- Home

- Sales and revenue

- Running costs

- Financial

Starting a medicine store can be a lucrative opportunity for those with a passion for healthcare and an entrepreneurial spirit. However, it is not enough to have the necessary medical supplies and medicines for your store; Building a solid financial model is essential for the success of your business. In this blog post, we’ll explore the steps needed to create a solid financial model for a drug store. From Pharmacy Business Plan Financials to Pharmaceutical Store Financial Planning , we’ll cover everything you need to know to create Pharmacy Financial Projections to help you make informed business decisions. Let’s dive!

Drug store sales figures and forecasts

Revenue and sales forecasts are an integral part of any drug store financial planning process. It helps to determine the estimated revenue and sales of the business. Forecasts are based on several factors such as launch date, ramp-up time, walk-in traffic and growth assumptions , customer and purchase assumptions, and sales seasonality.

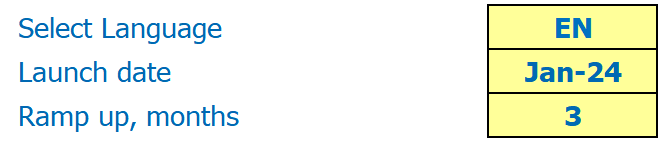

Drug store launch date

Choosing the launch date for your drug store is very important as it sets the foundation for your business operations. The launch date will determine the timing of your marketing campaigns, staffing, and inventory.

The Medicine Store financial model template includes an assumption for the month of business launch, but it’s important to choose the date that works best for your business needs. You can launch your business in the middle of the year, even if the financial model starts in January. This will help you prepare and plan activities and costs related to launching your business in a timely manner.

Tips & Tricks

- Choose a launch date that coincides with an important event such as a local health or community health awareness event to increase your visibility.

- Be sure to factor in the time required to obtain the necessary permits and licenses needed to run your business.

- Consider conducting a soft launch in advance to resolve operational issues before your grand opening.

By carefully selecting your launch date, you can set yourself up for success and ensure a smooth start for your medicine business.

Ramp-up time

When it comes to forecasting sales, an important factor to consider is the ramp-up time to the sales plateau. This is the time it takes for your business to reach a stable level of sales, after which it should remain relatively constant. Estimating ramp-up time accurately is crucial because it affects many aspects of your business, including cash flow, inventory management, and marketing campaigns.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In your industry, it could be anywhere from three months to a year, depending on various factors such as your store location, competition in the area, and the size of your target market. To estimate your specific ramp-up time, you need to do a thorough market analysis, considering all relevant factors.

Tips & Tricks

- Research your target market to understand their buying behaviors and preferences.

- Keep track of your sales data and adjust your marketing strategy accordingly.

- Stay on top of industry trends and adjust your inventory accordingly.

Proper forecasting of your ramp-up and sales time projections allows you to plan and budget the budget accordingly. For example, you can make sure you have enough cash reserves to cover expenses during the initial phase of your business, when income may be scarce. You can also get a better idea of how much inventory to stock and when to order more.

Overall, understanding sales plateau time is an essential part of any drug store’s financial planning. By accurately estimating this period and adjusting your business strategy accordingly, you can set your business up for success and achieve sustainable growth.

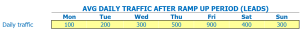

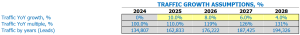

Drug Store Appointment Traffic Inquiries

After the ramp-up period, the average walk-in traffic of medicine store visitors was analyzed in detail. From Monday to Friday, the average traffic is around 400 visitors per day. While on weekends, i.e. Saturday and Sunday, the average walk-in traffic is around 700 visitors per day. This input is crucial in building a robust financial model for drug store appointment traffic inputs.

Assuming the walk-in traffic growth factor increases by 5% every year. Based on this input, the financial model will estimate future walk-in weekday traffic for five years. For example, if the current average weekday dating traffic is 400 visitors, in five years the average daily dating traffic will be approximately 505 visitors per weekday. Similarly, the average weekend weekend traffic in five years, given the 5% growth, will be approximately 888 visitors per weekend day. This forecast is crucial in assessing the financial feasibility and determining the viability of the medicine store business plan.

Tips & Tricks:

- Always consider trends and growth factors when building a financial model.

- Regularly monitor your walk-in traffic entries and update your model accordingly.

- Use multiple inputs when developing your financial model to ensure the accuracy of your assumptions.

Therefore, considering the daily traffic inputs, growth factors and trends described in this chapter, we can forecast the future walk-in traffic for the next five years. This walk-in traffic forecast is vital for building a robust financial model, assessing business feasibility, and making informed investment decisions.

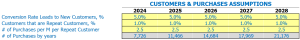

Drug store visits for sales conversion and sales inputs

When evaluating the financial performance of a drug store, two crucial inputs are the percentage of conversion of store visitors into new customers and the percentage of repeat customers. These metrics are essential to building an accurate financial model for your pharmacy business plan.

Let’s say your drug store gets 100 visitors a day, and 30% of them become new customers. This means that you will have 30 new customers per day or 900 new customers per month.

Of those 900 new customers, let’s assume that 20% become repeat customers. This means that you have 180 repeat customers per month.

To calculate the total purchases per repeat customer per month, you must use your pharmacy financial projections. Let’s say your financial analysis of your medical store shows that each customer spends an average of per month. Therefore, 180 repeat customers will spend ,000 per month.

Tips & Tricks:

- Offer discounts to entice new customers to make their first purchase.

- Implement a loyalty program to retain repeat customers.

- Regularly review your pharmaceutical store’s financial plan to identify areas for improvement.

Having accurate estimates of visits to sales conversion and repeat sales is vital when creating a healthcare store financial forecast. With this information, you can develop a robust pharmacy financial modeling strategy, make informed decisions about hiring staff, managing inventory, and setting pricing.

By regularly monitoring your medicine store’s financials and financial feasibility, you can assess the effectiveness of your customer acquisition and retention strategies and make necessary adjustments to maximize your profits.

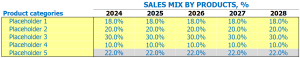

Mix of drug sales

At Drug Store , we sell a variety of medical products ranging from prescription drugs to over-the-counter drugs. Each product belongs to a specific product category, and entering sales mix assumptions on the product category lever would make it easier for people to understand.

- Be sure to regularly review and adjust your sales mix assumptions to reflect changes in customer demand.

Tips & Tricks:

Here is an example of how we can break down our sales mix by product category:

- Cold and flu remedies: 30%

- Prescription drugs: 25%

- Vitamins and supplements: 20%

- Skin care products: 15%

- Painkillers: 10%

We plan to forecast our sales mix category by product for the next five years, and here’s how we expect our sales mix to change:

- Cold and flu remedies: 30%, 28%, 25%, 23%, 20%

- Prescription drugs: 25%, 26%, 28%, 30%, 32%

- Vitamins and supplements: 20%, 21%, 22%, 23%, 24%

- Skin care products: 15%, 15%, 14%, 13%, 12%

- Painkillers: 10%, 10%, 11%, 11%, 12%

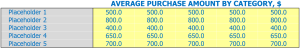

Amount of drugs average sale of inputs

Our pharmacy sells various products including prescription drugs, over-the-counter drugs, vitamins, and health supplies that belong to specific product categories. We found it much easier to enter assumptions at the product category level rather than at the product level.

For example, we assume that the average sale amount for prescription drugs is higher than over-the-counter drugs because prescriptions tend to be more expensive. Over the years, we have been able to track our sales and adjust our assumptions accordingly. Here are some of our average sales amounts by product category:

- Prescription drugs: per product

- Over-the-counter drugs: per product

- Vitamins: per product

- Healthcare supplies: per product

Using these assumptions, we can estimate the average ticket size. We do this by using the sales mix and the average sales amount of each product category. For example, if our sales mix for a specific year is 40% prescription drugs, 30% over-the-counter drugs, 20% vitamins, and 10% health supplies, the average ticket size for this year would be:

( x 40%) + ( x 30%) + ( x 20%) + ( x 10%) =

Tips & Tricks:

- Monitor your sales mix and adjust your average sales amounts accordingly.

- Gather data and track sales over time to better estimate your average ticket size.

- Use product categories to simplify your financial projections.

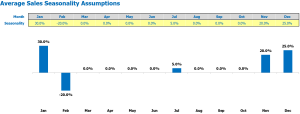

Seasonality of drug store sales

Seasonality is a common factor that affects the financial performance of a medical store. It refers to changes in demand for goods and services depending on the time of year. In medicine stores, the seasonality of sales can be influenced by different factors such as weather conditions, holidays and events, among others.

The pharmacy business plan should include an analysis of how seasonal factors affect store sales. An accurate financial feasibility study of the pharmacy should take seasonality projections into account in the financial modeling of the pharmacy. Here are examples of how seasonal factors can look like:

- January – 10% lower than average sales per day

- February – 5% lower than average sales per day

- March – 5% above average daily sales

- April – 5% above average daily sales

- May – 10% above average daily sales

- June – 5% above average daily sales

- July – 5% above average daily sales

- August – 5% above average sales per day

- September – 5% above average daily sales

- October – 5% below average sales per day

- November – 5% lower than average sales per day

- December – 10% lower than average sales per day

Tips & Tricks:

- Use historical data to determine the trend of sales seasonality.

- Periodic promotions and discounts can help mitigate the negative effects of seasonality.

- Adjust staffing levels to match expected sales volumes at different times of the year.

Financial analysis of the medical store is essential to understand the financial performance of the store, find its weaknesses and plan financial improvements. If sales seasonality is properly understood, analyzed and considered in the financial planning of the pharmacy, it is possible to more accurately predict the financial future of the store and make strategic decisions accordingly.

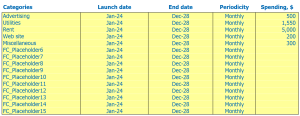

Drug Store Operational Expense Forecast

Operational expense forecasts are an important part of the medicine store’s financial model. It includes the expected costs of running the business on a monthly basis. Expenses related to running a drug store typically include cost of goods sold by products %, wages and salaries of employees, rent, lease payment or mortgages, utilities, d other operating costs.

| Operating Expenses | Amount (per month) USD |

|---|---|

| Cost of goods sold by products % | ,000-,000 |

| Salaries and wages of employees | ,000-,000 |

| Rent, lease or mortgage payment | ,000-,000 |

| Public services | ,000-,000 |

| Other running costs | ,000-,000 |

| Total | ,000-,000 |

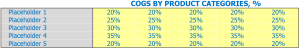

Cost of drug products sold

Cost of Goods Sold (COGS) is the cost of producing or buying goods sold by a pharmacy. Several factors influence the workings of pharmacy.

First, the product categories exported, such as prescription drugs or over-the-counter drugs, impact cogs. The COG percentage for prescription drugs is higher than over-the-counter drugs because they require greater investment in research and development.

Second, the market price and the choice of supplier have an impact on COGs. For example, a pharmacy’s COGs decrease when it purchases drugs in bulk at discounted prices from selected vendors.

Third, the supply and demand of the items sold affect the workings. If supply does not match demand, COGs increase due to increasingly expensive prescription drugs.

Tips & Tricks:

- Run statistical analysis to optimize vendor selection.

- Use market analysis to project drug supply and demand.

- Opt for multiple vendor options to prevent contamination of goods.

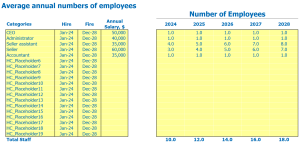

Salaries and wages of drug store employees

When planning the finances of a drug store, it is important to consider the wages and salaries of its employees. When creating our pharmacy business plan, we made a few assumptions about our staff members and positions.

We will have a total of seven staff including a pharmacist, pharmacy technician, cashier, stock manager, marketing specialist, delivery person and cleaning staff. Our Pharmacist and Pharmacy Technician will need to be hired before the store opens, while the rest will be hired within the first three months of operation.

In terms of salary, our pharmacist will earn an annual salary of 0,000, while the pharmacy technician will earn ,000. The cashier will earn ,000, the inventory manager will earn ,000, the marketer will earn ,000, the delivery person will earn ,000, and the cleaners will earn ,000.

Our full-time equivalent (FTE) staff will be equivalent to 4.5 employees, as some positions such as delivery driver and cleaning staff only require part-time hours. This means that some positions, such as pharmacist and pharmacy technician, will require more hours to complete the workload.

Tips & Tricks:

- Consider the roles and responsibilities needed for your specific medicine store and adjust the number and type of staff members accordingly.

- Research industry standards and salaries to ensure you offer competitive salaries to attract and retain top talent.

- Regularly review your staffing needs and make adjustments as necessary to ensure optimal efficiency and customer satisfaction.

Drug store rent, lease, or mortgage payment

One of the biggest expenses a pharmaceutical store owner will face is their rent, lease or mortgage payment. It will be difficult to establish a sound pharmacy business financial plan without carefully considering this expense.

Assuming you will be renting, it is essential to research average rent prices in the area and adapt to the size and location of your store. You’ll also want to consider any potential year-to-year rent increases and factor that into your pharmacy financial projections.

If you decide to buy the property, you need to take a holistic approach to calculating how much you can afford. To accurately assess your financial capability, you need to perform an extensive financial analysis of the medical store.

On the other hand, if you choose to lease the store, you’ll want to make sure you fully understand the implications of the lease agreement. This includes the length of the lease, renewal options, and what happens if you want to end the lease early. All of these factors will have an impact on the financial planning of your pharmaceutical store.

Tips & Tricks

- Before signing a lease or mortgage agreement, be sure to consult a financial adviser or lawyer.

- Factor the potential cost of rent increases or rental breakthroughs into your pharmacy financial modeling.

- Always have a contingency plan in place in case unexpected financial issues arise in your medicine store’s financial statements.

The bottom line is that your rent, lease, or mortgage payment is one of the most important expenses you’ll need to factor into your healthcare store’s financial forecast. It is essential to do your due diligence before making final decisions and to continually reassess your financial situation.

When you complete a pharmacy financial feasibility analysis and take the time to accurately assess and project these expenses, you will be in a better position to create a successful medical store financial performance.

Your pharmacy store’s financial assessment will give you the data you need to create a plan that sets you up for long-term success.

Store utilities

When creating a pharmacy business plan, it is important to consider utility assumptions . These include electricity, water, gas and internet bills, as well as rent and taxes. Projecting these expenses accurately is crucial to getting a pharmacy financial feasibility .

Utility bills may vary depending on the location of the pharmacy. For example, a pharmacy located in a busy commercial area with high foot traffic may have higher rent and utility bills than a pharmacy in a residential area.

Additionally, the type of pharmacy can also affect utility expenses. A medical financial statement for a large chain may require more electricity and water for air conditioning and washing facilities, respectively, than a smaller, independent pharmacy.

Tips & Tricks

- Research utility bills for the specific location and size of the pharmacy to get accurate estimates.

- Consider energy-efficient appliances and technology to reduce long-term electricity bills.

- Include an emergency fund in the Pharmacy Financial Model to account for unexpected utility expenses.

Drug Store Other Operating Costs

Aside from the direct costs of acquiring drugs and other inventory, a pharmacy business also incurs other operating costs that must be considered in building a financial model.

These costs include rent or lease payments for store space, utilities such as electricity and water, employee salaries and benefits, insurance premiums, marketing expenses and advertising, as well as repairs and maintenance.

For example, if a medical store is located in a main commercial area, the rent may be higher than if it were in a less desirable location. Electricity bills can also increase during the hot summer months when air conditioning is needed to keep medications at appropriate temperatures.

Employee salaries are another major expense, with pharmacists and pharmacy technicians typically earning higher salaries than other retail workers due to their specialized expertise. Benefits such as health insurance and pension plans can also increase the total cost.

Finally, a pharmacy business must also consider the cost of marketing and advertising to attract and retain customers. This may include placing ads in local newspapers or on radio stations.

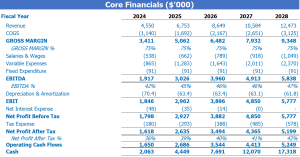

Drug store financial forecasts

Financial forecasts are an important part of the medical financial model to project the future growth and profitability of the business. It involves the preparation of profit and loss statements and sources and uses a report to assess the current financial condition and future performance of the business. By analyzing historical data and trends, financial forecasts can help the drug store make critical decisions in areas such as pricing strategy, inventory management, and marketing campaigns.

Drug store profitability

Once we have built Revenue and Expense Projections , we can check the Profit and Loss (P&L) from revenue to net profit. This will help you visualize “profitability” as Gross Profit or EBITDA Margin .

It is important to review and analyze a drug store’s financial statements to determine its profitability. Pharmacy Financial Modeling Can help forecast financials for the future growth of the medicine store.

Tips & Tricks:

- Financial pharmacy business plan should be reviewed frequently to check the financial health of the medicine store.

- Analyze the financial projections of the pharmacy to forecast the future growth of the medicine store.

- Financial evaluation of the pharmaceutical store can help determine the financial profitability of the drug store.

After reviewing the Medical store financial analysis, Pharmaceutical store financial planning, or Healthcare store financial forecast , we may necessitate the decisions and strategies to improve the Medical store financials, Pharmacy financial feasibility, or performance. finance of medicine store medical store.

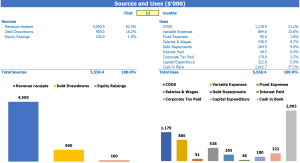

Sources of Medicines and Use of the Chart

Sources and uses of funds in Excel’s financial model for Medicine Store provides users with an organized summary of where capital will come from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other.

Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks:

- Make sure you have accurate financial projections before you create your sources and use a statement.

- Include all potential sources of funds, such as stocks, debt, and grants.

- Be specific in the Uses of Funds section, describing how the money will be spent.

In conclusion , building a financial model for your drug store is crucial to its success. A well-thought-out financial plan will help you make informed decisions about the future of your business and ensure you’re on track to achieve your financial goals. Whether you are starting your pharmacy business from scratch or have an established store, creating a financial model is a must. By considering factors such as sources of income, expenses, and cash flow, you can create a realistic projection that can serve as a guide for the future of your business.