The stock market is certainly the most profitable financial investment.

Indeed, by investing in quality companies, it is not uncommon to make large capital gains and receive monstrous dividends.

However, the risk of poor performance exists…

…or even worse: you can even leave all of your capital there.

So how do you invest in the stock market in extraordinary companies with high capital gains and/or high dividends?

What should be looked at most importantly to value a company on the stock market?

And especially…

How to spot successful companies that are spitting cash?

This is exactly what we are going to see.

Today’s objective: to master the most useful financial ratios that allow a company’s profitability to be measured.

No need to be a financial analyst.

Let’s go.

How can one obtain a strong competitive advantage? Several ways exist.

The goal here is to prevent any other competitor from entering our market.

How to do ?

Companies like Coca-Cola, Apple, or Microsoft excel in this area.

For example, today it is impossible to compete with Windows present on 85% of computers. Unimaginable.

So, Microsoft does these 3 things splendidly:

To create a barrier to entry, the royal method is still to obtain a patent.

With this legal protection, no one can market a product using the patented process for 20 years. That’s why it’s so coveted: once you’re granted a patent, you’re good to go for two decades!

At Microsoft, for example, the Start Menu is protected. Difficult for competitors to build interfaces when a simple menu at the bottom left of your screen can lead you to pay heavy compensation.

For us, it’s perfect: no one else can create a toolbar at the bottom of the screen with a “Start” button!

In 1999, when this patent was filed, it was certainly a barrier for the birth of any other computer operating system.

Conclusion: in our analysis, we will favor companies that sell products with at least 1 patent.

This barrier to entry is mainly found in luxury products such as Dior, Chanel, Porsche…

… all of these brands have an asset that no one else can own: their reputation with consumers.

Thus, it will be very difficult for an SME to compete with Chanel in the field of high-end perfumes.

The brand image takes time to obtain and requires heavy financial investments.

Conclusion: in our analysis, we would therefore favor large companies selling flagship products, which are recognized worldwide.

Another element, the ability of a company to produce in large volumes often allows it to pay for its raw materials at unbeatable prices.

Indeed, given the quantities ordered, a plastic bottle supplier will be much more likely to award Coca-Cola a rebate rather than an SME wishing to launch a new drink.

This SME will therefore find it difficult to be competitive against Coca-Cola.

Conclusion: we will mainly target already mature companies benefiting from large sales volumes allowing them to obtain strong discounts on supplier prices.

Indeed, it is much easier to gain market share if customers have little choice.

It’s a competitive advantage that’s quite difficult to obtain, but when it’s achieved, it’s the jackpot!

For example, in the aeronautical field, there are only two choices for purchasing commercial aircraft, Airbus and Boeing. They are therefore in a strong position.

Airlines are forced to renew their fleet, commercial aircraft not exceeding 20 years of service.

These companies are therefore obliged to regularly buy new aircraft to continue their activity.

But that’s not all…

… it is extremely difficult for a company to switch from Boeing to Airbus and vice versa:

All ground technicians, pilots and on-board staff must be retrained in all the particularities of the new manufacturer.

This is why some low-cost airlines choose to remain faithful at all costs to one manufacturer and to one only: Ryanair, for example, only buys Boeing planes, EasyJet only Airbus planes.

Conclusion: in our study, we will be keen to study companies that only know a limited number of competitors, no more than 4 or 5.

A substitute product is a product that can be purchased and consumed instead of another.

For example, if your toothpaste becomes too expensive, you can change brands: your teeth will always be clean with each brushing.

On the other hand, if you love the taste of Coca-Cola, you will not find any brand with the exact same taste (there are a few other colas, but the taste remains different).

Conclusion: to discover a profitable business, it must be able to sell a product that cannot be replaced by another product.

Accounting plays a key element in the valuation of a business, because it makes it possible to assess the financial health of the business at a given time.

As a result :

By analyzing a few simple ratios, we can determine in seconds how profitable a company is.

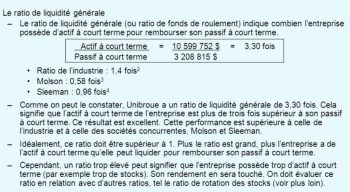

The general liquidity ratio

First, to analyze liquidity, we use the general liquidity ratio. It is calculated as follows:

If this ratio is greater than 1, the working capital is said to be positive.

That is, if all of the company’s creditors demanded that their debts be repaid immediately, the company would have enough cash to repay. A ratio of 2 is generally considered reasonable.

If the ratio is less than 1, the company may not be able to meet its commitments, this is a bad sign.

For example, for Total, we obtain the following data:

A ratio of 1.5: Total can therefore meet all of its short-term debts.

Thus, Total passes the general liquidity ratio test!

The cash ratio

In addition to general liquidity, the cash ratio is also used.

It makes it possible to analyze more finely the assets immediately available in the company, in the event that the company has to repay its debts immediately.

Thus, the cash ratio does not take into account inventories, because these are not entirely cash: they must first be sold to become cash.

This ratio therefore makes it possible to be a little more precise about a company’s ability to meet its commitments.

The interpretation is similar to that of the general liquidity ratio: a ratio of 2 is considered reasonable; below 1, the situation is difficult because the company does not have enough cash to meet its commitments.

Listen :

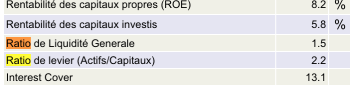

Now that we have analyzed the strengths and weaknesses of the company by ensuring that it can repay its debts, it is time to discuss what interests the most investors…

… the profitability.

Indeed, the ultimate goal of investing is of course to earn as much money as possible.

In order to identify high-performance companies, it is above all necessary to analyze the cash that they can produce, in the short term.

This is exactly what we are going to see.

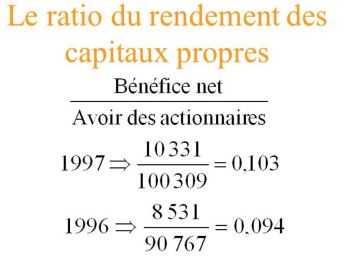

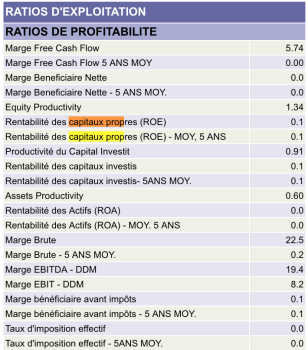

Behind this super barbaric name hides in fact a very simple notion:

What is the return obtained by the shareholders who hold shares of the company?

The ROE helps answer exactly that.

In other words…

… this ratio allows you to calculate how many euros the company can earn you, for each euro invested.

It is calculated this way:

As a general rule, you invest only if the equity yields at least 15% return.

Let’s keep our example of Total:

AIE Aie Aie…

Total does not pass the criterion.

In other words…

… one euro invested brings in only 4.5 cents when it should bring in at least 15!

Total’s equity does not bring in enough money…so this is an important black point to note in Total’s analysis.

Now that we know how much a euro invested in the company brings in, we must determine how such profitability is possible.

Does it simply come from turnover? Or business family jewelry sales?

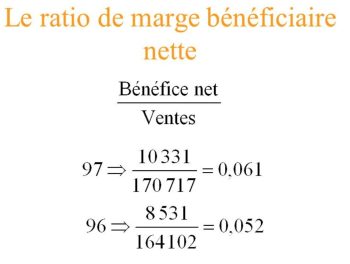

The net profit margin ratio helps answer these questions.

In other words, this ratio makes it possible to calculate the net profit generated after each euro of turnover.

It is calculated as follows:

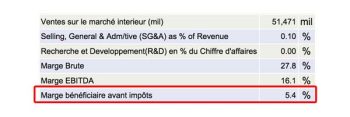

On this ratio, there is no limit but the higher it is, the more the company earns money on each sale.

Compared to similar companies, it is therefore necessary to prefer the one with the largest net profit margin.

For Total, the result is very disappointing:

5.4% pre-tax margin…in other words, very little.

With this second setback, Total is now totally out of our study.

Correct profit margins are for example those of Apple, at almost 30%

We even notice that the ROE (return on equity) is excellent!

The return on invested capital (or ROIC, Return On Invested Capital)

We have seen above the return on equity, then the importance of calculating the net profit margin.

But to find a successful company, there is a golden ratio that cannot be overlooked.

Please note this:

If the ROIC ratio is not high enough, you can immediately close the file and analyze another company.

That’s all.

This ratio of return on capital invested makes it possible to verify that the capital invested (that is to say the money that you, the shareholder, provide) yields a sufficiently high return.

I’ll spare you the formula this time, because it’s a standard ratio that is provided by each company in its annual reports.

No need to remember how it is calculated.

A minimum ROIC of 10% is expected . Below, the money you invest in the business is not working hard enough.

To come back to our example, Apple does have a return on invested capital (ROIC) of 27%, which is well above our expectation of 10%. Similarly, the ROE is also far beyond expectations. The profit margin seen just before reached 30%!

Apple therefore seems to be very profitable.

On the other hand, Total’s ROIC is a ridiculous 3.1%!

As said above, at the mere sight of this number, we can close the Total file immediately: no question of investing in this value!

To end with our financial ratios, a last one which is however of significant importance.

Similar to the ROIC seen above, the CROIC has the advantage of taking into account the net cash flow generated by the company (also called Free Cash Flow).

In other words, the CROIC measures the profitability of a company by taking into account what it has actually released as cash over a year.

Exit the accounting measures that could inflate a net result…

… with the CROIC only hard cash is taken into account.

And there too:

Like the ROIC, it’s all or nothing: a bad CROIC ratio and you can abandon the idea of investing in this company.

A company is performance if its CROIC is at least equal to 10%.

Thus, making a diagnosis to identify the strengths and weaknesses of a company is not complicated. A few simple ratios and high barriers to entry are enough to avoid the most common investment mistakes.

Valuing a company on the stock market is not rocket science.

Go to a stock market analysis site like ADVFN. You will have access to the balance sheets of the largest listed companies. Ideal for checking that a company in which you want to invest respects the ratios seen earlier in the article.

Share your thoughts on these different ways to spot successful companies. Leave me your questions, I answer all comments.