- Home

- Sales and revenue

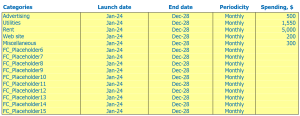

- Running costs

- Financial

Welcome to our comprehensive guide on how to build a financial model for a confectionery store. Running a successful confectionery shop requires passion, dedication and a good financial plan. A financial plan is an essential tool for any entrepreneur looking to start a business or expand an existing one. It helps ensure your business is operating profitably and lays out a clear roadmap for achieving your financial goals. In this guide, we will provide you with a comprehensive breakdown of key financials for a confectionery business plan, including revenue models, financial projections, income statements, cash flow forecasts, profit statements and loss, evilance analysis and financial planning and financial planning . Read on to learn more about building a robust financial model for your confectionery store.

Confectionery figures and sales forecasts

One of the most crucial aspects of any financial confectionery business plan is revenue forecasting. The revenue model of a confectionery shop is highly dependent on several factors such as launch date, ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, seasonality of sales, etc. Various financial projections for confectionery, confectionery store Financial analysis and financial feasibility of confectionery

Launch date of the confectionery workshop

The launch date of your confectionery shop is very important for its success. It can have a significant impact on your confectionery’s financial analysis and projections. You should consider various factors such as market demand, competition, and the financial feasibility of your confectionery shop before finalizing the launch date.

The confectionery shop financial model template provides information about the month the business was started and you can choose the date when your business starts and operates. Suppose you plan to launch your business in the middle of the year while the financial model begins in January. In this case, you need to prepare and plan all the activities and costs related to the launch of the activities of the confectionery workshop.

Tips & Tricks:

- Study the market demand and competition before finalizing the launch date to succeed in the business market.

- Be sure to consider financial projections and feasibility reports before deciding on a launch date.

- Prepare a detailed plan and schedule all activities and costs related to your business launch in advance for a smoother process.

Considering these factors and carefully planning the launch date can significantly affect the success and financial planning of your confectionery.

Confectionery Workshop Ramp Up Time

Sales forecasting is an essential part of a confectionery business plan. A crucial factor to consider is the ramp-up time of the sales plateau. This is the time it takes for a new store to reach a point where sales begin to stabilize. The ramp-up period is essential to anticipate because it has a direct impact on the financial projections for the confectionery and the financial feasibility of the confectionery.

The ramp-up period for a confectionery shop depends on various factors such as location, marketing, and competition. In your industry, it may take three to six months to reach sales plateau.

Tips & Tricks:

- Choose the right location that is visible and accessible to customers

- Invest in effective marketing strategies, such as social media advertising and collaborations with local businesses

- Offer unique and quality confectionery items to stand out from competitors

- Analyze and adjust pricing strategies based on market feedback and demand

The financial analysis of the confectionery store requires an in-depth understanding of the financial projections of the confectionery. The income statement, cash flow forecast, profit and loss, and break-even analysis are crucial elements to consider in the financial planning of the confectionery workshop.

CONFICATION CONFICATION WACK-IN FIELD ENTRIES

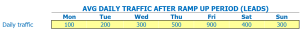

After the ramp-up period, the average daily traffic in the confectionery store is 300 visitors on weekdays and 500 on weekends. To build a financial model for the store, this assumption is essential in order to estimate expected revenues. Average weekly traffic fluctuates throughout the weekdays, with Monday being the slowest day with just 200 visitors and Friday being the busiest with 350 visitors.

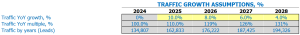

Considering historical data and market trends, the average traffic growth factor in traffic is estimated at 5% per year over the next five years. This means that by the end of year five, daily traffic will be over 400 visitors on weekdays and 600 on weekends.

Tips & Tricks

- Conduct market research and collect foot traffic data in the area.

- Analyze historical data and trends to estimate future growth.

- Consider seasonality and holidays when projecting future traffic.

Using daily inputs, financial projections for the confectionery shop, including income statement, cash flow forecast, profit and loss loss, break-even analysis, and revenue analysis. financial feasibility can be estimated. These projections will help determine the financial viability of the confectionery’s business plan and allow the shop to plan for future growth accordingly.

Visits to the confectionery workshop for sales conversion and sales inputs

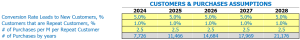

When analyzing the financial feasibility of a confectionery shop, it is important to consider store visits to sales conversion rate and percentage of repeat customers. A high conversion rate and repeat business can have a significant impact on the store’s revenue model.

For example, let’s say the confectionery shop gets 100 visitors a day, which has resulted in an average of 20 new customers each day. This means that the store’s sales conversion rate is 20%. Now suppose that 30% of these new customers become repeat customers, buying on average three times a month. That would equate to 18 repeat sales per day, or 540 repeat sales per month.

In terms of building a financial model for the confectionery store, it is crucial to consider these assumptions. By knowing the conversion rate and percentage of repeat customers, the income statement, cash flow forecast, profit and loss, and break-even analysis can be projected more accurately.

Tips & Tricks

- Offer loyalty programs or discounts to incentivize repeat sales

- Track customer behavior and feedback to improve conversion rate

- Invest in marketing and advertising to increase awareness and attract new customers

Confictiony Shop Sales Mix Intarts

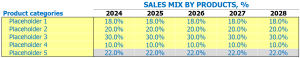

In our confectionery shop, we offer a variety of products, each belonging to a specific product category. To better understand our sales mix, we entered sales mix assumptions on the product category leverage.

For example, our product categories include chocolate, candies, pastries, ice cream and beverages. We assume chocolate will contribute 40% of our total sales, Candy will contribute 25%, baked goods 15%, ice cream 10% and beverages 10% of our total sales.

When entering sales mix assumptions, it is important to consider historical sales data, consumer trends, and market research. By doing so, we can accurately project our sales mix for the next five years.

For our financial projections for the confectionery store, we estimate that our total annual revenues will increase by 10% each year. With this assumption, we expect our chocolate category to earn 0,000 in year one and grow to 1,051 in year five. Our candy category will start at ,500 and grow to 0,658. Our baked goods category will start at ,500 and grow to ,394. Our ice cream category will start at ,000 and grow to ,263, and our beverage category will start at ,000 and grow to ,263 in five years.

Tips & Tricks

- Be sure to base your sales mix assumptions on historical sales data and market research

- Consider consumer trends when projecting sales for the blend for the next five years

- Regularly review your sales mix assumptions and adjust accordingly

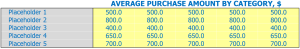

Confectionery Shop Means of Selling Sale Entrees

When doing financial planning for your confectionery business, it is important to consider the average sales amount for each product category. Although your store may sell many different confectionery products, each product belongs to a specific product category. By entering the assumptions at the product category level rather than the product level, it becomes much easier to estimate the average ticket size.

For example, suppose your confectionery has three product categories: candies, chocolates, and pastries. You can estimate that your store will sell ,000 worth of candy in the first year, with an average sale amount of per candy. For chocolates, you can estimate ,000 in sales at an average sales amount of per chocolate. Finally, baked goods can bring in ,000 in sales at an average sale amount of per baked good.

Using the sale mix and average sale amount of each product category, the model will then calculate an average ticket size. For example, if your store sells 20% candies, 30% chocolates, and 50% baked goods, your average ticket size would be .80. This calculation is found by aggregating the average sale price of each product category based on its sales mix.

Tips & Tricks:

- Regularly review and update your assumptions for average sale amount and sales mix to accurately reflect changes in the market and demand for your products.

- Consider bundling products to increase average ticket size and boost sales.

- Offering promotions and discounts can also influence the average ticket size and drive traffic to your store.

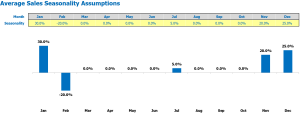

Confectionery store sales seasonality

When planning your confectionery business, it’s important to keep in mind the seasonal nature of sales. Seasonality refers to the fluctuation in sales volume throughout the calendar year. It is important to anticipate these fluctuations and adjust your business plan accordingly.

In the confectionery industry, sales tend to be higher during certain holidays such as Valentine’s Day, Easter, Halloween and Christmas. However, sales may dip during the summer months when people focus more on outdoor activities and may not be as interested in buying sweet treats.

It’s important to use historical sales data to make informed decisions about how to adjust your business operations to meet the demands of the season. Here are some tips and tricks:

Tips & Tricks:

- Offer seasonal specials and promotions to boost sales during slow times.

- Adjust inventory and staff levels to align with seasonal fluctuations.

- Consider expanding your product line to meet seasonal trends.

By considering your confectionery shop’s financial projections and analyzing the financial feasibility, you can create a solid financial plan that includes a confectionery shop income statement, cash flow forecast, profit statement and losses, and a break-even analysis that takes seasonal factors into account.

Forecast of operational expenses of the confectionery workshop

One of the critical parts of creating a confectionery shop financial model is forecasting operational expenses. As the owner of a confectionery shop, you need to know what the operating expenses are and how much they cost each month. Major operating expenses include cost of goods sold by products %, salaries and wages of employees, rent, lease or mortgage payment, utilities, and other operating expenses.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | 0 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,500 – ,000 |

By forecasting confectionery shop operational expenses, you will have a better understanding of your monthly expenses and be able to make informed financial planning decisions.

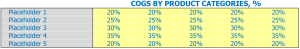

Confectionery Cost Cost of Goods Sold

Cost of Goods Sold (COG) refers to the cost of producing goods sold by a business. In the confectionery store, COGS includes the cost of all raw materials and direct labor used to create the candies, candies, and pastries sold in the store. Assumptions for COGs include:

- The COG percentage for different product categories may vary. For example, COGs for chocolates may be higher due to the cost of premium ingredients, while reels for bulk candy may be lower due to larger quantities purchased at a reduced price.

- Keep track of COGs on a regular basis to identify any cost reduction opportunities and adjust pricing accordingly.

Tips & Tricks

COGS is an important metric for calculating the company’s gross margin. To ensure financial feasibility, the COG percentage should be kept as low as possible. Financial projections for confectionery should include:

- Confectionery store financial analysis

- Confectionery Shop Revenue Model

- Confectionery business plan

- Declaration of the results of the confectionery workshop

- Candy Shop Cash Flow Forecast

- Declaration of profit and loss of the confectionery workshop

- Confectionery Workshop Break-Even Analysis

- Financial planning of the confectionery workshop

By keeping COGs in check and accurately projecting finances, the confectionery shop can improve profitability and continue to grow over time.

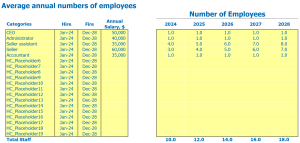

Salaries and wages of confectionery employees

When planning your confectionery store’s finances, an important aspect to consider is wages and salaries of employees. In order to make realistic financial projections for your confectionery store , it is crucial to have a clear understanding of how many employees you need and how much you need to pay them.

When it comes to naming your staff members/positions, you can choose to go with traditional titles like manager, shift supervisor, or cashier. However, you can also get creative and choose names that reflect your candy theme, like candy curator or sweetie specialist.

In terms of salaries, you can use industry standards as a starting point. For example, a manager might earn an average of ,000 per year, while a shift supervisor might earn around ,000. A cashier might earn around ,000 a year.

It’s also important to consider how many full-time equivalent (FTE) staff you need each year. This will depend on factors such as the size of your store, the number of customers you anticipate, and the variety of products you sell. For a small confectionery store, you may only need 1-2 ETCs, while a larger store may require 5-6 or more.

Tips & Tricks

- Consider offering bonuses or incentives for outstanding performance to motivate your staff.

- Remember to factor in the cost of benefits (e.g. health insurance, vacation pay) when calculating salaries and wages.

- Outsource certain tasks (such as accounting or cleaning) rather than hiring additional employees to save costs.

Confectionery lease, lease or mortgage payment

When it comes to starting a candy store, one of the biggest expenses you face is the cost of your physical storefront. You will need to decide if you want to rent, lease or buy space to run your business.

If you choose to rent a space, you will pay your landlord a fixed amount of money each month to use the space. This is a good option if you don’t have a lot of initial capital to buy a property.

If you choose to rent a space, you will sign a contract with the landlord to rent the space for a set time, usually a few years. This can be a good option if you want more stability than a rental agreement but don’t want to commit to a full mortgage.

If you choose to take out a mortgage to buy a property, you will take out a loan to buy the property. This means that you own the property, but you will also be responsible for all maintenance and repairs.

Tips & Tricks:

- Be sure to consider additional expenses such as property taxes, insurance, and maintenance when making your decision on whether to rent, lease, or buy a space.

- Consider speaking with a financial consultant or accountant to help you make the best decision for your business.

- Research the local real estate market to get an idea of average commercial property prices in your area.

Whichever option you choose, it is important to carefully consider the financial implications of your decision. Analyzing your confectionery shop finances, such as your confectionery revenue model, confectionery store financial analysis, confectionery shop financial feasibility, and financial projections for confectionery, can help you to make an informed decision.

Create financial documents such as confectionery shop income statement, confectionery cash flow forecast, confectionery profit and loss statement and confectionery shop analysis to get an idea the costs and revenues that your business will generate.

Financial planning is key to the success of any business, so be sure to take the time to carefully calculate your expected expenses and income before making any decisions about your storefront.

Confectionery utilities

Utilities are one of the most critical aspects of running a confectionery store. The most important utility assumptions are electricity, gas, and water bills. Electricity is needed to power machinery, refrigerators and lighting.

Gas is mainly used for cooking items in the kitchen, while water is needed for cleaning and other activities. Utility projections should be based on expected usage and historical data. For example, if ,000 a month is needed on utilities, future projections should reflect that amount.

Tips & Tricks:

- Use energy efficient light bulbs to reduce electricity costs

- Take advantage of off-peak hours to perform tasks that consume a lot of electricity

- Install low-flow faucets and toilets to reduce water consumption

Confectionery shop Other running costs

In addition to the direct costs associated with ingredients and labor, there are other expenses that need to be accounted for in your Confectionery Financial Model. These include rent, utilities, marketing costs, and other expenses such as packaging, equipment maintenance, and insurance.

Rent is a fixed cost that must be considered when calculating the Confectionery Shop Revenue Model. Depending on the location and size of your store, this expense could have a significant impact on your profit margins. Utilities such as electricity and water are also costs that should be accounted for when creating financial projections for your confectionery shop.

Marketing costs such as advertising, promotions, and social media are essential to generating revenue for your confectionery business plan, but they are also a significant cost to your overall expenses. Other miscellaneous expenses such as equipment maintenance, packaging, and insurance should also be considered when developing your financial feasibility of a confectionery workshop.

It is important to understand all of the costs associated with running a confectionery store and factor them into your Confectionery Store Financial Analysis. Otherwise, you may underestimate your costs, leading to inaccurate financial projections and financial planning.

Be sure to include all of these Profit and Loss Statement of Confectionery Shop Expenses in your financial model to ensure that you have a complete view of your projected costs and revenues. Additionally, consider running a Confectionery Shop Break-even Analysis to determine how much revenue you need to generate to cover your costs and make a profit.

By factoring in direct and indirect expenses, you can create a Confectionery Shop Cash Flow Forecast that accurately reflects your financial situation and helps guide your business decisions.

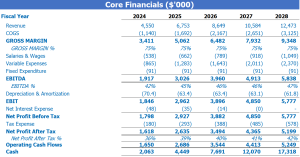

Financial forecast of the confectionery workshop

Financial forecasting plays a crucial role in driving the success of a confectionery store. A profit and loss statement, sources and uses of the report, cash flow forecasts, and break-even analysis are some of the key confectionery shop financial projections that can help owners make informed decisions. By conducting a confectionery shop financial feasibility, owners can assess the overall financial analysis and create a well-defined financial planning structure.

The profitability of the confectionery workshop

Once we’ve built the financial projections for our confectionery business plan, it’s important to take a look at the Income Statement to assess financial feasibility . We want to make sure that our revenue model generates enough revenue to cover our expenses and make a profitable Confectionery Store Financial Analysis .

The revenue statement is an important tool to see how much money our confectionery store is making and where we are spending the most. We can analyze the confectionery store cash flow forecast to identify any potential financial issues and make any necessary adjustments.

The financial planning aspects of running a confectionery business include assessing Gross Profit or EBITDA Margin , which will give us a better understanding of our Candy Shop Break-Even Point Analysis .

Tips and tricks

- Regularly review your financial statements to identify trends and areas for improvement.

- Consider offering special offers or promotions during slow times to increase revenue.

- Reduce expenses by negotiating better agreements with suppliers or reducing unnecessary costs.

Overall, it is important to regularly monitor and evaluate the financial projections for the Candy Shop to ensure that we are maximizing our Candy Shop revenue model and maintain profitability.

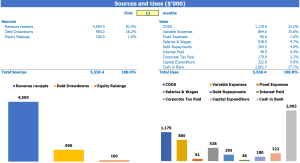

Sources and use of the confectionery workshop

The Sources and Uses of Funds in the Financial Model in Excel for Confectionery provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses.

It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks:

- Regularly review and update your sources and use a statement to ensure accuracy

- Consider the impact of economic fluctuations on your sources and uses reporting

- Include a contingency plan for unexpected expenses or delays in funding

In conclusion , building a financial model for a confectionery shop is crucial for any entrepreneur who wants to run a profitable business. With a detailed confectionery business plan , you can make informed decisions and create a viable confectionery shop revenue model . Confectionery Shop financial projections help assess the financial feasibility of your business idea. A Confectionery Store Financial Analysis will give you insight into your finances and ensure profitability. With a Confectionery Shop Results Statement , you can track your expenses, income, and net profit. A Candy Shop Cash Flow Forecast will help you manage your finances and avoid cash flow problems. A Candy Shop Profit and Loss Statement provides insight into the financial health of your business, while a Candy Shop Breakeven Point Analysis helps you determine the minimum revenue you need to break. Finally, financial planning of the confectionery workshop is the key to long-term business success.