Related Blogs

- Master your investment game: Learn how to maximize returns and manage risk with asset allocation

- Maximize your risk appetite for strategic decision making

- Explore the Global Investment Climate

- Maximize Your Gross Profit Margin – Take Control of Your Business Profitability Now!

- Do and do to invest in startups

Strengths and weaknesses go together in every business, regardless of its size and work capacity. Therefore, identifying the strengths and weaknesses of the business plays a vital role in the development of any business. However, most businesses celebrate their corporate strength but don’t try to identify their financial weaknesses.

Every business needs to identify its weaknesses and strengths for several reasons, and it is unavoidable for beginners. When you know the financial strengths of your business, you can better use this information to focus on those areas to grow and grow your business. And you can’t make changes in your business to grow well unless you know the weaknesses of the business. Only by identifying your weakness can you address these areas, resolving your issues of weakness, and can steer your business back on track for success and growth.

Now the question is how to analyze your business using financial ratios? The answer to this vital question is to use SWOT Analysis or Ratio Analysis which helps you identify your weak areas and strengths.

Download the Excel template ⟶

What does SWOT stand for?

SWOT includes four categories of financial ratios, which are strengths, weaknesses, opportunities and threats.

What is SWOT Analysis?

A SWOT Analysis Or ratio analysis is one of the most commonly used tools to help you develop your business strategy, regardless of a startup or an existing business. You can use ratio analysis for any person, product, place, or industry, and it helps with both strategic planning and decision-making.

The strengths and weaknesses of the business are the factors that are called internal to your business. This means that the things you have control over and can change to suit your needs are strengths and weaknesses. Your team members, patents, intellectual property, and location are examples of your company’s internals.

On the other hand, the opportunities and threats are called the external factors. These factors are beyond your business and control. You cannot avoid or modify these factors. Customer buying trends, competitors and raw material prices are some examples of these external factors.

The strengths and weaknesses of financial ratio analysis are current or look back, while the opportunities and threats are looking forward. Thus, by SWOT analysis, you get the opportunity to fill in what the company has achieved and the strategies that can prevent any loss in profitability.

Download the Excel template ⟶

Key Features of Ratio Analysis

The financial analysis of the Company can be divided into two factors: internal factors and external factors. A comprehensive study of these factors allows you to redefine your strategies that improve business profitability and prevent future factors that can affect profitability. Let’s take a look at these factors one by one.

INTERNAL FACTORS

- Corporate culture

- Company reputation

- Operational efficiency

- Operational capacity

- Brand recognition

- Market making

- Strong financial resources

- Competent staff

- Effective organizational structure

EXTERNAL FACTORS

External factors include opportunities and threats to the business. Opportunities are the things that a business sees and sets as its goal to achieve in the future. These are the factors likely to contribute to the development of your business. In comparison, threats are the elements of the external environment that could prevent the company from achieving its objective or create an obstacle to the development of the company. These factors are not in your control and you may need to put a plan in place to handle these factors if they occur.

- Seasonal changes.

- Customer mood.

- Shopping trends

- Economic environment

- Government regulations

- Suppliers

- Cost of raw materials

- Adversary Strategies

To initiate the SWOT analysis, you need to gather the required information about strengths, weaknesses, opportunities and threats. Below are some typical questions that help you find the required factors.

Download the Excel template ⟶

STRENGTHS

- Benefits to your business.

- Unique resources that your opponents don’t have.

- Unique selling proposition.

- Positive customer perceptions.

- All the low cost resources you have

- Products with good performance.

WEAKNESSES

- Things are not being done well in your business.

- The factors contributed to your weaker brand.

- Reasons for your customers’ negative behavior.

- Any missing resources.

- Underperforming products.

OPPORTUNITIES

- Opportunities available in the market.

- Changes to get the maximum benefit from your resources.

- Modifications to maximize your profitability.

- Seasonal trends

- Extension to explore new markets.

THREATS

- Customer buying trends.

- Seasonal sales.

- Government regulations.

- Economic environment.

- Cost of goods.

- Transportation costs.

- Availability of suppliers.

A SWOT Analysis is a simple tool to identify strengths, weaknesses, opportunities and threats to your business. Once you have performed a SWOT analysis, you can leverage your strengths, minimize weaknesses, plan to avoid threats, and take full advantage of opportunities.

The SWOT analysis is about producing a strategy that you can work on over the next few months to increase your profitability and efficiency by controlling weaknesses and avoiding threats. Once you have performed a ratio analysis, you can convert it into a real strategy.

After completing the SWOT analysis, the first step is to examine your financial strengths and use them to get the most out of the opportunities available in the market. And then determine how your financial strengths can counter the threats you may face.

The next step is to prepare a list of actions you can take to remove your financial weaknesses and seize opportunities while avoiding threats.

With your action list in hand, you’re in a better position to decide when to execute those actions. Now mark your business calendar and place the goals you have decided to achieve in each calendar quarter or month.

The summary of the outcome of a successful SWOT analysis is the action list that you can prioritize and plan for your business development.

Writing a good SWOT analysis requires a complete knowledge of your strengths, weaknesses, opportunities and threats. Recommended is to prepare a list of questions for each of the elements, both external and internal. The questionnaire serves as a guideline to complete the ratio analysis and create a list of all factors. The SWOT framework can be designed as free text, a list format, or a four cell table. Each quadrant is dedicated to each element. Strengths and weaknesses are listed at the top, followed by opportunities and threats at the bottom of the table.

If you don’t have a skilled team to analyze your company’s financial strengths and weaknesses, it’s difficult for just one person to perform a SWOT analysis. However, don’t worry if you don’t have such a capable team; FinModelslab is here to help.

Download the Excel template ⟶

FinModelslab has designed a functional SWOT analysis template that helps you to perform report analysis by entering specific information. An example of such a SWOT analysis template is given below.

This standalone Excel spreadsheet template helps you determine your financial strengths, weaknesses, opportunities, and threats. It assigns a weight to each item based on the information you enter into the model. Let’s take a look at some of these easy to use SWOT templates .

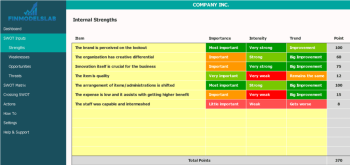

Internal forces

This easy-to-use template helps you identify areas of strength in your business. You have to select the different options of importance, intensity and trend tabs for each strength element. Then the system automatically weighs each selection and assigns its points. At the bottom, you get the accumulated strength of your business as a point, which is used to assess SWOT results.

Internal weaknesses

This model helps you determine the financial weaknesses of your business. In order for the financial weaknesses to be assessed, you must select the different options in the Material, Intensity and Trend tab for each weakness item. The system accordingly awards points for your selections for each element of weakness. The accumulated weakness score is displayed at the bottom of the screen.

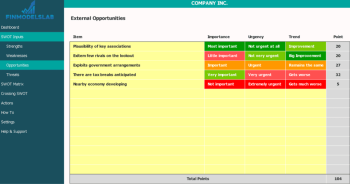

External opportunities

This template helps you identify available opportunities and use them for the development of your business. It’s a very simple model, and you have to select the intensity level of each opportunity, and the system does the rest. Then it assigns relevant points to each selection and provides you with an accumulated score for external opportunities at the bottom of the points column.

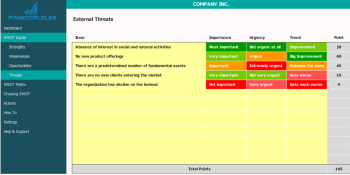

External threats

This is another simple and easy to use template that identifies external threats to your business. You simply need to select the relevant tab for each threat item. Then the system will automatically assign some points for each item, and you will get the accumulated score at the end of the points column.

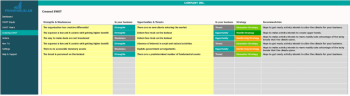

Crossed Swot

This template makes it easy for you to analyze financial strengths, weaknesses, opportunities, and threats on the same page. Also, it shows you your business status based on SWOT tool and provides you the recommendation to improve your business efficiency.

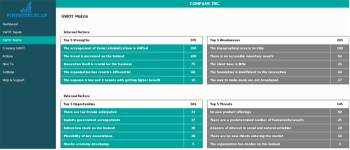

SWOT Metrics

This template reminds you of the traditional method of writing SWOT analysis. Like four categories of financial ratios, each occupied by a single item displaying the top five strengths, top five weaknesses as well as top five opportunities and top five threats.

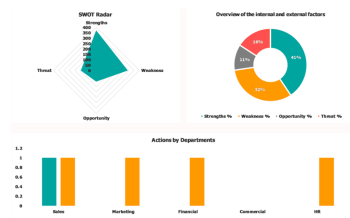

Graphic presentation

For better understanding, the SWOT analysis template presents the SWOT Results in a graphical form. Thus, it saves time and provides a quick overview of all SWOT metrics for some time.

SWOT Dashboard

The SWOT Dashboard in FinModelslab The SWOT model is the most powerful tool that provides you with all the information about your SWOT analysis. For example, your SWOT score, SWOT recommendations result and graphical layout save your time searching various pages for the required information.

RESULTS

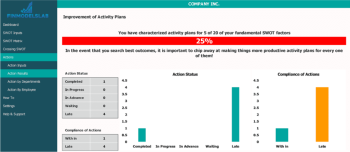

The SWOT Analysis Template Helps you determine the fundamentals and follow the action recommended by the system as well as the names of the employees and the department concerned.

Improved business plan

Another important screen inside the SWOT analysis template provides your real-time feedback on improving your business plans. Besides the numbers, the graphical representation makes it easier for executives and team members to understand.

Swot Results

This is the most comprehensive template that provides comprehensive insights into your company’s SWOT analysis. A colorful representation of your company’s SWOT rating, as well as the individual presentation of financial strengths, weaknesses, opportunities and threats, catches your eye.

Download the Excel template ⟶

Do not hesitate to visit FinModelslab If you have decided on a SWOT analysis of your company to plan your objectives.

[right_ad_blog]