- Home

- Sales and revenue

- Running costs

- Financial

As a vital aspect of any business, finance plays a vital role in the success of a supermarket. Financial modeling is the process of creating a representation of a real-world financial situation, and it is an essential part of financial planning, analysis, and supermarket management. By building a Supermarket Financial Model , you can analyze and forecast the financial performance of your business, helping you make informed decisions and stay competitive in the industry. In this blog post, we will discuss everything you need to know about building a financial model for a supermarket, including revenue and profit models, financial planning, forecasting, reporting, management, strategies and projections.

Supermarket revenue and sales forecast

The supermarket revenue model relies heavily on its sales forecast. It helps define supermarket profit model and financial planning. Sales forecasts are essential for financial analysis, management and performance measurement.

Supermarket financial statements are an important aspect that guides financial management and planning. Prior to launch, a supermarket should consider ramp-up time, walk-in traffic, and growth assumptions. They should also estimate typical customer behavior and purchase assumptions.

Sales seasonality is another factor that affects supermarket sales. For example, sales of different foods can fluctuate depending on the season. Thus, it is crucial to have a detailed and accurate sales forecast when developing a financial strategy and supermarket projection.

Supermarket launch date

Starting a supermarket business is an exciting time. It represents the culmination of months if not years of planning and hard work. In the supermarket industry, choosing the right launch date is critical to business success.

Supermarket financial planning requires attention to detail, and this extends to choosing a date for the launch. The launch date determines many things for a supermarket business, including the amount of buzz that can be generated in the market, the cost of marketing and advertising, and the potential for a strong launch period.

If the launch date is set at a time when other competing companies are also launching, it can be difficult to stand out from the crowd. Conversely, if the launch date is set at a time when customer demand is low, it may be difficult to generate the initial sales needed to get the business up and running.

Tips & Tricks:

- Supermarket Financial Forecast The software can help you determine the best launch date by analyzing market trends and potential demand.

- Consider conducting a launch or preview opening to generate buzz and test the market before the official launch.

- Coordinate with marketing and publicity teams to ensure maximum exposure and impact around launch date.

- Keep an eye on competitor launch dates to avoid scheduling conflicts.

Overall, choosing the right launch date is an essential part of supermarket financial management and can have a significant impact on the success of the business. Considering market trends, customer demand, and competition can help you make an informed decision on the ideal launch date for your supermarket business.

With a solid launch date in place, you can move forward with Supermarket Financial Projection , financial analysis and the implementation of a sound Supermarket Financial Strategy to ensure that your business financial performance is strong and consistent.

Supermarket ramp-up time

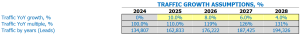

When forecasting sales, it is important to consider the ramp-up time to the sales plateau. This means the time it takes for a new supermarket to reach its maximum sales potential. Failure to consider ramp-up time could lead to financial forecasting issues later.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In your industry, it may be three to six months. However, it is important to consider various factors, such as location, competition, and market demand to determine an accurate ramp-up time for your specific supermarket.

Tips & Tricks:

- Conduct market research to fully understand the market dynamics of your location.

- Identify your competition and understand their strengths and weaknesses.

- Set realistic expectations for your financial forecast by considering seasonal trends and other factors that can impact sales.

By understanding ramp-up time, your supermarket can better plan and project its financial performance. Effective financial analysis, management and planning can result in a profitable financial strategy and revenue model for your business.

Walk-in traffic entries

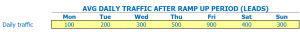

After the ramp-up period, which can last several weeks, it is essential to analyze and understand the average daily traffic of daily visitors on weekdays. This information is crucial for building a reliable supermarket revenue model and financial statements .

Daily walk-in supermarket traffic is highly dependent on weekdays. For example, Friday and Saturday are known to be the busiest days when traffic is significantly higher compared to Tuesday or Wednesday. Sales still flatten out on weekdays, as the number of customers is much lower.

Let’s say you plan to open a new supermarket on a particular street. You have been advised by the local council that the average daily weekday appointments over the previous year were 1000. However, traffic has increased by an average of 5% each year for the past five years.

The data provided allows you to make a future estimate of walk-in traffic for the next five years on weekdays. These inputs can be used to build a financial forecast through financial analysis , financial planning , and financial projection .

Tips & Tricks

- Be sure to analyze various time periods for a more accurate estimate of visitor traffic.

- If you are moving the store to a new location, consider analyzing the new location’s foot traffic before making a decision.

- Understand visitor demographics – this could have a significant impact on sales and sales projections.

Supermarket visits in sales conversion and sales inputs

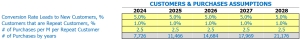

When considering a supermarket revenue model, an important factor to consider is the conversion rate from visitors to new customers. On average, a supermarket can expect to convert around 30% of visitors to new customers.

The next factor to consider is the percentage of repeat customers. Repeat customers are essential to maintain a stable source of income. Supermarkets can expect a repeat customer rate of around 40%. This means that 40% of all customers will return for additional purchases.

Each repeat customer will have an average of three purchases per month, representing approximately 60% of total monthly sales. This is a critical assumption when building a financial model for a supermarket. Accurately forecasting repeat purchases helps ensure that financial planning and forecasting is accurate and precise.

Tips & Tricks

- Offering loyalty programs, discounts or incentives to repeat customers can help increase customer rates.

INPETATIONS TO SELL OF SALES OF SUPERMARKET

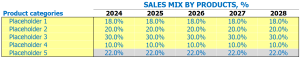

Your supermarket store sells a variety of supermarket products, and each product belongs to a specific product category. In order to make financial projections, you must enter the sales mix assumption at the product category level. This will make it easier to understand how each product category contributes to your overall sales.

Consider an example of a supermarket that sells five product categories, such as:

- grocery stores

- Fresh products

- Meat and poultry

- Dairy products

- Bakery items

Now suppose that for the next five years, you have projected a percentage sales mix for each category as follows:

- Groceries: 40%, 38%, 36%, 34%, 32%

- Fresh products: 20%, 22%, 24%, 26%, 28%

- Meat and poultry: 15%, 16%, 17%, 18%, 19%

- Dairy products: 15%, 14%, 13%, 12%, 11%

- Bakery items: 10%, 10%, 10%, 10%, 10%

Tips & Tricks:

- Regularly review your sales mix assumptions and adjust accordingly based on market trends and customer preferences.

- Use historical sales data to validate your projections and make informed decisions.

- Consider factors such as seasonality and promotional activities when entering sales mix assumptions.

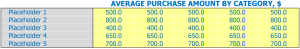

Average supermarkets with average entrance sales

Suppose your supermarket sells various products categorized as produce, bakery, meat, dairy, and non-food. Rather than estimating the average sale amount for each product individually, it is easier to calculate it at the product category level. For example, average sale amount for all products, average sale amount for all bakery items, etc.

For example, if the average sale amount per item in the product category for the first year is .00 and for the second year is .10, the system will associate these numbers with the product category. This assumption will then be used to estimate the average ticket size based on the mix of sales for each category.

The average sale amount of each product category is determined, then using the combination of sale and the average sale amount of each product category in the calculation, the model will calculate the average ticket size. This average ticket size estimate will be helpful in determining the revenue model and projected revenue.

Tips & Tricks:

- Use historical data to generate assumptions for your average sales amount by product category to help with forecasting.

- Recognize that each product category will have its unique attributes that will quantify it.

The average sale amount is a crucial input in calculating the average ticket size for the supermarket’s revenue and profit models. Accordingly, in-depth financial analysis, planning and forecasting is required to optimize management, performance, strategy, reporting and projections.

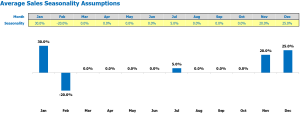

Seasonality of supermarket sales

When analyzing supermarket financial performance , one of the factors to consider is sales seasonality . This refers to the fluctuation in sales over a calendar year.

Certain assumptions must be made regarding seasonal factors. For example, during the holidays, sales tend to increase significantly, while during the summer months, sales tend to decrease slightly. Supermarket financial forecasts Must take these trends into account in order to accurately predict sales.

When preparing a sales seasonality model, it is important to establish monthly average sales per day. This number can then be used as a reference to calculate seasonal changes. For example, in December, sales could increase by 150% compared to the monthly average, while in July, sales may decrease by 10%.

Tips & Tricks:

- Look at historical sales data to see what seasonal trends exist

- Don’t forget to consider local events that could impact sales

- Consider creating a separate sales seasonality model for different store locations

By understanding the impact of seasonality on sales, supermarket financials , you can plan and manage your store’s finances more effectively. Whether adjusting inventory levels or creating targeted marketing campaigns, having a solid understanding of sales seasonality is key to maximizing profits and achieving long-term success.

Supermarket operating expenses forecast

Operational expense forecasts are an essential part of the supermarket financial model . It includes estimating various operating expenses that a supermarket will incur in its daily operations. These expenses include the cost of goods sold by the products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating expenses. An accurate forecast of operational expenses will help create a stronger financial model for a supermarket.

| Operating Expenses | Amount (per month) USD |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | ,000 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | 0,000 – 3,000 |

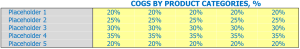

Supermarket cost of goods sold

Supermarket financial analysis involves calculating the cost of goods sold (COG) for various products. COGS is the cost incurred in producing and selling a product. It includes the cost of raw materials, labor, overhead, and packaging used in the production process.

COG assumptions vary by product category. For example, the cogs for fruits and vegetables are between 16 and 22 percent, while the cogs for dairy are between 60 and 70 percent. Supermarkets must track COGs for each product category to determine overall profitability.

Tips & Tricks

- Track COGs regularly to make better financial projections and forecasts.

- Reduce the COGS percentage by buying in bulk or acquiring products at a lower price.

- Implement effective inventory management to reduce waste and reduce COGs.

Supermarkets need to analyze COGs to make good financial decisions. It helps in developing financial strategy, planning and forecasting financial performance of supermarkets.

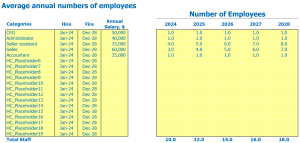

Salaries and wages of supermarket employees

In a financial analysis of the supermarket , one of the key factors to consider is the amount of money that will be spent on wages and salaries of employees . When making assumptions about this cost, it is important to consider the different positions that will be needed and when they will be hired.

For example, when planning a new supermarket, there will be a need for a store manager, cashiers, interns and cleaning staff. Each of these positions will have a different salary range, and it is important to determine the number of people needed in each category to ensure appropriate coverage.

When it comes to naming staff members, it is essential to use clear titles that correctly represent their roles. For example, instead of using generic terms like “employee” or “clerk”, more specific titles like “cashier” or “store manager” should be used to avoid confusion.

When creating the salaries and wages budget, it is important to keep in mind how much revenue the supermarket is expected to generate, as this will heavily influence the number of staff that can be hired. Additionally, deciding how many of each person/category per month or per year and how many full-time equivalent (FTE) staff will be needed are also crucial parts of creating an accurate budget.

Tips & Tricks:

- Use specific job titles to avoid confusion in your budget

- Consider the supermarket’s expected revenue to accurately determine the number of staff that can be hired

- Create a clear plan for how much each person/category should make per year and how many ETT staff will be needed to ensure proper coverage

Supermarket rent, rental or mortgage payment

In Supermarket Financial Analysis , it is important to consider rent, lease, or mortgage payment assumptions. These are vital expenses and can have a huge impact on a supermarket revenue model .

Rent is a fixed monthly cost paid by the supermarket to the owner. It is important that supermarkets determine a rent cost that does not exceed their Supermarket Profit Model . Additionally, it is necessary to include rent escalation clauses in the rental agreement to maintain supermarket financial planning and forecasting.

Rental Payments are similar to rent, but are generally long-term agreements ranging from 3 to 20 years. This can be beneficial for supermarkets to maintain a fixed cost for a longer period, which is important for supermarket financial management . However, it is necessary to periodically review the rental agreement to ensure that the rent is still competitive in the market.

Mortgage Payments are visible in supermarkets that own their buildings. The payment of a mortgage provides an opportunity to increase the financial performance of supermarkets as it builds equity. However, it is necessary to assess the interest rate and the monthly payments, to ensure that they are in line with the supermarkets financial strategy and do not exceed the supermarkets financial projection .

Tips & Tricks:

- Before signing a lease or buying a property, it is necessary to examine the locations with the highest foot traffic.

- Consider negotiating with the landlord for rent or lease payments to ensure they are affordable and competitive.

- Keep track of your expenses and allocate a budget for rental costs Supermarket financial statements .

Supermarket utilities

Utilities are the basic assumptions on which a supermarket’s financial model is built. They are important because they determine the financial performance of the supermarket. Examples of utility assumptions include revenue model, profit model, financial analysis, planning, forecasting, reporting, management, performance, strategy, and projection.

The revenue model is the amount of money the supermarket receives from sales. The profit model is the difference between income and expenses. Financial analysis is the process of evaluating the financial performance of the supermarket. Financial planning is the determination of how the supermarket will use its resources to achieve its financial goals. The financial forecast is the estimate of the future financial performance of the supermarket. Financial statements are a document that shows the financial performance of the supermarket. Financial management is the process of managing the financial resources of the supermarket. Financial performance is the measure of the supermarket’s ability to generate value for its stakeholders. The financial strategy is the plan by which the supermarket should achieve its financial goals. The financial projection is the estimate of the future financial performance of the supermarket.

Tips & Tricks

- Determine your supermarket’s revenue and profit models to ensure that you generate enough revenue and profit.

- Use financial analysis to determine your supermarket’s financial strengths and weaknesses.

- Create a financial plan that ensures your supermarket has enough resources to meet its financial goals.

- Use financial forecasts to estimate your supermarket’s future financial performance.

- Keep an eye on your financial statement to make sure your supermarket is doing well financially.

- Effectively manage your supermarket’s financial resources to maximize profitability.

- Create a financial strategy that aligns with your supermarket’s overall goals.

- Use a financial projection to plan for the future and ensure your supermarket is on track to meet its financial goals.

Supermarket other running costs

In addition to major expenses like rent, labor and inventory, supermarkets also incur a number of small other running costs . These costs can include utility bills, equipment repairs, marketing and advertising costs, and even office supplies. For example, a supermarket may need to spend money on flyers, business cards, and other promotional materials to promote a new product.

Other running costs can also include things like restocking shelves, hiring security personnel, and creating customer loyalty programs. Supermarkets may also need to hire professionals, such as accountants, to help with financial analysis and planning. Other running costs will vary depending on the size of the supermarket, its location and its target market.

It is important to include these other operating costs in any supermarket financial model to ensure that a business owner has a complete picture of the financial performance of the business. Understanding the various expenses that go into running a supermarket will help business owners financial projection of the supermarket , which can be used to make better strategic financial decisions.

Supermarket financial forecasts

Financial forecasting is an integral part of the supermarket financial model which predicts, estimates and analyzes the future financial performance of a supermarket. It involves developing a financial projection that includes a profit and loss statement, sources, and usage report. The financial projection is made based on historical data, industry trends and economic factors.

Supermarket profitability

Once we’ve built our income and expense projections, it’s time to move on to the profit and loss (P&L) statement. This will help us visualize supermarket profitability, such as our gross profit or EBITDA margin.

It is important to analyze our supermarket financial statements to verify our current and past financial performance. Supermarket financial analysis allows us to focus on key efficiency metrics, such as sales per employee or sales per square foot of retail space, which help assess where there is room for improvement.

Tips & Tricks:

- Be sure to regularly analyze your supermarket financial projection

- User supermarket Financial planning to adjust budget based on performance

- Check your gross margin to make sure it’s in line with industry standards and trends

Finally, we need to focus on the financial management of supermarkets. Good financial management can help you optimize your supermarket financial strategy, so you can achieve your long-term goals. By regularly monitoring your supermarket’s financial performance, you can adjust your supermarket revenue model and supermarket profit model accordingly.

Supermarket sources and use of the chart

The Sources and Uses of Funds in Financial Model in Excel for Supermarket provides users with an organized summary of where capital will come from sources and how that capital will be spent in the uses . It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is especially critical when the company is considering or going through a recapitalization, restructuring, or mergers and acquisitions (M&A) proceeding .

An analysis of the supermarket’s financial statements is important to ensure that the business is on the right track in terms of financial management, planning, forecasting and performance . It lays a foundation for various measures that the company can put in place to increase revenue and profit margin.

Tips & Tricks:

- Integrate the sources and uses of cash statements into your financial model for a complete overview of capital inflows and outflows.

- Regularly analyze your financial statements to track the financial progress of your business.

In conclusion, Building a financial model for your supermarket is key to ensuring its success and sustainability. By performing a thorough financial analysis, developing a financial strategy and plan, forecasting future financial performance, and creating financial projections and statements, you can gain a clear understanding of your supermarket’s revenue and profit patterns. This information will help you make informed decisions and take proactive steps to improve your supermarket’s financial performance over time.