Related Blogs

- The Benefits of a Cash Mate Presentation

- Understanding Financial Statements: A Complete Guide

- Cash Flow and Credit Management – Easily Improve Your Finances

- Master Finacial Modeling: Learn best practices and principles

- 5 tips to improve your cash flow

There are different ways to View financial data within an organization. And dynamic dashboards are one of the main ways to represent such data. They give a visual representation of the performance of the organization in any period. Moreover, they show all past and present profits and losses. Dashboards reveal areas that need improvement within the organization and help restructure the way the business of the business is running. Dashboards are an important part of a company’s financial structure and the foundation of any organization that wants to succeed.

With Excel Dynamic Dashboards , users who work across the organization can manage data visibility without having to make a separate dashboard, with their own run folder for each data access step. Additionally, an administrator controls data access by keeping the dashboard in a folder with specific visibility settings. The dashboard folder can have general access. You can hide it or close it to certain groups. If you have access to a folder, you can see its dashboard.

Additionally, Excel Dashboards in the financial world deliver visual storytelling as well as dynamic cooperation with numbers to all users in the organization. It simply means that the same dashboard is used by all users in the company.

This is a good idea if you as a developer or business owner want to show how close your business is to its annual final sales goal. But what about a case where the business owner wants every user to see how close they are to their own sales goal?

Dynamic dashboards allow users to view all the information and data they have access to.

What exactly are Dynamic Dashboards

Dynamic Excel Dashboards Allow each user to see only the data they have access to based on the security settings that are there. Without read access to a financial record, the record will not be displayed on the dashboard. This allows the user to control data visibility without creating separate dashboards.

Creating a dynamic dashboard and creating a standard dashboard are generally the same process but with one main difference. Since it is clear that the dynamic dashboard should work based on the security configuration of the viewers, and not just the specified user, the selection having a “current user in user”.

It modifies the security parameters to accompany that of the user, connected at this time of visualization. Since dashboards show the financial performance of organizations, various data can be included in the dashboard. Generally, this should be the data that can help predict the future of a company’s financial growth. One of the important data that can be visualized in a general dashboard or a dynamic dashboard includes the pro forma financial statements described below.

Pro forma financial statements

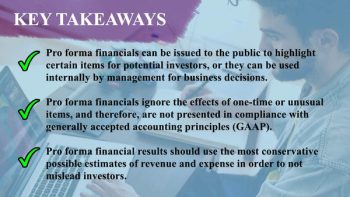

First of all, What is a pro forma financial statement? Pro forma financial statements refer to a group of financial statements designed to show financial results in the future. Specialists have done so using a assumed input data which usually consists of expenses.

Download the Excel template! Learn even more ⟶

It comes with the estimated amount of income to show the estimated amount of income. Pro forma financial statements are a very reliable source of information for an ongoing business in any organization. Hence, become an important part of the plan when building a good dashboard for the business.

So what are pro forma financial statements? It includes the following:

- Income statements

- Balance sheets

- Cash flow statement

The pro forma financial statements definition makes it very clear that companies and businesses use data to better understand how their business is performing. So there is a better way to understand their operational results.

It also allows investors to rule out anything that could hinder a company’s performance and financial prospects.

And its utility is as follows:

- Helps visualize a company’s prospects

- Provides an accurate view of an organization’s financial performance

- Helps entrepreneurs, investment companies and banks in their own business regarding future expectations

It is clear why dynamic Excel Dashboards and the pro forma Financial statements work hand in hand to create a good view of a company’s future performance. This is because they help in keeping track of the financial condition of the organization.

So why do people think a dynamic dashboard is a good idea?

- It is very informative of the position of any company

- It holds a high predictive value in a business

- It seems like a good base on which businesses can thrive

Download the Excel template! Learn even more ⟶

Download the Excel template! Learn even more ⟶

Download the Excel template! Learn even more ⟶

Doing dynamic Excel dashboards the right way involves proper estimation of financial sources, expenses, income, economic impact, and proper financial statement writing. All of these factors are important in a dynamic dashboard. To conclude, dynamic dashboards and pro forma financial statements have very high predictive values in companies. It is a good foundation on which any business should thrive.

[right_ad_blog]