- Home

- Sales and revenue

- Running costs

- Financial

Opening a tea shop is a great idea for tea lovers who want to turn their passion into a business. However, it is essential that the proper planning is done before embarking on this venture. One of the essential aspects of a tea shop business is building a solid financial model. Without a proper financial plan , a business can struggle to stay afloat, but with a realistic analysis and projection of business finances, it becomes easier to make smart decisions that will help the business grow and achieve success. financial. This article will provide you with a step by step guide on building a financial model for a tea shop which will help you understand the financial analysis of tea business and provide a tea shop revenue model , shop profit projection , Tea Shop Financial Statements , Tea Business Financial Planning , Tea Shop Income Statement , Tea Shop Financial Performance , and Tea Shop Cash Flow Forecast .

Tea Shop Revenue and Sales Forecast

One of the most important aspects of tea shop financial planning is projecting sales revenue. The tea shop revenue model considers various factors such as launch date, sales ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions and a seasonality of sales to estimate future sales revenue.

Tea shop launch date

The launch date of your tea business is very important. It sets the pace for all future activities and serves as a deadline for your planning and preparations. It’s important to give yourself plenty of time to make all the necessary arrangements to ensure a smooth launch.

The tea shop financial model template provides a guess for the start month of businesses. Choose the date when your tea business will start operating. You can assume that you launch your business in the middle of the year while the financial model begins in January. This can be useful if you need to prepare and plan activities and costs related to the launch of tea shop activities.

Tips & Tricks:

- Consider the seasonality of tea drinking when choosing your launch date. Launching in the winter months may attract more customers as tea is a popular warming drink during cold seasons.

- Allow a soft opening before the official launch to determine the creases and get customer feedback.

- Pick a launch date that gives you plenty of time to build excitement and market your business.

By choosing a realistic launch date and following the tips and tricks above, you can set your theater business for success from the start. Don’t underestimate the importance of a well-planned and executed launch!

Ramp-up time

When forecasting sales for your tea business, it is important to consider the ramp up time of the sales plateau. This is the period during which sales gradually increase until they stabilize at a certain level.

The ramp-up period varies for each business and can be influenced by factors such as location, marketing efforts, and competition. To determine your tea shop’s ramp-up period, analyze data from similar businesses in your industry. Depending on your business details, the period can range from a few months to over a year.

Tips & Tricks:

- Invest in effective marketing strategies to shorten the ramp-up period and accelerate sales growth.

- Offer unique, high-quality tea blends to attract customers and increase customer retention.

- Regularly review your tea shop’s financial statements to track your financial performance and adjust your financial planning strategies accordingly.

By forecasting the ramp-up time and sales of your tea shop, you can develop a detailed tea financial plan, which includes a tea cash flow forecast, a tea shop revenue model, a statement financial statement, tea financial projection, tea shop income statement and tea shop financial analysis. This plan will help you evaluate your tea shop’s financial performance and effectively manage your tea shop’s profit projection.

Trafficking of tea shops

After the ramp-up period, the average daily visitor traffic on weekdays is 50 on Mondays and Tuesdays, while Wednesday and Thursday have a visitor number of 75, and Friday to Sunday is expected to reach a number traffic of 100.

This is an important assumption as it helps to determine the tea shop’s estimated sales potential on each day of the week. With a higher number of specific daily visitors, we can optimize our resources in terms of inventory, personnel and other operational aspects.

The average traffic growth factor in future years is estimated at a progressive rate of 5% each year. These entries allow us to calculate future walk-in traffic for the next five years with precision.

Tips & Tricks:

- Regularly monitoring daily visitor counts and using them to refine your operational and marketing strategies can help increase your foot traffic.

- Focusing on attracting and retaining customers on days with lower foot traffic, such as Mondays and Tuesdays, can help improve sales and profitability during slower times.

- Offering promotional offers and specials during high foot traffic days can attract new customers and increase your revenue.

In conclusion, considering daily walk-in weekday traffic is a vital aspect of building the financial model for the tea shop. This input helps determine the estimated sales potential of the store and optimize its resources accordingly.

Tea shop visits in sales conversion and sales inputs

Understanding the conversion rates of tea shop visits to actual sales is an important aspect of a tea financial analysis. For example, if 100 customers visit the tea shop every week, how many of them will become new customers?

Based on the tea shop’s revenue model, the percentage of new customers could be around 30%. This means that 30 out of 100 customers will be purchasing tea leaves or other tea products for the first time. In the meantime, what is the percentage of repeat customers?

According to Tea Shop’s financial statements, the percentage of repeat customers can be as high as 60%. This means that out of the 30 new customers, 18 of them will come back and buy tea again.

In addition, the number of purchases each repeat customer will have per month is also an important assumption in the tea shop’s financial plan. With the tea shop profit projection, it is estimated that every repeat customer will buy 1-2 packs of tea leaves every month.

Tips & Tricks

- Offering discounts to new customers can attract them to buy tea on their first visit.

By understanding visit-to-sale conversion rates and repeat sales inputs, tea business financial planning can be improved. This can be especially beneficial in terms of creating a cash flow forecast, tea financial projection, and financial performance reports.

Tea shop sales mix starters

In our tea shop, we sell a variety of different tea products that belong to specific product categories. To make our sales mix assumptions easier to understand, we entered them by product category lever.

For example, if we look at our green tea product category, we assume that it will represent 30% of our sales mix. Meanwhile, our black tea category is expected to represent 40% of our sales mix. Then we have our fruit infusion category with 20% of the sales mix, the herbal infusion category with 5% of the sales mix, and our specialty tea category with 5% of the sales mix.

When entering our sales mix assumptions by product category, it helps us better understand where our sales are coming from and how we can optimize them. We have projected our sales mix for the next five years, by product category.

Tips & Tricks:

- Be sure to regularly review and adjust your sales mix assumptions based on changing customer demand and trends.

Average Sale Inputs Average Sale Carry

In our tea shop, we sell a variety of tea products such as black tea, green tea, herbal tea and oolong tea. Each product belongs to a specific product category. It is much easier to enter assumptions at the product category level than at the product level. This way, we can estimate the average sale amount for each product category and use that to calculate the average ticket size.

For example, let’s say we estimate that the average sales amount for the black tea category is for the first year and for the second year. Similarly, for green tea, we estimate the average sales amount to be for the first year and for the second year.

Using the sales mix, which is the percentage of each product category sold and the average sale amount of each category, the model will calculate the average ticket size. For example, if the sales mix is 30% black tea, 40% green tea, and 30% herbal tea, the average ticket size would be:

Average ticket size = ( * 0.30) + ( * 0.40) + ( * 0.30) = .80

Tips & Tricks:

- Conduct market research and analyze customer preferences to determine the sales mix.

- Regularly update and reassess average sale amount assumptions to reflect any changes in the market.

- Consider offering promotions or discounts to increase sales of particular product categories.

Seasonality of tea shop sales

As a tea business owner, it’s important to consider seasonality when projecting sales and creating a financial plan for the coming year. Sales seasonality refers to the fluctuation in revenue that occurs throughout the year due to factors such as weather, holidays, and events.

For example, during warmer months, sales of iced teas and fruit infusions may increase, while in winter, sales of hot beverages like hot tea and cocoa may be higher. It is important to analyze previous sales data to determine the average sales per day for each month and then adjust seasonal factors accordingly.

Tips & Tricks:

- Consider local events, such as festivals or markets, which may impact sales during certain months.

- Be prepared for unexpected weather changes by having seasonal menu options and appropriate marketing materials.

- Consider offering promotions or discounts during slower months to boost sales.

Using a tea shop revenue model, create a tea shop financial projection that takes sales seasonality into account to create a realistic estimate of sales and profit. By carefully analyzing and adjusting seasonal factors, you can create a tea financial plan

Tea Shop Operating Expense Forecast

In order to establish and maintain the long-term profitability and success of a tea business, it is necessary to have an effective financial plan. A crucial part of any good financial plan is having an accurate forecast of operational expenses. A comprehensive operating expense forecast should consider all the key expenses of running a tea shop, including:

- Cost of Goods Sold by Products%

- Salaries and wages of employees

- Rent, lease or mortgage payment

- Public services

- Other running costs

| Exploitation charges | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,500 |

| Salaries and wages of employees | ,500 – ,000 |

| Rent, lease or mortgage payment | ,500 – ,000 |

| Public services | 0 – ,500 |

| Other running costs | ,000 – ,500 |

| Total | ,500 – ,500 |

Tea Shop Cost of Goods Sold

The tea shop’s financial plan should include a tea product cost of goods sold, which is the cost associated with producing or obtaining the products sold by a shop. This includes the cost of raw materials, direct labor expenses, and other expenses needed to create the product. COGS is calculated by subtracting the cost of goods sold from the store’s revenue.

The financial analysis of the tea business requires the identification of COGS percentages for each product category. It is crucial to understand which product categories bring in the most revenue and which product categories bring in the least revenue. For example, if the tea store’s revenue model shows that the highest revenue comes from green tea, the COGS percentage for the green tea category should be carefully analyzed to see if it can be lowered.

The tea shop financial statements and the tea shop income statement should include a percentage of COGS for each product category. The COGS percentage for the product category shows the revenue share of the store to produce the product category. The tea shop profit projection is based on the assumption of COGS, and it is important to maintain accurate COGS percentages.

Tea shop cash flow forecasts are an essential part of tea financial planning, and it is important to understand how changes in COGs could affect cash flow. If the COGS percentage for a product category is too high, it may be necessary to reduce prices for that product or adjust the COGS percentage for that product category.

Tips & Tricks

- Regularly review and adjust COGS percentages.

- Identify the product categories that bring in the most revenue and adjust COGS percentages accordingly.

- Monitor changes in COGs and how they affect store cash flow.

Salaries and wages of tea shop employees

Wages and employee salaries are an important part of the tea shop’s revenue model. To master tea financial planning, we made a few assumptions:

- Take salary surveys for your area or industry.

- Offer benefits to attract and retain quality staff.

- Keep labor laws and regulations in mind when hiring staff.

Tips and tricks:

First, we will name our staff members/positions as follows:

- Manager (hired from opening day)

- Assistant Manager (5 Month Hire)

- Full-Time Business Associates (hired from month 3)

- Part-Time Business Associates (hired from 3 months)

Second, the tea shop profit projection assumes a hiring plan for the tea financial plan:

- Manager to earn an annual salary of ,000

- Assistant manager to earn an annual salary of ,000

- Full-time business associates to earn an annual salary of ,000

- Part-time business associates to get an annual salary of ,000

Finally, we must have a full-time equivalent (FTE) staff each year:

- Manager for 12 months

- Deputy Director for 8 months

- Full-time business associates for 12 months

- Part-time sales associates equivalent to 2 full-time sales associates for 12 months

With these assumptions in mind, we can create an accurate tea shop income statement, tea financial statement, tea financial projection and tea shop cash flow forecast to ensure the growth and stable financial performance.

Tea shop rent, lease or mortgage payment

One of the biggest expenses for a tea shop is the rent, rental or mortgage payment for the shop space. It is important to plan and set aside enough finance for these expenses to ensure the smooth running of the business.

Assuming a financial plan for the tea shop, the rent, lease or mortgage payment for the shop can be calculated based on the location and size of the shop. For example, a prime location in a busy city may have higher rental costs compared to a quieter location.

The tea shop revenue model should be developed while considering rent, lease or mortgage payment assumptions to ensure a profitable business. Based on this model, the financial analysis of the TEA Business can be performed to project the profit projection of the tea shop.

A tea shop financial statement should be prepared which includes a tea shop income statement, a tea shop financial projection and a tea shop cash flow forecast to monitor financial performance.

Tips & Tricks:

- Research the location thoroughly before signing a lease or mortgage agreement.

- Plan your finances properly and set aside enough funds to cover the rent, lease, or mortgage payment for the store space.

- Consider negotiating with the landlord for a lower rent or longer rental period to reduce expenses.

- Periodically reassess the tea shop’s revenue model and adjust rent, lease, or mortgage payment assumptions accordingly.

tea shop utilities

When creating a financial plan for a teahouse, it is important to consider the various utilities and costs associated with running the business. These include rent, electricity, water, gas and internet, among others.

For example, if the tea business financial planning revealed that rent is one of the most important expenses, you can consider opening your tea shop in a less expensive location. Similarly, you can try to reduce electricity costs by switching to more energy-efficient light bulbs or appliances.

The tea shop cash flow forecast can help you better understand how much you can afford to spend on utilities each month. By projecting your tea shop’s revenue model and estimating expenses, you can see how much money you will have for other needs.

It is important to keep these utility costs in mind when creating tea shop financial statements and tracking your expenses in order to understand the financial performance of your tea shop. By doing so, you can avoid overspending on utilities and ensure your tea shop remains profitable in the long run.

Tips and tricks

- Try to negotiate a lower rent with your landlord.

- Switch to energy efficient appliances to save on electricity costs.

- Consider using a programmable thermostat to save on heating and cooling costs.

- Regularly track your utility costs to identify areas where you can make reductions.

Tea shop other running costs

Apart from basic expenses such as rent, utilities, and employee salaries, there are some other running costs that need to be considered when building a financial model for a tea shop. These other costs include:

- Inventory costs: This includes purchasing tea leaves, herbs, and spices for the store, as well as packing materials.

- Marketing costs: This involves promoting the store through advertisements, flyers or social media campaigns.

- Equipment Costs: This covers the purchase and maintenance of cafe equipment such as coffee machines, tea brewers and water filters.

It is important to factor these costs into your tea shop’s financial plan, as they can significantly affect your tea shop profit projection . By doing so, you can better estimate your tea shop revenue model and keep track of your tea shop financial performance . Additionally, creating a Tea Shop Cash Flow Forecast and Tea Shop Income Statement can help ensure that you have a solid tea business financial plan .

Tea shop financial forecast

As a crucial part of the tea shop’s financial model, the financial forecast provides valuable information about the expected financial performance of the business. This includes an in-depth analysis of revenues, costs, expenses, profits and cash flow over a specific period. The forecast shows the statement of expected profits and losses, sources and uses of the fund report. The financial forecasting process implements tea shop financial planning and helps business owners develop a plan and make informed decisions based on the tea shop’s financial projection.

Tea shop profitability

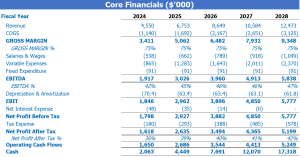

Once we have built Revenue and Expense Projections , we can check the profit and loss (P&L) from revenue to net profit. This will help you visualize “profitability” such as gross profit or EBITDA margin.

For a tea shop, the revenue statement will include revenue from sales of tea, food products and other retail items. Expenses will include rent, employee salaries, inventory costs and other operating costs. By subtracting expenses from income, we can calculate net profit projection .

Tips & Tricks:

- Create multiple scenarios for revenue and expense projections to assess profitability under different circumstances.

- Consider the impact of seasonal fluctuations on income and expenses.

- Regularly monitor financial performance to stay on top of profitability and make necessary adjustments.

With a clear understanding of tea shop financial performance , we can develop a financial plan that identifies opportunities for growth and optimizes operations for long-term success.

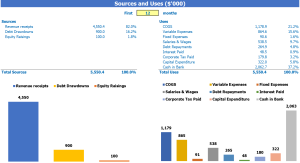

Sources and use of the tea shop and use

The Sources and Uses of Funds in Excel’s Financial Model for Tea Store provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When creating a tea theater financial plan, one should include a tea shop revenue model, tea business financial analysis, tea shop profit projection, tea shop financial statements , a Tea Shop Cash Flow Forecast, a Tea Financial Planning, a Tea Shop Income Statement and a Tea Shop Financial Projection. By having these key financial documents in place, you will be able to closely monitor your tea shop’s financial performance and easily make adjustments to your business operations.

Tips & Tricks

- Research current tea industry trends and consumer preferences to better understand market demand

- Offer unique tea blends to separate from competitors

- Partner with local bakeries to offer a variety of tea accompaniments

- Monitor inventory levels closely to avoid overstocking or inventory

With a detailed financial plan in place and strategic business decisions, your tea shop can effectively generate revenue and provide a quality customer experience in the competitive tea market.

Building a financial model for a tea shop is a crucial step in ensuring the success of your business. From developing a tea shop financial plan to estimating your tea shop revenue model , tea business financial analysis and projecting your tea shop profit projection , a well-designed tea shop financial statement can help you. help make informed decisions that set your tea shop up for financial success. Plus, a carefully crafted Tea Shop Cash Flow Forecast is an essential tool for making important financial decisions, like investing in new equipment, expanding your store, or hiring additional employees. Armed with a solid Tea Business Financial Planning Strategy, your tea shop’s income statement can also help measure your financial performance and identify key areas for improvement. By following these steps and creating a complete Tea Shop Financial Projection , you are well on your way to creating a sustainable and successful business.