After the publication of this article, ING Direct decided to change the rules of the game. From now on, the bank no longer offers any account opening bonus but it continues to offer a referral bonus to the godson (you) and to the godfather (me) for an amount of 30€ (30€ for the godson, and 30€ for the godfather).

To benefit from this sponsorship bonus of €30, simply enter this sponsor code when registering: KHKDACC.

When it comes to saving money and making money at the same time……there is no excuse: you have to jump at the chance. In this article, it is this type of opportunity that I will present to you.

But before that :

Aren’t you tired of continually paying fees to your bank?

And when I talk about fees, I’m talking about account management, credit card, intervention commission (the list is very long)…

Some time ago, I had already told you about the monstrous fees that our dear French banks charged to all of their customers.

Since then, little has changed.

In this article, I show you how:

We promise: no scams, no dirty tricks, no advertising, nothing, nada.

With me, everything is clean , well explained and in detail so that you too can enjoy it. This article is my honest opinion of ING after several years as a customer.

If, after reading this article, you wish to open an account with ING Direct then I will be delighted to have convinced you! You can (not mandatory) support the site by entering this sponsor code when you register: KHKDACC.

Today, I’m giving you some feedback on one of the banks I chose to host my personal current account: ING Direct.

This is what will allow you to save and earn money at the same time.

This article aims to offer a comparison between this online bank and traditional banks such as BNP Paribas, Société Générale or Caisse d’Épargne.

In addition, I take this opportunity to give you my opinion on ING Direct, where I have been a client for several years.

For me, it is one of the best banks with which I could have a current account.

Changing banks is not complicated. In addition, opening an online bank account is very simple.

My opinion on ING Direct

Business: Online banking for individuals

Ease of account opening

A letter to send, with a little paperwork to fill out

Banking advice

Advisers not appointed but reachable by phone until 9 p.m.

Customer Support

Effective support by phone and social media

Current transaction prices

2nd cheapest bank in France (Union Bancaire study)

I like

I do not like

Understand the online banking niche:

They reduce the level of service in the sense that you will not have a dedicated advisor in a physical agency.

On the other hand, they return part of these operating savings to you by making many operations free of charge in other banks.

If you are one of the majority of people who never make an appointment with their bank advisor, then online banks will allow you to save money while gaining independence.

You can make your transfers from home, print your bank details, consult your statements… from the comfort of your computer.

Managing your budget like a Fox then becomes child’s play!

The consequence is this:

Happy customers, who manage themselves and when they have a problem can reach a bank employee by telephone.

On the other hand, if you regularly need to be in contact with an employee of your bank for various operations, or if you are not ready to be the sole manager of your account, then stop reading here – online banks are not for you.

ONLINE BANKING ADVANTAGES

DISADVANTAGES

ONLINE BANKS

Rest assured :

Opening an online bank account is very simple. Below, I take the example of opening a bank account in one of the best online banks: ING Direct.

Let’s see how the registration goes.

#1: To change bank, go to the ingdirect.fr website and complete the registration form

When you arrive on the home page of their site, there is nothing simpler:

A click on the orange button: “Discover the bank account”:

Then on “Open your current account”:

And we arrive on a third page, where you can finally enter your information:

Then follows a classic form to request your opening of an account.

Nothing very complicated: the form is easy to use and is relatively comparable to what your current bank asked you when opening your account.

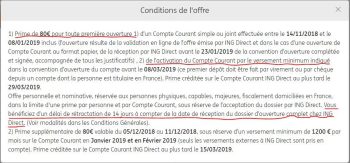

Now let’s talk about these famous 80€. Conditions are attached to it (circled in red in the last screenshot).

Of course, if you click on the “See conditions” link (boxed in red on the last screenshot), you come to a very long paragraph with a good number of conditions.

Luckily, I’ve highlighted the really important ones for you:

In summary :

The rest is just legalese. It immediately made you less afraid, didn’t it?

#2: Follow the instructions in the account confirmation email to the letter

A few minutes after completing the registration form, you will receive the following email:

You must therefore return the opening agreement and the supporting documents in an unstamped envelope to the address indicated in the email.

That’s all ! Your part of the job is done.

The creation of your current account and your means of payment is now in the hands of ING Direct.

#3: Receiving your Gold Mastercard by post

A few days later, you receive three things in the mail:

#4: Receiving the €80 welcome bonus

You come to the end of the process.

In a few days, you will see this on your ING account:

Cheer ! You have just received 80€ without doing anything.

In addition, you benefit from ING advantages for life: free day-to-day transactions, free high-end Carte Bleue, cash withdrawals from all ATMs, etc.

It’s over, you have successfully changed banks by opening an online bank account!

By registering with ING, you have accumulated two advantages:

Free Current Account

While traditional banks charge up to €150 per year for this service

Bonus of 80€

Non-existent with traditional banks

A secure and polished customer interface, which makes ING Direct one of the best online banks

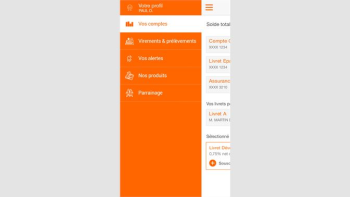

In addition to all these advantages, the client interface is very very simple.

You cannot miss the access link:

Then you are asked for your customer number and date of birth:

And all you have to do is enter your secret code via the electronic keyboard:

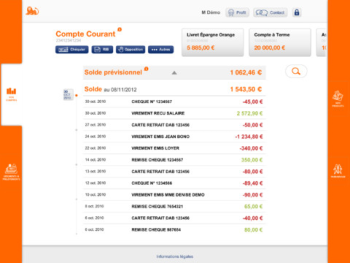

Once connected, the customer area consists of 3 main functions:

Your accounts

This is where you will be able to see your account statements and transactions.

Your transfers

This is where you can create one-time or monthly transfer orders.

Your messages

This is the communication interface with ING Direct customer service

Pretty simple, isn’t it?

Make a transfer in 10 seconds from home (ING Direct)

Even if I am generally happy with my customer experience at ING, I still have to highlight a big black point.

Indeed: if you travel a lot (and therefore spend a lot) outside the euro zone, then ING Direct may not be for you.

Here’s why :

The bank applies what is called a minimum cap on its commissions.

Let me explain :

When you make a purchase with a credit card outside the Euro zone (in England for example), the bank must convert your euros into local currency (= pounds sterling here).

To carry out the operation, it takes a commission from your account.

On credit card transactions outside the Euro zone, the amount of the commission is usually 2% of the amount of the transaction.

This is for example the case in a large number of banks that you know, for example the Banques Populaires or Société Générale:

Comparison of traditional French banks

At the Banques Populaires (2.10%)

Click here to access the full pricing brochure

At Société Générale (€1 + 2.70%)

ING Direct offers slightly cheaper pricing (2.0%), but it adds a very restrictive condition:

In other words, the commission charged by ING may not be less than €0.5, regardless of the amount of the transaction.

It does not matter whether you make a purchase worth 5 pounds or 10 pounds, ING will debit €0.5 from your account as a foreign exchange commission. Instead of the €0.12 (for £5) and €0.18 (for £10) that it would have charged without the cap.

Difference in pricing on credit card transactions abroad, between ING Direct and a popular traditional network bank (comparison of two transactions)

€0.50 Amount of ING’s commission for a purchase of £4 (pound sterling)

Explanations: £4 equals approximately €5.6. 2% of €5.6 is equal to €0.11. This is less than €0.5 (the minimum cap), so ING charges €0.5.

€1.12 Amount of ING’s commission for a purchase of £40 (pound sterling)

Explanations: £40 equals €56.16. 2% of €56.16 is €1.12.

0.12 € Amount of the commission of a popular bank for a purchase of £4 (pound sterling)

Explanations: £4 equals approximately €5.6. 2.1% of €5.6 is equal to €0.12. There is no minimum ceiling, the bank charges €0.12.

1.18 € Amount of the commission of a popular bank for a purchase of £40 (pound sterling)

Explanations: £40 equals approximately €56.16. 2.1% of €5.6 is equal to €1.18.

These amounts may seem negligible to you.

But if, like me, you travel a lot outside the euro zone and you do a lot of small transactions by Carte Bleue, then these tens of cents will add up quickly and can represent several hundred euros over a year.

So, I warn you: ING is perfect for transactions in France and those carried out abroad on large amounts (greater than 25 EUR, the one that breaks the minimum cap). Below, the default commission of 0.5€ will cost you dearly especially if you travel a lot!

It is a bank which has many advantages, and which is the least expensive for the vast majority of banking operations. It is also a bank with rather lax account opening conditions (€1,200/month), unlike other players such as Fortunéo or Boursorama. My opinion on ING Direct is therefore rather positive.

Now it’s up to you to choose your bank. This choice depends greatly on your uses: if you are rather independent, then opening an online bank account can be a very good idea. ING Direct then represents one of the best banks and above all one of the cheapest.