- Home

- Sales and revenue

- Running costs

- Financial

Welcome to my guide on how to build a financial model for a bike shop. As with any business, it is essential to have a plan in place to ensure its success. In this article, we’ll go over the different aspects of creating a complete financial model for your bike shop. This includes reviewing revenue models, revenue projections, profit forecasts, budgeting, and cash flow analysis. Whether you run a bicycle retail business, a bicycle accessories store, or a bicycle rental shop, this guide will help you create a solid financial plan for the growth and success of your business.

Bicycle Shop Revenue & Sales Forecast

Revenue and sales forecasts are a crucial part of the bike shop’s financial model. It helps to determine the estimate of the amount of money a bike shop earns in a specific period. Sales forecasts should be prepared based on factors such as launch date, sales ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and seasonality of sales. sales. All of these factors should be carefully considered to prepare an accurate revenue projection that can help the business owner make informed decisions for a successful future.

Launch date of the bike workshop

The launch date of your bike shop can make or break your success. It is very important to choose a launch date that gives you enough time to prepare and plan your finances accordingly. The Bicycle Shop financial model template provides a guess for the start month of businesses.

It is recommended to choose a launch date that aligns with the needs of your target market. For example, if you’re targeting commuters, it might be best to get started before the school year starts or during the summer when more people are cycling to work.

Tips & Tricks:

- Research your local community to determine the best launch date.

- Consider seasonality and weather conditions when choosing a launch date.

- Allocate enough time for marketing and publicity before the launch date.

Once you’ve chosen your launch date, be sure to factor it into your bike shop’s financial plan. Your revenue projection, cash flow analysis, profit forecast, and budgeting should all be based on the selected launch date.

With the right focus and planning, your bike shop launch date can set your business up for success.

Bike Workshop Ramp Up Time

When planning sales for a bike shop, it’s important to consider the ramp-up time to the sales plateau. This is the period of time it takes for a new business to reach a point where sales become consistent and reliable.

What is the ramp-up period for your business? This may vary depending on the industry and the specific circumstances of the store. For a bike store, the ramp-up period can be around 6-12 months, as customers may take some time to experience the new store and build trust in its products and services.

Tips & Tricks

- Offer promotions or discounts during the ramp-up period to attract new customers

- Focus on building customer relationships to drive loyalty and repeat business

- Closely monitor sales during this period to adjust strategies if necessary

By factoring in ramp time when creating a financial plan for a bike shop, owners can ensure that they have sufficient resources to sustain their business during this time and reach plateau. selling more well.

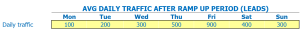

Bike Shop Appointment Traffic Entries

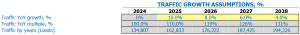

After the ramp-up period, the bike shop receives an average walk-in traffic of 100 visitors per day. This number varies on weekdays with a weekday average of 80 visitors and a weekend average of 120 visitors per day.

Based on historical data, the average traffic growth factor in traffic is 5% per year. Using this growth factor, the model projects future walk-in traffic for the next five years. By 2026, average walk-in traffic is expected to increase to 127 visitors per day on weekdays and 190 visitors per day on weekends.

Tips & Tricks:

- Offer promotions and discounts on weekdays to attract more customers and increase traffic.

- Host weekend events and group rides to build a strong following and increase weekend traffic.

- Use social media and targeted advertising to reach new customers and drive traffic to the store.

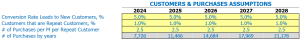

Bike shop visits for sales conversion and sales inputs

In order to build a strong bike shop revenue model , it is important to understand the Bike Conviction Visits to Sales Conversion Rate and Repeat Sales Percentage . Let’s say your bike shop gets 500 visitors per month and from those, 100 are new customers. This means your conversion rate is 20% .

Next, let’s talk about repeat sales percentage . If out of those 100 new customers, you get 40 to return, your repeat sales percentage is 40% . And now comes the interesting part, let’s say each of those 40 repeat customers buys an average of two bikes per year, which equates to 0.16 purchases per month per repeat customer .

Tips & Tricks:

- Be sure to accurately track your customer visits and data to ensure a clear understanding of your conversion rates and repeat sales percentages.

- Encourage customers to return by offering rewards programs or discounts.

- Consider offering maintenance services or ancillary promotions to drive repeat sales.

Why are these assumptions important when building a bicycle retail business plan ? Knowing your conversion rates and repeat sales percentages allows you to estimate projected sales to help build a Bike Shop Cash Flow Analysis and Cycle Shop Profit Forecast . Additionally, understanding these assumptions can help you with Bike Dealer Budgeting and Bike Rental Financials if these are aspects of your business.

In conclusion, be sure to understand and track your Bicycle Conviction Visits to Sales Conversion Rate and Repeat Sales Percentage in order to create an accurate financial model and make informed business decisions.

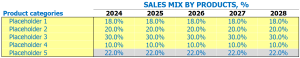

Bike shop sales mix starters

In our bike store, we offer a variety of products spanning across multiple categories including bikes, accessories, rentals and repairs. To help forecast our revenue, we need to understand the sales mix by product category. By entering the sales mix hypothesis on the product category leverage, we can better understand our sources of revenue.

Let’s take our bike sales category as an example. We have a variety of bikes ranging from road bikes to mountain bikes to e-bikes. We assume our sales mix for road bikes will be 40%, mountain bikes 35% and e-bikes 25%. Using these assumptions, we can project our revenues for the next five years.

It is important to note that this process will need to be repeated for each product category. This includes our rental sales category, accessory sales category and repair sales category. By having separate projections for each category, we can easily adjust our revenue projections based on changes in sales mix assumptions.

Tips & Tricks:

- Regularly update your assumptions as customer preferences may change over time.

- Consider external factors such as changes in the cycling industry or the economy when making sales mix assumptions.

- Use historical sales data to inform your sales mix assumptions.

In summary, understanding the sales category by product is a crucial part of our bike store financial planning. By accurately projecting our revenue for each category, we can make informed decisions about the future of our business.

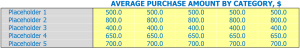

Bicycle Shop Average Sale Entry Amount

Your bike shop offers a variety of products including bikes, accessories, rentals and repairs. To simplify your financial planning, each product belongs to a specific product category. This way it is much easier to enter assumptions at the product category level rather than at the product level.

For example, you can assume that the average sale amount for a bicycle is different from the average sale amount for an accessory or rental.

You can enter the average sale amount by product categories and by years. The model will then calculate the average ticket size using the sales mix and the average sales amount of each product category. So what is the average sale quantity of each product category?

Let’s say your bike shop sells three product categories: bikes, accessories, and rentals. You estimate that the average sale amount for a bike is 0, an accessory is , and a rental is .

Using these estimates, you can calculate the average ticket size. If your sales mix is 60% bikes, 25% accessories, and 15% rentals, your average ticket size would be:

- (0 * 0.60) + ( * 0.25) + ( * 0.15) = 0

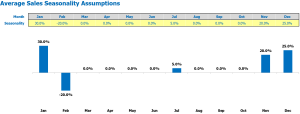

Seasonality of bike shop sales

When it comes to forecasting revenue and managing cash flow in a bicycle retail business plan, it’s important to consider seasonal factors that affect sales. This will help owners and operators prepare for periods of high demand and allocate resources efficiently. In this section, we will explain in detail the sales seasonality assumptions that should be taken into account.

Projecting bike shop income should generally take into account that sales will peak during the summer months when people are more likely to participate in outdoor activities. On average, there is a 20% increase in sales during the summer months of June, July and August compared to the average sales per day throughout the year. Spring and autumn are also strong sales periods with a 15% increase in sales compared to the average sales per day. Meanwhile, winter sales for the months of December, January and February are dropping significantly with a 35% drop from average daily sales.

Tips & Tricks:

- Consider offering off-season promotions and discounts to boost sales during slow times.

- Have high-demand products during peak sales times to avoid inventory.

- Adjust staffing levels based on sales projections for different times of the year.

Keeping these seasonal factors in mind, owners and operators of a cycling accessories store financial model or bicycle dealership budgeting can make informed decisions on budgeting, inventory management, pricing and marketing. Overall, understanding sales seasonality is crucial to creating a sustainable and profitable bike shop financial plan.

Bike Shop Operational Expense Forecast

In order to create a successful bicycle retail business plan, a comprehensive financial model is essential. An important component of this model is an operational expense forecast, which includes the expected costs associated with running the business.

| Costs | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | 6,000 – 18,000 |

| Salaries and wages of employees | 3,000 – 9,000 |

| Rent, lease or mortgage payment | 4,000 – 12,000 |

| Public services | 500 – 2,000 |

| Other running costs | 2,000 – 6,000 |

| Total | 15,500 – 47,000 |

The table above provides a range of monthly expenses for cost of goods sold by products %, employee wages and salaries, rent, lease or mortgage payment, utilities and other operating expenses. Being aware of these expenses will help bike dealers with budgeting so they can avoid cash flow issues later.

Cost of Goods Sold

Cost of Goods Sold (COGS) is the cost of producing or purchasing the products a business sells. In the context of the bike shop revenue model, COGS includes the direct costs incurred to manufacture or purchase bikes and cycling accessories sold in the shop. Examples of COG include the cost of purchasing bicycles from the manufacturer, the cost of bicycle parts, and the cost of labor to assemble the bicycles.

The percentage of COGS varies depending on the product category. For example, the cogs on a high-end carbon road bike are higher compared to the COGs for a base city bike. A Bike Store financial plan should include assumptions based on average COGS percentages for each product category. The bike shop revenue projection should be based on this information to ensure that the business is profitable.

Tips & Tricks:

- Regularly review your COGS assumptions to ensure that they are still accurate.

- Track your inventory and the cogs to identify areas where costs can be reduced.

- Consider negotiating with manufacturers for better prices on products.

Crafting an accurate bicycle retail business plan requires careful attention to COGs. Performing cash flow analysis, bike shop, cycle shop profit forecasting, and bike dealership budgeting requires an understanding of COGS assumptions. By monitoring COGs and implementing strategies to reduce costs, a bicycle rental shop, a bicycle accessories financial model, or a bicycle repair shop, financial planning can be profitable and successful.

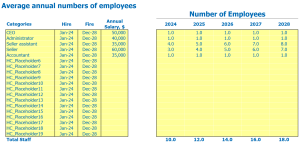

Wages and Salaries of Bike Shop Employees

When creating a bike shop financial plan, an important aspect to consider is the cost of hiring and paying employees. It’s important to research industry standards and consider your company’s specific needs when determining salaries and wages.

When planning employee salaries and wages, it helps to name your staff positions and determine when each person will be hired. For example, you may need to hire a salesperson as soon as your doors open, while a bike mechanic may not be needed until you have a larger inventory of bikes.

Next, determine the annual salary for each staff member or position. This can range widely depending on experience, duties and location. A salesman making minimum wage can make around ,000 a year, while a full-time mechanic with years of experience can make over ,000 a year.

Finally, calculate the number of full-time equivalent (FTE) staff you will need each year. This refers to the total number of hours worked by all employees divided by the number of hours in a full-time work week. This will help you budget wages and salaries accurately.

Tips & Tricks

- Consider offering competitive salaries and benefits to attract and retain high quality employees.

- Be sure to factor in payroll taxes and other employee-related expenses when budgeting for salaries and wages.

- Regularly review and adjust employee wages as necessary to ensure your business remains competitive in the market.

Rent, lease or mortgage

When planning your bicycle retail business plan , one of the most important expenses to consider is the cost of owning or renting store space. These expenses can have a substantial impact on your bike shop revenue model and the sustainability of your business over time.

If you choose to rent space, you will be required to pay monthly rent that covers your use of the property. The cost of rent will depend on the size and location of your store, as well as other factors such as the length of your lease and local market rates. When developing your Cycle Store Profit Forecast , be sure to include your rent costs each month.

A lease is another option for getting a storefront. Unlike leasing, leasing involves a pre-determined contract, often lasting several years, with specific terms and means of renewing the lease. Although the initial costs of renting may be higher than renting, renting can be a more cost-effective option in the long run. In your bike shop financial plan , be sure to calculate the cost of the lease over time, including the initial lease fee and the cost of renewal if you decide to continue the lease.

If you choose to purchase property for your shop, you will need to take out a mortgage to provide for the initial costs of the purchase. Mortgage payments can vary depending on the amount of the loan, interest rates and additional expenses such as property taxes or insurance. As part of your Bike Dealer Budgeting , consider your projected income and expenses to determine if owning a property is a financially sound decision.

Tips & Tricks:

- Consider the cost of utilities when budgeting for a storefront.

- Don’t forget to include costs associated with breaking a lease or ending a mortgage agreement early.

- When evaluating different storefront options, consider the cost and convenience of parking for your customers.

Bike shop utilities

Utilities are an important aspect of a bike shop’s financial plan. It includes fuel, electricity, water, telephone and internet costs. The cost may vary depending on the size, location of your business and other factors.

When creating your bike shop’s revenue projection, you need to be sure to consider monthly expenses for utilities. For example, a financial bike shop will have fluctuating bills depending on the number of bikes rented each month. A bicycle retail business plan in a large city will have different utility costs than in a small city.

Budgeting for bike dealerships should factor in monthly utility costs like phone and internet expenses to run their business online. Financial planning for bicycle repair shops will have electricity costs to run their tools and equipment.

Tips & Tricks:

- Consider energy-efficient options such as LED lights, smart thermostats, and low-flow fixtures to lower your utility costs.

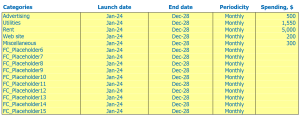

Bicycle Shop Other running costs

While creating a bike shop financial plan , it is essential to include the ‘Other’ running costs that the business incurs. This category includes items that are not directly related to sales products. Costs are those not shown in Bike Shop Revenue Model .

Examples of Operating Costs or Operating Expenses Include rent for the store, utilities like water, electricity, garbage collection, among others. This category also includes insurance costs, legal fees, marketing fees, licenses and permit fees.

It is essential to include them under the financial plan of the bicycle shop since they have an impact on the overall profitability of the business. These Bike Shop Income Projection Expenses differ depending on the state, location, and operation of the shop.

A Bike Dealer Budgeting Plan should include possible contingencies and an emergency fund for timely solutions to unforeseen expenses. This approach means the business remains flexible and agile while keeping finances organized.

It is also necessary to include Bicycle repair shop Financial planning expenses of “other” running costs. This category can interact with the cost of goods sold, especially with regard to spare parts and labor costs.

Bike shop financial forecast:

If you are interested in starting a bike shop, having a solid financial plan in place is essential. A complete financial model should consist of several documents or reports, including the profit and loss statement, sources and uses of the report, and a financial forecast which contains essential data such as the workshop revenue projection of cyclis Analysis. It is also essential to consider the budgeting of a bicycle dealership, a financial bicycle shop, a financial model of bicycle accessories or a financial planning of bicycle repair.

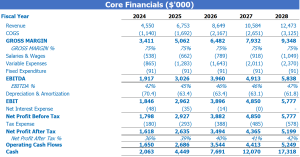

Profitability of the bike workshop

Once we have created revenue and expense projections for our cycling store, we can check the Profit & Loss (P&L) statement from revenue to net profit. This process will help us visualize the “profitability” of the store, such as gross profit or EBITDA margin.

For the financial planning of the bike shop, it is crucial to do a thorough analysis of our cash flow. This includes reviewing our bike store financial plan, cycle store profit projections, and bike accessories financial model to get an accurate projection of our revenues and expenses.

Tips & Tricks:

- Review our Financial bike rental store regularly to identify areas that need improvement.

- Keep track of our bike dealership budgeting and adjust our expenses to maximize revenue margins.

- Offer promotions and discounts to incentivize customers and increase sales.

- Provide excellent customer service to retain customers and create a loyal customer base.

It’s important to focus on our bike shop revenue model and develop a solid business plan that will help us achieve our financial goals. The consistent Bike Repair Shop financial planning, reviewing our cycle shop profit forecasts and a cash flow analysis will keep us on track and profitable.

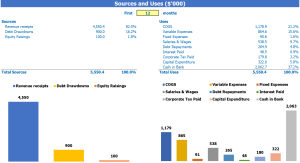

Bicycle sources and use of the chart

The Sources and Uses of Funds in Excel’s Financial Model for Bicycle Shop provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

It is important for Bicycle Shop to develop a complete Bicycle Retail Business Plan, including Bicycle Shop Revenue Model, Bicycle Shop Financial Plan, Workshop Revenue Projection Bike Shop, Bike Shop Cash Flow Analysis, Cycle Shop Profit Forecast, Bike Dealer Budgeting, Bike Rental Finances, Bike Accessories Stores Financial Model, and a Bike Repair Shop Model financial planning to ensure the financial sustainability of the different business aspects.

Tips and tricks:

- Be sure to update your sources and regularly use a statement as your business grows to ensure your financial decisions are well-informed.

Building a financial model for a bike shop is an essential step in ensuring the success of your business. Using Bike Shop Revenue Model , Bike Shop Financial Plan , Bike Shop Revenue Projection , Bike Retail Business Plan , Shop Cash Flow Analysis Cycle Store Profit Forecast , Bike Dealer Budgeting , Bike Rental Financial , Bike Accessories Store Financial Model and Bike Repair Shop Financial Planning You can create a realistic strategy for your business, this that will help you make informed decisions and take actions that create long-term success. Consider potential changes that could impact your business and create a flexible financial model, so you can adjust your plans accordingly. With a well-designed financial model, you can set achievable goals and create a solid foundation for a successful business.