Related Blogs

- Personal guarantees – what to consider before signing

- Maximize business profitability with effective financial management and investment strategies

- Unlock Your Business Potential – Increase Profitability Now!

- Improve your credit rating – check now for better finance deals

- Using Free Cash Flow to Measure Financial Health – How to Analyze and Evaluate Businesses

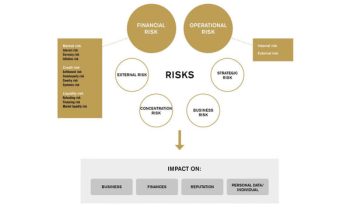

Most of the time, managers and investors do not recognize the crucial problems of the company. Due to the large amount of trivial problems they face, they simply miss them. Financial risk analysis is an essential tool that calculates different risk ratios in order to minimize the long-term problems of a business.

For this reason, financial risk analysis should be a priority in every business. With financial risk analysis, not only can you identify your risks, but you can also manage and reduce their long-term effect. In this article, we will see how to prepare a financial risk analysis in a simple and easy way.

Four simple and easy steps to prepare your financial risk analysis

The easiest way to prepare your financial risk analysis is to follow these four steps:

- Start by defining your problems – The first thing to do is to identify all of your critical stakeholders and how they influence the overall risk of the business.

- Apply risk analysis methods – Risk is an inevitable category that must occur in different phases of business operation. However, the risks must be recognized and managed in order to reduce the negative effect they have. Their impact can be identified and analyzed using key performance indicators. Valuable assumptions can be derived using the KPI as a tool. They are at the heart of a good financial risk analysis.

- Define your risk triggers – It is important to identify all triggers related to a certain risk. At the same time, you will have numerical indicators and narrative reports. Possible triggers can be: delayed cash inflows from customers, price fluctuations in the market, increased loan interest, inefficient business strategy and many more.

- Prepare the action plan – The last thing to do is to prepare an action plan. What should your company do to reduce these risks? How will they affect the income statement? Develop a set of activities and form an effective business strategy. Your plans should be long term and realistic.

Leverage analysis

One of the ways to optimize a company’s risk is to measure it and then quantify it in the right way. Risk quantification can be done using a few valuable tools.

These are two types of the most important risks that a company can face:

- Operational risk

- Financial risk

Operational risk

Financial risk

Define your problems, set your goals

Preparing your financial risk analysis can be a demanding task to do, especially if you do not have the necessary expertise. We can always help you find financial risks. Our employees have the knowledge and tools to give you the best possible solution in the end. you can always Contact us here or in the comments section. Feel free to do so!

[right_ad_blog]