- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our guide on how to build a financial model for a snack and candy store. Planning the finances of your business is an essential step towards its success. A well-designed financial plan can help you identify potential opportunities and challenges ahead. In this blog, we’ll walk you through the essential steps of creating a financial projection for your snack and candy shop. We’ll cover everything from revenue model to budget plan and cash flow analysis. Whether you’re starting a new candy business or revamping an existing one, this guide will help you assess the financial feasibility of your business and create a roadmap for success.

Snacks & Candy Shop Revenue & Sales Forecast

As part of the financial model for opening a snack and candy store, it is essential to create revenue and sales forecasts. This forecast should consider various factors such as store launch date, ramp-up time, walk-in traffic, and growth assumptions. Additionally, customer and purchasing assumptions and sales seasonality should also be considered when creating a revenue forecast for a candy store.

Snacks & Candy Shop launch date

The launch date of your business is crucial for its success.It’s important to choose a launch date that considers factors such as your target audience, market trends, and competition. The Snacks & Candy Shop financial model template provides a guess for the month businesses start, but ultimately the decision is yours.To ensure a successful launch, plan ahead.Plan and prepare for business start-up activities and costs well in advance. This will allow you to properly allocate your resources and focus on delivering a quality product or service by your launch date.

Tips & Tricks:

- Research market trends to determine the best launch date for your business.

- Consider planning a soft launch to test and refine your product or service before the official launch date.

- Create a detailed launch plan with timelines and budgets to stay on track.

Remember that your launch date sets the tone for your business.By carefully selecting the right launch date, you can give your business a competitive edge, attract your target audience, and establish a foundation for long-term success.

Snacks & Candy Shop Ramp-Up Time

When it comes to forecasting sales for a snack and candy store, it’s important to consider ramp-up time. This is the time it takes for a company to gradually increase its sales until it reaches a plateau. This plateau is where the business reaches its maximum sales potential and remains consistent.

- Research the ramp-up time for your industry to get an accurate estimate.

Tips & Tricks:

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In the candy store industry, this may take around 6 months. It is important to note that this varies depending on location, marketing efforts, and competition in the area.

By understanding ramp-up time, you can create a more accurate financial plan for your snacks and candies, including a financial projection , revenue forecast , and budget plan . Additionally, you can perform a candy store financial analysis and cash flow analysis to ensure the financial feasibility of your candy store.

Snacks & Candy Shop Walk-In Traffic Intarts

After the ramp-up period, the average daily traffic for snacks and sweets is estimated at 200 visitors on Monday 215 visitors on Tuesday 210 visitors on Wednesday 225 visitors on Thursday 230 visitors on Friday 240 visitors on Saturday and 210 visitors on Sunday .

This walk-in traffic information is essential for creating a financial plan for Snacks & Candy Shop. By estimating daily traffic levels, revenue projections for Candy Store can be determined and a Snack Shop profit model can be established. Based on the financial analysis of Candy Store, it can help determine the financial feasibility of Candy Shop and provide insight into the budget plan of snacks and candies.

Using daily traffic levels and the average walk-in traffic growth factor of 2% per year, the model can calculate future walk-in traffic for the next five years accurately. This Snacks and Candy revenue projection will help in the financial projection for Snacks and Candy including Candy Store cash flow analysis and Candy Store revenue forecast.

Tips & Tricks

- Consider conducting surveys or traffic analysis in the area to refine traffic estimates.

- Tive into external events or holidays which can have a significant impact on traffic levels.

- Use daily traffic levels to determine staffing levels and optimize inventory management.

Sales conversion snack and candy visits and repeat sales entries

When opening a snack and candy store, one of the most important factors to consider is the conversion rate of visitors to new customers. This is the percentage of people who enter your store and make a purchase for the first time. On average, this rate is around 20%, but it can vary depending on location, marketing efforts, and product offerings.

Another important factor is the percentage of repeat customers, which is the number of people who come back to buy from your store. The industry average is around 30%, but it can be higher if you offer unique products or have exceptional customer service.

Assuming you have a good mix of new and repeat customers, it’s important to know how much each customer is repeating per month. This will help you estimate your income and plan your inventory needs. For example, if a repeat customer spends an average of per month and you have 100 repeat customers, you can expect ,000 in revenue from that segment of your customer base.

Tips & Tricks:

- Offer loyalty programs or other incentives to encourage repeat business.

- Keep track of your conversion and repeat customer rates to adjust your marketing and inventory strategies accordingly.

- Consider offering unique or seasonal products to attract new customers and keep them coming back.

These assumptions are important when building a financial model for your snack and candy stores, especially when creating a financial projection or revenue forecast. By understanding your conversion and repeat customer rates, you can estimate your monthly revenue and create a realistic budget plan. You can also use this information to analyze your candy store financial analysis and perform candy store cash flow analysis to ensure long-term financial feasibility.

Snacks & Candy Shop Sales Mix Intarts

In our Snacks & Candy Shop, we sell a variety of products such as fries, chocolates, gammies, popcorn, etc. Each product belongs to a specific product category. To make it easier for us to understand the sales mix, we enter the sales mix hypothesis on the product category lever.

For example, we have five product categories: chips, chocolates, gummies, popcorn and drinks. For the first year of our forecast, we assume that our sales mix will be 30% chips, 25% chocolates, 20% gummies, 10% popcorn and 15% drinks. In year two, we assume our sales mix will be 28% chips, 26% chocolates, 18% gummies, 12% popcorn, and 16% drinks. We enter the sales mix in percentage for each of the 5 years planned by product category.

Tips & Tricks:

- Regularly updating your sales mix assumptions can help you better understand your business and improve your financial plan for your snack and candy store.

- Be aware of changing trends and tastes of your customers in order to adjust your sales mix if necessary.

Snacks & Candy Shop Average Sale Amount

Your store sells many different snacks and candy products, each belonging to a specific product category such as chocolate bars or gummy candies. To make it easier to enter assumptions, we estimate the average sale amount by product categories and by years rather than at the product level.

For example, the average sale amount per unit of candy bars in the first year is .50, while the average sale amount of gum is .00. Using the mix of sales and the average sale amount of each product category, the model will calculate the average ticket size, which is the estimated total amount per transaction.

Tips & Tricks:

- Regularly review your sales figures to adjust your sales projections and financial plan for your snacks and candies.

- Consider offering seasonal or themed products to increase revenue and increase customer engagement.

- Partner with local businesses or organizations to promote your snacks and candies and diversify your customer base.

Snacks & Candy Shop Sales Seasonality

Hypotheses:Every business has its ups and downs throughout the year, and snack and candy shops are no exception. Seasonality is a critical consideration when creating a financial projection for snack and candy shops or when analyzing candy store finances.

Forpredict candy sales seasonality accurately, you need to consider population, location, time of year, customer behavior, weather conditions, and other factors that will influence sales figures.

For example, holiday-related sales typically increase during Halloween, Christmas, Valentine’s Day, and Easter. You must adjust your business operations to accommodate peak periods and slow seasons. However, the extent to which seasonal factors affect your business can differ significantly depending on many factors.

Tips & Tricks

- Analyze monthly sales data and calculate average sales per day (ASPD) for each month.

- Calculate the sales deviation from the monthly ASPD to determine seasonal trends.

- Use historical data to make more accurate predictions.

When you have data showing how seasonal factors impact your business, you can project Candy Store revenue projections and create a Snack Shop profit model or develop a Candy Shop business plan that fits. in budgetary terms.

A snack and candy revenue model that factors sales seasonality views cash flow analysis in a more nuanced and realistic way, allowing you to make informed decisions that improve Candy Shop’s financial feasibility.

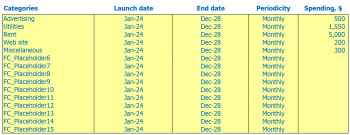

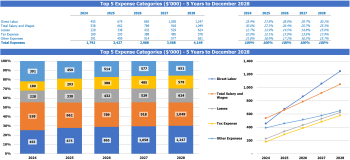

Snacks and Candy Operational Forecast

As part of a snack and candy store’s financial model, operational expense forecasts play a crucial role in determining the viability of the business. Operating expenses include cost of goods sold by products %, wages and salaries of employees, rent, lease or mortgage payment, utilities, and other operating expenses.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | ,500 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,500 – ,500 |

| Public services | 0 – 0 |

| Other running costs | 0 – ,000 |

| Total | ,800 – ,000 |

Snacks & Candy Shop Cost of Goods Sold

Cost of Goods Sold (COG) is an important aspect to consider when analyzing the financial feasibility of a snack and candy store. COGs represent expenses directly associated with the production of goods sold by the business, including materials, labor, and overhead. In a snack and candy store, these costs may include raw ingredients to make the products, packaging, and supplies.

To come up with a financial projection for a candy store, we have to make some assumptions about the inner workings. For example, we can assume that the cogs for a lollipop would be around 25% of the sale price, while for a chocolate bar it would be around 60% of the sale price. These percentages can vary depending on factors such as supplier prices, seasonal demand and the skill level of the production team.

Tips & Tricks

- Regularly review your COGs to see if there are ways to optimize your costs.

- Consider working with local suppliers to get better prices and lower transportation costs.

- Experiment with different product categories to see where you can maximize your profit margins.

By carefully considering COGS and other financial aspects, such as revenue projections and budget plan, one can create a solid financial plan for a snack and candy store. It is crucial to conduct financial analysis and candy store financial analysis to assess the profitability and sustainability of the business.

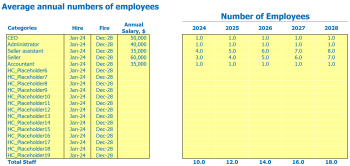

Snacks & Candy Shop Employee Salaries and Wages

In our financial plan for snacks and sweets, we assume to hire four positions for the duration of 12 months. These positions include a store manager, a cashier and two business associates.

The store manager will be hired during the first month of operation and will earn ,000 per year. The cashier will be hired in the second month, earning ,000 per year. The two business associates will be hired in the third month, earning ,000 each per year.

We assumed a 40-hour work week for all positions, with the store manager working 52 weeks per year, the cashier working 50 weeks per year, and the sales people working 48 weeks per year.

Tips & Tricks

- Consider offering benefits such as health and retirement plans to attract and retain quality employees.

- Use part-time staff during peak seasons to control labor costs.

- Set clear expectations and job descriptions for each position to ensure efficiency and productivity.

Based on these assumptions, our annual employee wages and salaries total 0,000 for snacks and candy.

SNACKS & Candy Shop Slow, Rent or Mortage Payment

The snacks and candy financial plan includes the decision to pay rent, lease, or mortgage payment. The decision will depend on various factors, such as the location and the type of building that the shop will occupy.

For example, if the store is located in a mall or mall, paying the rent may be the only option. The amount of rent will depend on the size of the shop and the location. If the store is located on a busy street or high traffic area, the rent amount will likely be higher.

If the store is located in a free-standing building, a mortgage payment may be an option if the owner can afford a down payment and monthly mortgage payments. This option will provide long-term stability, but is not without risks.

Renting is also a popular option as it offers flexibility. A lease will allow the store owner to move to a different location if the current location turns out to be less profitable than expected.

Tips & Tricks

- Research the local market to determine the average rent for a store of a similar size and location.

- Consider negotiating with the landlord for a lower rent amount or additional benefits.

- Consider the cost of utilities and maintenance expenses when making a final decision on what type of payment to make.

Candy Sernces and Services

When creating a financial plan for a snack and candy store, it is essential to consider the various utilities and how they relate to the budget. This includes utilities such as electricity, water, gas, garbage disposal and internet services.

A useful assumption is that the electric bill will be higher during the summer months when the air conditioning is on more frequently. Another hypothesis is that water usage will increase during high traffic periods, such as holidays, and during the summer when customers are more likely to purchase beverages.

In terms of garbage disposal, the amount of garbage produced from snacks and candies will likely fluctuate depending on the number of customers and the types of products sold. Gas can also be a factor if the shop has a kitchen or needs to drive a vehicle for deliveries.

Tips & Tricks:

- Consider investing in energy-efficient appliances and light bulbs to reduce electricity costs.

- Negotiate with utility providers for better rates or research alternative providers if possible.

- Set goals to reduce waste progress and follow through to help control garbage disposal costs.

Ultimately, understanding usage assumptions and planning for them accordingly can help ensure a realistic and achievable financial projection for snacks and candies.

Snacks & Candy Shop Other running costs

Aside from the basic expenses of running a snack and candy store, there are also other costs that need to be considered when building your financial model . These include things like marketing and advertising expenses, licensing and permit fees, and website development fees.

For example, marketing and advertising expenses can include anything from creating flyers and posters to running social media ads. Licenses and permit fees, on the other hand, will depend on where you are located and what type of license you need to obtain for your business. Also, developing a website, if you plan to have an online presence, is another cost that needs to be added to your financial plan.

While these may seem like small miscellaneous costs, they can add up over time and impact affordability . Be sure to factor in all of your operating expenses, including other running costs, to get a clear cash flow analysis and a more accurate revenue forecast for your snack and candy business.

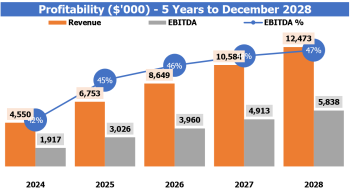

Snacks & Candy Shop Financial Forecast

One of the most important parts of starting a snack and candy store is creating a solid financial plan. The financial plan should include a profit and loss statement, revenue forecast, cash flow analysis, and Sources and Use report. This will help determine the financial feasibility of the Candy Shop business plan and provide a roadmap for success. By forecasting and analyzing the revenue model and budget plan, an accurate financial projection for the snack and candy can be created.

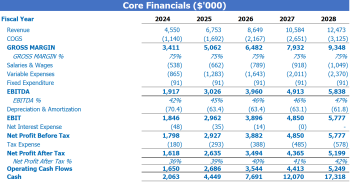

Ritability Snacks & Candy Shop

Once we have created our financial projection for a snack and candy store, we need to check the profit and loss (P&L) from revenue to net profit. This will help us visualize the profitability of our business, including gross profit or EBITDA margin.

When analyzing our financial analysis of our candy store, we need to consider whether our revenue projections match our actual financial performance. We can do this by creating a revenue model that outlines all potential revenue streams, including Snack Shop profit models and candy store budget plans. By comparing our actual revenues to our forecast revenues, we can see how well our business is doing.

To better understand the financial feasibility of our business, we need to perform a candy store cash flow analysis. This analysis will give us a better understanding of the inflows and outflows of our business, helping us to make informed financial decisions.

Before starting our business, it is important to have a solid candy business plan, including a detailed financial plan. This will ensure that we have a clear idea of our financial goals and the steps we need to take to achieve them. Additionally, by creating a financial plan for a snack and candy store, we can identify any potential financial risks and prepare accordingly.

Tips & Tricks:

- Create income and expense projections to determine your P&L.

- Compare your actual revenue to your projected revenue to gauge business performance.

- Perform Candy Store cash flow analysis to better understand financial flows.

- Have a clear snack and candy budget plan to plan for potential risks.

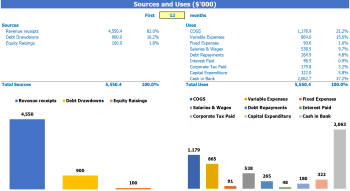

Snacks & Candy Shop Sources and Uses Chart

The Sources and Uses of Funds in Financial Model in Excel for Snacks & Candy Shop provides users with an organized summary of where capital will come from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

One of the key elements of the snacks and candies revenue model is to develop a financial plan that takes into account all the costs associated with opening and operating the store. This plan should include a detailed financial projection for Snacks and Candy that highlights the revenue forecast for Candy Store and other key metrics such as breaking point, cash flow, profitability, and return on investment. It is important to analyze the financial analysis of candy and the profit model of analysis and snack to assess the feasibility of the business.

Tips & Tricks

- Understand your cash flow needs and plan accordingly

- Work on cost control as much as possible

- Build relationships with vendors who can give you the best deals on products and services

- Make sure you have a solid understanding of your target market

Additionally, it is important to create a snack and candy budget plan that takes into account all the fixed and variable costs associated with running the business. This budget plan will be used to estimate the total amount of capital needed to run the store, as well as the ongoing capital requirements to keep the business running smoothly.

The financial feasibility of Candy Shop largely depends on the strength of the customer base and competition in the local market. It is essential to conduct market research and analyze the competition to determine the level of demand for your products and services, as well as identify any potential challenges or barriers to entry. By performing a candy store cash flow analysis and carefully considering all the key elements of the financial plan, you can increase the chances of your snack and candy store being successful.

Building a financial model for a snack and candy store is critical to its success. By following the steps in this blog post and using financial planning tools like revenue and profit models, budget plans, and cash flow analysis, you can create a solid financial plan that will help you plan and manage your business finances. By conducting a candy store financial analysis and revenue forecast accurately, you can make informed decisions on how to grow and scale your snack and candy store. Ultimately, investing in the financial feasibility of your candy store will help ensure its long-term success.