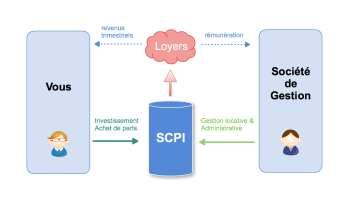

A scpi is a company that pools the funds of its partners to invest in real estate. Just like an apartment building, it’s a real estate investment that the vast majority of people don’t think about. The huge advantage of this type of investment is that the scpi takes full responsibility for all aspects of the land.

The scpi, made up of experts in all areas of real estate, is able to unearth the best opportunities, to negotiate usefully with all stakeholders, land sellers, architects, builders and developers, or with craftsmen in the framework of renovations.

The risks inherent in this activity are spread over a large number of buildings, which allows the scpi to maintain an attractive level of return even in the event of difficulty on one or the other property, unlike an individual investment whose the income can very quickly be wiped out in the event of non-payment by a tenant, for example. Not to mention the legal proceedings which can be long and painful. The member only has to manage the income from his investments, which are paid to him periodically.

Civil real estate investment companies have experts in wealth management in their teams and it is always wise to take their advice before choosing your scpi. SCPIs specialize in a type of premises that they manage.

Some target buildings with high potential for tax exemption, it will then be mainly residential premises eligible for various tax depreciation schemes, others target more professional property in general or particular to a specific activity. Some favor geographical or even international sectors in search of advantageous taxation or interesting future prospects.

Before any acquisition of scpi shares, it is absolutely necessary to precisely establish its heritage profile to determine which type of scpi will best meet its expectations and then carefully study the real estate held by the scpi as well as the strategy implemented for future purchases.

All scpi highlight the dividends paid during the last few years. This is obviously an indicator of some interest, but it should be borne in mind that this is data from the past not guaranteed in the future.

It is therefore necessary to push the analysis a little further. For example, many companies no longer need fixed premises because their staff work partly online, others prefer to locate far from city centers to avoid transport and other constraints and to be able to have more premises. great in an environment that improves the well-being of their teams.

The new sustainable development standards are also to be taken into account, professionals are not mistaken in wanting to give their company an ecological image. To make the right choice, it is more than important to make a good scpi comparison. We can make an investment in scpi from very small amounts which allows a unique and incomparable flexibility in the field of real estate. You can move upmarket, mix your portfolio, and reselling on the secondary market is much easier than reselling an individual good.