- Understanding the Connection between Working Capital and Cash Flow

- Understanding Financial Risk Through Financial Modeling

- Cash Flow Statement Indirect Method

- Understanding Financial Modeling: An Essential Tool for Businesses

- Understanding Cash Flow from Investing Activities

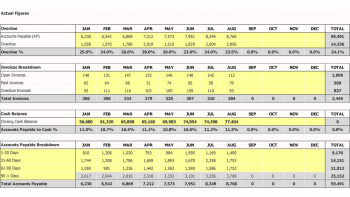

FinModels Lab has created a fancy Accounts Payable Dashboard to visualize the structure and progress of account accounts. A well-built template is designed for users without advanced Excel skills. Just enter the numbers in the appropriate cells and run the dashboard smoothly.

After reading this article, you should be Apple to learn:

- What are Accounts Payable (AP)

- Accounts payable journal entries

- Accounts payable cycle

- Importance of accounting accounts

- Accounts Payable Management

- AP and cash balance

- Impact of APS on working capital

- FREQUENTLY ASKED QUESTIONS

What are Accounts Payable (AP)

The amount due to vendors/service providers against the purchase of goods/services is AP. This is normally a company’s short-term debt and appears on the balance sheet under current liabilities. The company follows the accounting basis of the AP accounting file.

Download the Accounts Payable Calculator in Excel

Accounts payable journal entries

In this case, examples will clarify the concept of PA.

Suppose you are the business owner of a fast food restaurant where you buy buns from a vendor. You have an arrangement with the seller that you will pay invoices within 45 days of purchases. This creates AP in your account books. You have now purchased 200 buns for /bun, making the total debt 0.

Record this purchase as:

|

account heads |

Debit |

Credit |

|

|

|

|

|

Inventory / purchases |

0 |

|

|

Accounts payable |

0 |

Now you are on the 45th day and you want to make the payment to settle the account

|

account heads |

Debit |

Credit |

|

|

|

|

|

Accounts payable |

0 |

|

|

Bank / cash |

0 |

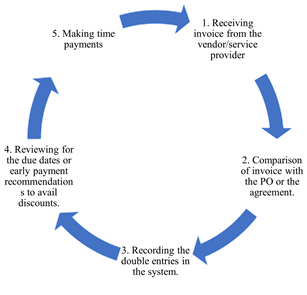

Accounts payable cycle

The flow chart below explains the complete accounts payable process

Download the Accounts Payable Calculator in Excel

Importance of accounting accounts

The financial situation of a company cannot be determined by evaluating a parameter; However, PA is one of the balance sheet metrics because any credit terms agreed provider/service provider will look at the PA on the balance sheet and assess the value of the credit.

One of the important things to know is that lower AP is better for business or more. The answer is that the lower the PA with respect to current assets, the better for a business and vice versa. In addition, the PA should be compared to previous periods and competitors as a benchmark. Accounts Payable Days indicates the average number of days for which the company owes the amount to vendors/vendors. It is an interesting reference while evaluating the financial situation of a company.

Higher days of accounts payable with respect to the previous period indicates that the company is paying slowly to suppliers/service providers and the business position may worsen or lower days of accounts with respect to the previous period indicates that the company pays quickly to the Vendors / service providers and the company post may have improved. It is important to compare the days payable with the credit terms authorized by the suppliers / service providers and in any case it should not exceed the agreed credit terms. Normally, the company will be cautious when the PA exceeds 50% of current assets.

Accounts Payable Management

AP management is important to make better use of resources. Some companies have money for AP payment, but they have credit days agreed with vendors/vendors. This is called PA management and it is important because if the funds are placed in a bank savings account or invested elsewhere that generates income, no one will be willing to repay the free debt and to lose interest income. However, if the vendor/service provider has a discount policy, the entrepreneur will decide whether the interest income or the discount generates more value for the business.

However, entrepreneurs should not delay AP payment beyond credit terms to avoid late payment surcharges or to deteriorate terms with vendors/service providers.

Business leaders should keep an eye on the following for better PA management:

- Aging scan to see overdue invoices.

- Comparison of AP and late payment.

- Cash/Bank Funds vs. APS.

- Number of open, paid or overdue invoices.

IMPORTANT NOTE: Our AP template designed in Excel and Google Sheet is an efficient and less expensive tool to manage APs and covers all the above metrics with an interesting and interactive dashboard. Make a copy of the Excel or Google sheet and need to enter numbers in the yellow highlighted cell and see the magic dashboard.

Download Excel Accounts Payable Dashboard Template in Excel

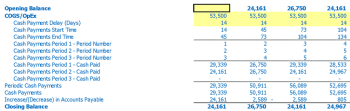

AP and cash balance

Since AP is basically a company’s unpaid business expenses, which indicates that the company is doing business using someone else’s money, so it has a positive impact on flows. cash. In other words, the increase in PA has a positive impact on the business cash flow position. When AP is refunded and reduced, a company’s cash balance is also reduced by a similar amount.

Impact of APS on working capital

Working capital is the difference between current assets and current liabilities. It indicates the overall liquidity and health of businesses. Positive working capital means that a company’s current assets are more than current liabilities and therefore it has the potential to grow and invest. PA is part of current responsibilities and therefore has an inverse correlation with working capital. To understand this concept, let’s see an example.

|

Description |

Amount |

|

|

Current assets |

,000 |

,000 |

|

Current liabilities – ap – Customer advances |

$(1,500) $(8.00) |

$(2,500) $(8.00) |

|

Working capital |

,700 |

,700 |

|

* All numbers except AP are constant to see impact. |

||

The table above shows how the increase in PA negatively impacted working capital.

IMPORTANT NOTE: Our Accounts Payable Working Capital Calculator is specially designed in Excel and Google Sheet to show you your AP closing balances based on credit terms. You just need to update the yellow highlighted two number manual and it will generate automatic reports.

Download the Accounts Payable Calculator in Excel

FREQUENTLY ASKED QUESTIONS

Q. What is the difference between Trade Accounts (TPS) and Accounts Payable (AP)?

A. There is a thin line between TPS and APS. GST relates to business debts due to the purchase of inventory. APS include all short-term debts or obligations of the business. Thus, all the TPs are part of the APs.

Q. How do I verify bills and access points to avoid fraudulent activity?

A. A technique called 3-way matching, where the purchase order, goods receipt note, and supplier invoice are compared to determine whether or not the invoice should be paid or partially paid.

Q. Are expenses and AP the same thing in accounting?

A. No. Expenses are the cost incurred by businesses whether paid or not. If the expenses are not paid, it becomes AP. Expenses appear on the income statement, while AP is a balance sheet item.

[right_ad_blog]