- Using Data in FP&A to Make Financial Decisions

- Exploring the Complexities of Activity Based Budgeting

- Achieving Transparency with Bottom-Up Budgeting

- The Pros and Cons of Incremental Budgeting

- Try These 4 Methods to Simplify Capital Budgeting

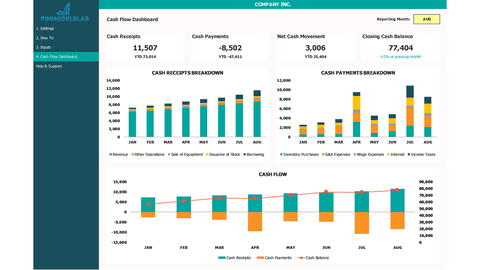

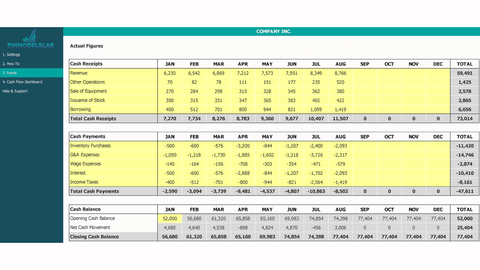

FinModels Lab has created a fancy but informative dashboard to visualize the strengths and weaknesses of your business by simply passing Annual Financial Performance Dashboard. A well-built template is designed for users without advanced Excel skills. Just enter the numbers in the appropriate cells and run the dashboard smoothly.

After reading this article, you should be Apple to learn:

- What are cash flows

- Cash flow components

- Cash flow preparation method

- Importance of cash flow

- Cash flow limits

- FREQUENTLY ASKED QUESTIONS

What are cash flows

Cash flow is the movement of money in the business in the form of inflows and the movements of the business in the form of outflows in a given period. Entries in the cash flow statement represent positive cash flows and expenditures of cash or cash equivalents represent the negative cash balance. Cash flows are made up of cash from operations or cash spent on operations, cash inflows from investments made or cash outflows on investments, and cash movements in financing items.

Cash flow components

The cash flow statement is based on three major segments:

- Cash flow from operations is the cash flow associated with the ordinary operations of the business. The ordinary operations of the company are based on sales and its operating expenses. This segment shows the long-term viability of the business. If the business has a positive cash flow from operations, the business is in a better position to repay its operating expenses. Operating cash flow plays a vital role in assessing the ability of the business to grow. It shows whether the company can grow with its own funds or it needs external funding to expand its operations.

- Investment Cash Flow shows the money used or cash generated by making investments during a specified period. Investing activities include buying long-lived assets, selling purchased assets, spending cash to acquire another business, or investing cash in marketable securities. This segment can result in positive cash flow or negative cash flow. Here, a point should be noted that negative cash flows from investment activity does not always indicate worse activity situations. This may be due to the investment made by the company for the long-term returns. There could be many items included in investing activities as the items vary with the nature of the business. Generally, changes in long-lived assets with respect to the last period, I belong to the investment activities other than the change in depreciation.

- Cash flows from financing are used to fund a business activity. The key elements in this segment are the injection of capital from the owners, the payment of capital return in the form of a dividend and the payment of any capital lease. Investors assess the corporate capital structure from this section.

Cash flow preparation method

There are two methods of preparing the cash flow statement. One is Direct Cash Flow and the other is the Indirect Method Cash Flow. In the direct method, cash instances are discretely accounted for whether it is received or spent. Operating cash flow is based on a list of incoming and outgoing cash, the rest of the segments are the same in both methods. Here is an example of a cash flow operating segment model based on the direct method:

Download Excel Monthly Cash Flow Template in Excel

|

ABC Restaurant |

||

|

Statement of Cash Flows ( Direct ) |

||

|

For the year ending June, 20xx |

||

|

Operation activities: |

||

|

Customer cash |

||

|

Sales revenue |

,000,000 |

|

|

Less: Cash paid for: |

||

|

Cost of Goods Sold |

$(23,000) |

|

|

Inventory |

,000 |

|

|

Accounts payable |

,000 |

|

|

Stationery |

$(75,000) |

|

|

Wages |

$(780,000) |

|

|

Interests |

$(15,000) |

|

|

Tax expenditures |

$(65,000) |

$(916,000) |

|

Net cash from operating activities |

,084,000 |

|

While in the indirect method accounting line items are taken into consideration to calculate the cash inflow or outflow. It is a reconciliation of net income at a cash point. The indirect method is followed by many companies and financial statement users. The indirect method is used during financial modeling. Here is an example of the operating segment of cash flow produced on an indirect approach:

Download Annual Cash Flow from Indirect Method to Excel

|

ABC Restaurant |

|||

|

Statement of cash flows ( indirect ) |

|||

|

For the year ending June 30, 20xx |

|||

|

Operation activities: |

|||

|

Net revenue |

,700,000 |

||

|

Deduct non-monetary impacts: |

|||

|

Depreciation |

,000 |

||

|

Gain from restaurant sale |

$(1,753,000) |

||

|

Inventory |

,000 |

||

|

Accounts payable |

,000 |

||

|

Stationery |

$(75,000) |

||

|

Wages |

$(780,000) |

||

|

Interests |

$(15,000) |

||

|

Tax expenditures |

$(65,000) |

$(2,616,000) |

|

|

Net cash from operating activities |

,084,000 |

||

Because it is obvious that the two approaches end in the same balance but the method to reach this balance is different. For financial modeling, the indirect approach is used to produce cash flow account.

IMPORTANT NOTE: Check out our detailed article on Financial Statements. You can also try our 13 exciting Free Excel Templates Showing Monthly/Yearly Cash Flow Using Direct/Indirect Methods and Cash Flow Projection at a discount. You can also try Cash Flow Dashboard Designed in Excel and Google Spread Spread. Here you just need to enter the data in the yellow cells and see the closing balances with well-built charts.

Download the Excel template! Learn even more ⟶

Importance of cash flow

Cash flow account is an integral part of all financial statements. Here are the key factors that make cash flow statement an essential part of financial statements:

- A company’s liquidity is assessed by a cash flow statement. In the operating segment, a company knows exactly how much money it has for operating. It helps in making decisions as to what a business can afford and what not.

- Movement in financial statement items e. Assets, liabilities and equity are shown on the cash statement as cash inflows, outflows or cash held. These main elements are used to manage the performance of a company and play a fundamental role in the accounting of the company. Cash flow allows us to see the movement of cash in these items.

- Prediction of future cash flows to make long term business plans, Projection of future cash flows is an integral part. Cash Flow Statement Allows the business to predict its future cash flows so that they can decide on the liquidity of a business in the future.

- Assist in planning and budgeting As the cash flow statement helps in financial planning and analysis. Upper level management uses cash flow analysis to properly coordinate financial operations. Cash management and budgeting is done on the basis of cash statements. Management prepares an estimate of various cash inflows and outflows so that they can prepare a future budget.

It is also pertinent to mention here that business leaders use cash flow forecasts to assess the in-activity hypothesis because cash is considered king and the more the business can generate or hold, the more the business will have lasting effects.

Cash flow limits

A cash flow statement despite many benefits has certain limitations. Here are some key limitations of cash flow statements:

- The cash flow account only considers cash income and does not present the total net income of a business. It ignores income resulting from non-monetary transactions. The net profit is correctly taken into account in the income statement.

- In real-world scenarios, the standalone cash flow statement cannot be used as a measurement tool to compare two companies in the same industry as it does not address all of a company’s performance metrics. A business may have negative cash flow, but it may be profitable.

FREQUENTLY ASKED QUESTIONS

Q. What are examples of fundraising activities?

- Short / long term loans – its repayments and borrowings

- Capital injection in the form of issuance of ordinary shares

- Pay cash dividends.

Q. Is the balance sheet cash balance the same as a cash statement?

Q. Why do most companies use an indirect method to prepare a cash flow statement?

A. Most accountants prefer to use the indirect method because it is easy and less time consuming to prepare the cash statement using information from the balance sheet and income statement. This is because the company has adopted the basis of accounting and the figures form the balance sheet and income statement are consistent with this method.

[right_ad_blog]