenders assess their equity ratios and ability to repay the loan and interest.

- Clients Researches the best supplier from a list of suppliers, then it will evaluate the company’s participation, financial strengths and ability to survive in the long term. This type of information is obtained from the financial statements by the client.

- Suppliers will require financial statements to decide if it is safe to extend credit to a business.

Each user of financial statements has a different reason for wanting access to this information.

FREQUENTLY ASKED QUESTIONS

Q. Are there accounting policies or guidelines available for the preparation of financial statements?

A. Yes, there are accounting standards available for the preparation of financial statements. Some countries have adopted international financial reporting standards and others have adopted generally accepted accounting principles. These standards help companies prepare financial statements with consistency that facilitates comparisons.

Q. How to ensure that the financial statements are reliable?

A. The reliability of the financial statements is enhanced when the financial statements are supported by appropriate disclosures (ie notes to the financial statements) and are audited by the external independent auditors.

Q. Which statement is prepared first in the five financial statements?

A. The best approach is to first prepare the prepared income statement, followed by the balance sheet, cash flow and statement of changes in equity. The notes of the financial statements are prepared by the accountants simultaneously with the balance sheet. However, when looking at an annual report, the balance sheet will be on the first page, followed by an income statement, a cash flow statement, statements of changes in equity, and then notes to the financial statements.

[right_ad_blog]