- Home

- Sales and revenue

- Running costs

- Financial

Running an appliance store comes with plenty of opportunities to grow your business and make it more profitable. However, this can only happen when you have a solid financial model guiding your decision making. Building a financial model for your appliance store involves creating an Appliance Store Financial Plan. This outlines your expected Appliance Store Revenue Model , Appliance Store Profit Model , Financial Projections. of the appliance store , and financial statements of the appliance store . This post outlines the Appliance Store Financial Planning Tips and Strategies you need to build a sustainable and profitable business. Keep reading to learn more.

Appliance Store Revenue and Sales Forecast

As part of the Appliance store’s financial model, revenue and sales forecasts play a crucial role. It helps in estimating the expected revenue from the planned period of operation. A financial plan for an appliance store should include a well-documented revenue model with detailed financial projections.

The revenue model should consider a variety of factors, including launch date, ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality. Financial projections should also be based on past performance and sales data, which makes it easier to estimate future revenues.

Financial planning for an appliance store should also include a good financial strategy, which supports the revenue model, ensuring that the store’s financial statements are properly maintained. Effective financial management is essential to the success of an appliance store, providing the necessary information and the ability to adjust strategies as needed.

Device Store Launch Date

The launch date of a device store is crucial for its success. Timing should be considered closely during the business planning process to ensure store success later on.

Why is the launch date important? It sets the pace for all the action that will follow before the doors open. It acts as a marker for a calendar with many important events that need to happen before the store is ready to open to the public.

Tips & Tricks: When deciding on a launch date, pick a time when finances are strong and overheads are low. Research the industry and choose a date when there are fewer competitors launching, as this can give your business a greater chance of success.

Device Store Ramp Time

When opening an appliance store, it is important to consider the ramp-up time to the sales plateau. This is the period of time it takes for your business to adapt and reach a stable level of sales. Predicting this period is crucial for your financial planning and projections.

What is the ramp-up period for your business? It depends on various factors such as location, competition and marketing strategies. In the appliance store industry, it can usually range from six months to a year.

Tips & Tricks:

- Conduct market research to understand your target audience and your competition.

- Invest in effective marketing strategies to increase brand awareness.

- Offer promotions and discounts to attract customers during the ramp-up period.

- Monitor your financials regularly and adjust your plan accordingly.

By factoring rise time into your financial analysis, you can make informed decisions about your company’s financial management and strategy. Plan wisely and prepare the sales floor to ensure the long-term success of your appliance store.

Device Store Appointment Traffic Entries

After the ramp-up period, the average daily walk-in traffic of appliance store visitors is crucial information to build a financial model. For example, on weekdays, Monday is the busiest with an average of 100 visitors, followed by Tuesday with 80 visitors, Wednesday and Thursday with 70 visitors, Friday with 90 visitors, then Saturday and Sunday with 120 visitors combined.

It is important to also consider the average traffic growth factor over the years. For the appliance store, we estimated that the traffic will increase by 5% every year, resulting in more potential customers in the future. With these inputs, the financial model will be able to forecast future walk-in traffic for the weekday appliance store for the next five years.

Tips & Tricks:

- Make sure to collect accurate walk-in traffic data to build the most reliable financial model for the appliance store.

- Keep in mind external factors that can influence walk-in traffic, such as seasonality or local events.

By taking into account estimated walk-in traffic growth and assumptions about sales conversion rates, average order values, and operating costs, we can create a comprehensive financial plan for the store. devices. This includes projected income, expenses and profits, as well as balance sheet and cash flow statements.

Appliance store visits to sales conversion and repeat sales entries

In order to determine the financial projections of an appliance store, it is important to consider the percentage of visitors who convert to new customers and the percentage of repeat customers. The conversion rate from visitors to new customers varies by location and competition, but averages around 20%. This means that out of 100 visitors, 20 will become new customers.

- Offer a discount on the first purchase for new customers to increase the conversion rate.

Tips & Tricks:

The percentage of repeat customers also varies, but again it’s around 20%. This means that out of 100 customers, 20 will return for at least one more purchase. It is important to consider the number of purchases each repeat customer will make per month. For example, if the average repeat customer makes one purchase per month and the store has 100 repeat customers, the store can expect about 100 sales per month from repeat customers.

These repeat conversion and sales inputs are crucial when building a financial model for an appliance store. By understanding these numbers, the store can make accurate financial projections and create a financial plan. Knowing the expected revenue from new and repeat customers is important in determining the profit model and financial strategy for the business.

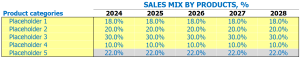

Appliance store sales mix entries

In our appliance store, we sell a variety of products ranging from refrigerators and washing machines to air conditioners and microwaves. We have classified our products into five categories, namely refrigerators, washing machines, air conditioners, microwaves and other appliances.

Entering sales mix assumptions at the product category level is much easier for us to understand. We make assumptions about the category of sales by product for each of the five forecast years.

Here is the sales mix by product category assumptions for the next five years:

- Refrigerators – 35%, 33%, 30%, 28%, 25%

- Washing machines – 25%, 27%, 28%, 30%, 32%

- Air conditioners – 20%, 18%, 17%, 16%, 15%

- Microwaves – 10%, 11%, 12%, 13%, 14%

- Other devices – 10%, 11%, 13%, 13%, 14%

Tips & Tricks:

- Be sure to update sales mix assumptions annually based on market trends and customer demand.

- Closely monitor the sales mix to identify changes and adjust inventory and marketing strategies accordingly.

- Use the sales mix calculation to determine the revenue and profit contribution of each product category and make informed decisions.

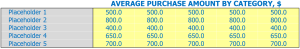

Device Store Average Entry Amount

In our appliance store, we sell many different products which are divided into specific product categories. This allows us to enter assumptions at the category level rather than the product level, making it easier for us to estimate the average sale amount.

For example, in our appliance store, we have the following product categories: refrigerators, ovens, washers, dryers and dishwashers. We may estimate the average sale amount of each category for each year based on historical data and market trends. The following table shows an example:

| product category | 2019 AVG. Sale amount | 2020 AVG. Sale amount | 2021 Avg. Sale amount |

|---|---|---|---|

| Refrigerators | ,200 | ,300 | ,400 |

| Ovens | 0 | 0 | 0 |

| washers | 0 | 0 | ,000 |

| Dryers | 0 | 0 | 0 |

| Dishwasher | 0 | 0 | 0 |

Using the sales mix of each category and the average sale amount, we can calculate the average ticket size of our store. Average ticket size is the average amount spent by a customer at our store per visit. This calculation is important for our financial analysis and the financial forecast of the appliance store.

Tips & Tricks:

- It is important to update the average input sale amount regularly to reflect changes in market trends and product availability.

- Compare each category’s average sale amount with the industry average to get a better idea of how our store performs against competitors.

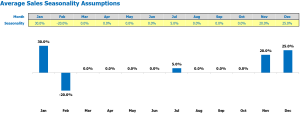

Appliance store sales seasonality

Understanding the seasonality of sales in an appliance store is essential to developing a successful financial plan. Most appliance stores have seasonal sales cycles that follow the calendar year with higher sales in certain months.

Financial analysis of the appliance store should take into account this seasonal variation and adjust the financial plan accordingly. Each month of the year should have an estimated average sale per day used to calculate monthly revenue projections and financial forecasts .

For example, summer months may see a 20% increase in sales due to higher air conditioning purchases, while winter months may experience a 10% drop in sales due to lower air conditioning. demand for refrigerators. These assumptions are based on historical sales data and market trend analysis.

Tips & Tricks:

- Take advantage of seasonal trends by stocking the most popular items during high value months and offering discounts during low value months.

- Adjust staff levels and inventory levels based on seasonal sales cycles to prevent over or under completion and under stocking.

- Monitor market trends and adjust sales seasonality assumptions accordingly to stay competitive and adapt to changing market conditions.

Appliance store financial management should use sales seasonality assumptions to develop a comprehensive financial plan that includes revenue projections, financial statements , and profit and loss calculations. By accounting for seasonal variation, the store can be better prepared for revenue fluctuations and adjust operations accordingly.

Overall, understanding sales seasonality is fundamental to developing a successful appliance store financial strategy that can adapt to changing market trends and seasonal variations.

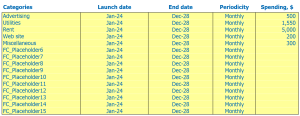

Device Store Operational Spend Forecast

As a vital part of the overall financial model for an appliance store, operational expense forecasts are crucial. These expenses include the cost of goods sold by the products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating expenses. These expenses should be as minimized as possible to make a profit and improve the business.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | 6,000 – 12,000 |

| Salaries and wages of employees | 10,000 – 18,000 |

| Rent, lease or mortgage payment | 8,000 – 15,000 |

| Public services | 1,500 – 3,500 |

| Other running costs | 1,000 – 3,000 |

| Total | ,500 – ,500 |

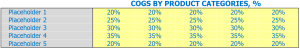

Device Store Cost of Goods Sold

Appliance store financial analysis requires a thorough review of appliance store revenue model , Appliance store financial plan , Appliance store profit model , Appliance store financial projections , Store financial planning , Appliance Store Financial Forecast , Appliance Store Financials , Appliance Store Financial Management , and Appliance Store Financial Strategy . One of the most important financial elements to consider is the Cost of Goods Sold also known as COGS.

Cost of Goods Sold Is the total cost incurred to produce and sell a product. It includes both the direct cost of materials, labor and overhead involved in the production of a product, as well as the indirect costs associated with it such as shipping, taxes , import duties, etc.

When calculating the Cost of Goods Sold , it is important to consider various factors such as the price of materials, production related expenses, labor costs, rental costs and other overheads. COGs may vary depending on the type of product sold. For example, large appliances like refrigerators and washing machines have high cogs due to the sheer scale of the product, while small appliances like blenders and toasters have low cogs.

Tips & Tricks

- Regularly keeping track of your COGs can help you make informed decisions about pricing and product strategies.

- Try to keep your cost of goods as low as possible without sacrificing quality to maximize profits.

- Use technology tools like inventory management software to monitor and optimize inventory levels and effectively manage COGs.

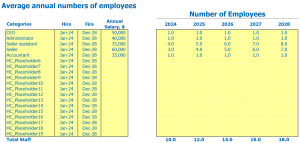

Salaries and wages of appliance store employees

Employee salaries and wages are an important part of the appliance store’s financial plan.

Proper management of staff wages and salaries will help the business achieve its financial goals.

Assumptions: The Appliance Store will have the following staff members/positions: Sales Associate, Customer Service Representative, Delivery Driver, Store Manager.

The Sales Associate will be hired within the first month of operation and will earn ,000 per year. The customer service representative will be hired in the third month and will earn ,000 per year. The delivery driver will be hired in month four and will earn ,000 per year. The store manager will be hired in month six and earn ,000 per year.

Based on the assumptions above, the total annual salary and wage cost will be 0,000. This means that the appliance store will need to generate enough revenue to cover staff costs.

Tips & Tricks

- Create a clear job description and salary range for each position before advertising new hires.

- Consider offering benefits such as paid time off or health insurance to attract quality employees.

- Regularly review employee performance and adjust salaries accordingly to ensure they are fairly compensated for their work.

Appliance store rent, lease, or mortgage payment

When starting an appliance store, one of the biggest expenses you will face is the rent, lease, or mortgage payment for the space you choose to operate your business. Your choice will have a significant impact on your company’s financial plan, profit model and ultimately financial management.

Rent: Renting property for your appliance store can be an attractive option for new business owners looking to reduce their upfront overhead. Renting often requires a smaller deposit and is more flexible than signing a long-term lease or buying a property. Rent can vary depending on the location and size of your space.

Lease: A lease requires a commitment for a set period, payments are usually higher, but an established business may prefer the stability of tenancy rather than a month-to-month tenancy arrangement.

Mortgage payment: Choosing to buy a property may require a substantial deposit, but you will have more control over the property, and you can build equity over time. Mortgage payments can be similar to rent payments, but the overall cost will depend on the total value of the property and your down payment.

Tips & Tricks

- Research various locations and real estate prices before making final decisions to ensure you are making a financially smart choice.

- Consider negotiating rental terms and conditions to create a win-win scenario.

- Evaluate your long-term goals and strategy before deciding between renting, renting or buying a property.

Device Store Utilities

Utilities are a crucial factor in any retail store’s financial plan. For an appliance store, this includes expenses such as electricity, gas, water, and waste disposal. An appliance store’s financial projections should take into account the average monthly cost of these utilities.

For example, if the average monthly electricity cost for the store is ,000 and the average monthly gas and water cost is 0, the total monthly utility cost would be ,000 . These expenses should be factored into the overall financial analysis of the appliance store.

Tips & Tricks:

- Consider upgrading to more energy-efficient appliances to reduce utility costs

- Implement recycling programs to reduce waste disposal expenses

- Compare utility providers to find the most cost-effective options

Effective utility financial management is essential to an appliance store’s financial strategy. By analyzing and forecasting these expenses, an appliance store can create a more accurate financial plan and profit model.

Device Store Other Running Costs

When building a financial model for an appliance store, it is essential to consider all expenses, including other running costs. Other operating costs are expenses that are not directly related to the cost of sales, rent and utilities.

These expenses may include administrative expenses such as taxes, insurance and legal fees. Other operating costs may also include marketing, training and travel costs. All of these expenses need to be accounted for in an appliance store’s financial plan.

For example, an appliance store might need to invest in training for its employees to better understand the products they sell. He might also need to invest in online marketing campaigns to get more customers in the door. These expenses may seem small, but they can quickly add up and impact the overall profitability of the store.

When building your financial model, be sure to budget for all of these expenses to ensure your projections are realistic and achievable. By analyzing and factoring these other operating costs into your appliance store financial analysis, you will be well on your way to creating a solid financial plan and profit model for your business.

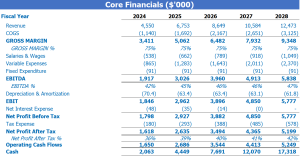

Appliance Store Financial Forecast

Financial forecasting is an essential part of an appliance store’s financial model. It includes projections of financial statements, such as profit and loss statements, balance sheet, and cash flow statements, based on assumptions about future sales, costs, and investments. The Sources and Use report is also a crucial part of financial planning, detailing how the store will acquire and deploy its resources to achieve its financial goals. Accurate financial projections and analysis are integral to making informed business decisions and guiding an appliance store’s financial strategy.

Appliance store profitability

Once we have created income and expense projections, it is important to check the profit and loss (P&L) statement. This will help visualize the store’s profitability, including gross profit and EBITDA margin.

By looking at the P&L statement, we will be able to see the store’s revenue model and how it affects the store’s financial planning. It is crucial to regularly analyze the financial statements to adjust the profit model and financial strategy for the appliance store.

Tips & Tricks:

- Regularly monitor financial projections to adjust the store’s financial strategy.

- Compare the P&L statement to previous periods to track progress.

- Invest in cost reduction measures to increase profitability.

With a detailed financial analysis, we can put in place an effective financial management plan to ensure the longevity and success of the store. By regularly monitoring the P&L and adjusting our financial projections, we can make data-driven decisions for the store’s financial future.

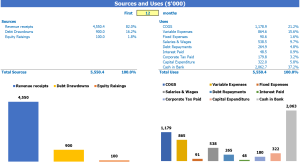

Device Store Sources and Usage

The sources and uses of funds in the financial model in Excel for Appliance Store provides users with an organized summary of where capital is coming from sources and how that capital will be spent in uses.

It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks

- Keep your sources and uses statement up-to-date

- Use historical data whenever possible to make accurate projections

- Consult a financial advisor to ensure accuracy

To sum up, the use of a financial model is essential for every appliance store owner to optimize their financial management . Building an accurate financial plan for your store requires careful attention to factors such as competition, pricing strategy, overhead, and marketing budget, among others. By using financial projections and financial statements , you can gain a clear understanding of your appliance store’s revenue model and profit model . Appliance store financial planning will help you identify potential problems and optimize your overall financial strategy for maximum success.