- Home

- Sales and revenue

- Running costs

- Financial

Starting a Props Store can be an exciting and exciting endeavor for any entrepreneur. With the growing popularity of fashion trends and the growing demand for accessories, it is a promising industry to enter. However, to ensure the success of your business, it is crucial to create a financial model . This model will help you assess the profitability of your business, identify potential risks, and forecast future revenue growth. In this blog post, we’ll walk you through the steps to building a comprehensive financial plan for your accessories store. We’ll cover everything from a SWOT Analysis to Competitive Analysis , Cash Flow Projection , Profitability Analysis , and many more. So let’s get started!

Accessories Shop Revenue & Sales Forecast

As part of the accessories store financial model, revenue and sales forecasts play a vital role. With the launch date set for the next quarter, the sales ramp-up time is expected to be six months. Based on current walk-in traffic and growth assumptions, we predict an average of 50 customers per day with an average purchase of . Sales seasonality is expected, with peak sales occurring in the fourth quarter due to holiday shopping.

Accessories Shop launch date

The launch date of your accessories store is very important. A well-planned launch sets the tone for your business, attracting customers and generating buzz. Choosing the right launch date requires careful consideration of your target market, industry trends, and seasonal factors such as holidays and special events.

When selecting the launch date for your accessories store, it is essential to consider the financial plan, including revenue and profitability analysis, cash flow projection, break-even point, sales forecasts and marketing strategy. You will also need to perform a SWOT analysis and competitive analysis to determine the best time to launch your business.

Once you’ve decided on the launch date, it’s time to start planning. You will need to prepare and plan activities and costs related to the launch of accessories boutique activities, including marketing materials, inventory, staffing and equipment. By launching in the middle of the year, you can maximize your launch impact while minimizing costs.

Tips & Tricks:

- Consider hosting a launch event or promotion to generate awareness and excitement for your accessories store.

- Research seasonal trends and industry events to identify the best time to launch.

- Make sure all launch activities are aligned with your business plan and financial projections.

Accessories Ramp-up time

Sales forecasting for a new business is an essential step in the business plan. One consideration that is often overlooked is the ramp-up time to the sales plateau. This is the time it takes for the business to reach its maximum sales potential. It is important to consider this when creating a sales forecast as it can have a significant impact on forecast accuracy.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In your industry, it may be 6 to 18 months, depending on the type of business and market conditions. For an accessories store, a 12-month ramp-up period is not uncommon.

Tips & Tricks

- Research the ramp-up period for your specific industry to get a better estimate of how long your business will take to reach its maximum sales potential.

- Use past data from similar businesses to help you predict your ramp-up time to the sales plateau.

- Consider your marketing strategy and how it may affect your ramp-up time. For example, a strong social media presence can help shorten the ramp-up period.

Accessories Shop Walk-In Traffic Entrance

After the six-month ramp-up period, the average daily traffic for accessories was estimated based on historical data for the last six months. On Monday the average daily traffic was 25 customers, Tuesday saw 30 customers, Wednesday had 35 customers, Thursdays had 40 customers, Friday had 50 customers, Saturday had 60 customers and Sunday saw 45 customers . These inputs are crucial in creating the financial plan for Boutique Accessories as it would help predict sales for years to come.

The average walk-in traffic for the future on weekdays for five years would be calculated using the walk-in traffic growth factor by years. The growth factor for Mondays, Tuesdays, Wednesdays, Thursdays, Fridays, Saturdays and Sundays ranges from 1.01 to 1.05 which is based on various factors such as marketing strategy, competitive analysis and SWOT analysis. Using these values, the Accessories Boutique sales forecast was created and the financial plan for the Accessories Boutique can accurately represent walk-in traffic for their business.

Tips & Tricks:

- Carefully analyze daily walk-in traffic to estimate future sales.

- Perform a competitive and SWOT analysis to define a realistic growth factor.

- Use a sales forecast to predict future walk-in traffic for financial planning.

Accessories Shop visits for sales conversion and repeat sales entries

One of the main contributions of creating a financial model for Accessories Boutique is the conversion rate of website visits to new customers. This rate will determine the number of new customers and revenue generated each month. Based on historical data, we can assume an average conversion rate of 10% for Boutique accessories. This means that out of 100 website visitors, 10 will make a purchase and become a new customer.

Another important assumption for building a financial model for Boutique Accessories is the percentage of repeat customers. Repeat customers are important because they regularly generate income and can be a source of referrals. Based on customer surveys, we can assume that 30% of Shop Accessories customers will make a repeat purchase each month.

In addition to the percentage of repeat customers, the average number of purchases made by each repeat customer per month is an important assumption for building a financial model for accessories. Based on historical data, we can assume that each repeat customer will make an average of 1.5 purchases per month.

Tips & Tricks:

- Regularly offering promotions to repeat customers can encourage them to make additional purchases each month.

- Collecting customer feedback and addressing their concerns can increase the likelihood of repeat purchases.

- Implementing a loyalty program can encourage customers to continue shopping at Accessories Boutique.

Accessories Shop Sales Mix Starters

Your Accessories Store sells a variety of Accessories Boutique Products , each belonging to a specific product category. To better understand your sales mix, it is important to enter sales mix assumptions at the product category level. This will make it easier to track your sales by category and make informed decisions.

For example, let’s say your accessories store sells the following product categories: jewelry, handbags, scarves, sunglasses, and hats. To determine the category of sales by product combination, you will need to forecast sales for each category and express as a percentage of total sales.

You can use previous sales data to estimate the sales mix for each year of your forecast. Let’s say that, based on historical data, you estimate that your sales mix for the first year of your forecast will look like this:

- Jewelry: 30%

- Handbags: 25%

- Scarves: 20%

- Sunglasses: 15%

- Hats: 10%

As you continue to forecast sales for each year, you can adjust these percentages based on new trends or upcoming product launches. By forecasting the reduction in sales by product category, you can make informed decisions about which product categories to focus on in your marketing strategy and how to allocate resources.

Tips & Tricks:

- Consider creating a matrix that tracks your sales mix by product category over time to spot trends and areas that need improvement.

- Periodically review your sales mix and compare it to industry benchmarks to stay on top of market shifts and changes.

Accessories Shop Average ticket sales amount

At Accessories Boutique, we sell a variety of products such as jewelry, bags, scarves and sunglasses, each belonging to a specific product category. We enter assumptions at the product category level rather than individually for each product, which makes estimation easier. One of these assumptions is the average sales amount by product categories and by years. For example, we assume that the average sale amount for jewelry will increase by 2% every year.

Using the average sale amount of each product category, the model will calculate the average ticket size. Our average sale amount for jewelry is , for bags it is , for scarves it is , and for sunglasses it is . If we assume a sales mix of 50% jewelry, 30% bags, 10% scarves and 10% sunglasses, the average ticket size would be calculated as follows:

(0.5*)+(0.3*)+(0.1*)+(0.1*) =

Tips & Tricks:

- Regularly review and update your average sales amounts to reflect changes in customer behavior, market trends and competition.

- Don’t just rely on historical data, factor in external market conditions and potential impacts on sales.

- Consider bundling products to increase average ticket size.

Accessories Boutique sale seasonality

Seasonality is a crucial aspect of any accessory store sales forecast. Business owners need to understand how sales seasonality works and plan their inventory, marketing, and other activities accordingly.

Usually, the seasonality of accessory boutique sales depends on several factors such as weather, holidays, and festivals. For example, sales of summer hats and sunglasses will be high during summers while winter coats and gloves will sell higher during winters. The holiday season can also bring an increase in sales.

Business owners can use the average monthly sales per day to calculate the percentage deviation from the average sales for each month. This will help them determine high and low sales months and plan their inventory and marketing budgets accordingly.

Tips & Tricks:

- Track and analyze customer buying patterns during different seasons to identify the hottest items.

- Offer season-specific discounts and promotions to entice customers to buy more.

- Plan ahead for seasonal stock needs to avoid stocking or overstocking.

- Consider diversifying product offerings to meet ever-changing customer buying patterns.

By accurately analyzing the seasonality of accessories store sales, business owners can make informed decisions on inventory, marketing strategies, and financial plans for accessories. A thorough accessories store sales forecast should consider seasonality to provide a realistic picture of revenue, cash flow, profitability, break-even analysis and other important elements of the business plan. props shop business.

Accessories Shop Operational costs Forecast

Operational expense forecasts are a crucial element within the accessories store financial model. It contains a detailed projection of business costs, including cost of goods sold by products %, employee salaries and wages, rent, lease payment or mortgages, utilities and other expenses Operating.

| Cost of goods sold by products % | 0 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,500 |

| Public services | 0 – 0 |

| Other running costs | 0 – ,500 |

| Total | ,200 – ,000 |

By calculating monthly expenses accurately, Accessories Boutique can manage its resources much more efficiently. This will eventually lead to increased revenue and profitability.

Accessories Shop Cost of Goods Sold

As part of our accessories store financial plan, we determined the cost of goods sold (COG) for our product categories. COGS includes the direct costs of acquiring, producing, and delivering goods to customers. The assumptions we made for the inner workings are:

- We estimate that our cogs will represent approximately 30% of the jewelry retail price.

- For handbags and wallets, we estimate a COG of 40% of the retail price.

- For scarves and hats, we estimate a COG of 20% of the retail price.

These assumptions will guide the profitability analysis of our accessories, as they are the necessary inputs to calculate our gross profit margin. We will regularly review and adjust our COGS assumptions as necessary based on changes in the market, supplier costs or other factors affecting our business.

Tips & Tricks

- Regularly review and adjust your COGS assumptions to ensure you are pricing your products appropriately for profitability.

- Shop around for the best deals on supplies and materials to help cut your cogs.

- Try to keep your COGs below 50% of your retail price to ensure you make a reasonable profit.

Accessories Shop Salaries and Wages of Employees

In order to project accurate expenses, we assume that one manager, two full-time business associates and one part-time associate will be hired for the year.

We will pay our manager an annual salary of ,000, our full-time sales associates ,000 each, and our part-time sales associate ,000. These salaries include payroll taxes and benefits.

The manager will be hired before the grand opening to oversee all aspects of the business. The two full-time business associates will be hired once we reach our planned starting point. The part-time Sales Associate will be hired during peak seasons or as needed throughout the year.

Assuming all positions are filled for the full year, the total salaries and wages will be 0,000.

Tips & Tricks:

- Consider paying a higher hourly wage to attract and retain top talent.

- Offering benefits such as health insurance or pension plans can also help attract quality employees.

- Consider hiring seasonal or part-time staff during busy periods to avoid unnecessary expenses during slower seasons.

Shop rent, rental or mortgage payment props

When creating a financial plan for an accessories store, it’s essential to make wise decisions about rent, lease, or mortgage payments. These payments take up a significant portion of an accessories store’s total spend.

For example, if an accessory store rents 500 square feet of space at per square foot, the annual rent costs would be ,000 per year. If the prop shop is leasing the space, the terms of the rental agreement should be well negotiated to ensure expenses are manageable over the lease period.

If the prop shop owner decides to take out a mortgage to buy the space, the mortgage payment would be more than the rent or lease payment, but the business owner would return the equity.

Tips & Tricks:

- Research the real estate market for the best rent, lease or mortgage payment offer.

- When negotiating a lease, ask for as much flexibility and concessions as possible.

- Consider buying a property if it is financially feasible.

Accessories Shop Utilities

Utilities are expenses necessary to operate the store. These include things like rent, electricity, water, internet, telephone and insurance. For our accessory shop business plan, we assumed that utilities will cost ,000 per month.

In addition to fixed costs, there are variable expenses that fall under utilities. For example, if the shop is open for longer hours and more people are employed, the cost of utilities will increase. We assumed that the cost of utilities could increase by about 15% each year.

Tips & Tricks

- Try to negotiate the rent with the landlord to get better rates.

- Consider energy-efficient lighting and equipment to reduce costs.

- Implement a paperless system to save money on printing and postage.

By considering utility expenses, we can better understand the overall expenses and profits of Boutique Accessories. This will help us create Financial Plan for Boutique Accessories and also in the Accessories Boutique Profitability Analysis , Accessories Boutique Cash Flow Projection , and Accessories Boutique Boutique Analysis .

Utilities expenses also play an important role in determining the Accessories Boutique Sales Forecast , Accessories Boutique Marketing Strategy , Accessories Boutique SWOT Analysis , and Accessories Boutique Competitive Analysis .

Accessories Shop Other running costs:

When constructing a financial plan for boutique fixtures , it’s important to consider not only the obvious costs like rent, inventory, and employee salaries, but also the other operating costs. These can include things like utilities, insurance, professional fees, and marketing fees.

For example, utilities can include electricity, water, and internet bills that are needed to run the store. Insurance costs may include liability insurance and property insurance to protect against unexpected events. Professional fees may include accounting and legal services necessary to ensure compliance with government regulations.

Marketing expenses may include promoting the store on social media, creating advertisements, and organizing events to attract more customers. It is important to allocate funds for these other operating costs in the Prop Shop Business Plan to ensure that there is enough money available to cover all expenses while maintaining profitability.

Accessories Store Financial Forecast

As part of the accessories store financial model, the financial forecast provides a projection of revenues, expenses, cash flow, and profitability over a certain period based on different assumptions. These forecasts include a profit and loss statement, which shows the company’s revenues, costs and expenses, and a Sources and Use report, which details where the company’s capital comes from and how it will be used. . By using financial forecasts, Boutique Accessories can make informed decisions about how to allocate resources and achieve business goals.

Shop Profitability Props

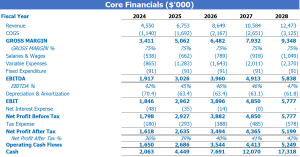

Once we’ve created revenue and expense projections, it’s critical that we check the profit and loss (P&L) statement from revenue through to net profit, which will help us visualize profitability metrics such as gross profit or EBITDA margin.

It’s also essential to conduct a comprehensive prop profitability analysis on a regular basis to assess the health of your business and adjust your strategies accordingly. This includes conducting a detailed accessories boutique sales forecast, cash flow projection and break-even analysis, as well as reviewing your accessories boutique SWOT analysis, competitive analysis and a marketing strategy.

Tips & Tricks:

- Keep track of your daily expenses and income reports to avoid sudden surprises.

- Adjust your prices based on market demand and customer feedback.

- Offer promotions and discounts to attract new customers and retain existing ones.

By implementing a financial plan for Boutique Accessories, you can determine the profitability potential of your business and take the necessary steps to maximize it. Building a strategic accessory boutique business plan, including a thorough revenue model, can help you achieve your desired level of success.

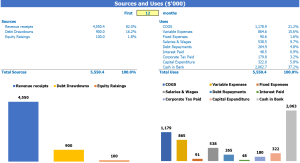

Props Sources and use of props: chart:

The Sources and Uses of Funds in Financial Model in Excel for Accessories Boutique provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses.

It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips and tricks:

- Be sure to accurately project sources and uses to avoid discrepancies.

- Regularly re-evaluate your sources and use statement to ensure it aligns with your business goals.

- Seek professional advice when dealing with complex capital allocation issues.

Financial modeling is crucial for any business looking to succeed and prosper. Creating a financial plan for an accessories store requires considering various factors that contribute to its profitability and sustainability. By performing in-depth analysis of accessories shop revenue model, profitability, cash flow projection, break-even analysis, sales forecast, marketing strategy, analysis SWOT, competitive analysis and business plan, a well-defined financial model can be developed. The financial model not only helps the business owner understand the financial health of the business, but also helps in making informed decisions about the future viability of the business. Therefore, building a robust financial model for an accessories boutique can pave the way for a profitable and successful business venture.