Optimizing your finances has never been more vital than in periods of successive crises, as we have experienced in recent years. Without going into the debate, add to that a necessary pension reform and you will understand that the search for savings, hunting down waste and regular savings are more topical than ever.

Let’s come to the subject of this article, which is intended to be a mixture of pedagogy and provocation. Cigarette. Yes, smoking is harmful to health, that of the smoker and unfortunately that of those around him. Yes, there is a good chance that a non-smoker will enjoy life, and especially his retirement, more than his colleague who smokes a pack a day. But no, health will not be the subject (although..) of this article. Because beyond the health aspect, which remains the most important, another angle must be taken into account: money!

It’s probably obvious to everyone, but you might as well push open doors: smoking is expensive , and not only to social security!

Neither my wife nor I are smokers. Also thank you in advance for forgiving my potential approximations on the subject :)! It seems to me that today the price of the package is between 6.50€ and 7€. For reasons of simplification, the price will be arbitrarily positioned at €7, and we consider that it does not change over time. We will now follow the lives of 3 fictional characters, all in their thirties. Mr. A smokes little, one pack a week. Mr. B is at 3 packets, while our last speaker, Mr. C, is at one packet per day. Any resemblance to people you know is of course coincidental, but it can give food for thought.

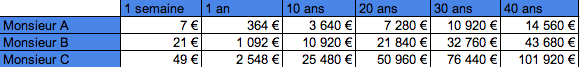

In order to approach this from a more optimistic angle, we are going to start from the hypothesis that our 3 acolytes have decided to quit smoking (following the reading of this article :)) and project what our new ex-smokers will save by this act full of common sense, and thus optimize their daily finances . The financial gains resulting from their life-saving stop are presented in this table:

As you can see, the potential savings are far from insignificant :

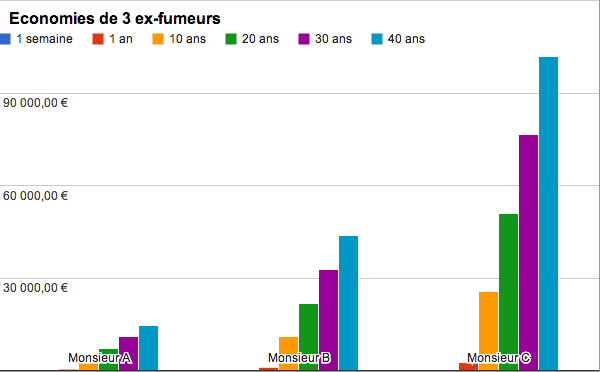

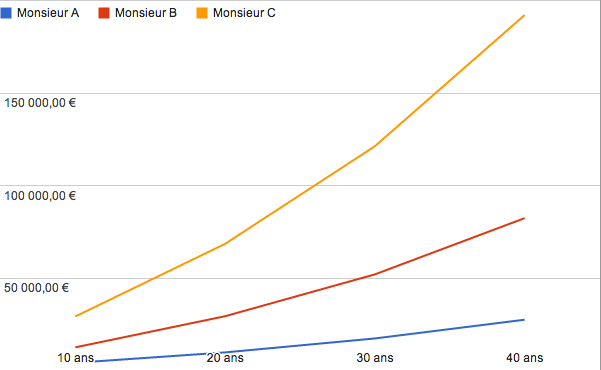

The more time passes, the more money you save, as this graph illustrates:

At the end of their career, after around forty years, our characters will therefore have respectively saved: nearly €15,000 for Mr. A, nearly €45,000 for Mr. B and more than €100,000 for Mr. C.

What if I told you that these gains can be optimized ? Thanks to a principle that you all know, at least indirectly, that of compound interest . Kezaco? Let’s take a simple example:

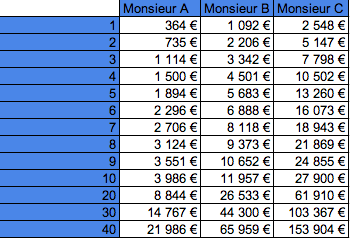

So what happens if our three repentant ex-smokers place their savings thus realized on a support remunerated at 2% net? What financial optimizations can they expect to have by doing this?

Starting from an assumption of a net rate of 2%, our friends will obtain the figures presented here, after 1 year, 2 years, … up to 40 years:

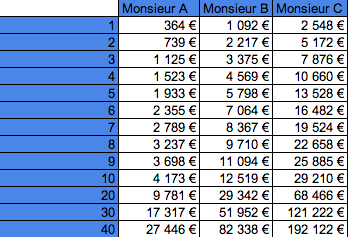

With a rate one point higher, 3%, they would then save:

Again, the numbers speak for themselves, and the importance of the rate is anything but negligible. If we compare the 3 methods, namely not placing your money, placing it on a support at 2% and 3% net, the comparison would be as follows:

For €7 per week, Mr. A will have saved:

The case of Mr. B is even more interesting, for €21 set aside per week:

Finally, for Mr. C and his €49 in weekly savings, the gains are substantial:

Well if you don’t smoke, so much the better! What you need to remember is that by investing little, but on a regular basis and as early as possible, it is possible to build up a nice amount of savings with a view, for example, to retirement.

By investing €7 per week, or about €30 per month, after about forty years you will have a small savings of almost €30,000, for €15,000 truly coming out of your pocket.

By saving 3 times more, you will obtain over the same period more than €82,000 for a monthly effort of less than a hundred euros (i.e. less than €44,000 of your own money).

And for around €220 per month, you will have invested just over €100,000 for available savings of nearly €200,000.

You know what you have to do: save, pay yourself first, and you will see that time and compound interest are valuable allies to prepare for your old age.

And you, have you already started putting aside each month to prepare for your retirement? Regularly or occasionally?