- Home

- Sales and revenue

- Running costs

- Financial

Gas stations are one of the most profitable businesses in the world, providing people with the fuel they need for their vehicles. However, building a successful gas station requires careful planning and understanding of the financial model. Creating a gas station revenue model involves a gas station profit model, a gas station cash flow forecast, and a gas station financial analysis among others. This article explores how to create a gas station revenue projection, an oil station budget plan, and a gas pump financial projection, all of which are essential components of a gas station financial plan. By the end of this article, you should have a great idea of how to set up a complete energy station financial statement to make your gas station successful.

Gas station revenue and sales forecast

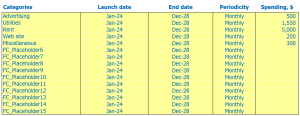

The gas station financial model has a variety of components, including revenue and sales forecasts. These forecasts typically span a period of time, starting with the station’s launch date and encompassing a walkthrough of ramp-up time, drop-in traffic and growth assumptions, assumptions and customer purchases and the seasonality of sales.

Gas station financial plan is made up of variable factors including gas station revenue model, gas station revenue projections, gas station financial analysis, flow forecast Petroleum Station Cash Flow, Petrol Station Profit Models, Energy Station Financials, Petroleum Station Budget Plans, Gas Pump Financial Projections and Fuel Distributor Financial Estimates.

Service station launch date

Choosing the right launch date for your gas station business is crucial to its success. A well-planned launch can set the tone for the life of your business.

It is important to consider your target customer demographic, local events, and seasonality trends in order to plan your launch date appropriately. Launching too early or too late can have a negative impact on your earnings and revenue.

Additionally, the timing of the launch along with marketing and promotional efforts can dramatically increase your gas station’s profit model. Consider offering special discounts or promotions during your launch period to attract customers and create buzz.

Tips & Tricks:

- Research local events and potential competitors before choosing your launch date

- Create a marketing and promotional plan that aligns with your launch date

- Offer special discounts or promotions during your launch period to attract customers

- Consider investing in a soft launch before a full-scale launch to test operations and refine processes

In summary, carefully selecting your gas station launch date and aligning it with effective marketing and promotional efforts can lead to a successful and profitable business.

Ramp-up time

When it comes to predicting the success of a gas station, a crucial factor to consider is the ramp-up time to sales plateau . This refers to the time it takes for station sales to reach a steady point, where they no longer increase significantly.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In your industry, it may take xxx months. It is crucial to understand this timeline and budget accordingly.

During this period of reduced sales, the service station is likely to incur significant expenses that can negatively impact cash flow. However, with a clear understanding of the scale-up schedule, business owners can effectively plan and work to minimize these costs.

Tips & Tricks:

- Take the time to research your specific service scope, your potential customers, and the competition around the location.

- Consider hiring a consultant who specializes in gas station scheduling and forecasting to gain an expert perspective on your business needs.

- Get a realistic view of how sales are generally progressing so you can create an accurate financial plan for your business.

By taking the time to understand gas station ramp-up time, business owners can improve their financial planning, increase the likelihood of success, and ensure expenses are minimized during the first few months of operation. .

Gas station in rendezvous traffic entrances

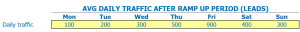

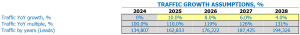

After the ramp-up period, the expected daily traffic of walk-in customers for a gas station varies significantly on weekdays.

For example, weekdays, Monday to Friday, are characterized by high traffic rates, while weekends, on the other hand, have a lower traffic flow. Within five years from the date of the opening of the service station, it is assumed that the average daily traffic of walk-in customers will increase by 5%.

Calculating the average daily traffic rate per day of the week, after the ramp-up period, is an important and difficult assumption that must be taken into account when building a financial model for a gas station. Projecting future gas station revenues necessarily requires adequate growth projections for the gas station’s walk-in traffic, which can impact financial estimates for other revenue streams.

Tips & Tricks

- Analyze nearby competitors to get a clear idea of traffic volumes likely to abound in the locality

- Examine market trends to understand what will be in high demand

- Continuously review your business plan to monitor your financial projections and adjust your assumptions accordingly

The ability to accurately predict gas station traffic growth factor can pave the way for realistic gas station budget plan, gas station financial analysis, gas station, gas station profit model, energy station financial statements, gas pump financial projection, fuel distributor financial estimate and even gas station revenue model.

Service station visits for sales conversion and sales inputs

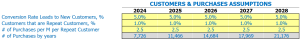

Understanding the conversion rate of visitors to customers and the percentage of repeat customers are crucial factors in developing a successful gas station revenue model. For example, if your station gets 100 new visitors every day and only 10 of them make a purchase, the conversion rate is 10%. This input is vital when creating a gas station revenue projection.

The percentage of repeat customers also plays an important role in the profit model of the gas station. Suppose that out of the 10 customers who made a purchase, 6 will become repeat customers. This indicates that your gas station has a repeat customer rate of 60%. If every repeat customer buys gasoline worth per month, that means your gas station will receive 0 in additional sales each month from those repeat customers. This data is crucial for building an oil station budget plan or an oil station cash flow forecast.

Tips & Tricks

- Use loyalty programs or reward cards to incentivize repeat customers and increase customer numbers.

- Train your staff to provide excellent customer service to encourage visitors to become customers and repeat customers to continue doing business with you.

- Track sales and customer data to understand trends and make informed decisions about promotions, inventory management and staffing.

In conclusion, knowing your gas station visits in sales conversion and percentages of repeat customers will help create a successful gas pump financial projection, fuel dispenser financial estimate, or station financial statements. energy. With this crucial financial analysis, you can make informed decisions on optimizing your gas station’s financial plan and ultimately profits.

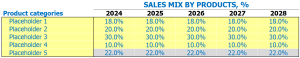

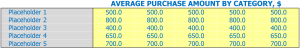

Gas station sales mix entries

In our gas station store, we offer a range of products to meet the needs of our customers. These products are divided into different categories such as gasoline, diesel, snacks, beverages and car accessories. To forecast our revenue and plan for the future, we use the combination of sales by product category assumptions.

By entering sales mix assumptions on the product category leverage, we can easily understand and project our sales for each category. Let’s say we have five product categories – gasoline, diesel, snacks, beverages and car accessories. To create a sales mix, we need to determine what percentage of our revenue will come from each category over the next five years.

- Use past sales data to understand which categories are the most popular.

- Consider external factors such as changes in fuel prices or the introduction of new products.

- Considering seasonality – Certain categories may sell better during specific months.

Tips & Tricks:

For example, suppose that based on past sales data, we know that gasoline and snacks are our top-selling categories. We can estimate that 50% of our revenue will come from gasoline, 20% from snacks, 10% from diesel, 10% from drinks and 10% from car accessories for the next year. We can then adjust these percentages based on our sales goals for the next five years.

In conclusion, using sales by product category assumptions is an effective way to forecast our gas station revenue model and create a gas station financial plan. It helps us make informed decisions on our product offerings and budget plan, which ultimately impacts our service station profit model and our fuel distributor financial estimate.

Gas station Amount of sale of inputs

Your gas station offers a variety of products, from fuel to snacks, and each product belongs to a specific product category. To simplify the revenue forecasting process, it is best to enter assumptions at the product category level rather than by product.

For example, let’s say the product categories are fuel, tobacco, snacks, and beverages. The fuel category includes all types of fuel offered by your station, while the tobacco category includes cigarettes and cigars.

A key assumption of revenue forecasting is the average sale amount of each product category. This is the average price per unit sold for a particular product category. For example, the average sale amount for the fuel category will reflect the average price per gallon across all fuel types, while the average sale amount for the snacks category will reflect the average price per unit for all snacks sold.

The average sales amount per product category can be estimated by looking at historical sales data. Suppose your station’s average sale amount for fuel was .50/gallon in year 1 and .70/gallon in year 2, and the average sale amount for snacks was .00 per unit in Year 1 and .10 per unit in Year 2.

With this information, you can estimate the average ticket size, which is the average amount spent by customers per transaction. To calculate the average ticket size, you will need to know the sales mix, which is the proportion of sales for each product category. Let’s say your sales mix was 50% fuel, 20% tobacco, 15% snacks, and 15% beverages in year 2.

Using the sales mix and the average sales amount per product category, the model will calculate the average ticket size as follows:

- Use historical data to estimate the average sale amount by product category.

- Enter assumptions at the product category level to simplify revenue forecasting.

- Calculate the average ticket size based on the sales mix and the average sale amount per product category.

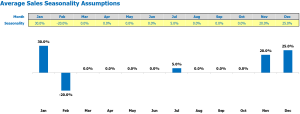

Gas station sales seasonality

The gas station revenue model relies heavily on the seasonality factor, which is the fluctuation in sales due to seasonal demand. Assuming sales are not too affected by external factors, we should see a pattern forming over the course of the year.

For example, in the United States, summer holidays tend to see higher demand due to an increase in travellers, road trips and other activities. Thus, the summer months may see a spike in sales. On the other hand, the winter months may have lower demand due to reduced mobility, worsening weather and other factors.

It’s crucial to consider these seasonal factors when developing your gas station’s financial plan.

Tips & Tricks:

- Collect historical data to find the average sales per day each month.

- ENTRY DISCOUNTS Compared to average monthly sales per day to create a seasonal demand pattern.

- Consider external factors, such as local weather conditions and cultural events, to predict changes in sales.

- Regularly review and revise your gas station’s revenue projection to ensure its accuracy.

By using these methods, you can create an accurate fuel station financial analysis that can help you make informed decisions about your business. An oil station cash flow forecast that takes seasonality into account will also help you avoid financial instability and keep your oil station’s profit model on track.

Service Station Operational Expense Forecast

Operational expense forecasts are an essential part of the gas station’s financial model. It helps in planning and estimating the total expenses required to run a gas station. Operating expenses include the cost of goods sold by products %, salaries and wages of employees, rent, payment of leases or mortgages, utilities and other operating expenses.

| Expenses | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | 10,000 – 50,000 |

| Salaries and wages of employees | 5,000 – 15,000 |

| Rent, lease or mortgage payment | 2,000 – 10,000 |

| Public services | 500 – 3,000 |

| Other running costs | 500 – 2,000 |

| Total | 18,000 – 80,000 |

Having a clear understanding of these expenses will help gas internship owners prepare a comprehensive budget, make informed decisions, assess the feasibility of the business, and come up with a financially viable operational plan. Remember to consider these financial projections when building your financial model and revenue model for your gas station.

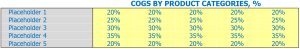

Gas station cost of goods sold

Cost of goods sold is the cost incurred by a business to acquire or produce the products sold to customers. At a gas station, it includes the cost of fuel, convenience store items, car wash services, and any other products sold. The COG percentage varies for each product category.

For example, COGs for fuel are determined by the bulk cost of gasoline and any transportation costs incurred to get the fuel to the station. On the other hand, COGS for convenience store items may include the cost of purchasing the items from a vendor, storage costs, labor costs, and spoilage or removal costs.

It is important to accurately estimate COGS as it affects the profitability of the service station. When projecting revenue, a gas station financial plan should take into account the expected COGs for each product category.

Tips & Tricks:

- Regularly review vendor costs to ensure you are getting the best price for inventory items.

- Minimize spoilage and shrinkage by implementing inventory tracking systems and employee training programs.

- Perform regular maintenance on fuel dispensers and car wash equipment to reduce repair costs.

By accurately estimating COGs and controlling expenses, a service station profit model can be created. It will provide a clear understanding of energy station financials, cash flow forecast, oil station budget plan, gas station financial analysis and gas station revenue projection .

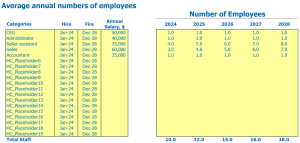

Gas Station Salaries and Salaries of Employees

When creating a gas station revenue model , it is crucial to consider employee wages and salaries . This includes salaries for employees like cashiers, mechanics, and other personnel needed for smooth operations.

To ensure that you consider salaries and employee wages when creating a Gas Station Financial Plan , you must have the following assumptions:

- Position: Staff member / position.

- Hire: When the person/position will be hired.

- Annual Genuations: How much this person/category is expected to earn for the 12 month period.

- Full-time equivalent: How many full-time equivalent staff do you need each year?

For example, assuming you need two full-time cashiers, the assumptions will be:

- Position: Cashier.

- Hiring: Start every year.

- Annual generations: ,000.

- Full-time equivalent: Two.

Tips & Tricks

- Consider offering health and retirement benefits to your employees to attract and retain good talent.

- Regularly review employee performance to ensure they are meeting required standards and identify any areas for improvement.

- Facilitating salary increases each year to ensure you remain competitive in the market.

Gas station rental, lease or mortgage payment

The gas station revenue model is an important factor for the success of any petroleum station. One of the major expenses that landlords need to consider is the rent, lease, or mortgage payment. These expense items require special attention as it can affect the financial condition of the business.

For example, if a gas station owner opts for a lease, he would have to pay a flat rate for the space used to operate his fuel dispenser or gas station. On the other hand, if they opt for renting, they should have a monthly payment which may vary depending on the location and availability of the property. Finally, if they opt for a mortgage, they can expect to pay the principal amount plus interest over time.

Tips & Tricks:

- Always consider location when deciding gas station rent, lease, or mortgage payment.

- Look for deals that lower monthly payments, such as rent-to-own options.

- Consider the term of the lease or mortgage before making decisions.

- Keep track of monthly payments to ensure consistent cash flow.

Understanding the different gas station rent, lease, or mortgage payment assumptions is crucial to ensuring a gas station budget plan. Fuel station revenue projection can only be successful if entrepreneurs consider all expenses and sources of revenue. The gas station’s financial analysis indicates that every expense needs careful consideration to reduce the impact on the company’s cash flow forecast.

Gas Station Utilities

Gas station utilities refer to the various expenses associated with running a gas station. These expenses include rent, utility bills, maintenance, and many other costs. The gas station financial plan must take all these expenses into account and ensure that there is enough revenue to cover them.

One of the key assumptions of the gas station revenue model is that the revenue projection must take into account each utility bill associated with the gas station. Projecting gas station revenue should be based on realistic estimates for these bills, which are critical to the financial analysis of the gas station.

Tips & Tricks:

- Keep a close eye on utility bills to make sure they align with your financial plan.

- Consider using energy efficient systems to reduce utility bills over time.

- Maintain equipment regularly to avoid costly repairs in the future.

Creating a sound gas station financial plan requires a thorough understanding of these utility expenses. Oil station cash flow forecasts should take into account fluctuating utility bills over time and ensure that there is enough revenue to cover them. By doing so, gas station owners can create a gas station profit model that is sustainable over the long term.

The fuel station budget plan should include expenses such as water bills, electricity bills, and maintenance costs, so that the fuel distributor’s financial estimate is accurate. These financial statements provide key information and help business owners make informed decisions about their gas stations.

Petrol station Other operating costs

While calculating the financial model of a gas station, we also need to consider the other running costs which can affect the profit model. These costs could range from rent, utility bills, insurance costs, maintenance costs, and employee salaries.

For example, the rent cost of a gas station location could be high if the station is located in an upscale area, and the rent cost could be relatively low if the station is located in a remote location. Likewise, the utility bills of a gas station could be higher in areas with extreme weather conditions than in moderate climates.

Insurance costs could be significant if the gas station operates on a large scale, and maintenance costs could vary on the age and condition of the equipment used at the station. Finally, the Employee salaries cost could also affect the profit model of a gas station, depending on the number of employees and the salary provided.

Gas Station Financial Forecast

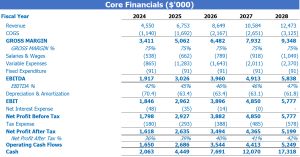

In order to build a solid gas station revenue model, it is crucial to understand the gas station financial plan, fuel station revenue projection, and gas station financial analysis. An important aspect is to create a reliable gas station financial forecast. A financial forecast should show the expected profit and loss statement, sources and uses of the report, and outline the oil station cash flow forecast, gas station profit model, statements energy station financials, oil station budget plan, gas pump and fuel financial projection Dispenser Financial estimate.

Service station profitability

Once we have built Income and Expense Projections , we can check the profit and loss (P&L) from income to net profit. This will help you visualize “profitability” such as gross profit or EBITDA margin.

It is important to include gas station revenue model , gas station financial plan , gas station revenue projection , gas station financial analysis , oil station cash flow forecast , Gas Station Profit Model , Energy Station Financials , Petroleum Station Budget Plan , Gas Pump Financial Projection , and Fuel Distributor Financial Estimate into your financial projections to get an accurate picture of the profitability of your station.

Tips & Tricks:

- Be sure to review and update your financial projections regularly to stay informed of any changes in your gas station’s profitability.

By monitoring your gas station’s profitability, you can make informed decisions about pricing, staffing, and other business strategies to ensure lasting success.

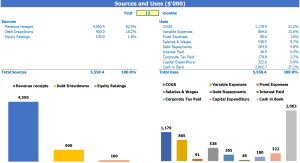

Gas Station Sources and Chart Usage

The Gas Station Sources and Usage graph provides a clear picture of the financial activity within a gas station.

This is an essential tool for businesses to track income and expenses. The graph allows owners to closely monitor capital and ensure efficient use of funds.

Tips & Tricks:

- Regularly update sources and uses to maintain accurate financial information.

- Be sure to include all sources of income and expenses in the chart, including unexpected costs such as repairs and maintenance.

- Use the graph to identify areas where costs can be reduced or additional revenue can be generated.

Whether creating a gas station financial plan, gas station revenue projection, gas station financial analysis, oil station cash flow forecast, gas station profit, an energy station financial statement, a petroleum station budget plan, a gas pump financial projection, or a fuel distributor financial estimate, The Sources and Use statement is a component essential. It enables businesses to make informed financial decisions and maximize profits.

Building a financial model for a gas station is crucial to the success of your business . By analyzing the gas station revenue model, developing a gas station financial plan, projecting gas station revenue, and performing a financial analysis of a gas station, you can determine the profitability and the potential challenges of your service station. In addition, performing an oil station cash flow forecast and developing a service station profit model can help you make important decisions about your energy station’s financial statements. Remember to create an oil station budget plan as well as gas pump financial projections and fuel distributor financial estimates. By taking the time to diligently analyze your gas station’s finances, you can ensure that your gas station is set up for success.