Related Blogs

- Understanding Excel Financial Models

- The Pros and Cons of Using a Business Broker for Valuation

- Easy business valuation methods

- Leverage financial models in your business plan

- Explore the benefits and limitations of Monte Carlo simulation

What is the investment payback period

The investment payback period is among the essential tools when it comes to financial modeling and forecasting for business development. It is a useful guide in the decision-making processes when you need to assess the attractiveness of the investment. This approach is based on evaluating the speed of recovery of cash expenditures (without taking into account the time value of money).

EndModelslab Calculate the return per year from the start of the project until the gross return equals the original investment amount. At this point, the investment is considered paid off. Accordingly, an investment payback period is the time required to achieve payback. Also mention that the investment payback period indicates how quickly the original investments recover. But does not measure the long-term profitability of the project.

How to Calculate the Payback Period of Investment

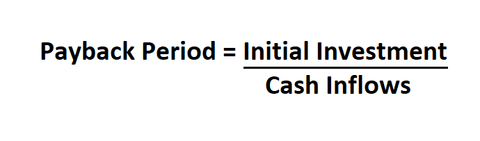

The payback period depends on two major factors: the cost of the project and the amount of annual cash flow . If the expected annual inflows are uniform, the formula is:

For example, if a certain project requires a financial contribution of million and is expected to produce a cash flow of 0,000 per year, the investment payback period will be million/0,000. This results in five years. In the case where the annual cash inflows vary, we must accumulate the net cash flows per year. We do this until they reach the initial investment amount. This year will be a year of recovery.

What else do you need to know about calculating the payback period

The more financial contribution the project needs and the less cash it generates, the longer the period to achieve recovery of cash expenditure. Generally, potential investors view shorter payback periods as more desirable.

However, sometimes the investment with a longer payback period can result in greater cumulative cash flow over time than one with a short cash expense payback period. It is obvious that to obtain a significant result during the calculation of the payback period, we must have an accurate estimate of the costs of the project and Cash flow forecasts .

In order to implement the payback period technique in an Excel spreadsheet, we need access to individual numerical data. It is important to include estimated cash flow amounts and cumulative cash flows. This allows the developer to find the cost recovery point through the programmed logic test.

What is a typical recovery period

The payback period as an approach to evaluating project acceptance raises a question about a threshold barrier at which investors consider the project attractive. Despite the existence of a considerable amount of research on this subject, there is no common answer to this question.

In practice, it seems that the required recovery period generally relates to subjective assessments, taking into account previous experience, as well as the perceived level of project risk. As a general rule, managers consider this indicator of two to four years to be acceptable. But these numbers may vary depending on the country and industry.

Some surveys of an optimal payback period carried out in the US have shown results of around two years, while one conducted in the UK reports that the perceived acceptable payback period for managers was almost three years. . The minimum period observed by the researchers was one year and the maximum was five years. The difference has also been noticed by industry insiders. According to some believers, new technology projects have longer payback periods than conventional projects.

Since payback periods vary in different countries and industries, companies must calculate it individually for each project. This information is essential for managers during decision-making processes. It helps them select the most profitable projects in which to invest. Interested in an efficient allocation of your resources? Want to calculate payback periods for your potential projects? Or know more about this method? feel free to Contact us here or via comments.

[right_ad_blog]