- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our guide on how to build a financial model for a clothing store. Financial planning is one of the most crucial aspects of running a successful clothing store. Without proper financial management and forecasting, it becomes difficult for store owners to make informed decisions regarding their business operations, including inventory management, pricing strategies, and expansion plans. In this comprehensive guide, we’ll cover all the essential aspects of boutique financial planning and help you create a well-structured financial model for your clothing boutique business plan finances. By implementing the tips and strategies outlined in this guide, you can improve your clothing store’s financial projections and create a solid foundation for your boutique financial plan.

Clothing Boutique Revenue and Sales Forecast

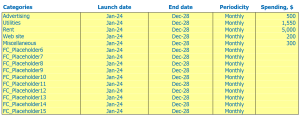

Revenue and sales forecasts are an essential part of the clothing store’s financial model. It allows owners to estimate future income and sales, which is essential for building a successful and profitable business. When building a apparel boutique financial model, owners estimate sales based on various assumptions such as launch date, sales ramp-up time, traffic and walk-in growth assumptions. you, customer and purchasing assumptions and sales seasonality.

Clothing store launch date

Choosing when to launch your clothing store is an important decision that can affect the success of your business. It is important to consider factors such as seasonal trends, competition, and stock availability before setting a launch date.

Financial Forecast: The clothing store financial model model considers the start month of the business. Therefore, you need to determine the specific launch date to accurately project the finances for your business.

You can choose to launch your clothing store in the middle of the year or during a specific month depending on your target customers and market trends.

Tips & Tricks

- Consider launching your clothing store during a season when your customers are most likely to buy new wardrobe additions.

- Research your contest launch dates and avoid launching during their peak season

- Schedule inventory deliveries in advance to ensure product availability for your launch

Store financial plan: Your launch date will also impact your store’s financial plan as it will determine the start date for revenue, expense, and profit projections.

Having a clear understanding of your clothing store’s financial plan before launch is crucial to ensure you have sufficient funds to cover expenses and sustain the business for the long term.

Overall, choosing a launch date for your clothing store should be a well-considered decision that aligns with your business goals, marketing strategy, and financial plan.

Clothing Shop Ramp Up Time

When it comes to financial planning for a clothing store, sales forecasting is crucial. However, it is also important to consider the ramp-up time to the sales plateau. This refers to the time it takes for your business to reach a steady point where sales are consistent and predictable.

The ramp-up period for a clothing store can vary depending on various factors such as location, target market, and marketing strategy. In general, the ramp-up period for a fashion boutique is usually around six months to a year.

Tips & Tricks

- Focus on building a strong brand image to appeal to your target audience

- Offer promotional offers and discounts to attract customers during the ramp-up period

- Invest in effective marketing strategies such as social media advertising to increase brand awareness

- Keep track of sales data and adjust your strategy as needed to accelerate the ramp-up period

By factoring in ramp-up time to sales plateau, you can create a more accurate financial forecast and enable a realistic expectation of revenue growth. With a solid plan in place, your clothing store can thrive and achieve long-term success.

Apparel Shop Walk-In Traffic Intarts

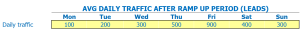

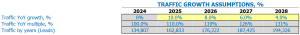

After the ramp-up period, it is important for a clothing boutique business plan to model the daily walk-in traffic of weekday visitors. Knowing how many visitors the store will have each day of the week is important for making decisions about balancing staffing levels, adjusting inventory levels, and determining marketing campaigns.

The average walk-in traffic for Monday through Sunday is 100, 120, 90, 85, 150, 200 and 250 respectively. These are the first year numbers, with a growth factor of 5% for the year next. Entering them into a retail store financial plan will help predict future walk-in traffic for each day of the week for five years.

Tips & Tricks

- Make sure your sales plateau period is long enough to identify stable traffic patterns.

- Consider adjusting marketing campaigns on days when traffic is below average to increase visits.

- Increase staff levels on days with higher traffic to ensure the store is fully serviced.

The walk-up traffic growth factor at 5% is expected to reach 128, 153, 183, 219 and 262 for Monday through Friday respectively, for year 2. Year 3 has a growth factor of 7% , which would result in a higher number of visitors. Continuing this projection for five years would allow for more accurate financial projections.

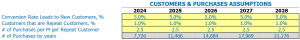

Clothing store visits for sales conversion and repeat sales entries

When it comes to Fashion Store Financial Model , an important assumption to consider is the conversion rate of visitors to new customers. In my experience running a clothing store, we typically had a conversion rate of around 25%. This means that out of 100 visitors, about 25 would become new customers.

Another key metric is the percentage of repeat customers. In our store, we have found that nearly 40% of our sales come from repeat customers. This is a significant percentage, and it highlights the importance of building strong relationships with your customers.

When it comes to Clothing Boutique Revenue Model , it is also important to consider the amount of each repeat customer per month. In our store, we found that the average repeat customer spent around 0 per month.

Tips & Tricks:

- Offer loyalty programs or discounts to incentivize repeat sales.

- Collect customer data and use it to personalize the shopping experience, such as sending recommendations or personalized offers.

- Provide excellent customer service to build strong relationships and encourage customer loyalty.

Overall, understanding the relationship between clothing store visits for sales conversion and repeat sales inputs is crucial to building a strong store financial forecast . By focusing on building loyal customers and maximizing the value of every sale, you can create a sustainable and profitable clothing store plan.

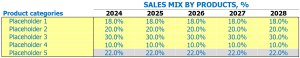

Clothing Store Sales Mix Intarts

In our clothing store, we sell a variety of products, each belonging to a specific category such as dresses, tops, bottoms, shoes and accessories. To better understand and predict our sales, entering the sales mix hypothesis on the product category lever will be much easier to understand.

For example, if we assume that our category of dresses will be 40% of our total sales, tops 30%, bottoms 15%, shoes 10%, and accessories 5%, this would help us create our model of income and financial projections.

We will enter these assumed sales mix percentages for each of the next five years to help us forecast our revenue and profit by category. This will help us create a financial model for our retail store financial plan, fashion store financial model, and clothing store financial planning.

Tips & Tricks:

- Regularly review and adjust your sales mix assumptions based on sales performance and customer behavior.

By using the combination of sales by product category assumptions, we can make informed decisions and financial forecasts for our clothing store. This financial forecasting and analysis, which includes clothing store financial projections and boutique financial statements, helps us achieve our ultimate goal of profitability and success.

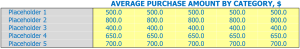

Clothes Boutique Average sale amount of entries

Our store offers a wide range of clothing boutique products to our customers. To simplify the process of entering assumptions, we have grouped all of our products into specific product categories. This makes it much easier to estimate the average sale amount by category level rather than product level. For example, product categories can be dresses, tops, bottoms, and accessories.

We make assumptions about the average sales amount of each product category for each year. For example, in 2022, the average sale amount for the dresses category is 0, and for the TOPS category, it is . We use this information to calculate the average ticket size, which is the average amount spent per transaction, by combining each product category’s sales mix with each category’s average sale amount.

Using the sales mix and the average sales amount of each product category, we can calculate the average ticket size. For example, if dresses account for 40% of total sales and the average sale amount for dresses is 0, the average ticket size for dresses is . Similarly, the average ticket size for TOPS would be , assuming a 40% sales mix and an average sale amount of .

Tips & Tricks:

- To accurately estimate the average ticket size, it is essential to keep track of the sales mix and the average sale amount by product category.

- Regularly analyzing and updating the average sale amount by product category helps us track sales and profit.

- When making financial projections for boutique apparel, always consider the seasonality of each product category.

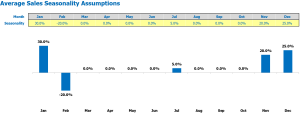

Clothing boutique sale seasonality

Fashion store financial analysis

Seasonality is an important retail consideration. Clothing store sales figures can vary significantly at different times of the year. For example, a store specializing in winter clothing may see increased demand in the months leading up to Christmas, while a store focused on summer clothing may do business briskly in the warmer months.

It’s crucial for store owners to consider how seasonal factors can impact their sales revenue and plan accordingly. One way to do this is to create a sales seasonality assumption table. This chart will show how sales revenue is expected to behave throughout the year. Here you have the ability to enter the percentage deviation from the monthly average sales per day.

Tips & Tricks:

- Consider surveying customers to find out which products they are most likely to buy at certain times of the year.

- Be sure to stock different products depending on the season.

- Offer promotions or discounts during shopping to attract customers.

By carefully mapping seasonality factors and adjusting your inventory and promotions accordingly, you can improve your store’s financial projections and be better prepared for fluctuations in sales revenue throughout the year.

Clothing Boutique Operational costs Forecast

Operational expense forecasts are a crucial part of a clothing store’s financial model. These expenses include cost of goods sold by product percentage, employee wages and salaries, rent, lease or mortgage payment, utilities, and other operating expenses.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | 10,000 – 30,000 |

| Salaries and wages of employees | 8,000 – 15,000 |

| Rent, lease or mortgage payment | 5,000 – 20,000 |

| Public services | 1,000 – 3,000 |

| Other running costs | 5,000 – 10,000 |

| Total | 29,000 – 78,000 |

By forecasting these operational expenses in advance, a clothing store can better understand its financial health and plan accordingly. This can help the store ensure long-term profitability and success.

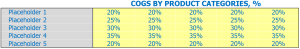

Clothing Shop Cost of Goods Sold

Apparel Boutique Cost of Goods Sold is the direct cost of producing or purchasing the products sold by the boutique. COGS includes the cost of materials, direct labor, and all other expenses that are directly associated with the production or purchase of the products.

COGS assumptions will vary depending on the categories of products sold by the store. For example, the COGS percentage for apparel may be higher than for accessories. Clothing store financial projections should be based on specific COGS assumptions for each product category to accurately forecast revenue and profitability.

Tips & Tricks:

- Regularly review your COGS percentage to ensure it aligns with industry standards.

- Consider different vendors to find the best price for materials.

- Explore ways to streamline production processes to reduce direct labor costs.

By accurately calculating COG and incorporating it into the store’s financial plan, business owners can forecast revenue and profitability more accurately. The financial analysis of the clothing store is essential to make informed decisions about the future of the business.

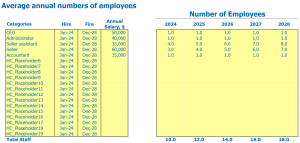

Clothing Boutique Salaries and Salaries of Employees

When creating a financial plan for a retail store, it is crucial to consider employee salaries and wages as they will form a significant portion of ongoing costs. To get started, we’ll start with the annual salary of each employee you plan to hire, which will vary depending on the staff member’s role and experience.

To illustrate, let’s say your store has a store manager, two full-time sales associates, and two part-time sales associates. The Store Manager will be responsible for overseeing store operations, inventory management and cash flow. Sellers will be responsible for customer service, visual merchandising and sales.

To name staff members, let’s say you name the store manager as “manager”, full-time sales associates as “sales specialist”, and part-time sales associates as part-time sales assistant.

Assuming the store manager is hired at the start of the year and the sales associates are hired midway through the year, the annual staff salary will be:

- Consider offering competitive salaries to attract top talent to your store.

- When determining how many staff members to hire, consider the busy and slow times of your business.

- To reduce staffing costs, consider hiring part-time sales assistants during slow times and full-time sales specialists during peak seasons.

Tips & Tricks:

With the right financial planning and strategic staffing decisions, your clothing store will be well on your way to success!

Clothes Shop Rent, Lease or Mortgage Payment

When creating a financial plan for your clothing store, it’s important to consider the cost of your rent, lease, or mortgage payments. It’s one of the biggest expenses your business will face, and it’s essential that you have realistic assumptions in place in order to create an accurate financial plan.

If you are renting space for your shop, you will need to calculate your monthly rent payments. This figure can be negotiated with the owner, and it can vary depending on the location and the size of the space. You may also need to consider additional costs, such as utilities, property taxes, or insurance.

If you are renting space, you will need to factor in the cost of your monthly rental payments. Leasing differs from leasing in that it is usually a longer term commitment and may include additional costs such as upkeep or upkeep.

If you purchased space for your store, you will need to factor in your mortgage payments. This may include your principal and interest payments, as well as any additional charges such as property taxes or maintenance fees.

Tips & Tricks:

- Find the average cost of rent, lease or mortgage payments in your desired location

- Factor in additional costs such as utilities, property taxes, or insurance

- Consider negotiating your rent or tenancy agreement with the landlord to get a better deal

Clothing Boutique Utilities

When creating a financial plan for your clothing store, it is essential to include utilities in your projections. Utilities assumptions Include expenses such as electricity, gas, water and internet. These expenses can vary depending on factors such as the size of your store, your location and your usage.

It is crucial to consider the seasonality of your business when projecting utility costs. During the summer months, air conditioning can be the biggest expense, while heating costs can be higher during the winter months.

Tips & Tricks:

- Invest in energy-efficient lighting and appliances to reduce your electricity bills.

- Opt for shared Internet service if possible to reduce Internet expenses.

When creating Clothing Boutique Financial Projections , it is a good idea to include a buffer amount for utilities to account for unexpected expenses, such as repairs or rate increases. By including utilities in your projections, you can get a more accurate picture of your business’ financial situation and plan accordingly.

Be sure to keep proper financial records which include all utility bills, taxes and other expenses. This way, you can easily see patterns in your spending over time and make more informed decisions about your store’s financial health.

By including utility costs in your Apparel Boutique Financial Planning , you can ensure that your boutique is financially stable and profitable over the long term.

Clothing Shop Other running costs

When building a financial model for a clothing store, it is important to consider all of the operating costs involved in running the business. Other Operating Costs Include expenses that are not directly related to selling clothes, but are necessary to keep the business running smoothly. Examples include rent, utilities, insurance, marketing costs, and other general expenses such as office supplies or internet charges.

These costs can vary significantly depending on store location, store size, and marketing initiatives. It is important to research and forecast all potential costs to accurately represent the store’s financial statements . By considering these expenses, a financial plan can be created to maximize profit and loss .

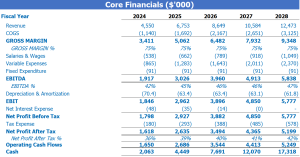

Clothing Boutique Financial Forecast

As part of a complete clothing store financial model , financial forecasts play a vital role in determining the feasibility of the Store Plan Business Plan Financial . An essential part of this forecasting process is the Income Statement , which describes the income, expenses and net income of the business over a certain period. Additionally, the Sources and Usage Report Provides a detailed breakdown of where the company’s revenue comes from and how it will be spent, making it easier to identify potential areas for improvement . of clothes .

Profitability Shop Clothes

Once we have created the revenue and expense projections for our store, it is crucial to analyze the profit and loss (P&L) statement. This report shows us the profitability of our business – from gross profit to net profit. By doing so, we are able to view important metrics such as gross profit or EBITDA margin, which give us a clear idea of our store’s profitability.

It is essential to understand that profitability is not the same as the amount of income we generate. A shop may have high revenue but still operate at a loss. Thanks to the P&L statement, we can accurately gauge how much money is coming in versus how much is going out.

Tips & Tricks:

- Regularly review your P&L statement to ensure you are on track to meet profitability targets.

- Analyze the statement at least once a month so you can identify trends and make timely adjustments.

- Use the report to determine profitable areas of your store and where you can optimize spend.

Overall, understanding the P&L statement is crucial to a store’s success. It helps us make informed decisions about financial planning and strategic growth with the goal of achieving long-term profitability.

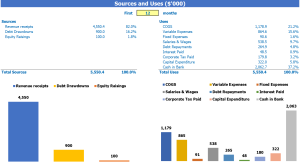

Clothing Shop Sources and Chart Usage

The sources and uses of funds in the financial model in Excel for Clothing Boutique provides users with an organized summary of where capital will come from sources and how that capital will be spent in the uses . It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When creating your financial plan for your clothing store, remember that reporting sources and uses is only one aspect of the required financial model. In addition to sources and uses, a complete financial model should include Boutique Plan Business Plan Financial , Clothing Store Financial Projections , Fashion Boutique Financial Analysis , Retail Boutique Financial Plan , Boutique Revenue Model Apparel , Boutique Financial Forecast , Fashion Store Financial Model , Apparel Boutique Profit and Loss , Boutique Financials , and Apparel Boutique Financial Planning .

Tips & Tricks

- Be sure to thoroughly research and analyze every aspect of the financial model before finalizing it.

- Regularly update and revise the financial model to reflect changes in the market, competition and internal operations.

- Consult financial experts and professionals to ensure the accuracy and validity of the financial model.

In conclusion ,

- Building a financial model for a clothing store requires a thorough understanding of the business plan and fashion store financial model.

- Clothing store financial forecast can help to describe clothing store revenue model and clothing store profit and loss based on projections and trends.

- Having a retail store financial plan is crucial before starting a business, as it can help identify potential challenges and opportunities for growth.

- The clothing store’s financial planning should be reviewed regularly to ensure that the store is on track to meet its financial goals and make necessary adjustments if necessary.

- All in all, having a well-thought-out boutique and clothing store financial projections can be beneficial for succeeding in the competitive world of retail clothing.