52 Simple Ways to Manage Your Money – 15. Friend Or Foe

A Weekly Journal & Workbook to Help You Take Real Control of Your Money

What it is …

When properly used, credit cards are a strong money management tool.

Unmanaged, they can become a staggering debt.

How it helps …

Good method of tracking purchases for analysis of spending patterns.

Reduces the necessity of carrying large sums of cash.

Convenience: credit cards are nearly always accepted in all places around the world.

A credit card can cover you in emergency situations.

Purpose …

Better control of your finances.

Time …

A half an hour or more each month to analyze your expenses and pay your bills.

Keys to action…

List all the cards you have, along with their interest rates, annual fees, and payment due dates.

Ask yourself, Do I need to keep this card?

Separate department store cards from bank cards. How often do you use the department score cards? Could a credit card with a lower interest rate be substituted?

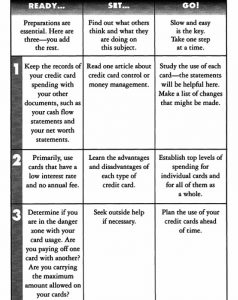

SET IT UP

Check your credit cards.

Are there any that are at the maximum balance allowed?

Are any overdue?

STEP ON IT

Review all of your cards. List the interest charged, the amounts you pay each month, and the annual fees.

STEP ON IT +

Work toward having fewer cards, keeping only those with the lowest cost.

Notice…

How you use credit.

Your willingness, or unwillingness, to spend more than you have.

Your willingness, or unwillingness, to change your charging habits.

But what if …

Spending seems out of control?

Get support from a therapist, Overspenders Anonymous, a credit consultant, or a financial planner.

Thought primers…

To me, credit means…

At the thought of spending more than I have…

If I could say “no” as easily as “yes”. ..

If I used credit more responsibly…

At the thought of paying off my cards every month…

If I worked only on a cash basis…