- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our blog post on how to build a financial model for an electric vehicle (EV) charging station. With growing environmental concerns and a shift to electric vehicles, EV charging stations are becoming more common. As more individuals and businesses switch to electric vehicles, investing in infrastructure for electric vehicle charging is a lucrative opportunity. However, before setting up an EV charging station, it is important to have a solid financial plan in place to ensure long-term success. In this article, we’ll explore the key elements of building a financial model for an EV charging station, including cost analysis, revenue streams, pricing strategies, and financial projections.

EV Charging Station Revenue Forecast and Sales Forecast

One of the most critical parts of an electric vehicle charging station business plan is the EV charging station revenue and sales forecast as it outlines the financial feasibility, return on investment and profitability of the business model. This financial model includes launch date, sales ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality.

EV charging station launch date

Your EV charging station launch date is a crucial aspect of your business. It can impact your EV charging station financial feasibility, your EV charging station cost analysis, EV charging station business case, EV charging station ROI, EV charging station financial projections and EV charging station revenue model and pricing strategy. A successful launch can help you establish strong market prominence, attract customers and generate revenue.

Tips & Tricks:

- Choose a launch date that aligns with your market analysis and customer preferences.

- Plan your business activities and costs related to the launch date.

- Consider launching your business in the middle of the year to coincide with a high demand for electric vehicles.

Having a clear understanding of your target market and competitors can help you set the right launch date. Additionally, formulating an EV charging station business plan that identifies opportunities and revenue streams can help prepare you for launching your business.

In conclusion, selecting the right launch date can be critical to the success of your EV charging station business. By carefully considering market dynamics, customer preferences, and overall financial projections and feasibility, you can prepare a solid foundation for launching your business.

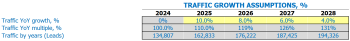

EV ramp-up time

When starting a new EV charging business, one of the most crucial aspects to consider is the ramp-up time to the sales plateau. This period refers to the time it takes for your business to reach a point where sales growth stabilizes. Understanding this period is important for projecting long-term financial forecasts, such as revenue sources and return on investment.

What is the ramp-up period for your EV charging charging business? It depends on various factors, such as your location, pricing strategy, revenue model, and market analysis. On average, the ramp-up period for EV charging stations is usually around 6-12 months. However, in some industries it can take up to 2 years to reach sales plateau.

Tips & Tricks:

- Conduct in-depth market research to understand the demand for EV charging stations in your area

- Develop a solid business plan that includes a detailed financial feasibility analysis

- Consider partnering with other businesses or organizations to increase exposure and revenue streams

- Offer competitive pricing and promotions to attract and retain customers

- Invest in marketing and advertising to raise awareness of your brand and services

By taking the time to understand your industry and the factors that impact ramp-up time, you can make informed decisions that build a solid foundation for long-term financial success.

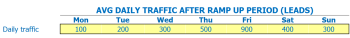

EV charging station Walk-in traffic entries

After the ramp-up period, the average daily walk-in visitor traffic for an EV charging station is an essential input when building a financial model. This is a crucial variable that determines the station’s revenue streams and pricing strategy . For example, suppose the average weekly rendezvous traffic for a station is high on weekends rather than weekdays. In this case, the station can adjust its pricing strategy accordingly to maximize profits.

The average traffic growth factor in the years in the future helps in estimating the growth trajectory of the station regarding the profit, demand and profitability of the station. Using these inputs, the model will calculate the future walk-in traffic for weekdays for the five years accordingly.

Tips and tricks

- Perform in-depth market analysis to determine target market and competition.

- Perform an EV charging station cost analysis and a feasible EV charging station financial projections.

- Create a strong electric vehicle charging station business plan focusing on EV charging station business case and EV charging station return on investment.

- Collaborate with local businesses whose customers align with the resort’s target market to increase walk-in traffic.

Average daily visitor traffic is a crucial factor in building a successful EV charging station that generates consistent profits, attracts EV users, and supports community green energy initiatives.

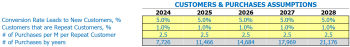

EV charging station visits in sales conversion and sales inputs

When analyzing the financial feasibility of an EV charging station, knowing the conversion rate of visitors to new customers and the likelihood of repeat customers is crucial. According to industry data, the average conversion rate of EV charging stations is around 15%. This means that out of 100 visitors, 15 will become new customers.

For repeat sales, the average percentage varies by location and level of service provided. However, a good rule of thumb is around 25%. This means that of those 15 new customers, four will return for repeat business.

To estimate the potential income of regular customers, it is important to know their average monthly purchases. Assuming an average recharge of 20 kWh per visit and a cost of .20 per kilowatt-hour, a repeat customer visiting twice a week will have monthly purchases of . Using this figure and the percentage of repeat customers, a financial model can be built to estimate potential revenue streams.

Tips & Tricks:

- Offer incentives and loyalty programs to increase the percentage of repeat customers.

- Perform market analysis to determine pricing strategy and gain competitive advantage.

- Implement advertising and marketing tactics to increase brand awareness and attract new customers.

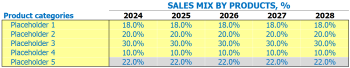

EV Sales Mix Inputs Charging Station

Your EV charging station store sells different EV charging station products, and each product belongs to a specific product category. To make it easier to understand, entering the sales mix assumption on the product category lever will be much easier to understand.

For example, you can categorize your products into different categories such as level 1 charging stations, level 2 charging stations, level 3 fast charging stations, accessories and installation services. By entering into the percentage sales mix assumption for each of the five projected years by product category, you will be able to make more accurate projections for revenue and profitability.

Tips & Tricks

- When entering sales mix assumptions, be sure to consider market demand and competition for each product category.

- Keep track of your actual sales mix and adjust your projections accordingly.

- Regularly reassess your sales mix assumptions based on changes in the market and customer demand.

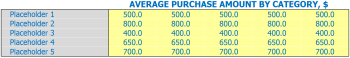

EV charging station INPUTS AVERAGE SELL AMOUNTS

Our store sells a variety of EV charging station products, including charging cables, wall charging stations and portable chargers. Each product belongs to a specific product category, which makes it easier to enter assumptions at the category level instead of the product level. For example, we estimate that the average sales amount of billing cables will be in the first year and increase by 3% every year.

On the other hand, the average sale amount of wall charging stations is estimated at ,200 in the first year and increases by 5% every year. By making assumptions at this level, we can estimate the average sale amount for each product category and calculate the overall average ticket size.

Tips & Tricks:

- Regularly review and update your assumptions to ensure the accuracy of your financial projections.

- Consider offering bundle bundles or discounts for customers who purchase multiple products.

- Perform market analysis to ensure your pricing strategy is competitive with other EV charging companies in your area.

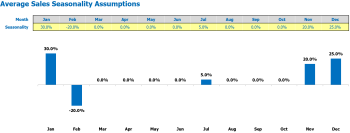

Seasonality of EV charging station sales

Seasonality is an important factor to consider when analyzing the profitability of EV charging stations. Based on market analysis, sales tend to vary throughout the year, with some months showing higher sales volume than others.

The assumption behind the seasonality of EV charging station sales may vary depending on location, weather, and events occurring in the area. For example, during colder seasons, sales volume tends to be lower, but sales may increase during warmer months.

Here are some examples of how seasonal factors can impact average monthly sales per day:

- Summer months (June, July, August) – 15% increase in average sales per day.

- Winter months (December, January, February) – 10% drop in average sales per day.

- Spring and fall months (March, April, May, September, October, November) – No significant change in average sales per day.

It is crucial to keep in mind that these are examples only, and actual seasonal factors may vary depending on location and other external factors. Therefore, it is essential to conduct thorough EV charging station financial feasibility studies and EV charging station business case analysis, including EV charging station cost analysis, return on investment of the EV charging station and the financial projections of the EV charging station, before implementing the business plan.

By understanding the monthly revenue streams of the EV charging station, the pricing strategy can be developed to maximize profits while keeping prices competitive.

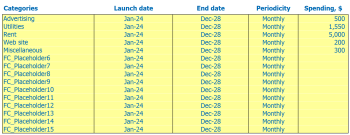

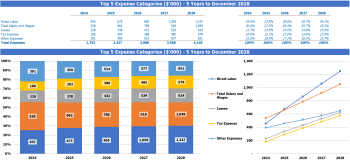

EV Charging Station Operational Expense Forecast

Operational expense forecasts are an essential part of an EV charging station financial model. These forecasts give you an overall estimate of the ongoing expenses you will incur while running an EV charging business. Some of the key operational expenses you need to consider are the cost of goods sold by products %, employee wages and salaries, rent, lease payment or mortgages, utilities and other operating expenses .

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | 500 – 1500 |

| Salaries and wages of employees | 2000 – 4000 |

| Rent, lease or mortgage payment | 4000 – 8000 |

| Public services | 500 – 1000 |

| Other running costs | 1000 – 3000 |

| Total | 8000 – 17800 |

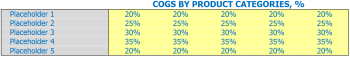

EV Charging Pad Cost of Goods Sold

When creating a financial feasibility analysis for an EV charging station business plan, it is important to include a cost of goods sold (COGS) section.

COGS assumptions for an EV charging station include the cost of electricity, maintenance and repairs, and any parking or property costs associated with the business. For example, the cost of electricity for a car’s billing hour can vary depending on location and energy prices. Station maintenance and repairs should also be accounted for, along with any costs of renting or owning the real estate or parking lot where the stations will be located.

Typically, the COG percentage for an EV charging station ranges from 10% to 30% of total revenue. The percentage may vary based on different product categories and pricing strategies. For example, if the charging station offers different rates for fast or slow charging, the COG percentage will vary between these categories.

Tips & Tricks:

- Include a detailed COG breakdown in your financial feasibility analysis

- Consider charging station location when estimating electricity, real estate, and parking costs

- Consider different pricing strategies to optimize COGS percentage

An accurate COGS section is crucial for creating accurate EV charging station financial projections, analyzing profitability, and estimating return on investment. A thorough analysis of the EV Charging Station market can help guide COGS assumptions and ensure the business is financially possible.

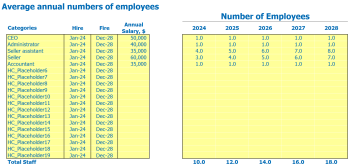

EV charging station employee salaries and wages

When it comes to salaries and employee salary assumptions, it is important to plan ahead and determine the number of staff and their respective salaries. For example, you may need an operations manager, a customer service representative, and a service technician.

It is also important to determine when these positions will need to be filled. As for salaries, this will depend on the skill set and experience of each employee. As a general guideline, an operations manager can earn around ,000 per year, a customer service representative can earn around ,000 per year, and a service technician can earn around ,000 per year.

Assuming you need each employee to work full-time for a 12-month period, you may need 1 full-time equivalent (FTE) for the operations manager, 2 FTEs for the customer service representative, and 1 FTE for the maintenance technician.

Tips & Tricks:

- Consider hiring part-time employees or contractors to minimize costs.

- Offer benefits such as health or retirement plans to attract and retain employees.

- Research standards and local wages to determine fair compensation.

EV LOC charging charge payment

One of the most important factors to consider when starting an electric vehicle charging business is how you pay for your property. The three most common options are renting, renting, or getting a mortgage.

Assuming a lease means you would pay a monthly amount to use the building, while renting involves paying an amount in exchange for temporary access. Alternatively, if you choose to take out a mortgage, you will need a loan to purchase the property.

EV Charging Station Rent Analysis: Renting is often the more affordable alternative because the rental rate is usually less than the purchase expense. Renting a property comes with less paperwork and less time spent searching for the right location. However, the downside of renting is that the property owner has the power to raise the rental charges or even sell the property, making it difficult to come up with a long-term business plan.

EV Charging Station Lease Analysis: A lease agreement provides a level of stability regarding expenses that can help EV charging business owners plan for the future. This method, however, requires a potentially more expensive initial investment, which will allow operators to run a higher level of control over the property.

EV Charging Station Mortgage Payment Analysis: Buying the property provides the most control over the property and a sense of security. Although owning the property may seem like a long-term investment in the EV charging business, scaling the business to more properties can be difficult due to the high cost of up-front expenses.

Tips & Tricks

- Choose the payment method that suits your business plan goals and stable revenue model.

- Research the market you want to invest in and the cost of renting or buying a property to develop a workable financial strategy.

- Include the lease or mortgage payment and its associated expenses in the financial projections of electric vehicle billing companies.

- Consider negotiating a lease or purchase price based on how long the property is leased or purchased.

EV Charging Station Utilities

The utilities of the EV charging station are a crucial aspect that must be taken into account when analyzing the financial feasibility of the project. The cost of utilities includes the cost of electricity, maintenance costs and other costs associated with the charging station. It is essential to consider these costs while analyzing the EV Charging Station Business Case , EV Charging Station Cost Analysis , and EV Charging Station ROI .

The EV Charging Station Financial Finability is based on utility assumptions. These assumptions are influenced by several factors, including the installation site, the number of charging station infrastructures, and the power rating of the charging station. For example, suppose the charging station requires more electric power to charge the EV. In this case, the cost of utilities will be higher and therefore the pricing strategy will be affected and the revenue projections will be affected.

Tips & Tricks:

- It is essential to conduct thorough research while analyzing market demand, competitor offerings and consumer preferences while drafting the EV Charging Station Business Plan .

- Determine the pricing strategy based on the capacity, location and charging time of the charging infrastructure to optimize the EV charging station revenue model .

Thus, the EV charging station financial projection must include an accurate assessment of the cost of utilities, which will help identify potential revenue sources and pricing strategy.

EV charging station Other running costs

When developing your electric vehicle charging station business plan and revenue model, it is important to include a thorough analysis of any other operating costs that could impact your financial feasibility and your profitability.

Other running costs Refer to all expenses that are not directly related to hardware or charging facility. For example, current electricity bills, rental of property, maintenance, advertising, and employee salaries all fall under this category.

It’s important to keep these expenses in mind when determining your pricing strategy and revenue streams . Failure to include them could result in an inaccurate representation of your charging station’s profitability, return on investment , and financial projections .

For example, if you assess the financial feasibility of your EV charging station and neglect to include monthly electricity bills or rental expenses, it could make your charging station appear to be earning more compared to its actual profitability. Additionally, if you overestimate your station’s profitability, you can price your services too high and lose customers to your competitors.

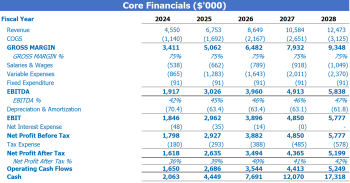

EV Charging Station Financial Forecast

In order to develop a solid electric vehicle charging station business plan, a thorough EV charging station financial feasibility analysis should be performed. This analysis should cover EV charging station cost analysis, return on investment, EV charging station business case, and EV charging station revenue sources. A crucial component of this analysis is the financial forecast of the EV charging station which includes the expected profit and loss statement, sources and uses of the report and the financial projections of the EV charging station. To ensure a successful EV charging station pricing strategy, it is important to conduct a comprehensive analysis of the EV charging station market and determine the most appropriate EV charging station revenue model.

EV Charging Station Revaluation

After creating a detailed EV charging station business plan, including EV charging station financial finance, EV charging station charging station, EV charging station cost analysis, charging station pricing strategy , EV Charging Station , EV Charging Station Market Analysis , EV Charging Station Profitability Analysis and EV Charging Station Financial Projection , it is recommended to do a profit and loss (P&L) analysis.

P&L analysis is important for visualizing the projection of revenues and expenses of the electric vehicle charging business. It offers ROI of EV charging station information, as well as gross profit or EBITDA margin. This analysis allows you to check every detail of the revenue model.

Tips & Tricks

- Review and verify all figures in the P&L statement.

- Compare the numbers with similar EV charging stations in the same market niche.

- Adjustments to costs or revenue figures may be required.

Finally, EV Charging Station Valuation Analysis is a tool that will help you evaluate the net profit of your electric vehicle charging business so that you can make the right decisions as a business owner.

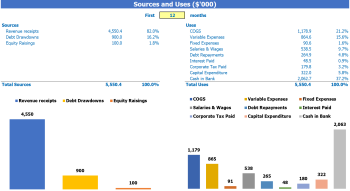

EV charging station sources and uses graph

The Sources and Uses of Funds in Financial Model in Excel for EV Charging Station provides users with an organized summary of where capital will come from sources and how that capital will be spent in the uses . It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When calculating funding sources for an EV charging station business plan, some common sources include bank loans, venture capital, angel investors, government grants, and crowdfunding. Uses of these funds may involve equipment purchases, rental or purchase of property, marketing, employee salaries, insurance, utilities, maintenance and repairs. These are just some of the factors that would be incorporated into the sources and use statement.

Tips & Tricks:

- To conduct a EV Charging Station Market Analysis , this information will help to form projected revenue streams

- Created an EV charging station pricing strategy that is both competitive and meets customer expectations

- Conduct an EV Charging Station Financial Finability study to determine if the project is worth investing in

- Prepare an EV charging station cost analysis to identify how much it will take to install and maintain your charging station, this will help with EV charging station business case and EV charging station return on investment .

- Use EV Charging Station Financial Projection to forecast your expected financial performance and compare actual with projected over time

- Choose the EV charging station revenue model that meets both your short-term and long-term business goals

At the end of the day, building a financial model for an EV charging station is essential to ensure its long-term financial feasibility and profitability. By analyzing Revenue Models, Pricing Strategies, Revenue Sources, and Market Analysis , entrepreneurs can develop a business plan that includes Cost Analysis, Financial Projections, and Return on Investment calculations. By undertaking such thorough financial planning, entrepreneurs can confidently navigate this emerging industry and guide their EV charging station to success.